Karen McIntyre, Editor04.05.19

While many often equate the spunlace market with wipes, the technology actually serves a versatile range of applications in the hygiene, medical and technical areas. As makers of spunlace continue to rely on the high volumes the wipes market offers, many are looking beyond wipes for new opportunities and a strong return on investment.

Despite these opportunities, investment in new spunlace lines has slowed in recent years in developed areas like North America and Europe where new lines or line expansions were completed by companies including Jacob Holm in the U.S., Suominen in the U.S., Europe and Brazil, Spuntech in the U.S. and Mogul in the U.S., which is a line now owned by Fibertex Nonwovens.

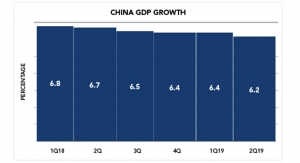

“The market has been growing steadily for the past few years and continues to do so worldwide,” says Carolin Weber, director of health and hygiene at Sandler. “The competitive landscape is changing constantly as new players are entering the market. Particularly Asian manufacturers have become a big influence, undertaking a lot of investments and building capacity that will influence the supply vs. demand ratio. It goes without saying that nonwovens manufacturers will have to monitor these developments closely.”

In fact, Asia is the region seeing the strongest rate of investment for spunlace technology. At the forefront of this expansion is Nan Liu Enterprises. The company operates production sites in Taiwan, India and China and largely serves the needs of disposable hygiene, medical, and nursing markets. In recent years, the company has invested about $100 million in Taiwan, mainly for expanding its spunlace capacities, and is constructing a new plant in India.

Meanwhile, its latest plant, in Yancho, China, recently started trial production on pure cotton spunlace nonwovens as well as high speed spunlace materials and spunlace nonwovens with biotech finishes to its product offerings.

“Thanks to growing demand in China, Nan Liu spunlace production lines are now fully loaded and production capacity is tight,” says Bernard Kerstens, commercial director of the overseas business. “This is why Nan Liu continues to invest in new spunlace production lines. In addition, the upgrading and modification of an existing old spunlace line could create high value-added products and avoid price competition with competitors.”

Next up for Nan Liu will be India where the company is currently in the planning stages of setting up production. According to Kerstens this investment follows those of Nan Liu’s customers who are already operating successful operations on the sub-continent. “With a population of more than 1.3 billion, its national income is increasing and demand for nonwoven-based products continues to increase. We are optimistic about India’s future market demand and development prospects,” Kerstens says. “Driven by the continuous growth of the overall Asian economy and the contribution of population growth, we believe that the Asian market of nonwovens will grow further, particularly in China, Southeast Asia and India.”

Elsewhere in Asia, Dalian Ruiguang Nonwoven Group in China has successfully achieved full capacity of 15,000 tons per year at a new neXline wetlace line. The highly flexible Andritz Wetlace technology, combining wet forming and hydroentanglement, is especially suited for the production of flushable wipes that are dispersible, 100% biodegradable, and without any chemical binders. This fulfills the highest environmental standards for the end products and enables production of certified nonwovens quality according to the latest EDANA/INDA guidelines for flushable wipes.

Wipes And Beyond

As one of the largest markets for nonwovens in general, the wipes market continues to represent the largest segment for spunlace nonwovens where the technology is valued for its excellent lotion handling, softness, textile-like feel and absorbency. As the wipes segment continues to develop new markets and new uses for their products, demand will continue to drive spunlace growth.

“There are wipes for almost every discernible use in everyday life, from baby care to cosmetics, from car interior care to furniture polish to the cleaning of computer screens,” Weber says. “They are readily available at any time, even on the go. In our fast-paced society, this is a major convenience factor and a driver for further demand growth.”

However, the supply chain can be challenged in wipes. For many applications, supply already matches demand and new suppliers are regularly entering the market. Growth and further development are only achievable through differentiation. Visual differentiation is possible in print or embossed motifs. Enhanced functionality, innovative product structures or combinations of different properties can also set a product apart from the competition.

Therefore, spunlace manufacturers like Suominen continue to look outside of the wipes market for spunlace growth. Markets where spunlace is being valued include from technical applications where they nonwovens are applied as processing aids or cover nonwovens. The automotive industry is just one sector benefitting from the functionality of these materials.

