Tara Olivo, Associate Editor12.10.19

The hygiene market continues to evolve. In both the baby diaper and feminine care categories, demands from parents and women for safer ingredients and ingredient transparency has led to the development of more natural and bio-based materials. In adult incontinence, active sufferers are asking for more discreet, comfortable products, which has led to significant product innovation, from flexible underwear-like garments to products specifically designed for fecal incontinence.

Despite the range of needs to fulfill, suppliers of topsheets, acquisition/distribution layers, backsheets, adhesives and other components, are up to the challenge.

“It is a dynamic market with lots of evolutions,” says Hakan Sisman, deputy general manager, Hassan Group, adding that suppliers need to fulfill needs with top quality and affordable prices, specifically with human health in mind.

Hassan’s group companies Merkas, Pelsan and Telasis supply nonwovens, films and composites. For topsheets, the group manufactures carded air through bonded or calendar bonded nonwoven options with different fiber combinations. For ADL, carded air through bonded nonwovens for ultimate liquid handling properties are developed with the latest process technologies and fiber combinations, and for backsheets, cast and blown film technologies are available with breathability and various print options.

Part of the evolution in the hygiene market has been the increased focus on softness in recent years. Looking at the backsheet specifically, Sisman says market players have been asking for more softness and bulkiness in the nonwoven, and Merkas has worked to satisfy this need by supplying sister company Pelsan with very soft and bulky carded air through bonded nonwovens as a laminate with breathable film. “So, the group can easily switch from one component to the other and create new value added products,” Sisman says. “Hassan Group takes advantage of diversity in its production technologies.”

Commenting on the hygiene industry, Mário Garrido, chief sales officer of adhesives supplier Colquimica, says the market is challenging and constantly sharpening its demands. “Due to this constant evolution in terms of requirements, reflecting the final customer needs, which then come down the supply chain as a whole, the entire chain needs to keep on evolving,” he explains.

Suppliers of hygiene components not only have to ensure that its own products do the job, but also work properly with other raw materials and components within the hygiene item.

“We currently hold partnerships with raw material suppliers, elastic producers and OEMs that enable Colquimica to prove and enhance its quality and performance, taking into consideration the full requirements of the adhesive application,” Garrido says.

Full Steam Ahead

Jenna Koenneke, global head of market strategy – personal hygiene adhesives for Henkel, says consumer demands have evolved from expecting basic functionality and quality to a demand for an improved experience when it comes to comfort and wellness. At the same time, “several emerging markets have become trendsetters adding to the inherent hyper-competitiveness in FMCG and battle for the emerging market consumer,” she adds. “Some companies address the challenge by aggressively managing their cost base, while other players go full speed ahead with investment in innovation. The originally more consolidated market from raw material suppliers to brand owners is seeing competition by new entrants alongside the value chain. It shows that the industry is attractive and offers manifold opportunities for differentiation, especially towards higher-end and sustainable brand positioning.”

Henkel continues to refine its products and add new solutions to its global portfolio, and the company has recently focused on two major innovation topics. The first is enhancing the consumer experience. To do this, Henkel strives to add real customer benefits in the areas of health, wellness and comfort. “Adhesives play a role here when it comes to creating a low odor profile, making the bonding of very soft materials possible and enabling new product designs that improve aesthetics and fit,” Koenneke explains.

Secondly, driving operational efficiency remains extremely important in a high volume, fast machining market, she adds. “We know that sticking to the same limited toolbox of raw materials means the incremental improvement we can deliver will only get smaller and smaller. So, we went down a new path and joined forces with strategic raw materials suppliers to develop tailor-made materials specifically designed to match the requirements of the hygiene market.”

This resulted in a product range that will be rolled-out globally in the next year under the umbrella Technomelt Advance. At INDEX 2020, Henkel will showcase how not only the materials they work with change, but also that adhesive handling on the production floor will enter a new era.

