Kin Ohmura03.02.18

Japan has long been considered one of the most innovative markets for baby diapers in the world. In recent years, manufacturers in the country have battled low birth rates by focusing on growing their role in the adult category and looking toward foreign markets where their products are considered superior.

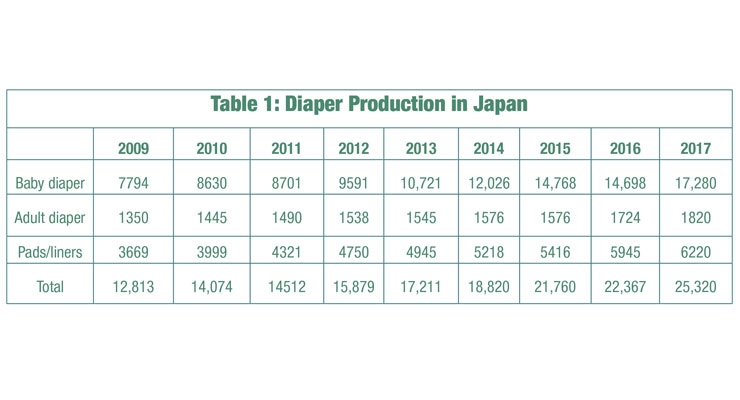

This has allowed baby diaper production to actually increase between 2012 and 2017, rather than decline as expected. Production of baby diapers and other disposable products made in Japan between 2012 and 2017 is shown in table 1.

Although baby diapers showed a high growth rate of 22.8% between 2014 and 2015, the amount of production leveled off in 2016. However, the inventories have increased again in 2017 as customers looked to recover their inventory levels after letting them decline in 2016.

For baby diapers, a good deal of this growth has been the result of exports, which counterbalanced declining demand domestically. Japanese diaper manufacturers have been exporting products to Russia, Taiwan, Hong Kong and China. China is the dominant destination for Japanese baby diapers, representing about 75% of diapers, as the Chinese consumer’s thirst for premium Japanese diapers has surprised many of the leading global brands. In fact, Chinese consumers prefer diapers made in Japan and shipped to China over the same types of diapers made by Japanese companies in overseas operations.

Although Japanese diaper manufacturers such as Unicharm, Kao and Daio Paper have also produced baby diapers in China, the diapers made in Japan are largely preferred for their higher reliability and quality. Therefore, regardless of the high price, imported goods from Japan are preferred to those made in China. So, the demand for diapers made in Japan have been increasing, led by wealthy people in China. However, as multinationals based outside of Japan, like Procter & Gamble and Kimberly-Clark, adjust their strategies for China, developing the type of soft, premium diapers preferred by consumers, the marketshare of Japanese companies could decline. Additionally, some local Chinese manufacturers are becoming more prominent in the market.

Another reason for growth in this market is the reversal of the one-child policy in China, which is expected to boost diaper demand at least for a little while. This will also lead to greater demand for nonwoven fabrics and superabsorbent materials.

Demand for spunbond nonwovens has increased even as the overall need for domestic nonwovens has decreased between 2016-2017. However, much of this demand is centered around exported spunbond materials. This condition is expected to continue for a while, although domestic production of the materials is expected to rise.

This has allowed baby diaper production to actually increase between 2012 and 2017, rather than decline as expected. Production of baby diapers and other disposable products made in Japan between 2012 and 2017 is shown in table 1.

Although baby diapers showed a high growth rate of 22.8% between 2014 and 2015, the amount of production leveled off in 2016. However, the inventories have increased again in 2017 as customers looked to recover their inventory levels after letting them decline in 2016.

For baby diapers, a good deal of this growth has been the result of exports, which counterbalanced declining demand domestically. Japanese diaper manufacturers have been exporting products to Russia, Taiwan, Hong Kong and China. China is the dominant destination for Japanese baby diapers, representing about 75% of diapers, as the Chinese consumer’s thirst for premium Japanese diapers has surprised many of the leading global brands. In fact, Chinese consumers prefer diapers made in Japan and shipped to China over the same types of diapers made by Japanese companies in overseas operations.

Although Japanese diaper manufacturers such as Unicharm, Kao and Daio Paper have also produced baby diapers in China, the diapers made in Japan are largely preferred for their higher reliability and quality. Therefore, regardless of the high price, imported goods from Japan are preferred to those made in China. So, the demand for diapers made in Japan have been increasing, led by wealthy people in China. However, as multinationals based outside of Japan, like Procter & Gamble and Kimberly-Clark, adjust their strategies for China, developing the type of soft, premium diapers preferred by consumers, the marketshare of Japanese companies could decline. Additionally, some local Chinese manufacturers are becoming more prominent in the market.

Another reason for growth in this market is the reversal of the one-child policy in China, which is expected to boost diaper demand at least for a little while. This will also lead to greater demand for nonwoven fabrics and superabsorbent materials.

Demand for spunbond nonwovens has increased even as the overall need for domestic nonwovens has decreased between 2016-2017. However, much of this demand is centered around exported spunbond materials. This condition is expected to continue for a while, although domestic production of the materials is expected to rise.