Karen Bitz-McIntyre, Editor03.02.18

China National Household Paper Industry Association

In 2017, the market capacity of the Chinese disposable hygiene products industry continued to grow steadily with increased fierce market competition. The high end consumption trend, comprehensive implementation of the two-child policy and aging population have presented new opportunities for the market in China, which has attracted a new round of investment and expansion.

Meanwhile, in order to maintain competition in China, the multinationals have continued to increase imports of high value added end products. Since profit margins were squeezed by the changes of market landscape and rising prices of raw materials, the enterprises were forced to carry out research and development innovation, equipment upgrades and consumption reduction. A number of enterprises have stood out from the competition. Some enterprises began to develop and march into overseas markets in various ways.

Investment Fever is Growing

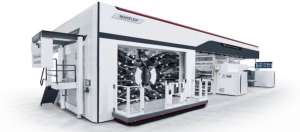

Existing domestic hygiene product enterprises invested to expand capacity, upgrade technology and equipment and introduce intelligent manufacturing.

On the basis of working as OEMs for overseas brands, some enterprises like Cosom and U-play have begun to launch their own brands to the developed markets. Meanwhile, Hengan and some other Chinese-based companies have started to explore the Southeast Asian market.

Some large pharmaceutical enterprises, textile enterprises and dairy enterprises outside of the hygiene industry, such as Maylinglong Pharm, Shuangfeiren Pharm and Beingmate, have entered into the disposable hygiene product industry with large investment projects and advanced technologies.

Meanwhile, existing multinationals in China are progressing smoothly and there have been a few new investments. In 2017, Kimberly-Clark’s diaper production base in Tianjin was completed and it began operation. Japan’s Daio Paper constructed a new diaper plant in Nantong Jiangsu and expanded production capacity of its current plant. P&G established its China digital innovation center in Guangzhou.

High End Disposable Hygiene Products

Improvements in sanitary protection products are mainly related to air permeability, fitness and individualization. The natural materials are favored by consumers while the tampon market is growing rapidly from a small base.

In diapers, the customers’ preference for high quality baby diapers have encouraged multi-national companies to continue introducing high end, foreign made products. The innovation and differentiation of these products have given them an advantage while the product quality of many domestic brands has reached and even exceeded many foreign brands. However, product stability and brand awareness needs to be strengthened to gain the trust of customers.

In other end use markets, adult diapers have been upgraded to achieve air permeability deodorization, wet indication and other functions while the function of wet wipes are becoming more differentiated and diversified.

Raw Material Products Investment

The suppliers of nonwovens, superabsorbent polymers, films, hot melt adhesives, closed systems, cores and packaging materials introduced advanced equipment and enlarged product capacity to provide more materials with stable performance and high added values. They are also developing more natural and biodegradable materials. These efforts are helping their customers meet the need for higher end products.

The overall level of homemade equipment has been improved, while that of the leading enterprises has reached the advanced international level. Customization, high orientation and differentiation are the development trends.

Tianjin Yiyi and Beijing Dayuan have been successfully listed on the National Equities Exchange and Quotations. Xiamen and Yanjan has been officially listed on the Shenzhen Stock Exchange GEM. While the enterprises have set foot on the capital market, breaking through the capital bottleneck, their business management also has become more standard.

Imports Increase

In the first three quarters of 2017, the import volume and amount of disposable hygiene products continued to increase. And, the overall growth was higher than that in the same period of 2016. The important diaper products experienced the highest increase at 19.14% (the increase rate was 7.69% at the same period of 2016). The average price of imported sanitary napkins, including tampons, increased significantly, which indicated the high end trend of imported products and the increasing proportion of tampons. As the major import category, the total import volume of baby diapers accounted for 93.7% of disposable hygiene products and the total import amount accounted for 90.8%. Its increase rate of import volume was higher than that of the overall disposable hygiene products. Since the import tariff of diapers has been reduced to zero in China beginning in December 2017, the competition between overseas brands and domestic brands of baby diapers has intensified.

