Karen McIntyre, Editor11.02.18

The big news in the airlaid market is Glatfelter’s continued dominance as the world’s largest producer of the material globally. In 2018, the York, PA, company, which entered the airlaid business through the acquisition of Concert Industries in 2010, added a 22,000-ton greenfield site in Fort Smith, AR, and acquired the European airlaid business of competitor Georgia-Pacific, bringing its share of the market to close to 30%, far ahead of the number two player, G-P whose share is below 10% and poised to drop through the closure of its Green Bay, WI, line later this year.

As Glatfelter, whose roots are in the paper industry, extends its lead in the market, some industry experts are concerned that its dominance, combined with industry consolidation, could mean a lack of research and development dollars in the airlaid market.

“Consolidation is going to lead to cut backs on product development and innovation because what has happened is Glatfelter has a lot of contracts, which means most of the innovation is going to shift even further forward into the end users—the customers,” says industry consultant Philip Mango.

Currently, the global airlaid nonwovens market is valued at $1.8 billion and consumed 6.5 billion square meters or 506,600 tons in 2017, and is projected to grow to $2.5 billion, and consume 8.2 billion square meters or 654,500 tons by 2022, according to research firm Smithers Pira. Among the key trends forecast are a production switch to new machinery as older lines are shut down and a greater share of multibonded and airlaid capacity.

Certainly, this is evident in recent activities in North America as Glatfelter completes that market’s first significant expansion in more than a decade and Georgia-Pacific shuts down one of the first airlaid lines even built in North America. These two leaders clearly have different objectives. Glatfelter has decided to leave the specialty papers business, selling that business and focusing on higher value markets like airlaid nonwovens, products for coffee filters and wall coverings and is betting that airlaid will help it grow in new areas. Meanwhile, G-P, which is owned by Koch Industries, will focus on its consumer and industrial products business like tissues, papers towels and industrial wipes as well as fluff pulp.

Glatfelter Goes For It

Glatfelter’s acquisition of G-P’s European business was complete in September at a purchase price of $185 million. The deal includes Georgia-Pacific’s operations located in Steinfurt, Germany, along with sales offices located in France and Italy, which G-P acquired though its purchase of Buckeye Technologies four years ago. The Steinfurt facility produces high-quality airlaid products for the tabletop, wipes, hygiene, food pad and other nonwoven materials markets, competing in the marketplace with nonwoven technologies and substrates, as well as other materials focused primarily on consumer based end-use applications. The Steinfurt facility is a state-of-the-art, 32,000-metric-ton-capacity manufacturing facility that employs approximately 220 people.

“Glatfelter’s agreement to acquire the European nonwovens business demonstrates our commitment to building leading positions in global growth markets for engineered materials,” says Dante C. Parrini, chairman and chief executive officer of Glatfelter. “Steinfurt’s products and technologies complement our current airlaid business very well and the acquisition provides synergistic capacity increase opportunities and an improved cost structure to support our ability to serve customers in growing consumer and industrial markets.

From a financial perspective, the investment provides an attractive return on capital, is immediately accretive and will deliver attractive EBITDA margins in a growing market.”

In 2017, the business generated net sales of $99 million and EBITDA of $18 million. The company expects to realize synergies in excess of approximately $6 million per year within three years, and expects to incur one-time costs of approximately $7 million for transaction fees and integration.

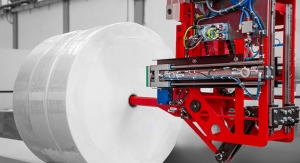

Also boosting Glatfelter’s business is the recent completion of its state-of-the-art airlaid facility in Fort Smith, AR, which began operations earlier this year. This newly-constructed facility, the division’s first located in the U.S., complements its facilities in Gatineau, Canada, and Falkenhagen, Germany. The additional 22,000 short tons of production capacity increases the company’s total global airlaid materials capacity to approximately 129,000 short tons, making Glatfelter the largest producer of airlaid materials in the world.

Glatfelter’s airlaid materials are found in a wide range of personal care products, including feminine hygiene and adult incontinence products, specialty wipes, tabletop, and homecare applications. The Fort Smith facility primarily supplies material to the specialty wipes market and is conveniently located near Rockline Industries, a major maker of wipes.

“We are excited to bring this new capacity and capabilities to our customers serving the growing North American market,” says Parrini. “I am grateful for the support of the community and impressed with the caliber of workforce we have been able to attract from the Fort Smith area, which has allowed us to open the facility on-time and produce high-quality products from the outset.”