Recent innovations from H.B. Fuller are focused on traditional adhesive applications and aimed at delivering efficiencies to the manufacturers of absorbent hygiene products. Its Full-Care 6215 new generation positioning adhesive has potential for up to 25% cost savings by coat weight reduction, while ensuring consistent peel over time across various garment materials. Meanwhile, the new Full-Care 8220 series of elastic attachment adhesives has excellent creep resistance to ensure a comfortable fit and dependable leakage control of an absorbent product. For wetness indicators, the company’s latest generation of Wetness Indicator Full-Care 9505 is designed to grow consumer satisfaction, thanks to clear, noticeable indication of wetness for timely diaper changes. For the feminine care market, H.B. Fuller is offering Full-Care 5586, a high-performing, cost-competitive construction adhesive.

“We are constantly innovating to support our customers as they develop new products in response to changing consumer needs,” says Julia Li, H.B. Fuller Global Hygiene marketing manager.

For its part, Sareks, a subsidiary of the Turkish company Korozo, specializes in the production of closure tape and frontal tape systems, breathable and non-breathable backsheets, elastic ears and films for underpads.

As an additional service this year, Sareks has begun applying wetness indicators in-house. “On the reverse side of printed backsheets, wetness indicators can be printed, and this helps support our clients [by having] one process less in their lines,” says Tuba Boduroglu Karakus, hygiene sales export manager at Korozo.“In the near future, we [will] target an intensive introduction of our backsheets with wetness indicators.”

For its nonwoven frontal range, options in the portfolio are available with and without film. “When we evaluated the discussions in the market in the last two year period, it was necessary to produce nonwoven frontals with different patterns, having different nonwoven grades and as a result meeting our clients’ needs and expectations,” Boduroglu Karakus adds.

Sareks is also currently working on projects in order to use renewable sources for the production of textile and PE backsheets, as well as for the production of frontal tapes.

Meanwhile, Israeli nonwovens producer Shalag has strengthened its position in the hygiene market, recently acquiring 100% of the shares of Texsus S.P.A, a manufacturer of air-through bonded nonwovens and laminated products for the hygiene market. Based in Pistoia, Italy, Texsus is now operated as a subsidiary of Shalag Industries.

“The recent merger between Shalag Nonwovens and Texsus has promoted the Shalag Group to be the largest through air bonded manufacturer, widening its portfolio encompassing products that range from light material ideal for lamination and as topsheet to heavier, multilayered ATB targeting ADL and ADL and topsheet combinations,” says Gabi Gal – Shalag global sales director. “Together with a wider range of commercial products, the fusion of our great institutions has granted us access to the combined R&D know-how allowing us to push our boundaries ever further towards laminated products designed to revolutionize the traditional landing zone, for example, or master a plethora of embossed and perforated substrate options.”

Together the group is now able to ship from three very distinct and perfectly positioned geographical areas, serving customers from two plants in Israel, one in Italy and one in the U.S., Gal adds.

Addressing Sustainability

The need to balance product quality and cost, while also keeping sustainability in mind, remains a challenge, but with growing interest from consumers, suppliers have been keen to respond to sustainability demands in a myriad of ways. On one hand, suppliers are working with more bio-based raw materials to address the concerns of consumers who believe natural materials are safer on the skin. On the other hand, suppliers are also finding ways to reduce the environmental impact of a product, such as using recycled materials or by reducing the weight of components, leading to less waste.

“Manufacturers of absorbent hygiene products are taking multiple paths to include sustainable product offerings,” says Ameara Mansour, H.B. Fuller Global Hygiene technical manager. “We have seen an increasing number of products claiming natural substrate usage, increased percentage of bio material content, recyclability and biodegradability.”

H.B. Fuller works with its customers to understand their unique sustainability goals. For example, it offers a series of products developed specifically for bonding cotton substrates, to help customers transition to sustainable, natural substrates that prove to be difficult to bond. It also offers adhesives with high bio-based content for use in hygiene articles.

H.B. Fuller also works closely with hygiene suppliers on the facilitation of scalability for sustainable raw materials to address increasing market demand for sustainable adhesives. “We also strive to anticipate the difficulties that our customers might face with transitioning to new substrates, offering effective solutions to help them create differentiated products that are poised to address evolving consumer sustainability needs,” Mansour adds.

Matt O’Sickey, global director of Market Development for Tredegar, a developer of topsheets, acquisition layers, and elastic films and fabrics, says the company’s customers are serving markets that have an ever-increasing focus on cost-effective solutions for everyday consumer needs. “This cost focus can be in conflict with a consumer desire for eco-friendly and sustainable solutions. Tredegar Personal Care is pursuing a range of product options that are sustainable and more eco-friendly, while still being affordable to consumers.”

