Tara Olivo, Associate Editor05.03.19

Despite its economic challenges, the Latin American market is still considered a region with potential for growth. In recent years, nonwovens producers and end-product manufacturers have been entering or expanding in the market through both acquisitions and investments.

Through its own acquisitions, Berry Global has gained a large presence in Latin America. Berry entered the nonwovens industry in 2014 when it purchased the world’s largest producer, Avintiv (formerly known as PGI). Prior to its acquisition, Avintiv/PGI made acquisitions and investments in the region including the purchase of Brazilian spunmelt maker Companhia Providencia in 2014, as well as adding printing, slitting and packaging capabilities for the personal care market at its San Luis Potosi, Mexico, site.

Today, Berry sees potential in the region within the hygiene market, despite market volatility. In March, during the conference session of IDEA19, Berry Global’s Francisco Tascón, product marketing manager, South America, discussed the importance of the disposable hygiene markets in the region. Worldwide, he said, birth rates are decreasing, and although Latin America is a region with some instability and volatility, there are still opportunities. Several years ago, Brazil faced difficulties when the Zika virus impacted the country. During this time, from 2015-2016, birth rates declined 5% because of the spread of Zika and potential birth defects. In 2017, opportunities looked up, with births growing 3% compared to 2016, Tascón noted. If this trend of recovery continues, or if the birth rates the country experienced in 2015 are recovered, that will be an important opportunity for Brazil and the region, he explained.

In the femcare market, Tascón believes there are two main opportunities for growth. First is increased penetration in panty liners for daily protection. Countries like Colombia have a very high penetration in daily protection, while more recently Argentina and Brazil are following this trend, he said.

The other opportunity for femcare is to simplify the portfolio. “There are a lot of products on the market available for menstrual protection. The space that they are using on the shelf is definitely an opportunity to simplify. We need that space for adult incontinence. That is a category that is really growing. We need that space for innovation,” Tascón said.

According to market tracker Euromonitor International, the Latin American hygiene market is one of the most price-sensitive markets, and here continuity of strong promotional activity is typically shaping consumers’ decisions.

The bright side, according to Rafael Pellegrini, research analyst for Euromonitor in Brazil, is that the total population in the region continues to post a 0.9% CAGR (2018-23) and general disposable income is expected to grow at 2.8% in U.S. dollar terms during the same forecast period (2018-23). “Demographics aside, hygiene still relies on spending power gains to fully capture the sizeable potential market in retail sales given the predominance of low-to-intermediary product lines and per capita consumption and spending that still lag behind developed regions like North America,” he says. “The gap is particularly large in categories like wipes and adult incontinence, both of which require higher and more stable disposable income levels for wider household adoption.”

The trends visualized in Latin America are gradually to add more value on hygiene categories, especially driven by mid-to-high manufacturers, and consumers are generally more rational especially in markets like this where they come across recession periods and are more prone to value their money, Pellegrini adds. “Cost consciousness remains, and it will be slowly accompanied by healthier and environmental-friendly claims, although limited to upper income bands of the Latin American consumers,” he continues. “Regarding formats, pants continue to grow above the market average and to entice consumers in both infant and adult incontinence categories.”

Showing positive growth in the region are the affluent economies of Brazil and Mexico, as well as some smaller markets, which are posting moderate growth in USD 2018 fixed rates, according to Euromonitor. “The growth is not uniquely derived from higher-quality hygiene products but primarily stems from rising costs with raw materials that are being passed along by manufacturers,” Pellegrini says.

On the other hand, Argentina is showing negative growth. “The market is grappling with staggering inflationary period and depreciation of local currency against the dollar, which turns out to be a double whammy effect on hygiene consumption of a budget-strapped population,” he adds.

When discussing the region’s challenges in general, Pellegrini notes Latin America’s historical volatility of economies underpins the difficulty to predict more assertively year-over-year hygiene consumption and long run investments such as new machinery. “Besides, overall low disposable income and alarming social inequality are downsides of a region where aging is already notable without reaching the levels of hygiene consumption in developed markets,” he concludes.

Hygiene Makers Go South

Undeterred by these challenges, hygiene manufacturers are looking to Latin America for growth, especially in the major markets of Brazil and Mexico.

Early last year, Zele, Belgium-based Drylock technologies expanded in the Latin American market when it simultaneously acquired two competing Brazilian personal care companies, Mardam and Capricho, both based in the São Paulo region.

