Karen McIntyre, Editor01.02.17

Disposing of disposables. This has been an issue since the first disposable diaper rolled off the production line nearly a half century ago. While diaper innovation has significantly reduced the weight of the average diaper, which today is not only more absorbent but also more effective than its ancestors, the industry’s toll on the world’s landfills remains a major issue as the market continues to expand around the globe.

According to industry statistics, absorbent product waste represents about 1.5-6.5% of landfill waste in the European Union. This percentage is lower in the U.S., but Americans produce considerably more garbage than Europeans.

This is particularly troubling in areas where landfill space is in short supply—like Italy where garbage crises have at times gotten so bad, armed forces have had to get involved or in developing regions like India, where people make a living off garbage picking, and hygiene products are contaminating their livelihoods.

Around the world, diaper manufacturers are looking to solve these problems, not just for the sake of the Earth, but for their own well being. The diaper industry’s impact on the world’s trash problem has been a PR challenge since day one. Plus, finding a new life for these products can offer a new revenue stream for manufacturers who are looking to create value from their sustainability efforts.

“For absorbent hygiene product recycling to be successful, manufacturers need to see where it becomes viable and have to see where the need is,” says Ioannis Hatzpoulos, sustainability communications senior manager, baby care for Procter & Gamble who also the chair of EDANA’s sustainability and working group. “The problem is that in many countries there is not the infrastructure to handle waste streams.”

While Procter & Gamble has made efforts to keep its industrial diaper waste out of landfills, it has not yet focused on post consumer diaper recycling. However, its joint venture company with the Angelini Group, Fater Spa, has achieved some success with a pilot diaper recycling project in Northern Italy. Using a proprietary carbon negative process, this project is designed to lessen the environmental impact of absorbent hygiene products which currently contributes about 900,000 tons—or three landfills worth—of waste to Italy’s landfills each year. The current project has an initial goal of keeping 8000 tons of this diaper waste out of the landfills per year.

“We are making great progress on all fronts,” says Marcello Somma, head of R&D and business development AHP-R for Fater. “One challenge is how to ensure best synchronization of technical innovation with regulatory requirements, specifically when working on new-to-the-world innovation. We are in agreement with the drive for circular economy and we are happy to jointly work on questions like “End-of-Waste,” that is deciding when waste stops being waste and becomes a secondary raw material.

Many considerations were made when developing the recycling line including storage, flexibility, economies of scales and customer needs. Once the diaper is collected, it needs to be sterilized, dried and separated so its components that can go into a number of product categories—bedding pads for pets, automotives, bottle caps and plastic part benches.

There is no doubt the technology works but the process of getting the soiled diapers to the recycling plant can prove challenging in some areas. “It is very hard to control consumer waste—the process has to be good for the environment, technically achievable and sustainable,” Hatzpoulos says. “It is hard to say where the next target area could be. All I know is it is working in Italy.”

Other post consumer diaper recycling efforts include Kimberly-Clark New Zealand’s operations partnership with Envirocorp. These two companies have been working together since 2011 to establish diaper composting facilities initially in New Zealand and will eventually expand to Ireland, Australia, the U.K. and throughout Europe. Since then, the companies have composted millions of diapers mixing them with green waste to make a compost suitable for commercial gardening of landscaping.

It is projects like these that are helping K-C achieve its goal of diverting 150,000 tons of post consumer landfill waste by 2022, while also creating valuable opportunities to reuse its waste streams.

Meanwhile, entrepreneurial starts ups like Zynnovation in Richmond, VA and Dycle in Berlin, Germany have developed their own end of life solutions for diapers. Zynnovation, led by husband-and-wife team Wi Zhang and Hailing Yang, hopes to use materials from disposable baby diapers to make TreeDiaper, a collar-shaped tree mat that absorbs and trains water. They are placed at the base of young trees and other plants to hydrate them over extended periods of time. While current TreeDiapers are made with agriculture-grade superabsorbent polymers, Zhang and Yang said they hope that deals, like one recently made with ACF Environmental, will help create an economic business model for diaper recycling.

Dycle (Diaper Cycle), meanwhile, is trying to establish a closed loop process whereby compostable diapers are used, along with other household waste, to create black or fertile soil that will ultimately be used in the planting of fruit trees. Dycle closed its first “cycle” in November, planning 50 fruit trees near Berlin.

Technology Takes the Lead

One believer in the viability of post consumer diaper recycling is Martin Scaife of Diaper Recycling Technology. Scaife has spent the last several years developing what he believes will be an economically viable post consumer recycling system. This project is about 60-70% complete.

“We think this is the first financially viable solution,” he says. “For any recycling operator having adequate processing volumes, a $3 million recycling system can earn someone $2-2.5 million per year by selling recycled materials. The fibers coming out of these systems are of high quality with the fiber tensile strength and fluid wicking properties very similar to virgin fibers with fiber length reducing on average by 10-15%.”