Under its Tredegar EcoCare Sustainability Solutions initiative, the company has broadened its portfolio with products that contain up to 100% bio-sourced materials. Additionally, it has begun to utilize green energy sources, eliminate energy and material waste, and safely utilize recycled materials in its products.

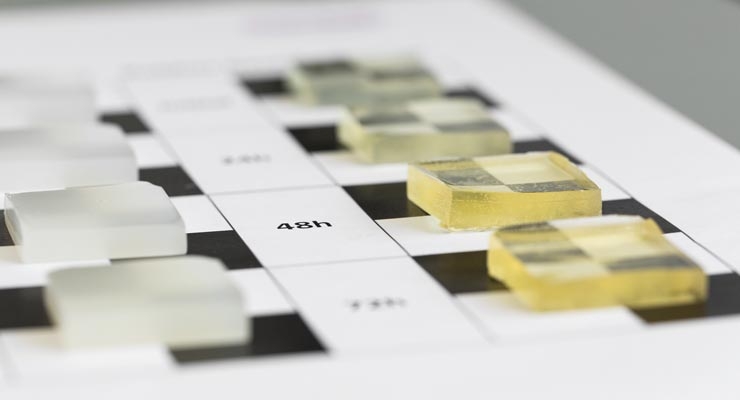

Savare Specialty Adhesives, which produces hot melt adhesives for hygiene applications, has been receiving more requests for adhesives that are compostable or bio-based, and is actively working with its suppliers to clearly understand the requirements and options to develop high performance adhesives that meet customers’ needs.

“We are working closely with our suppliers to identify actual sustainable raw materials that can be used to formulate effective adhesives,” says Pat Kellogg, sales manager, North America, at Savare Specialty Adhesives. “There is considerable confusion about the terms being used to market new products. We have developed adhesives that perform very well on cotton substrates even when wet.”

Henkel’s Koenneke says the market is now recognizing that there is more to sustainability than just being green. “In addition to sustainable product designs that support the movement toward a more circular economy, sustainability is also about improving health and safety,” she says. “The call for more natural or organic materials by consumers is likely driven by an association of safety, softness and purity – factors that can be perceived as being environmentally sound. All are very good reasons and some plant-based materials do deliver on those goals.”

Henkel is addressing this trend in through product innovation and expanding its adhesives portfolio. First, Henkel offers solutions for bonding natural materials, which sometimes have very different properties compared to conventional substrates, Koenneke says. Another way Henkel is responding is by further enriching its material toolbox with materials that can increase the level of bio-based content in adhesive formulations, potentially to 100% at some point and at the same time have a positive impact on different end-of-life and disposal scenarios.

Colquimica has also focused on providing its partners with sustainable solutions while maintaining the levels of performance expected for each of the applications. Over three years ago the company started several projects in order to improve the sustainability of its products based on solutions that are more recyclable, less consuming on quantity and less demanding on energy needs, Garrido explains.

The company has also been diligently moving forward, along with its partners, on developing solutions that are based on organic originated compounds, without sacrificing the product performance.

“All the new products designed for this end are promoted to our customers, not only as our future proof products, as they are in our belief, but also the next generation solutions for hygiene,” Garrido says. “We take these products highly seriously supporting our customers with tests, workshops and training required to explain the advantages of these products.”

Adhesives specialist Bostik views the adhesive as the enabler. “Adhesive makes up only a small percentage of the weight of a hygiene product, but it is essential to ensuring the substrates work as designed,” says Paul Andrews, global marketing manager. “The adhesive needs to be suitable for use with whatever product design, substrate or raw material that the article producer wishes to use.”

Bostik tests adhesives to ensure they remain compatible with newer organic or natural substrates, such as cotton and PLA based substrates, and new designs that the article producer wishes to adopt.

Another way Bostik is responding to sustainability demands is through research, looking at the benefits in the area of reducing adhesive add-ons, or doing more with less. “We use life cycle analysis to understand the value that different options (such as different formulations and different operating conditions such as lower temperature or lower add-on) can bring to our customer’s sustainability goals,” says Andrews. “This gives us a clear and quantitative comparison. In the case of adhesives, using less adhesive to obtain the same level of performance not only reduces our customer’s material cost but also has the most significant impact on LCA. Impact on sustainability is considered in the stage gate process for every product development project we consider.”