“Our wide-spread portfolio and know-how of different manufacturing technologies made it easier to consider the spunlace technology for applications other than wipes,” says Lynda Kelly, senior vice president, Care. “As we are active in a variety of markets, we are also aware of requirements, trends and customer demands in these other segments. This enables us to ascertain whether spunlaced materials would make an adequate – or in the best case even superior – alternative for a specific application. Having different technologies at our disposal also enables us to combine material properties in order to further enhance functionality. To this end, we are also collaborating with our customers and partners, advancing their products as well as our own.”

As the largest maker of spunlace nonwovens globally, Suominen has spent the last few years investing in new technologies both to help this expansion in new markets but also to benefit its wipes business. Recent line upgrades, which promote its focus on value added products, include Green Bay, WI, where Suominen has invested €6 million to install new carding machinery on an existing line, expanding the product range made at the site.

The upgrade has allowed Suominen to supply high value added nonwovens for a range of technologies including baby wipes, which can now be supplied more efficiently.

Other investments include a line upgrade in Paulínia, Brazil, which allowed Suominen to launch Fibrella Wrap, a high-performing material for undercast paddings and cushions used in wound care, to the South American market, Suominen’s initial foray into the growing medical market of South America. In Alicante, Spain, the investment expanded the plant’s product offering and increased its capability and capacity to supply also products with high added value. The focus of the investment was particularly on workplace and medical segments.

In medical, Suominen continues to grow in niche medical applications utilizing its unique thermal bond line called Novonette nonwovens. This technology offers unparalleled hold and release characteristics of fluid necessary for many niche medical applications.

Meanwhile, Webril, the company’s 100% cotton nonwovens line of products, continues to meet the rigorous needs of the medical cast padding and medical market.

For Sandler, its experience in a variety of markets has helped fuel its involvement in new spunlace categories. “Our wide-spread portfolio and know-how of different manufacturing technologies made it easier to consider the spunlace technology for applications other than wipes,” Weber says. “As we are active in a variety of markets, we are also aware of requirements, trends and customer demands in these other segments.

She adds that technical applications as well as hygiene products , hold a lot of opportunities to bring the advantages of spunlace nonwovens to bear. In the technical sector, spunlace nonwovens are applied as processing aids or cover nonwovens. The automotive industry is just one sector benefitting from the functionality of these materials.

“To advance innovation in these new fields of application as well as in the wipes market, we cooperate closely with our customers and partners along the supply chain,” Weber says.

For Fibertex Nonwovens, which is also a needlepunch producer, an existing background in many technical markets has helped it expand spunlace into new market areas. “We already sell spunlace technology in various industrial segments—automotive interiors , engine bay, backing, composites, filtration and acoustics,” says Michel Vincent-Dospital, CCO, Automotive & Wipes.

Fibertex’s trust in the strength of the spunlace market is proven through recent acquisitions in the U.S. and Brazil. “These recent acquisitions are driven by the market observations as well as the growth of the volume and flexible spunlace technology and our knowledge of the specialty wipes market in Europe and Americas in line with Fibertex‘s recent acquisition of DUCI in Brazil,” says Vincent-Dospital.

Earlier this year, the Denmark-based company purchased Mogul’s North American spunlace facility in Grey Court, SC providing it with better access to customers in North America. The acquisition gave Fibertex 14,000 tons of spunlace nonwovens as well as 20 acres, giving it ample room for future expansion.

“We will exploit the advantages of now having Fibertex Nonwovens production sites located in the most important markets in Europe, Africa, South and North America,” says Jørgen Bech Madsen, CEO of Fibertex Nonwovens. “At the same time, we will make full use of the our global product development capabilities, which has contributed to some of the most recent technological breakthroughs. We therefore see a great potential in investing in further growth.”

The acquired plant complements Fibertex’s other North American operation in Chicago, IL, a needlepunch facility acquired from NonWoven Solutions in 2014. Fibertex Nonwovens also has considerable experience with spunlace technology and produces this type of substrate at facilities worldwide.

“We have been offered to acquire the production site as Mogul wants to focus on its Madaline product and new innovative nonwovens in Turkey,” says Madsen. “The line has been built in accordance with state-of-the-art production principles and already operates in a fully reliable manner. In this way, we save time and money compared to a greenfield investment in North America, where the market is currently undergoing rapid growth.”