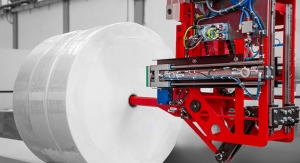

Based in Singapore, Diaper Recycling Technology currently offers commercial factory waste recycling systems that gives diaper manufacturers an opportunity to create a new revenue stream from its diaper scrap. According to Scaife, his company’s systems utilize low energy processes designed to separate diaper factory material streams (pulp / SAP / plastic) with minimal damage.

“If you do the math, you can see that every minute of the day 20,000 diapers are rejected globally and a large proportion of this waste stream would normally go in the landfill. The sheer volume and environmental impact of this global waste stream is typically not known and is very much low hanging fruit for any hygiene company wishing to recycle their factory waste and generate financial income from these waste streams,” he says.

While P&G won’t reveal what type of technology it uses, it will say that it has repurposed diaper waste from sites in Stupino, Russia and elsewhere into new areas like cement applications.

“At P&G we are working towards zero-waste-to-landfill in particular in manufacturing. All our diaper manufacturing sites are fully involved in finding alternatives to reduce waste and then finding alternatives to reuse or recycle our diaper waste,” Hatzpoulos says. “We either recycle or repurpose waste. Depending on the country and the local infrastructure the main alternatives are the separation of the different components in the diaper to then sent to recyclers and/or use as alternative fuel in different industries for example on cement kiln operations.”

Osprey Corporation has already helped diaper manufacturers around the world lessen their landfill contributions and currently has about 60 diaper recycling lines installed around the world. These machines can keep hundreds of thousands of tons of waste out of the landfill or the incinerator over a 24-hour period.

What happens to the waste once it is recycled varies by the company, says Osprey president Kirk Harpole.

“Some of the diaper guys won’t consider it virgin material so they would consider that a defective product and they don’t want to put it back into their lines. These guys will sell it into other industries or to other regions,” he says. “Meanwhile, some of the smaller guys, like private labelers, might have different product lines, like bed pads or pet pads, and they will use the repurposed materials there.”

Know More Waste

U.K.-based Knowaste has been in the diaper recycling game since the mid 1990s, becoming the first in the U.K. to recycle absorbent hygiene products in 2011. This original plant was closed in 2014 because it was not large enough to become commercially viable, and the company, which is based in Canada, is now seeking approval for its first commercial scale facility in North London. The process reverts the diapers back to fiber and then plastic materials following a sterilization process. The result is a product that could be ideal for a number of areas including park benches, decking fence posts, waste container buckets and kitty litter.

Executives hope to eventually operate five plants throughout London.“The key for us is to open our first plant and be successful,” U.K. business development director Paul Richardson says. “We want to prove that we can do what we say without disruption.”

Richardson says the company will first target commercial hospitals and nurseries for the recycling program because these places already separate waste. “These areas are easier to work with than residential homes but there is no reason the collections cannot be set up. In homes where baby diapers are used, they can make up 50-70% of the garbage.”

According to industry statistics, absorbent product waste represents about 1.5-6.5% of landfill waste in the European Union. This percentage is lower in the U.S., but Americans produce considerably more garbage than Europeans.

This is particularly troubling in areas where landfill space is in short supply—like Italy where garbage crises have at times gotten so bad, armed forces have had to get involved or in developing regions like India, where people make a living off garbage picking, and hygiene products are contaminating their livelihoods.

Around the world, diaper manufacturers are looking to solve these problems, not just for the sake of the Earth, but for their own well being. The diaper industry’s impact on the world’s trash problem has been a PR challenge since day one. Plus, finding a new life for these products can offer a new revenue stream for manufacturers who are looking to create value from their sustainability efforts.

“For absorbent hygiene product recycling to be successful, manufacturers need to see where it becomes viable and have to see where the need is,” says Ioannis Hatzpoulos, sustainability communications senior manager, baby care for Procter & Gamble who also the chair of EDANA’s sustainability and working group. “The problem is that in many countries there is not the infrastructure to handle waste streams.”

While Procter & Gamble has made efforts to keep its industrial diaper waste out of landfills, it has not yet focused on post consumer diaper recycling. However, its joint venture company with the Angelini Group, Fater Spa, has achieved some success with a pilot diaper recycling project in Northern Italy. Using a proprietary carbon negative process, this project is designed to lessen the environmental impact of absorbent hygiene products which currently contributes about 900,000 tons—or three landfills worth—of waste to Italy’s landfills each year. The current project has an initial goal of keeping 8000 tons of this diaper waste out of the landfills per year.

“We are making great progress on all fronts,” says Marcello Somma, head of R&D and business development AHP-R for Fater. “One challenge is how to ensure best synchronization of technical innovation with regulatory requirements, specifically when working on new-to-the-world innovation. We are in agreement with the drive for circular economy and we are happy to jointly work on questions like “End-of-Waste,” that is deciding when waste stops being waste and becomes a secondary raw material.

Many considerations were made when developing the recycling line including storage, flexibility, economies of scales and customer needs. Once the diaper is collected, it needs to be sterilized, dried and separated so its components that can go into a number of product categories—bedding pads for pets, automotives, bottle caps and plastic part benches.