Bostik can also help its customers in other ways, from optimizing their use of adhesive to generating less waste and improving the efficiency of their production lines. It is also examining alternative sources of raw materials and adapting its production processes in order to provide a more “sustainable” adhesive, according to Andrews.

He also connects the sustainability topic to the growing need by the end consumer for greater transparency. “We have very quickly developed an expertise in the area of Substances of Interest (SOIs) in disposable hygiene products and are taking the time to share this knowledge with our customers to help them understand the topic and to develop their own action plans to satisfy the consumer need,” Andrews explains.

Different Markets, Different Needs

In developing regions, increasing disposable incomes as well as more access to absorbent hygiene products have opened up opportunities for players in the hygiene market. But in these geographies, cost is key.

According to H.B. Fuller’s Mansour, many consumers in developing areas are just entering the market, so accessibility and affordability are critical. “These consumers are looking for reliable products at affordable prices. There also are various regional preferences at play, such as acceptance of perfume solutions for odor control and preference for softer and loftier substrates,” she adds.

Hassan Group’s Sisman agrees, saying while penetration in developing countries is getting higher and higher, these markets aren’t able to spend much, therefore cost and performance are the key factors for those markets to grow.

Bostik also expects growth predominantly in the emerging geographies, driven by growth in disposable incomes, product awareness and availability. “As a result, we are seeing an increase in the number of article producers, either newcomers to the market or experienced producers expanding into new countries or regions. With the growth in the emerging geographies attracting first time users, the need of the consumer, and therefore of the article, can be different to those in the more mature regions. The needs of new producers of hygiene products can also be different, requiring additional training and support from their material suppliers,” Andrews says.

On the other hand, Bostik is seeing a general slowing of market growth and increased competition, mainly in mature geographies. “The end consumer is now faced with a plethora of product options, branded, private label and retailer own brands; the challenge for the article producer therefore is to stand out and still grow or at least retain market share profitably,” he explains. “The pressure is on the article producer and of course their suppliers to remove cost from the entire supply chain. Having said this, we continue to also see the possibility to focus on adhesive applications and products where the adhesive can bring value not only to our customer, but also the consumer.”

An area that is indicating growth potential across both mature and emerging regions, from Bostik’s point of view, is the adult incontinence segment. “As the aging population expands, so does its need and willingness to use incontinence products,” Andrews says. “This willingness does vary considerably from one region to another and can be linked to the taboos that still exist around the condition as well as the knowledge of and availability of products. The increased need means increased demands linked to confidence and discretion; for better absorption, thinner cores, a more satisfying fit and greater comfort and discretion.”

According to statistics from U.S. Census Bureau, U.S. Department of Commerce, the older population will be about 1 billion (12% of the projected total world population) by 2030, and by 2050, 1.6 billion, or 17% of the total population of 9.4 billion, will be 65 and older.

The aging of developed regions, coupled with declining fertility rates, has led to growth in the adult incontinence market. In Japan, for instance, more adult diapers are being sold than baby diapers.

And, with aging consumers who have more active lifestyles today, consumer feedback has changed the landscape of this market. Users of incontinence underwear, pads and diapers are expressing their opinions on comfort, fit and performance, and manufactures of hygiene products and the suppliers who partner with them are responding.

Because of this consumer feedback, O’Sickey, of Tredegar Personal Care, says there is a demand for increasingly underwear-like solutions for both absorbent briefs and pants. As a result, the company has shifted focus towards making its topsheet and acquisition layer materials more soft, conformable and reliably dry, and its elastic fabrics thinner, cooler, and more akin to conventional stretch textiles.

With a growing and active aging population, Henkel sees incontinence as becoming less of a taboo subject. “In the retail category incontinence, a lot of attention goes to seamlessly integrating hygiene products into the consumer’s life,” Koenneke says. “With stretchy materials and thinner, more fitted designs, even now tailored to different body forms and sex, we as Henkel see ourselves as design enablers with our adhesives and additives.”

