Shirley Zhang, Nonwovens Industry China, Ringier Trade Media03.04.19

Berry Global has been the leading company in specialty engineered materials and plastic packaging protection solutions for more than half a century. In October 2015, PGI officially joined the Berry family, which made Berry the world’s biggest nonwovens producer. It was also an important milestone for the company – the first time to appear in the list of Fortune 500 companies in 2017. The original nonwovens business formed the new division of Berry Global - Health, Hygiene and Specialties (HH&S).

In 1996, PGI installed the first Reicofil line in China in Foshan Nanhai, which opened the development chapter in Asia. Since then, two nonwoven plants have been established in Nanhai and Suzhou, offering comprehensive solutions to hygiene and specialty clients.

Berry has never stopped the pace of expansion. In February 2018, the company announced the successful acquisition of Clopay Plastic Products, and in August announced the acquisition of Laddawn. The first move strengthens the leadership of Berry HH&S in the attractive hygiene and healthcare market. It also expands the range of their products and services supplied to leading consumer and industrial manufacturers. Now that Berry’s nonwovens business is combined with its film business, the two businesses will benefit from the expansion of customer relationships and synergies between them. After the acquisition of Laddawn, the group’s three divisions are able to leverage their online/e-commerce platform, an important modern marketing channel, to boost business growth.

At the same time, Berry’s commitment to its customers in Asia fully demonstrates the company’s presence and strong confidence in growth potential of the Asian market, such as the first RF5 line in Asia and the recently announced investment in a specialty meltblown line.

During the FSA show, Nonwovens Industry China had the opportunity to interview Yan Cui, EVP and general manager of HH&S Asia, Wendy Warner, VP Global Specialties of HH&S Division of Berry Global and Johnny Wong, VP – HH&S Asia Commercial & Product Development.

NWI: Berry announced the investment of a specialty meltblown asset to produce high efficiency filtration media serving the Asia markets. Could you please share with us more details and the latest progress of the project?

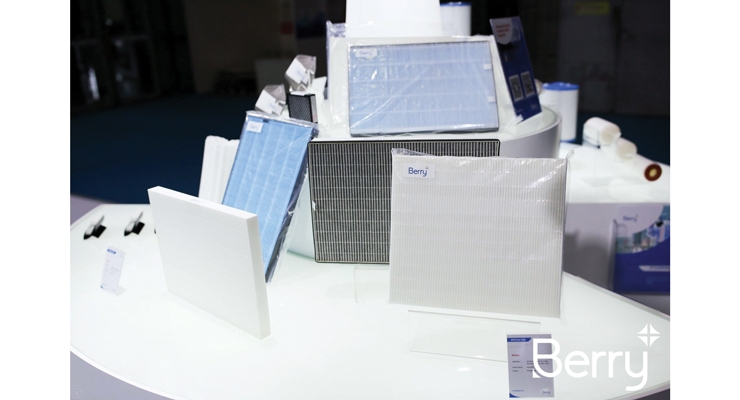

Yan Cui (YC): This investment, which will be a part of the company’s Health, Hygiene, and Specialties Division, is targeted to meet forecasted market and customer growth, and will be focused on premium applications in the Room Air Purification, Industrial Face Mask and Cabin Air Filtration markets. Current projections are for commercial production to start in 2019. The project is on track.

NWI: What role does the investment play in Berry’s global filtration business strategy?

YC: In line with the global Specialties strategy, a key growth enabler has been leveraging highly-differentiated value propositions. This includes products such as Meltex for room air purifiers, air filters and face masks as well as Typar and Reemay for liquid filtration applications including drinking water and industrial filtration of fluids. Our nonwovens portfolio is also gaining ground as support layers for filtration media. Our investment in meltblown capacity is the next step in advancing our market position in filtration solutions.

NWI: What benefits will it bring to Berry and your customers after the line is commercialized?

YC: Growth. There is a high market growth rate for air filtration and liquid filtration, particularly in China. We are excited to expand our capacity to accommodate the growing markets and increased demand. We have been responding quickly to customers’ needs, such as sample requests, ordering and technical support. We have also partnered with customers on the technical and marketing aspects of product development.

With added capacity of a new meltblown line in China in sight for 2019 and further expansion plans in consideration, we are committed to continued rapid growth in this exciting marketplace.

NWI: How about Berry HH&S Asia’s business growth this year?

YC: Over the past 12 months, we integrated Clopay into the Berry family successfully, expanded our market share, enhanced partnerships with strategic customers, enriched product portfolios, and increased our sales. We also continue improvement in both Safety and Quality - both key criteria for a sustainable organization.