Both companies had demonstrated sustained growth in the Brazilian retail market primarily driven behind their own company brands, as well as private label initiatives within the South East of Brazil. Drylock previously had sales in both the baby and adult category in all major South American markets, and these acquisitions were a natural next step for the company’s development. According to Drylock, given the strong presence of modern retail formats in both Brazil and Latin America and the long-term growth potential of private label within the personal care segment across the region, the company sees Latin America as an important part of its growth strategy.

“The acquisitions consolidate the presence of Drylock in the region as well as it is a hub to expand our business in Latin America,” says Bart Van Malderen, CEO and chairman of Drylock Technologies.

Today, Drylock Brazil supplies products to the whole country as well as exporting to Bolivia, Chile, Colombia, Dominican Republic, Paraguay, Surinam, Uruguay and Venezuela.

Within the region, baby care and femcare are stronger than the adult incontinence market, but incontinence has grown in two digits in recent years, Van Malderen points out. “Latin America is a growing market where there is a lot of space to innovate and improve the products,” he says. “It is a market in phase of consolidation where there are still several ‘national champions.’”

Meanwhile, hygiene manufacturer Ontex is also looking south for growth. In 2016 the Belgian company established its Americas Division after it acquired 100% of the shares of Grupo P.I. Mabe, which had a strong position in the Mexican market, as well as in the U.S. A year later, Ontex expanded its Americas Division with the acquisition of the personal hygiene business of Hypermarcas S.A. The addition of HM personal hygiene supported Ontex’s strategy by extending its growth platform in the Americas to Brazil, increasing revenue from Ontex-owned brands and accessing a fast growing market. HM personal hygiene’s portfolio of strong local brands include BigFral and AdultMax in the adult incontinence category and PomPom, Cremer and Sapeka in the babycare category.

Last year in Brazil, Ontex rapidly implemented a series of actions to rebase the business and rectify issues it had encountered post acquisition in 2018. It successfully consolidated the two manufacturing plants into one—located in Senador Canedo—and added new proprietary technology to support future growth plans. According to Ontex, it continued to engage with its consumers in the region on innovation and enhanced the diaper range with the relaunch of a number of brands. The progress to date, with sequential improvements made every quarter, indicates that this comprehensive turnaround plan is slowly but surely taking effect, the company says.

Nonwoven Players

Fitesa is the fastest growing spunmelt nonwoven company in Latin America, and produces spunmelt or carded nonwovens at four production units in the region—in Gravataí and Cosmópolis, Brazil, Peru and Mexico. It also has the only bicomponent line in the region, located in its Cosmópolis facility.

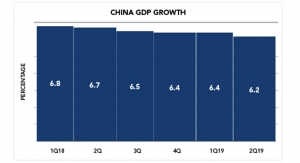

Fitesa supplies nonwovens to the hygiene, industrial and medical markets. According to Mariana Mynarski, global marketing, Fitesa, the region has been seriously impacted by the recent economic slowdowns in Brazil and Mexico, which have significantly reduced demand. “Growth started to resume in 2018, and we expect it to increase slowly, until it stabilizes at GDP growth levels in the coming years,” she adds.

New lines in Cosmópolis and Mexico a few years ago were the most recent new machines for Fitesa in the region, and since then the company has continued to invest in technology upgrades and improvements, in order to improve its safety, quality and efficiency levels. “For now, we are working on debottlenecking and upgrading the existing capacities in the region,” Mynarski says.

Fitesa considers Latin America a very complex market. “On one hand, penetration levels for disposable hygiene products point to good growth potential. However, this potential has been limited by the economic and political instabilities in its countries. It is also a very fragmented market, with a high number of players both in the demand (customers) and supply (competitors) sides,” Mynarski explains.

Meanwhile, Fibertex Group has been supplying nonwovens to Latin America since 1990. Despite big tariff barriers, Fibertex was able to find opportunities along the years in mainly needlepunched technical products. Now, with the acquisition of Duci, it added technical spunlace to its Latin American portfolio.

According to Carlos Benatto, managing director of Fibertex Nãotecidos Ltda in Brazil, Brazil is the sixth largest nonwovens market globally, and Latin America all together is two times Brazil, but despite that, nonwoven market penetration is still one third of a developed market. For Fibertex, there’s a huge growth potential when thinking long term. “With this acquisition, Fibertex establishes a regional platform/’hub’ enabling the opportunity of creating a strong presence and servicing other markets and global customers,” Benatto says.

In September, Fibertex announced it would increase its Brazilian production capacity by 20% to accommodate growing demand for special-purpose products for the automotive and other industries.