Henkel’s solutions handle stretch alongside a bond, which allow the use of thinner substrates, contribute to softness and reduce unwanted odor, “essentially everything that helps to support consumers living life unlimited,” she adds.

In institutional healthcare, Koenneke is optimistic that significant changes will be realized and that there will be much anticipated improvements to quality of life for patients. The Henkel adhesives team has been working on the development of printed moisture sensor technology together with its colleagues from the Henkel Printed Electronics business and in IoT partnerships. “This technology plays a key role in smart diapers and has the potential to improve institutional care in many aspects,” she says. “Alerting caregivers for a timely product change and monitoring patients alongside additional health conditions are just two of the many possible applications. With that in mind, we added conductive inks designed for hygiene industry needs to our portfolio.”

Despite the range of needs to fulfill, suppliers of topsheets, acquisition/distribution layers, backsheets, adhesives and other components, are up to the challenge.

“It is a dynamic market with lots of evolutions,” says Hakan Sisman, deputy general manager, Hassan Group, adding that suppliers need to fulfill needs with top quality and affordable prices, specifically with human health in mind.

Hassan’s group companies Merkas, Pelsan and Telasis supply nonwovens, films and composites. For topsheets, the group manufactures carded air through bonded or calendar bonded nonwoven options with different fiber combinations. For ADL, carded air through bonded nonwovens for ultimate liquid handling properties are developed with the latest process technologies and fiber combinations, and for backsheets, cast and blown film technologies are available with breathability and various print options.

Part of the evolution in the hygiene market has been the increased focus on softness in recent years. Looking at the backsheet specifically, Sisman says market players have been asking for more softness and bulkiness in the nonwoven, and Merkas has worked to satisfy this need by supplying sister company Pelsan with very soft and bulky carded air through bonded nonwovens as a laminate with breathable film. “So, the group can easily switch from one component to the other and create new value added products,” Sisman says. “Hassan Group takes advantage of diversity in its production technologies.”

Commenting on the hygiene industry, Mário Garrido, chief sales officer of adhesives supplier Colquimica, says the market is challenging and constantly sharpening its demands. “Due to this constant evolution in terms of requirements, reflecting the final customer needs, which then come down the supply chain as a whole, the entire chain needs to keep on evolving,” he explains.

Suppliers of hygiene components not only have to ensure that its own products do the job, but also work properly with other raw materials and components within the hygiene item.

“We currently hold partnerships with raw material suppliers, elastic producers and OEMs that enable Colquimica to prove and enhance its quality and performance, taking into consideration the full requirements of the adhesive application,” Garrido says.

Full Steam Ahead

Jenna Koenneke, global head of market strategy – personal hygiene adhesives for Henkel, says consumer demands have evolved from expecting basic functionality and quality to a demand for an improved experience when it comes to comfort and wellness. At the same time, “several emerging markets have become trendsetters adding to the inherent hyper-competitiveness in FMCG and battle for the emerging market consumer,” she adds. “Some companies address the challenge by aggressively managing their cost base, while other players go full speed ahead with investment in innovation. The originally more consolidated market from raw material suppliers to brand owners is seeing competition by new entrants alongside the value chain. It shows that the industry is attractive and offers manifold opportunities for differentiation, especially towards higher-end and sustainable brand positioning.”

Henkel continues to refine its products and add new solutions to its global portfolio, and the company has recently focused on two major innovation topics. The first is enhancing the consumer experience. To do this, Henkel strives to add real customer benefits in the areas of health, wellness and comfort. “Adhesives play a role here when it comes to creating a low odor profile, making the bonding of very soft materials possible and enabling new product designs that improve aesthetics and fit,” Koenneke explains.

Secondly, driving operational efficiency remains extremely important in a high volume, fast machining market, she adds. “We know that sticking to the same limited toolbox of raw materials means the incremental improvement we can deliver will only get smaller and smaller. So, we went down a new path and joined forces with strategic raw materials suppliers to develop tailor-made materials specifically designed to match the requirements of the hygiene market.”

This resulted in a product range that will be rolled-out globally in the next year under the umbrella Technomelt Advance. At INDEX 2020, Henkel will showcase how not only the materials they work with change, but also that adhesive handling on the production floor will enter a new era.