There is no doubt the technology works but the process of getting the soiled diapers to the recycling plant can prove challenging in some areas. “It is very hard to control consumer waste—the process has to be good for the environment, technically achievable and sustainable,” Hatzpoulos says. “It is hard to say where the next target area could be. All I know is it is working in Italy.”

Other post consumer diaper recycling efforts include Kimberly-Clark New Zealand’s operations partnership with Envirocorp. These two companies have been working together since 2011 to establish diaper composting facilities initially in New Zealand and will eventually expand to Ireland, Australia, the U.K. and throughout Europe. Since then, the companies have composted millions of diapers mixing them with green waste to make a compost suitable for commercial gardening of landscaping.

It is projects like these that are helping K-C achieve its goal of diverting 150,000 tons of post consumer landfill waste by 2022, while also creating valuable opportunities to reuse its waste streams.

Meanwhile, entrepreneurial starts ups like Zynnovation in Richmond, VA and Dycle in Berlin, Germany have developed their own end of life solutions for diapers. Zynnovation, led by husband-and-wife team Wi Zhang and Hailing Yang, hopes to use materials from disposable baby diapers to make TreeDiaper, a collar-shaped tree mat that absorbs and trains water. They are placed at the base of young trees and other plants to hydrate them over extended periods of time. While current TreeDiapers are made with agriculture-grade superabsorbent polymers, Zhang and Yang said they hope that deals, like one recently made with ACF Environmental, will help create an economic business model for diaper recycling.

Dycle (Diaper Cycle), meanwhile, is trying to establish a closed loop process whereby compostable diapers are used, along with other household waste, to create black or fertile soil that will ultimately be used in the planting of fruit trees. Dycle closed its first “cycle” in November, planning 50 fruit trees near Berlin.

Technology Takes the Lead

One believer in the viability of post consumer diaper recycling is Martin Scaife of Diaper Recycling Technology. Scaife has spent the last several years developing what he believes will be an economically viable post consumer recycling system. This project is about 60-70% complete.

“We think this is the first financially viable solution,” he says. “For any recycling operator having adequate processing volumes, a $3 million recycling system can earn someone $2-2.5 million per year by selling recycled materials. The fibers coming out of these systems are of high quality with the fiber tensile strength and fluid wicking properties very similar to virgin fibers with fiber length reducing on average by 10-15%.”

Based in Singapore, Diaper Recycling Technology currently offers commercial factory waste recycling systems that gives diaper manufacturers an opportunity to create a new revenue stream from its diaper scrap. According to Scaife, his company’s systems utilize low energy processes designed to separate diaper factory material streams (pulp / SAP / plastic) with minimal damage.

“If you do the math, you can see that every minute of the day 20,000 diapers are rejected globally and a large proportion of this waste stream would normally go in the landfill. The sheer volume and environmental impact of this global waste stream is typically not known and is very much low hanging fruit for any hygiene company wishing to recycle their factory waste and generate financial income from these waste streams,” he says.

While P&G won’t reveal what type of technology it uses, it will say that it has repurposed diaper waste from sites in Stupino, Russia and elsewhere into new areas like cement applications.

“At P&G we are working towards zero-waste-to-landfill in particular in manufacturing. All our diaper manufacturing sites are fully involved in finding alternatives to reduce waste and then finding alternatives to reuse or recycle our diaper waste,” Hatzpoulos says. “We either recycle or repurpose waste. Depending on the country and the local infrastructure the main alternatives are the separation of the different components in the diaper to then sent to recyclers and/or use as alternative fuel in different industries for example on cement kiln operations.”

Osprey Corporation has already helped diaper manufacturers around the world lessen their landfill contributions and currently has about 60 diaper recycling lines installed around the world. These machines can keep hundreds of thousands of tons of waste out of the landfill or the incinerator over a 24-hour period.

What happens to the waste once it is recycled varies by the company, says Osprey president Kirk Harpole.

“Some of the diaper guys won’t consider it virgin material so they would consider that a defective product and they don’t want to put it back into their lines. These guys will sell it into other industries or to other regions,” he says. “Meanwhile, some of the smaller guys, like private labelers, might have different product lines, like bed pads or pet pads, and they will use the repurposed materials there.”

Know More Waste

U.K.-based Knowaste has been in the diaper recycling game since the mid 1990s, becoming the first in the U.K. to recycle absorbent hygiene products in 2011. This original plant was closed in 2014 because it was not large enough to become commercially viable, and the company, which is based in Canada, is now seeking approval for its first commercial scale facility in North London. The process reverts the diapers back to fiber and then plastic materials following a sterilization process. The result is a product that could be ideal for a number of areas including park benches, decking fence posts, waste container buckets and kitty litter.

Executives hope to eventually operate five plants throughout London.“The key for us is to open our first plant and be successful,” U.K. business development director Paul Richardson says. “We want to prove that we can do what we say without disruption.”

Richardson says the company will first target commercial hospitals and nurseries for the recycling program because these places already separate waste. “These areas are easier to work with than residential homes but there is no reason the collections cannot be set up. In homes where baby diapers are used, they can make up 50-70% of the garbage.”