04.16.19

Price Hanna Consultants LLC, a management consulting firm whose principals have specialized in the nonwoven products, hygiene absorbent products and related fields, worldwide, for more than 35 years, has published a new report which provides comprehensive global and regional market information on spunbonded and spunmelt nonwoven polypropylene manufacturing costs and profitability, demand and capacities through 2023. The report provides detailed information on capacity by producer, country, line, and technology and beam configuration and compares regional and global supply to demand. The report is of value to companies at all levels of the spunbonded and spunmelt nonwoven polypropylene value chain to enhance their understanding of capacities, comparative producer costs and profitability and regional and global supply/demand. The report is available for immediate delivery in hard copy or electronic PDF.

From 2013 to 2018, 31 production lines with an annual nameplate capacity of 15,000 tons or more were commissioned around the world totaling more than 728,000 tons of nameplate capacity. During this period, 19 new producers began using this nonwoven technology worldwide. Between 2019 and 2023, only a fraction of that amount has been announced to be commissioned globally. More is likely to be installed. The large increment of capacity installed over the last five years has affected regional capacity utilization and challenged the continued operation of early generation technology. The report provides a detailed estimate and analysis of supply, demand and machine utilization each year from 2018 - 2023 in each global region.

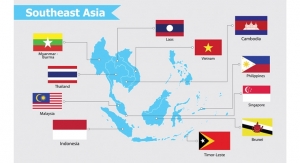

Demand for polypropylene spunbonded nonwovens is growing at attractive rates in some regions and less so in others. Capacity utilization will be uneven among global regions and producers. Hygiene demand continues to dominate consumption in this technology segment. Demand growth is driven by the increasing market penetration and a variety of other factors. Positioning of new plants in India, Africa and throughout the Asia-Pacific region illustrates demand growth in these locations. Several major factors influence producer profitability around the world, including raw material costs, supply/demand imbalances, increasing use of modern, low-cost technology, emergence of new global and regional producers, shifts in merchant market versus captive demand, producer consolidation and restructuring. Many spunbonded polypropylene producers struggle with profitability, while others are performing well. In some regions, capacity rationalization has occurred as new technology is commissioned. Modern, advanced technology has been, and will continue to be, installed. Newer technology will take share from older, less productive units of capacity to supply the hygiene market. Older technology will be used to supply non-hygiene markets and generally operate at lower utilization rates until retired.

This Price Hanna Consultants study provides significant new findings on the following topics:

• Perspective on regional and global capacity development from 2013 - 2023 and estimates of supply/demand by global region for each year from 2018 - 2023.

• Estimates of imports and exports by region and their impact on regional capacity utilization.

• Analysis of regional output capacity capable of supplying modern hygiene end uses by individual machine and in total by producer and region as compared to regional demand.

• Cost-of-manufacture estimates for selected leading regional producers using the latest generation technology based on estimates of Q1 2019 polypropylene costs.

From 2013 to 2018, 31 production lines with an annual nameplate capacity of 15,000 tons or more were commissioned around the world totaling more than 728,000 tons of nameplate capacity. During this period, 19 new producers began using this nonwoven technology worldwide. Between 2019 and 2023, only a fraction of that amount has been announced to be commissioned globally. More is likely to be installed. The large increment of capacity installed over the last five years has affected regional capacity utilization and challenged the continued operation of early generation technology. The report provides a detailed estimate and analysis of supply, demand and machine utilization each year from 2018 - 2023 in each global region.

Demand for polypropylene spunbonded nonwovens is growing at attractive rates in some regions and less so in others. Capacity utilization will be uneven among global regions and producers. Hygiene demand continues to dominate consumption in this technology segment. Demand growth is driven by the increasing market penetration and a variety of other factors. Positioning of new plants in India, Africa and throughout the Asia-Pacific region illustrates demand growth in these locations. Several major factors influence producer profitability around the world, including raw material costs, supply/demand imbalances, increasing use of modern, low-cost technology, emergence of new global and regional producers, shifts in merchant market versus captive demand, producer consolidation and restructuring. Many spunbonded polypropylene producers struggle with profitability, while others are performing well. In some regions, capacity rationalization has occurred as new technology is commissioned. Modern, advanced technology has been, and will continue to be, installed. Newer technology will take share from older, less productive units of capacity to supply the hygiene market. Older technology will be used to supply non-hygiene markets and generally operate at lower utilization rates until retired.

This Price Hanna Consultants study provides significant new findings on the following topics:

• Perspective on regional and global capacity development from 2013 - 2023 and estimates of supply/demand by global region for each year from 2018 - 2023.

• Estimates of imports and exports by region and their impact on regional capacity utilization.

• Analysis of regional output capacity capable of supplying modern hygiene end uses by individual machine and in total by producer and region as compared to regional demand.

• Cost-of-manufacture estimates for selected leading regional producers using the latest generation technology based on estimates of Q1 2019 polypropylene costs.