Recent innovations from H.B. Fuller are focused on traditional adhesive applications and aimed at delivering efficiencies to the manufacturers of absorbent hygiene products. Its Full-Care 6215 new generation positioning adhesive has potential for up to 25% cost savings by coat weight reduction, while ensuring consistent peel over time across various garment materials. Meanwhile, the new Full-Care 8220 series of elastic attachment adhesives has excellent creep resistance to ensure a comfortable fit and dependable leakage control of an absorbent product. For wetness indicators, the company’s latest generation of Wetness Indicator Full-Care 9505 is designed to grow consumer satisfaction, thanks to clear, noticeable indication of wetness for timely diaper changes. For the feminine care market, H.B. Fuller is offering Full-Care 5586, a high-performing, cost-competitive construction adhesive.

“We are constantly innovating to support our customers as they develop new products in response to changing consumer needs,” says Julia Li, H.B. Fuller Global Hygiene marketing manager.

For its part, Sareks, a subsidiary of the Turkish company Korozo, specializes in the production of closure tape and frontal tape systems, breathable and non-breathable backsheets, elastic ears and films for underpads.

As an additional service this year, Sareks has begun applying wetness indicators in-house. “On the reverse side of printed backsheets, wetness indicators can be printed, and this helps support our clients [by having] one process less in their lines,” says Tuba Boduroglu Karakus, hygiene sales export manager at Korozo.“In the near future, we [will] target an intensive introduction of our backsheets with wetness indicators.”

For its nonwoven frontal range, options in the portfolio are available with and without film. “When we evaluated the discussions in the market in the last two year period, it was necessary to produce nonwoven frontals with different patterns, having different nonwoven grades and as a result meeting our clients’ needs and expectations,” Boduroglu Karakus adds.

Sareks is also currently working on projects in order to use renewable sources for the production of textile and PE backsheets, as well as for the production of frontal tapes.

Meanwhile, Israeli nonwovens producer Shalag has strengthened its position in the hygiene market, recently acquiring 100% of the shares of Texsus S.P.A, a manufacturer of air-through bonded nonwovens and laminated products for the hygiene market. Based in Pistoia, Italy, Texsus is now operated as a subsidiary of Shalag Industries.

“The recent merger between Shalag Nonwovens and Texsus has promoted the Shalag Group to be the largest through air bonded manufacturer, widening its portfolio encompassing products that range from light material ideal for lamination and as topsheet to heavier, multilayered ATB targeting ADL and ADL and topsheet combinations,” says Gabi Gal – Shalag global sales director. “Together with a wider range of commercial products, the fusion of our great institutions has granted us access to the combined R&D know-how allowing us to push our boundaries ever further towards laminated products designed to revolutionize the traditional landing zone, for example, or master a plethora of embossed and perforated substrate options.”

Together the group is now able to ship from three very distinct and perfectly positioned geographical areas, serving customers from two plants in Israel, one in Italy and one in the U.S., Gal adds.

Addressing Sustainability

The need to balance product quality and cost, while also keeping sustainability in mind, remains a challenge, but with growing interest from consumers, suppliers have been keen to respond to sustainability demands in a myriad of ways. On one hand, suppliers are working with more bio-based raw materials to address the concerns of consumers who believe natural materials are safer on the skin. On the other hand, suppliers are also finding ways to reduce the environmental impact of a product, such as using recycled materials or by reducing the weight of components, leading to less waste.

“Manufacturers of absorbent hygiene products are taking multiple paths to include sustainable product offerings,” says Ameara Mansour, H.B. Fuller Global Hygiene technical manager. “We have seen an increasing number of products claiming natural substrate usage, increased percentage of bio material content, recyclability and biodegradability.”

H.B. Fuller works with its customers to understand their unique sustainability goals. For example, it offers a series of products developed specifically for bonding cotton substrates, to help customers transition to sustainable, natural substrates that prove to be difficult to bond. It also offers adhesives with high bio-based content for use in hygiene articles.

H.B. Fuller also works closely with hygiene suppliers on the facilitation of scalability for sustainable raw materials to address increasing market demand for sustainable adhesives. “We also strive to anticipate the difficulties that our customers might face with transitioning to new substrates, offering effective solutions to help them create differentiated products that are poised to address evolving consumer sustainability needs,” Mansour adds.