NWI: What is your strategy and development plans in Asia/China in the next few years?

YC: Asia is an important region for Berry Global. We are very positive entering fiscal 2019. Our strategic growth programs, and major investments in China like RF5 and meltblown lines, are all on track. We are targeting continued advancement with our technology and innovation to provide high value proposition products for our customers.

NWI: In your opinion, what are the opportunities and challenges brought by the rapid growth and increasing demand of the Asia/China filtration market for upstream and downstream companies?

Wendy Warner (WW): The Asian filtration market has been rapidly growing over the past several years. Berry has been successfully participating with the brands Reemay, Typar and Meltex. As the technical requirements become more and more demanding in China, we can consider China a leader in filtration markets. In Berry, we strive to be the Partner of Choice for filtration media developments to bring innovative solutions to the market.

NWI: How do Berry’s products and solutions help filtration customers to seize the opportunity and win in the market?

WW: We have a dedicated team that works very closely with the customer. Together we design filtration media that can better solve their needs and offer added-value to the end user. If we take face masks as an example, our patented meltblown technology allows us to offer very high efficiency filter media at a lower grammage. Our mono-layer solution delivers better breathing than incumbents requiring several layers or thicker media.

NWI: Could you please introduce the characteristics, advantages and application fields of Arium nanofiber materials? Could it be combined with other materials to create specialty composites?

WW: Arium is a proprietary technology that produces submicron fibers, predominately in the range of 500 – 600 microns. Arium is capable of producing submicron fibers at through puts comparable to traditional meltblown processes. By combining technologies, or utilizing Arium technology alone, innovative product solutions can be delivered to the market. With its high surface area, Arium is a tool to deliver a range of high efficiency filtration applications to advance product performance.

NWI: What do you think are the future technology trends on the application of nonwovens in filtration?

WW: We have been seeing how the customer concern and governmental regulations are pushing the industry to deliver more safe and reliable filtration in every day activity. Filters will need to adapt to fulfill such demands and focus strongly in industrial processing and healthcare applications.

NWI: Innovation and R&D are always Berry’s focus. As an industry leader in both nonwovens and films, what are the innovation strategies you have been insisting on?

Johnny Wong (JW): Our innovation strategies are built on the following elements.

NWI: Any other key drivers to keep Berry ahead of the industry?

JW: Innovation lead time and speed to the market: Innovation lead-time and speed are vital to business through meeting our customer needs. We measure the effectiveness of innovation by how much growth business is gained through innovation and on-time delivery. By accelerating speed of product development, we can help ensure healthy growth that outpaces the market.

In 1996, PGI installed the first Reicofil line in China in Foshan Nanhai, which opened the development chapter in Asia. Since then, two nonwoven plants have been established in Nanhai and Suzhou, offering comprehensive solutions to hygiene and specialty clients.

Berry has never stopped the pace of expansion. In February 2018, the company announced the successful acquisition of Clopay Plastic Products, and in August announced the acquisition of Laddawn. The first move strengthens the leadership of Berry HH&S in the attractive hygiene and healthcare market. It also expands the range of their products and services supplied to leading consumer and industrial manufacturers. Now that Berry’s nonwovens business is combined with its film business, the two businesses will benefit from the expansion of customer relationships and synergies between them. After the acquisition of Laddawn, the group’s three divisions are able to leverage their online/e-commerce platform, an important modern marketing channel, to boost business growth.

At the same time, Berry’s commitment to its customers in Asia fully demonstrates the company’s presence and strong confidence in growth potential of the Asian market, such as the first RF5 line in Asia and the recently announced investment in a specialty meltblown line.

During the FSA show, Nonwovens Industry China had the opportunity to interview Yan Cui, EVP and general manager of HH&S Asia, Wendy Warner, VP Global Specialties of HH&S Division of Berry Global and Johnny Wong, VP – HH&S Asia Commercial & Product Development.

NWI: Berry announced the investment of a specialty meltblown asset to produce high efficiency filtration media serving the Asia markets. Could you please share with us more details and the latest progress of the project?

Yan Cui (YC): This investment, which will be a part of the company’s Health, Hygiene, and Specialties Division, is targeted to meet forecasted market and customer growth, and will be focused on premium applications in the Room Air Purification, Industrial Face Mask and Cabin Air Filtration markets. Current projections are for commercial production to start in 2019. The project is on track.

NWI: What role does the investment play in Berry’s global filtration business strategy?