Raw Materials Fluctuate

As the price of raw materials continues to rise, manufacturers continue to be faced with greater operating pressures. They need to increase income and reduce expenses through enterprise management to ensure the basic profit.

In 2017, the market capacity of the Chinese disposable hygiene products industry continued to grow steadily with increased fierce market competition. The high end consumption trend, comprehensive implementation of the two-child policy and aging population have presented new opportunities for the market in China, which has attracted a new round of investment and expansion.

Meanwhile, in order to maintain competition in China, the multinationals have continued to increase imports of high value added end products. Since profit margins were squeezed by the changes of market landscape and rising prices of raw materials, the enterprises were forced to carry out research and development innovation, equipment upgrades and consumption reduction. A number of enterprises have stood out from the competition. Some enterprises began to develop and march into overseas markets in various ways.

Investment Fever is Growing

Existing domestic hygiene product enterprises invested to expand capacity, upgrade technology and equipment and introduce intelligent manufacturing.

On the basis of working as OEMs for overseas brands, some enterprises like Cosom and U-play have begun to launch their own brands to the developed markets. Meanwhile, Hengan and some other Chinese-based companies have started to explore the Southeast Asian market.

Some large pharmaceutical enterprises, textile enterprises and dairy enterprises outside of the hygiene industry, such as Maylinglong Pharm, Shuangfeiren Pharm and Beingmate, have entered into the disposable hygiene product industry with large investment projects and advanced technologies.

Meanwhile, existing multinationals in China are progressing smoothly and there have been a few new investments. In 2017, Kimberly-Clark’s diaper production base in Tianjin was completed and it began operation. Japan’s Daio Paper constructed a new diaper plant in Nantong Jiangsu and expanded production capacity of its current plant. P&G established its China digital innovation center in Guangzhou.

High End Disposable Hygiene Products

Improvements in sanitary protection products are mainly related to air permeability, fitness and individualization. The natural materials are favored by consumers while the tampon market is growing rapidly from a small base.

In diapers, the customers’ preference for high quality baby diapers have encouraged multi-national companies to continue introducing high end, foreign made products. The innovation and differentiation of these products have given them an advantage while the product quality of many domestic brands has reached and even exceeded many foreign brands. However, product stability and brand awareness needs to be strengthened to gain the trust of customers.

In other end use markets, adult diapers have been upgraded to achieve air permeability deodorization, wet indication and other functions while the function of wet wipes are becoming more differentiated and diversified.

Raw Material Products Investment

The suppliers of nonwovens, superabsorbent polymers, films, hot melt adhesives, closed systems, cores and packaging materials introduced advanced equipment and enlarged product capacity to provide more materials with stable performance and high added values. They are also developing more natural and biodegradable materials. These efforts are helping their customers meet the need for higher end products.

The overall level of homemade equipment has been improved, while that of the leading enterprises has reached the advanced international level. Customization, high orientation and differentiation are the development trends.

Tianjin Yiyi and Beijing Dayuan have been successfully listed on the National Equities Exchange and Quotations. Xiamen and Yanjan has been officially listed on the Shenzhen Stock Exchange GEM. While the enterprises have set foot on the capital market, breaking through the capital bottleneck, their business management also has become more standard.

Imports Increase

In the first three quarters of 2017, the import volume and amount of disposable hygiene products continued to increase. And, the overall growth was higher than that in the same period of 2016. The important diaper products experienced the highest increase at 19.14% (the increase rate was 7.69% at the same period of 2016). The average price of imported sanitary napkins, including tampons, increased significantly, which indicated the high end trend of imported products and the increasing proportion of tampons. As the major import category, the total import volume of baby diapers accounted for 93.7% of disposable hygiene products and the total import amount accounted for 90.8%. Its increase rate of import volume was higher than that of the overall disposable hygiene products. Since the import tariff of diapers has been reduced to zero in China beginning in December 2017, the competition between overseas brands and domestic brands of baby diapers has intensified.

Raw Materials Fluctuate

As the price of raw materials continues to rise, manufacturers continue to be faced with greater operating pressures. They need to increase income and reduce expenses through enterprise management to ensure the basic profit.