Matt O’Sickey, global director of Market Development for Tredegar, a developer of topsheets, acquisition layers, and elastic films and fabrics, says the company’s customers are serving markets that have an ever-increasing focus on cost-effective solutions for everyday consumer needs. “This cost focus can be in conflict with a consumer desire for eco-friendly and sustainable solutions. Tredegar Personal Care is pursuing a range of product options that are sustainable and more eco-friendly, while still being affordable to consumers.”

Under its Tredegar EcoCare Sustainability Solutions initiative, the company has broadened its portfolio with products that contain up to 100% bio-sourced materials. Additionally, it has begun to utilize green energy sources, eliminate energy and material waste, and safely utilize recycled materials in its products.

Savare Specialty Adhesives, which produces hot melt adhesives for hygiene applications, has been receiving more requests for adhesives that are compostable or bio-based, and is actively working with its suppliers to clearly understand the requirements and options to develop high performance adhesives that meet customers’ needs.

“We are working closely with our suppliers to identify actual sustainable raw materials that can be used to formulate effective adhesives,” says Pat Kellogg, sales manager, North America, at Savare Specialty Adhesives. “There is considerable confusion about the terms being used to market new products. We have developed adhesives that perform very well on cotton substrates even when wet.”

Henkel’s Koenneke says the market is now recognizing that there is more to sustainability than just being green. “In addition to sustainable product designs that support the movement toward a more circular economy, sustainability is also about improving health and safety,” she says. “The call for more natural or organic materials by consumers is likely driven by an association of safety, softness and purity – factors that can be perceived as being environmentally sound. All are very good reasons and some plant-based materials do deliver on those goals.”

Henkel is addressing this trend in through product innovation and expanding its adhesives portfolio. First, Henkel offers solutions for bonding natural materials, which sometimes have very different properties compared to conventional substrates, Koenneke says. Another way Henkel is responding is by further enriching its material toolbox with materials that can increase the level of bio-based content in adhesive formulations, potentially to 100% at some point and at the same time have a positive impact on different end-of-life and disposal scenarios.

Colquimica has also focused on providing its partners with sustainable solutions while maintaining the levels of performance expected for each of the applications. Over three years ago the company started several projects in order to improve the sustainability of its products based on solutions that are more recyclable, less consuming on quantity and less demanding on energy needs, Garrido explains.

The company has also been diligently moving forward, along with its partners, on developing solutions that are based on organic originated compounds, without sacrificing the product performance.

“All the new products designed for this end are promoted to our customers, not only as our future proof products, as they are in our belief, but also the next generation solutions for hygiene,” Garrido says. “We take these products highly seriously supporting our customers with tests, workshops and training required to explain the advantages of these products.”

Adhesives specialist Bostik views the adhesive as the enabler. “Adhesive makes up only a small percentage of the weight of a hygiene product, but it is essential to ensuring the substrates work as designed,” says Paul Andrews, global marketing manager. “The adhesive needs to be suitable for use with whatever product design, substrate or raw material that the article producer wishes to use.”

Bostik tests adhesives to ensure they remain compatible with newer organic or natural substrates, such as cotton and PLA based substrates, and new designs that the article producer wishes to adopt.

Another way Bostik is responding to sustainability demands is through research, looking at the benefits in the area of reducing adhesive add-ons, or doing more with less. “We use life cycle analysis to understand the value that different options (such as different formulations and different operating conditions such as lower temperature or lower add-on) can bring to our customer’s sustainability goals,” says Andrews. “This gives us a clear and quantitative comparison. In the case of adhesives, using less adhesive to obtain the same level of performance not only reduces our customer’s material cost but also has the most significant impact on LCA. Impact on sustainability is considered in the stage gate process for every product development project we consider.”

Bostik can also help its customers in other ways, from optimizing their use of adhesive to generating less waste and improving the efficiency of their production lines. It is also examining alternative sources of raw materials and adapting its production processes in order to provide a more “sustainable” adhesive, according to Andrews.

He also connects the sustainability topic to the growing need by the end consumer for greater transparency. “We have very quickly developed an expertise in the area of Substances of Interest (SOIs) in disposable hygiene products and are taking the time to share this knowledge with our customers to help them understand the topic and to develop their own action plans to satisfy the consumer need,” Andrews explains.