Mogul’s Madaline product was launched in 2017. This bicomponent microfilament hydroentangled nonwoven is suitable for artificial leather, anti-mite home textile, outdoor/sportswear, facial mask, dry wipe, precision product packaging, automotive headliner/acoustics and graphic design applications. Meanwhile in dry wipes, or cleaning cloths, Mogul has established a subsidiary called Asterion to promote the material. Asterion hopes to challenge the reusable microfiber wipes market, which is traditionally comprised of woven rags, and open up new opportunities for nonwovens.

When used in the cleaning wipes market, Mogul’s microfilament technology performs well when cleaning dust and dirt commonly found in industry, light and heavy manufacturing and professional cleaning. Featuring microfilaments 100 times thinner than a human hair, Asterion wipes are a cost-effective, convenient and a portable tool for spot cleaning and wiping irregularly shaped surfaces.

“The cleaning industry is basically fragmented into two major distinct applications, one is the disposables and the other is washable,” says Enver Kayali, president of Asterion Global. “The disposables can be named as paper-based multi use wipers and man-made fibers (spunlace), etc. In the washable segment, the products are textile scraps/rags, terry towels and microfibers. The nonwovens industry supplies to the disposable side of the industry and almost has no presence in the washable side.”

The development of Madaline was the result of an investment in unique microfilament technology with a high throughput production line, which made Mogul one of just two nonwoven producers, globally, to have such a high capacity and patented production line in-house.

While Mogul is not a large player in spunlace when it comes to capacity, commercial director Serkan Gogus believes the company plays an important role with diversified technologies like Madaline and its Durell crosslapped technology, which has created opportunities in artificial leather, home décor, medical and automotives.

“Hydroentangling brings unique properties to polymer based nonwovens, so this is definitely a growth area for the future. Also new technology combining wetlaid and hydroentangling brings,” he says.

Last year Suominen, one of the largest suppliers of substrate material to the global wipes market, took a concrete step in its Changemaker strategy and introduced the Suominen Intelligent Nonwovens concept to the market. First of its kind in the world of nonwovens, the concept makes it possible to embed digital features into Suominen nonwovens, allowing things like product traceability and safety to a whole new level. It also gives Suominen customers opportunities for a new kind of sophisticated marketing tool.

The concept stems from Suominen’s research and development projects that previously led to the launch of the High Definition Design Series, a revolutionary pattern selection for nonwovens. The Suominen Intelligent Nonwovens concept adds a unique technical capability into the mix and combines artificial intelligence with extremely high definition patterning. With Suominen Intelligent Nonwovens, all kinds of digital features can be embedded into the substrate without deteriorating other functionalities or aesthetic appearance of nonwovens.

According to the company, the idea of Suominen Intelligent Nonwovens was originally based on traceability and counterfeit problems that the company observed in the market place and wanted to solve.

In today’s world in a case of a customer claim, consumers do not call a customer service number or similar. Instead they take a picture from the product and distribute the complaint via social media to the whole world. In these cases the damage to the brand can be huge and nonwoven suppliers have very limited tools to help their customers to solve the problem.

Suominen has IPR protected 21 different patterns ready for its customers to be used. It can design customer or brand specific patterns with the Suominen Intelligent Nonwoven capability included.

This customization is central to Suominen’s technology strategy for the past years. Three to four years ago the company started to work in very detail on the patterning of its wipes. Especially it wanted to understand the connection of customer perception to its patterns and the connection to real data from its laboratories. Suominen looked at perceived softness and cleanability of different patterns and compared that to real cleaning data from its laboratories. With this iterative process, it was able to design the most soft and best cleaning patterns in the industry.

Through this work the company was able to improve its technical patterning capabilities and the patterns of today are a magnitude better than the ones five year back. The contrast became so good that Suominen noticed that the pattern is easily recognizable with a normal smart phone camera. Suominen used artificial intelligence (AI) to teach the camera what it should be looking for in the pattern. The beauty is that the system learns and becomes better every time you scan a pattern.

