10.31.19

Like all consumer markets, personal care wipes are undergoing a significant paradigm shift in their retail landscape. The simplest characterization is the ongoing shift from ‘brick and mortar’ selling to online selling or e-commerce.

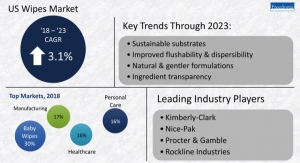

Smithers latest market report, ‘The Future of Personal Care Wipes in a Changing Retail Landscape to 2024’ forecasts global retail sales for personal care wipes will grow from a projected $9.3 billion in 2019 at an annual rate of 6.1% during 2019-2024 to reach $12.5 billion in 2024. Personal care wipes is the largest wipes segment using nonwovens.

The changing retail landscape presents specific opportunities for wipe suppliers, Smithers’ analysis tracks five brands active in this space and how they are reacting to the challenges of e-commerce selling and the latest unmet end-user demands.

With shifts in end-use demands increasing across the five years to 2024, ‘The Future of Personal Care Wipes in a Changing Retail Landscape to 2024’ identifies the following key drivers and trends for the global personal care wipes industry today:

Sustainability – In 2019, there are multiple levels of sustainability driving personal care wipes – to reduce/eliminate plastics waste, to use all-natural ingredients, and to use biodegradable materials.

Nonwoven supply and demand – One of the most important drivers for wipes over the next five years will be the oversupply of high-quality nonwovens for the wipes market. This will result in lower prices and accelerated product development as nonwovens producers attempt to sell this oversupply.

Current, near-term and long-term global economy impact – Consumers tend to revert to the lowest-cost options – paper or cloth scraps replacing wipes, or baby wipes replacing higher-price speciality wipes – in times of economic hardship. Thus any future economic downturn will have a major negative impact on the personal care wipes market.

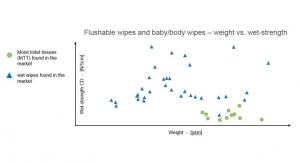

Performance requirements and developments – Wipes performance continues to improve, some to the point of passing from luxury to requirement. For example, flushable wipes originally were not dispersible and were not very good at cleaning. But these products have improved to the point now that many consumers cannot do without them. Even if governmental agencies try to outlaw them, it is expected that many consumers would revert to using fewer dispersible wipes rather than do without.

Smithers latest report, ‘The Future of Personal Care Wipes in a Changing Retail Landscape to 2024’ quantitatively defines this burgeoning sector by end-use segment, region, nonwoven product type, and raw materials used.

To contextualise this rapid growth, Smithers’ analyses the changing retail landscape for these wipes, reviewing current brand owners, suppliers, retailers, business models, and supply chains; within a growing global nonwovens market.

Smithers latest market report, ‘The Future of Personal Care Wipes in a Changing Retail Landscape to 2024’ forecasts global retail sales for personal care wipes will grow from a projected $9.3 billion in 2019 at an annual rate of 6.1% during 2019-2024 to reach $12.5 billion in 2024. Personal care wipes is the largest wipes segment using nonwovens.

The changing retail landscape presents specific opportunities for wipe suppliers, Smithers’ analysis tracks five brands active in this space and how they are reacting to the challenges of e-commerce selling and the latest unmet end-user demands.

With shifts in end-use demands increasing across the five years to 2024, ‘The Future of Personal Care Wipes in a Changing Retail Landscape to 2024’ identifies the following key drivers and trends for the global personal care wipes industry today:

Sustainability – In 2019, there are multiple levels of sustainability driving personal care wipes – to reduce/eliminate plastics waste, to use all-natural ingredients, and to use biodegradable materials.

Nonwoven supply and demand – One of the most important drivers for wipes over the next five years will be the oversupply of high-quality nonwovens for the wipes market. This will result in lower prices and accelerated product development as nonwovens producers attempt to sell this oversupply.

Current, near-term and long-term global economy impact – Consumers tend to revert to the lowest-cost options – paper or cloth scraps replacing wipes, or baby wipes replacing higher-price speciality wipes – in times of economic hardship. Thus any future economic downturn will have a major negative impact on the personal care wipes market.

Performance requirements and developments – Wipes performance continues to improve, some to the point of passing from luxury to requirement. For example, flushable wipes originally were not dispersible and were not very good at cleaning. But these products have improved to the point now that many consumers cannot do without them. Even if governmental agencies try to outlaw them, it is expected that many consumers would revert to using fewer dispersible wipes rather than do without.

Smithers latest report, ‘The Future of Personal Care Wipes in a Changing Retail Landscape to 2024’ quantitatively defines this burgeoning sector by end-use segment, region, nonwoven product type, and raw materials used.

To contextualise this rapid growth, Smithers’ analyses the changing retail landscape for these wipes, reviewing current brand owners, suppliers, retailers, business models, and supply chains; within a growing global nonwovens market.