Different Markets, Different Needs

In developing regions, increasing disposable incomes as well as more access to absorbent hygiene products have opened up opportunities for players in the hygiene market. But in these geographies, cost is key.

According to H.B. Fuller’s Mansour, many consumers in developing areas are just entering the market, so accessibility and affordability are critical. “These consumers are looking for reliable products at affordable prices. There also are various regional preferences at play, such as acceptance of perfume solutions for odor control and preference for softer and loftier substrates,” she adds.

Hassan Group’s Sisman agrees, saying while penetration in developing countries is getting higher and higher, these markets aren’t able to spend much, therefore cost and performance are the key factors for those markets to grow.

Bostik also expects growth predominantly in the emerging geographies, driven by growth in disposable incomes, product awareness and availability. “As a result, we are seeing an increase in the number of article producers, either newcomers to the market or experienced producers expanding into new countries or regions. With the growth in the emerging geographies attracting first time users, the need of the consumer, and therefore of the article, can be different to those in the more mature regions. The needs of new producers of hygiene products can also be different, requiring additional training and support from their material suppliers,” Andrews says.

On the other hand, Bostik is seeing a general slowing of market growth and increased competition, mainly in mature geographies. “The end consumer is now faced with a plethora of product options, branded, private label and retailer own brands; the challenge for the article producer therefore is to stand out and still grow or at least retain market share profitably,” he explains. “The pressure is on the article producer and of course their suppliers to remove cost from the entire supply chain. Having said this, we continue to also see the possibility to focus on adhesive applications and products where the adhesive can bring value not only to our customer, but also the consumer.”

An area that is indicating growth potential across both mature and emerging regions, from Bostik’s point of view, is the adult incontinence segment. “As the aging population expands, so does its need and willingness to use incontinence products,” Andrews says. “This willingness does vary considerably from one region to another and can be linked to the taboos that still exist around the condition as well as the knowledge of and availability of products. The increased need means increased demands linked to confidence and discretion; for better absorption, thinner cores, a more satisfying fit and greater comfort and discretion.”

According to statistics from U.S. Census Bureau, U.S. Department of Commerce, the older population will be about 1 billion (12% of the projected total world population) by 2030, and by 2050, 1.6 billion, or 17% of the total population of 9.4 billion, will be 65 and older.

The aging of developed regions, coupled with declining fertility rates, has led to growth in the adult incontinence market. In Japan, for instance, more adult diapers are being sold than baby diapers.

And, with aging consumers who have more active lifestyles today, consumer feedback has changed the landscape of this market. Users of incontinence underwear, pads and diapers are expressing their opinions on comfort, fit and performance, and manufactures of hygiene products and the suppliers who partner with them are responding.

Because of this consumer feedback, O’Sickey, of Tredegar Personal Care, says there is a demand for increasingly underwear-like solutions for both absorbent briefs and pants. As a result, the company has shifted focus towards making its topsheet and acquisition layer materials more soft, conformable and reliably dry, and its elastic fabrics thinner, cooler, and more akin to conventional stretch textiles.

With a growing and active aging population, Henkel sees incontinence as becoming less of a taboo subject. “In the retail category incontinence, a lot of attention goes to seamlessly integrating hygiene products into the consumer’s life,” Koenneke says. “With stretchy materials and thinner, more fitted designs, even now tailored to different body forms and sex, we as Henkel see ourselves as design enablers with our adhesives and additives.”

Henkel’s solutions handle stretch alongside a bond, which allow the use of thinner substrates, contribute to softness and reduce unwanted odor, “essentially everything that helps to support consumers living life unlimited,” she adds.

In institutional healthcare, Koenneke is optimistic that significant changes will be realized and that there will be much anticipated improvements to quality of life for patients. The Henkel adhesives team has been working on the development of printed moisture sensor technology together with its colleagues from the Henkel Printed Electronics business and in IoT partnerships. “This technology plays a key role in smart diapers and has the potential to improve institutional care in many aspects,” she says. “Alerting caregivers for a timely product change and monitoring patients alongside additional health conditions are just two of the many possible applications. With that in mind, we added conductive inks designed for hygiene industry needs to our portfolio.”