“The process of taking over the factory in Brazil has far exceeded our expectations. Our South American customers have given us a really warm welcome, and we’re already facing an urgent lack of capacity,” says Fibertex Nonwovens CEO Jørgen Bech Madsen. “We’ve been planning to expand capacity since acquiring Duci, but the need has arisen faster than we anticipated, and we will begin to upgrade the existing production line immediately. We know from previous experience in expanding our other factory sites that an upgrade can increase our output capacity by 20%. In addition, we will accelerate planning for other expansion projects.”

Estimated at close to DKK 15 million, the investment is expected to be fully implemented by this summer. Bech Madsen says Fibertex has already sold the extra capacity to the growing Brazilian market. The spunlacing technology made by Fibertex Nonwovens in Brazil is manufactured by just one other company in South America. Fibertex already makes this type of nonwovens at sites in France and Turkey, and its experience in this segment was a key factor in its success.

According to Fibertex, demand for special-purpose products is growing faster than any other part of the industry, and not just in the Brazilian market. Several other South American markets, including Argentina, are reporting strong growth in industrial production.

“Historically, the nonwovens market has grown at three times the rate of our GDP, and there is still a huge potential. The average Brazilian consumer spends only about one-third of what an American or European consumer does, and this is where nonwovens play an important role,” explains Benatto.

Brazil is also seeing an investment from regional player Fabril Scavone. The company is constructing a new industrial plant featuring European machinery with state-of-the-art technology. The new site, in the town of Itatiba in São Paulo, will make needlepunched nonwovens, with the capacity to produce 500 tons per month, for the automotive, filtration, synthetic laminates and footwear industries as well as the geotextile, acoustics and furniture sectors.

According to Laerte Guião Maroni, commercial director of the company, the investment is being carried out in order to maintain its position among the leaders in the Brazilian market, better attend the demands of clients and expand business abroad.

Scheduled to start operating in 2020, the project will have an area of 20,000 square meters on a 100,000-square-meter plot along the Dom Pedro I Highway. In addition to its strategic location, the project will have ample room for future investment. After the start of operations, the new factory will generate more than 50 direct jobs as well as hundreds of indirect jobs.

The new production line will use the most advanced technologies available in the market to produce carded needlepunched and thermo calendered nonwovens. With the new production, Fabril Scavone will have a total production capacity of 1250 tons per month, which consolidates its position among the largest Brazilian producers and exporters of nonwovens.

Through its own acquisitions, Berry Global has gained a large presence in Latin America. Berry entered the nonwovens industry in 2014 when it purchased the world’s largest producer, Avintiv (formerly known as PGI). Prior to its acquisition, Avintiv/PGI made acquisitions and investments in the region including the purchase of Brazilian spunmelt maker Companhia Providencia in 2014, as well as adding printing, slitting and packaging capabilities for the personal care market at its San Luis Potosi, Mexico, site.

Today, Berry sees potential in the region within the hygiene market, despite market volatility. In March, during the conference session of IDEA19, Berry Global’s Francisco Tascón, product marketing manager, South America, discussed the importance of the disposable hygiene markets in the region. Worldwide, he said, birth rates are decreasing, and although Latin America is a region with some instability and volatility, there are still opportunities. Several years ago, Brazil faced difficulties when the Zika virus impacted the country. During this time, from 2015-2016, birth rates declined 5% because of the spread of Zika and potential birth defects. In 2017, opportunities looked up, with births growing 3% compared to 2016, Tascón noted. If this trend of recovery continues, or if the birth rates the country experienced in 2015 are recovered, that will be an important opportunity for Brazil and the region, he explained.

In the femcare market, Tascón believes there are two main opportunities for growth. First is increased penetration in panty liners for daily protection. Countries like Colombia have a very high penetration in daily protection, while more recently Argentina and Brazil are following this trend, he said.

The other opportunity for femcare is to simplify the portfolio. “There are a lot of products on the market available for menstrual protection. The space that they are using on the shelf is definitely an opportunity to simplify. We need that space for adult incontinence. That is a category that is really growing. We need that space for innovation,” Tascón said.

According to market tracker Euromonitor International, the Latin American hygiene market is one of the most price-sensitive markets, and here continuity of strong promotional activity is typically shaping consumers’ decisions.