Akinal Sentetik Tekstil

2. Org. San. Bol. 83226 Cad. No.:11,

Baspinar, Sehitkamil

Gaziantep, 27500 Turkey

www.asnonwovens.com

BC Nonwovens

Avda. Diagonal 463 bis 9A

Barcelona, 08036 Spain

www.bcnonwovens.com

Bondex

2 Maxwell Drive

Trenton, SC 29847

803-663-1922

www.bondexinc.com

Eruslu Nonwovens

4.Organize San. bl. 83414 Sk. No:22 Baspinar

Gaziantep, , 27010

Turkey

90-342-357-07-20

www.eruslu.com

Fibertex Nonwovens

Svendborgvej 16

Aalborg, 9220

Denmark

96-35-35-35

www.fibertexnonwovens.com

Ginni Nonwovens

H-6 Sector 63

Noida 201301

India

www.ginninonwovens.com

Ihsan Sons

Dar Road

Raiwind Lahore 55150 Pakistan

www.ihsansons.com

Jacob Holm Industries

Picassoplatz 8

Basel, 4052

Switzerland

www.jacob-holm.com

KNH Enterprises

27F No. 456 Sec. 4 Sinyi Road

Taipei, 11052

Taiwan

www.knh.com.tw

Lentex

ul. Powstancow 54

Lubliniec, PL 42-701

Poland

www.lentex.com.pl

Mogul Nonwovens

Baspinar 2. Organize Sanayi Bolgesi

83228 Nolu Cadde No: 8

Gaziantep, 27120

Turkey

www.mogulsb.com

Nan Liu Enterprises

Baspinar 2. Organize Sanayi Bolgesi

83228 Nolu Cadde No: 8

Gaziantep, 27120

Turkey

www.nanliu.com.tw

Norafin

Gewerbegbiet Nord 3

Mildenau, 09546

Germany

www.norafin.com

Novita

Dekoracyjna 3

Zielona Gora, 65-722

Poland

www.novita.com.pl

Sandler

Lamitzmühle 1

Schwarzenbach/Saale, 95126

Germany

www.sandler.de

Spuntech

Spuntech555 North Park Drive

Roxboro, NC 27573

www.spuntech.com

Suominen

PO Box 25, Suomisentie 11

Nakkila, FI-29251

Finland

www.suominen.fi

Tenowo

Postfach 1529

Fabrikzeile 21

Hof, 95014

Germany

www.tenowo.com

Welspun

6th Floor, Kamala Mills Compound

Senapati Bapat Mar, Lower Parel

Mumbai 400 013

India

www.welspunindia.com

Despite these opportunities, investment in new spunlace lines has slowed in recent years in developed areas like North America and Europe where new lines or line expansions were completed by companies including Jacob Holm in the U.S., Suominen in the U.S., Europe and Brazil, Spuntech in the U.S. and Mogul in the U.S., which is a line now owned by Fibertex Nonwovens.

“The market has been growing steadily for the past few years and continues to do so worldwide,” says Carolin Weber, director of health and hygiene at Sandler. “The competitive landscape is changing constantly as new players are entering the market. Particularly Asian manufacturers have become a big influence, undertaking a lot of investments and building capacity that will influence the supply vs. demand ratio. It goes without saying that nonwovens manufacturers will have to monitor these developments closely.”

In fact, Asia is the region seeing the strongest rate of investment for spunlace technology. At the forefront of this expansion is Nan Liu Enterprises. The company operates production sites in Taiwan, India and China and largely serves the needs of disposable hygiene, medical, and nursing markets. In recent years, the company has invested about $100 million in Taiwan, mainly for expanding its spunlace capacities, and is constructing a new plant in India.

Meanwhile, its latest plant, in Yancho, China, recently started trial production on pure cotton spunlace nonwovens as well as high speed spunlace materials and spunlace nonwovens with biotech finishes to its product offerings.

“Thanks to growing demand in China, Nan Liu spunlace production lines are now fully loaded and production capacity is tight,” says Bernard Kerstens, commercial director of the overseas business. “This is why Nan Liu continues to invest in new spunlace production lines. In addition, the upgrading and modification of an existing old spunlace line could create high value-added products and avoid price competition with competitors.”

Next up for Nan Liu will be India where the company is currently in the planning stages of setting up production. According to Kerstens this investment follows those of Nan Liu’s customers who are already operating successful operations on the sub-continent. “With a population of more than 1.3 billion, its national income is increasing and demand for nonwoven-based products continues to increase. We are optimistic about India’s future market demand and development prospects,” Kerstens says. “Driven by the continuous growth of the overall Asian economy and the contribution of population growth, we believe that the Asian market of nonwovens will grow further, particularly in China, Southeast Asia and India.”