YC: In line with the global Specialties strategy, a key growth enabler has been leveraging highly-differentiated value propositions. This includes products such as Meltex for room air purifiers, air filters and face masks as well as Typar and Reemay for liquid filtration applications including drinking water and industrial filtration of fluids. Our nonwovens portfolio is also gaining ground as support layers for filtration media. Our investment in meltblown capacity is the next step in advancing our market position in filtration solutions.

NWI: What benefits will it bring to Berry and your customers after the line is commercialized?

YC: Growth. There is a high market growth rate for air filtration and liquid filtration, particularly in China. We are excited to expand our capacity to accommodate the growing markets and increased demand. We have been responding quickly to customers’ needs, such as sample requests, ordering and technical support. We have also partnered with customers on the technical and marketing aspects of product development.

With added capacity of a new meltblown line in China in sight for 2019 and further expansion plans in consideration, we are committed to continued rapid growth in this exciting marketplace.

NWI: How about Berry HH&S Asia’s business growth this year?

YC: Over the past 12 months, we integrated Clopay into the Berry family successfully, expanded our market share, enhanced partnerships with strategic customers, enriched product portfolios, and increased our sales. We also continue improvement in both Safety and Quality - both key criteria for a sustainable organization.

NWI: What is your strategy and development plans in Asia/China in the next few years?

YC: Asia is an important region for Berry Global. We are very positive entering fiscal 2019. Our strategic growth programs, and major investments in China like RF5 and meltblown lines, are all on track. We are targeting continued advancement with our technology and innovation to provide high value proposition products for our customers.

NWI: In your opinion, what are the opportunities and challenges brought by the rapid growth and increasing demand of the Asia/China filtration market for upstream and downstream companies?

Wendy Warner (WW): The Asian filtration market has been rapidly growing over the past several years. Berry has been successfully participating with the brands Reemay, Typar and Meltex. As the technical requirements become more and more demanding in China, we can consider China a leader in filtration markets. In Berry, we strive to be the Partner of Choice for filtration media developments to bring innovative solutions to the market.

NWI: How do Berry’s products and solutions help filtration customers to seize the opportunity and win in the market?

WW: We have a dedicated team that works very closely with the customer. Together we design filtration media that can better solve their needs and offer added-value to the end user. If we take face masks as an example, our patented meltblown technology allows us to offer very high efficiency filter media at a lower grammage. Our mono-layer solution delivers better breathing than incumbents requiring several layers or thicker media.

NWI: Could you please introduce the characteristics, advantages and application fields of Arium nanofiber materials? Could it be combined with other materials to create specialty composites?

WW: Arium is a proprietary technology that produces submicron fibers, predominately in the range of 500 – 600 microns. Arium is capable of producing submicron fibers at through puts comparable to traditional meltblown processes. By combining technologies, or utilizing Arium technology alone, innovative product solutions can be delivered to the market. With its high surface area, Arium is a tool to deliver a range of high efficiency filtration applications to advance product performance.

NWI: What do you think are the future technology trends on the application of nonwovens in filtration?

WW: We have been seeing how the customer concern and governmental regulations are pushing the industry to deliver more safe and reliable filtration in every day activity. Filters will need to adapt to fulfill such demands and focus strongly in industrial processing and healthcare applications.

NWI: Innovation and R&D are always Berry’s focus. As an industry leader in both nonwovens and films, what are the innovation strategies you have been insisting on?

Johnny Wong (JW): Our innovation strategies are built on the following elements.

- Continuous investment in innovation and talent: We believe the value of innovation is the key driver to success. People with unique and innovative thinking can bring unique high-value product solutions to customers.

- Culture: Foster an innovative culture in the whole company. Innovation exists not only in our R&D team but also in the entire organization. Not just R&D department, all Berry people actively explore every possibility of innovation at work. When the team’s thinking sparks collide, they can actively explore opportunities.

- Application based innovation: In our industry, innovation is linked closely with applications. Customers in different fields have their own unique needs, so we can only offer targeted solutions after deep understanding. We believe true innovation will address unmet application needs.

- Global innovation platform: Our innovation platform is composed of corporate R&D and regional PD. The global footprint helps collaboration across different regions. We are actively transferring various technologies / know-how to regions from our global innovation platform.

NWI: Any other key drivers to keep Berry ahead of the industry?

JW: Innovation lead time and speed to the market: Innovation lead-time and speed are vital to business through meeting our customer needs. We measure the effectiveness of innovation by how much growth business is gained through innovation and on-time delivery. By accelerating speed of product development, we can help ensure healthy growth that outpaces the market.