The bright side, according to Rafael Pellegrini, research analyst for Euromonitor in Brazil, is that the total population in the region continues to post a 0.9% CAGR (2018-23) and general disposable income is expected to grow at 2.8% in U.S. dollar terms during the same forecast period (2018-23). “Demographics aside, hygiene still relies on spending power gains to fully capture the sizeable potential market in retail sales given the predominance of low-to-intermediary product lines and per capita consumption and spending that still lag behind developed regions like North America,” he says. “The gap is particularly large in categories like wipes and adult incontinence, both of which require higher and more stable disposable income levels for wider household adoption.”

The trends visualized in Latin America are gradually to add more value on hygiene categories, especially driven by mid-to-high manufacturers, and consumers are generally more rational especially in markets like this where they come across recession periods and are more prone to value their money, Pellegrini adds. “Cost consciousness remains, and it will be slowly accompanied by healthier and environmental-friendly claims, although limited to upper income bands of the Latin American consumers,” he continues. “Regarding formats, pants continue to grow above the market average and to entice consumers in both infant and adult incontinence categories.”

Showing positive growth in the region are the affluent economies of Brazil and Mexico, as well as some smaller markets, which are posting moderate growth in USD 2018 fixed rates, according to Euromonitor. “The growth is not uniquely derived from higher-quality hygiene products but primarily stems from rising costs with raw materials that are being passed along by manufacturers,” Pellegrini says.

On the other hand, Argentina is showing negative growth. “The market is grappling with staggering inflationary period and depreciation of local currency against the dollar, which turns out to be a double whammy effect on hygiene consumption of a budget-strapped population,” he adds.

When discussing the region’s challenges in general, Pellegrini notes Latin America’s historical volatility of economies underpins the difficulty to predict more assertively year-over-year hygiene consumption and long run investments such as new machinery. “Besides, overall low disposable income and alarming social inequality are downsides of a region where aging is already notable without reaching the levels of hygiene consumption in developed markets,” he concludes.

Hygiene Makers Go South

Undeterred by these challenges, hygiene manufacturers are looking to Latin America for growth, especially in the major markets of Brazil and Mexico.

Early last year, Zele, Belgium-based Drylock technologies expanded in the Latin American market when it simultaneously acquired two competing Brazilian personal care companies, Mardam and Capricho, both based in the São Paulo region.

Both companies had demonstrated sustained growth in the Brazilian retail market primarily driven behind their own company brands, as well as private label initiatives within the South East of Brazil. Drylock previously had sales in both the baby and adult category in all major South American markets, and these acquisitions were a natural next step for the company’s development. According to Drylock, given the strong presence of modern retail formats in both Brazil and Latin America and the long-term growth potential of private label within the personal care segment across the region, the company sees Latin America as an important part of its growth strategy.

“The acquisitions consolidate the presence of Drylock in the region as well as it is a hub to expand our business in Latin America,” says Bart Van Malderen, CEO and chairman of Drylock Technologies.

Today, Drylock Brazil supplies products to the whole country as well as exporting to Bolivia, Chile, Colombia, Dominican Republic, Paraguay, Surinam, Uruguay and Venezuela.

Within the region, baby care and femcare are stronger than the adult incontinence market, but incontinence has grown in two digits in recent years, Van Malderen points out. “Latin America is a growing market where there is a lot of space to innovate and improve the products,” he says. “It is a market in phase of consolidation where there are still several ‘national champions.’”

Meanwhile, hygiene manufacturer Ontex is also looking south for growth. In 2016 the Belgian company established its Americas Division after it acquired 100% of the shares of Grupo P.I. Mabe, which had a strong position in the Mexican market, as well as in the U.S. A year later, Ontex expanded its Americas Division with the acquisition of the personal hygiene business of Hypermarcas S.A. The addition of HM personal hygiene supported Ontex’s strategy by extending its growth platform in the Americas to Brazil, increasing revenue from Ontex-owned brands and accessing a fast growing market. HM personal hygiene’s portfolio of strong local brands include BigFral and AdultMax in the adult incontinence category and PomPom, Cremer and Sapeka in the babycare category.

Last year in Brazil, Ontex rapidly implemented a series of actions to rebase the business and rectify issues it had encountered post acquisition in 2018. It successfully consolidated the two manufacturing plants into one—located in Senador Canedo—and added new proprietary technology to support future growth plans. According to Ontex, it continued to engage with its consumers in the region on innovation and enhanced the diaper range with the relaunch of a number of brands. The progress to date, with sequential improvements made every quarter, indicates that this comprehensive turnaround plan is slowly but surely taking effect, the company says.