Elsewhere in Asia, Dalian Ruiguang Nonwoven Group in China has successfully achieved full capacity of 15,000 tons per year at a new neXline wetlace line. The highly flexible Andritz Wetlace technology, combining wet forming and hydroentanglement, is especially suited for the production of flushable wipes that are dispersible, 100% biodegradable, and without any chemical binders. This fulfills the highest environmental standards for the end products and enables production of certified nonwovens quality according to the latest EDANA/INDA guidelines for flushable wipes.

Wipes And Beyond

As one of the largest markets for nonwovens in general, the wipes market continues to represent the largest segment for spunlace nonwovens where the technology is valued for its excellent lotion handling, softness, textile-like feel and absorbency. As the wipes segment continues to develop new markets and new uses for their products, demand will continue to drive spunlace growth.

“There are wipes for almost every discernible use in everyday life, from baby care to cosmetics, from car interior care to furniture polish to the cleaning of computer screens,” Weber says. “They are readily available at any time, even on the go. In our fast-paced society, this is a major convenience factor and a driver for further demand growth.”

However, the supply chain can be challenged in wipes. For many applications, supply already matches demand and new suppliers are regularly entering the market. Growth and further development are only achievable through differentiation. Visual differentiation is possible in print or embossed motifs. Enhanced functionality, innovative product structures or combinations of different properties can also set a product apart from the competition.

Therefore, spunlace manufacturers like Suominen continue to look outside of the wipes market for spunlace growth. Markets where spunlace is being valued include from technical applications where they nonwovens are applied as processing aids or cover nonwovens. The automotive industry is just one sector benefitting from the functionality of these materials.

“Our wide-spread portfolio and know-how of different manufacturing technologies made it easier to consider the spunlace technology for applications other than wipes,” says Lynda Kelly, senior vice president, Care. “As we are active in a variety of markets, we are also aware of requirements, trends and customer demands in these other segments. This enables us to ascertain whether spunlaced materials would make an adequate – or in the best case even superior – alternative for a specific application. Having different technologies at our disposal also enables us to combine material properties in order to further enhance functionality. To this end, we are also collaborating with our customers and partners, advancing their products as well as our own.”

As the largest maker of spunlace nonwovens globally, Suominen has spent the last few years investing in new technologies both to help this expansion in new markets but also to benefit its wipes business. Recent line upgrades, which promote its focus on value added products, include Green Bay, WI, where Suominen has invested €6 million to install new carding machinery on an existing line, expanding the product range made at the site.

The upgrade has allowed Suominen to supply high value added nonwovens for a range of technologies including baby wipes, which can now be supplied more efficiently.

Other investments include a line upgrade in Paulínia, Brazil, which allowed Suominen to launch Fibrella Wrap, a high-performing material for undercast paddings and cushions used in wound care, to the South American market, Suominen’s initial foray into the growing medical market of South America. In Alicante, Spain, the investment expanded the plant’s product offering and increased its capability and capacity to supply also products with high added value. The focus of the investment was particularly on workplace and medical segments.

In medical, Suominen continues to grow in niche medical applications utilizing its unique thermal bond line called Novonette nonwovens. This technology offers unparalleled hold and release characteristics of fluid necessary for many niche medical applications.

Meanwhile, Webril, the company’s 100% cotton nonwovens line of products, continues to meet the rigorous needs of the medical cast padding and medical market.

For Sandler, its experience in a variety of markets has helped fuel its involvement in new spunlace categories. “Our wide-spread portfolio and know-how of different manufacturing technologies made it easier to consider the spunlace technology for applications other than wipes,” Weber says. “As we are active in a variety of markets, we are also aware of requirements, trends and customer demands in these other segments.

She adds that technical applications as well as hygiene products , hold a lot of opportunities to bring the advantages of spunlace nonwovens to bear. In the technical sector, spunlace nonwovens are applied as processing aids or cover nonwovens. The automotive industry is just one sector benefitting from the functionality of these materials.

“To advance innovation in these new fields of application as well as in the wipes market, we cooperate closely with our customers and partners along the supply chain,” Weber says.

For Fibertex Nonwovens, which is also a needlepunch producer, an existing background in many technical markets has helped it expand spunlace into new market areas. “We already sell spunlace technology in various industrial segments—automotive interiors , engine bay, backing, composites, filtration and acoustics,” says Michel Vincent-Dospital, CCO, Automotive & Wipes.

Fibertex’s trust in the strength of the spunlace market is proven through recent acquisitions in the U.S. and Brazil. “These recent acquisitions are driven by the market observations as well as the growth of the volume and flexible spunlace technology and our knowledge of the specialty wipes market in Europe and Americas in line with Fibertex‘s recent acquisition of DUCI in Brazil,” says Vincent-Dospital.

Earlier this year, the Denmark-based company purchased Mogul’s North American spunlace facility in Grey Court, SC providing it with better access to customers in North America. The acquisition gave Fibertex 14,000 tons of spunlace nonwovens as well as 20 acres, giving it ample room for future expansion.

“We will exploit the advantages of now having Fibertex Nonwovens production sites located in the most important markets in Europe, Africa, South and North America,” says Jørgen Bech Madsen, CEO of Fibertex Nonwovens. “At the same time, we will make full use of the our global product development capabilities, which has contributed to some of the most recent technological breakthroughs. We therefore see a great potential in investing in further growth.”

The acquired plant complements Fibertex’s other North American operation in Chicago, IL, a needlepunch facility acquired from NonWoven Solutions in 2014. Fibertex Nonwovens also has considerable experience with spunlace technology and produces this type of substrate at facilities worldwide.

“We have been offered to acquire the production site as Mogul wants to focus on its Madaline product and new innovative nonwovens in Turkey,” says Madsen. “The line has been built in accordance with state-of-the-art production principles and already operates in a fully reliable manner. In this way, we save time and money compared to a greenfield investment in North America, where the market is currently undergoing rapid growth.”

Mogul’s Madaline product was launched in 2017. This bicomponent microfilament hydroentangled nonwoven is suitable for artificial leather, anti-mite home textile, outdoor/sportswear, facial mask, dry wipe, precision product packaging, automotive headliner/acoustics and graphic design applications. Meanwhile in dry wipes, or cleaning cloths, Mogul has established a subsidiary called Asterion to promote the material. Asterion hopes to challenge the reusable microfiber wipes market, which is traditionally comprised of woven rags, and open up new opportunities for nonwovens.

When used in the cleaning wipes market, Mogul’s microfilament technology performs well when cleaning dust and dirt commonly found in industry, light and heavy manufacturing and professional cleaning. Featuring microfilaments 100 times thinner than a human hair, Asterion wipes are a cost-effective, convenient and a portable tool for spot cleaning and wiping irregularly shaped surfaces.

“The cleaning industry is basically fragmented into two major distinct applications, one is the disposables and the other is washable,” says Enver Kayali, president of Asterion Global. “The disposables can be named as paper-based multi use wipers and man-made fibers (spunlace), etc. In the washable segment, the products are textile scraps/rags, terry towels and microfibers. The nonwovens industry supplies to the disposable side of the industry and almost has no presence in the washable side.”

The development of Madaline was the result of an investment in unique microfilament technology with a high throughput production line, which made Mogul one of just two nonwoven producers, globally, to have such a high capacity and patented production line in-house.

While Mogul is not a large player in spunlace when it comes to capacity, commercial director Serkan Gogus believes the company plays an important role with diversified technologies like Madaline and its Durell crosslapped technology, which has created opportunities in artificial leather, home décor, medical and automotives.

“Hydroentangling brings unique properties to polymer based nonwovens, so this is definitely a growth area for the future. Also new technology combining wetlaid and hydroentangling brings,” he says.

Last year Suominen, one of the largest suppliers of substrate material to the global wipes market, took a concrete step in its Changemaker strategy and introduced the Suominen Intelligent Nonwovens concept to the market. First of its kind in the world of nonwovens, the concept makes it possible to embed digital features into Suominen nonwovens, allowing things like product traceability and safety to a whole new level. It also gives Suominen customers opportunities for a new kind of sophisticated marketing tool.