Nonwoven Players

Fitesa is the fastest growing spunmelt nonwoven company in Latin America, and produces spunmelt or carded nonwovens at four production units in the region—in Gravataí and Cosmópolis, Brazil, Peru and Mexico. It also has the only bicomponent line in the region, located in its Cosmópolis facility.

Fitesa supplies nonwovens to the hygiene, industrial and medical markets. According to Mariana Mynarski, global marketing, Fitesa, the region has been seriously impacted by the recent economic slowdowns in Brazil and Mexico, which have significantly reduced demand. “Growth started to resume in 2018, and we expect it to increase slowly, until it stabilizes at GDP growth levels in the coming years,” she adds.

New lines in Cosmópolis and Mexico a few years ago were the most recent new machines for Fitesa in the region, and since then the company has continued to invest in technology upgrades and improvements, in order to improve its safety, quality and efficiency levels. “For now, we are working on debottlenecking and upgrading the existing capacities in the region,” Mynarski says.

Fitesa considers Latin America a very complex market. “On one hand, penetration levels for disposable hygiene products point to good growth potential. However, this potential has been limited by the economic and political instabilities in its countries. It is also a very fragmented market, with a high number of players both in the demand (customers) and supply (competitors) sides,” Mynarski explains.

Meanwhile, Fibertex Group has been supplying nonwovens to Latin America since 1990. Despite big tariff barriers, Fibertex was able to find opportunities along the years in mainly needlepunched technical products. Now, with the acquisition of Duci, it added technical spunlace to its Latin American portfolio.

According to Carlos Benatto, managing director of Fibertex Nãotecidos Ltda in Brazil, Brazil is the sixth largest nonwovens market globally, and Latin America all together is two times Brazil, but despite that, nonwoven market penetration is still one third of a developed market. For Fibertex, there’s a huge growth potential when thinking long term. “With this acquisition, Fibertex establishes a regional platform/’hub’ enabling the opportunity of creating a strong presence and servicing other markets and global customers,” Benatto says.

In September, Fibertex announced it would increase its Brazilian production capacity by 20% to accommodate growing demand for special-purpose products for the automotive and other industries.

“The process of taking over the factory in Brazil has far exceeded our expectations. Our South American customers have given us a really warm welcome, and we’re already facing an urgent lack of capacity,” says Fibertex Nonwovens CEO Jørgen Bech Madsen. “We’ve been planning to expand capacity since acquiring Duci, but the need has arisen faster than we anticipated, and we will begin to upgrade the existing production line immediately. We know from previous experience in expanding our other factory sites that an upgrade can increase our output capacity by 20%. In addition, we will accelerate planning for other expansion projects.”

Estimated at close to DKK 15 million, the investment is expected to be fully implemented by this summer. Bech Madsen says Fibertex has already sold the extra capacity to the growing Brazilian market. The spunlacing technology made by Fibertex Nonwovens in Brazil is manufactured by just one other company in South America. Fibertex already makes this type of nonwovens at sites in France and Turkey, and its experience in this segment was a key factor in its success.

According to Fibertex, demand for special-purpose products is growing faster than any other part of the industry, and not just in the Brazilian market. Several other South American markets, including Argentina, are reporting strong growth in industrial production.

“Historically, the nonwovens market has grown at three times the rate of our GDP, and there is still a huge potential. The average Brazilian consumer spends only about one-third of what an American or European consumer does, and this is where nonwovens play an important role,” explains Benatto.

Brazil is also seeing an investment from regional player Fabril Scavone. The company is constructing a new industrial plant featuring European machinery with state-of-the-art technology. The new site, in the town of Itatiba in São Paulo, will make needlepunched nonwovens, with the capacity to produce 500 tons per month, for the automotive, filtration, synthetic laminates and footwear industries as well as the geotextile, acoustics and furniture sectors.

According to Laerte Guião Maroni, commercial director of the company, the investment is being carried out in order to maintain its position among the leaders in the Brazilian market, better attend the demands of clients and expand business abroad.

Scheduled to start operating in 2020, the project will have an area of 20,000 square meters on a 100,000-square-meter plot along the Dom Pedro I Highway. In addition to its strategic location, the project will have ample room for future investment. After the start of operations, the new factory will generate more than 50 direct jobs as well as hundreds of indirect jobs.

The new production line will use the most advanced technologies available in the market to produce carded needlepunched and thermo calendered nonwovens. With the new production, Fabril Scavone will have a total production capacity of 1250 tons per month, which consolidates its position among the largest Brazilian producers and exporters of nonwovens.