The concept stems from Suominen’s research and development projects that previously led to the launch of the High Definition Design Series, a revolutionary pattern selection for nonwovens. The Suominen Intelligent Nonwovens concept adds a unique technical capability into the mix and combines artificial intelligence with extremely high definition patterning. With Suominen Intelligent Nonwovens, all kinds of digital features can be embedded into the substrate without deteriorating other functionalities or aesthetic appearance of nonwovens.

According to the company, the idea of Suominen Intelligent Nonwovens was originally based on traceability and counterfeit problems that the company observed in the market place and wanted to solve.

In today’s world in a case of a customer claim, consumers do not call a customer service number or similar. Instead they take a picture from the product and distribute the complaint via social media to the whole world. In these cases the damage to the brand can be huge and nonwoven suppliers have very limited tools to help their customers to solve the problem.

Suominen has IPR protected 21 different patterns ready for its customers to be used. It can design customer or brand specific patterns with the Suominen Intelligent Nonwoven capability included.

This customization is central to Suominen’s technology strategy for the past years. Three to four years ago the company started to work in very detail on the patterning of its wipes. Especially it wanted to understand the connection of customer perception to its patterns and the connection to real data from its laboratories. Suominen looked at perceived softness and cleanability of different patterns and compared that to real cleaning data from its laboratories. With this iterative process, it was able to design the most soft and best cleaning patterns in the industry.

Through this work the company was able to improve its technical patterning capabilities and the patterns of today are a magnitude better than the ones five year back. The contrast became so good that Suominen noticed that the pattern is easily recognizable with a normal smart phone camera. Suominen used artificial intelligence (AI) to teach the camera what it should be looking for in the pattern. The beauty is that the system learns and becomes better every time you scan a pattern.

Akinal Sentetik Tekstil

2. Org. San. Bol. 83226 Cad. No.:11,

Baspinar, Sehitkamil

Gaziantep, 27500 Turkey

www.asnonwovens.com

BC Nonwovens

Avda. Diagonal 463 bis 9A

Barcelona, 08036 Spain

www.bcnonwovens.com

Bondex

2 Maxwell Drive

Trenton, SC 29847

803-663-1922

www.bondexinc.com

Eruslu Nonwovens

4.Organize San. bl. 83414 Sk. No:22 Baspinar

Gaziantep, , 27010

Turkey

90-342-357-07-20

www.eruslu.com

Fibertex Nonwovens

Svendborgvej 16

Aalborg, 9220

Denmark

96-35-35-35

www.fibertexnonwovens.com

Ginni Nonwovens

H-6 Sector 63

Noida 201301

India

www.ginninonwovens.com

Ihsan Sons

Dar Road

Raiwind Lahore 55150 Pakistan

www.ihsansons.com

Jacob Holm Industries

Picassoplatz 8

Basel, 4052

Switzerland

www.jacob-holm.com

KNH Enterprises

27F No. 456 Sec. 4 Sinyi Road

Taipei, 11052

Taiwan

www.knh.com.tw

Lentex

ul. Powstancow 54

Lubliniec, PL 42-701

Poland

www.lentex.com.pl

Mogul Nonwovens

Baspinar 2. Organize Sanayi Bolgesi

83228 Nolu Cadde No: 8

Gaziantep, 27120

Turkey

www.mogulsb.com

Nan Liu Enterprises

Baspinar 2. Organize Sanayi Bolgesi

83228 Nolu Cadde No: 8

Gaziantep, 27120

Turkey

www.nanliu.com.tw

Norafin

Gewerbegbiet Nord 3

Mildenau, 09546

Germany

www.norafin.com

Novita

Dekoracyjna 3

Zielona Gora, 65-722

Poland

www.novita.com.pl

Sandler

Lamitzmühle 1

Schwarzenbach/Saale, 95126

Germany

www.sandler.de

Spuntech

Spuntech555 North Park Drive

Roxboro, NC 27573

www.spuntech.com

Suominen

PO Box 25, Suomisentie 11

Nakkila, FI-29251

Finland

www.suominen.fi

Tenowo

Postfach 1529

Fabrikzeile 21

Hof, 95014

Germany

www.tenowo.com

Welspun

6th Floor, Kamala Mills Compound

Senapati Bapat Mar, Lower Parel

Mumbai 400 013

India

www.welspunindia.com