These two investments significantly increase Glatfelter’s global share of the airlaid market with a 26% share, compared to 10% for G-P, the world’s second largest producer. This is a big change from the situation five years ago when Buckeye, before it was purchased by G-P, commanded a 16.5% share and Glatfelter had a 19% share.

And now, with G-P’s decision to close its Green Bay, WI, latex bonded airlaid line, the chasm between number one and number two will increase even more. Now, G-P’s sole airlaid operation will be located in Gaston, NC, a line built by Buckeye in the early 2000s which at the time was considered a mega-machine capable of making 42,000 tons of airlaid nonwovens per year. Much of this output serves G-P’s industrial wipes business internally.

“G-P was taking 50% of the Green Bay output for itself. Even though it was built in the 1970s, it was an efficient latex line in the world because they had many so many improvements to it,” Mango says.

And, Glatfelter’s share will be particularly high in Europe now that G-P is out of the market, leaving just some smaller producers like McAirlaids and Germany and Duni in Sweden. These two companies tend to stay outside of the larger markets for airlaid like hygiene and wipes. McAirlaids is strong in areas like food packaging and incontinence as well as a few niche markets while Duni narrowed its focus exclusively on tabletop products in 2015 through a plant consolidation in Sweden. Last last year, the company announced it was increasing its airlaid capacity by 25% through an existing line upgrade. At the time of the announcement, Duni said that demand for premium napkin materials was on the rise in Europe. The company’s airlaid material is largely used in Duni’s own napkin brands including Dunilin and Dunisoft.

Engineered Absorbent Materials (EAM)

Domtar, a maker of paper of absorbent hygiene products, also owns the nonwovens assets of EAM (Engineered Absorbent Materials) including its NovaThin Technology. While Domtar uses some of its EAM capacity to fuel its absorbent hygiene business, it continues to sell a portion of this output within the feminine hygiene and adult incontinence markets.

Located in Jesup, GA, EAM is a hotspot for innovation and product development. Its client list includes some of the world’s largest and most successful consumer product manufacturers.

Lee West, global vice president of procurement and IT at Domtar Personal Care and general manager of EAM, says, “Domtar has made significant investments in EAM since it was acquired in 2012. This has allowed us to grow and continue to innovate for our customers. Locally and globally, we have a lot to be proud of.”

EAM manufactures high-quality absorbent cores that are used for many applications, including baby diapers, food packaging, medical and healthcare solutions, feminine hygiene and adult incontinence. Of particular note is the Butterfly body liner, a bowel leakage product purchased by Domtar in 2016. The product had already used the EAM core technology, making the two companies an ideal partner. Domtar has also reportedly restaged its Indasec light incontinence brand to feature EAM core technology. To help facilitate this product improvement, Domtar has added EAM capabilities to its plant in Toledo, Spain, and has indicated that eventually all its lines will be able to accommodate the technology.

Thanks to their exceptional flexibility, thinness and super absorbency, EAM’s absorbent cores help ensure dignity, health and comfort for millions of people. Such high-quality products are the hallmark of a company that continually pushes the limits of absorbent materials technology.

Paul Ducker leads research and development at EAM. His name appears on several process and product patents, along with the names of other scientists and engineers at Domtar. In fact, collaboration is critical to the team’s success.

One notable partner is Harry Chmielewski, a senior research scientist who works in the Domtar research lab in Raleigh, NC. “Harry was the lead inventor on our multilayered laminate core (MLC), one of our recent patented innovations,” Ducker says.

Constructed of ultra-thin layers of different absorbent materials, the MLC improves fit, decreases leakage, reduces package size and allows for more efficient use of raw materials. “It’s as soft and flexible as a paper towel, with multiple benefits for the customer,” Ducker says.

EAM’s absorbent materials are sold under two brand names: NovaThin and NovaZorb. The secret to the company’s success is its ability to customize its absorbent cores for a variety of applications to meet customers’ specific needs.

Lori Venn, EAM’s vice president of sales and marketing, points out that it’s not only the variety of end uses that drives innovation, but also the breadth of markets. “We have customers across six continents — everywhere except Antarctica,” she says. “Much of the innovation we do is in collaboration with our clients. We don’t make an off-the-shelf product.”

Plant manager Kim Sumner agreed, noting how well EAM aligns to Domtar’s values of agility, caring and innovation. “We’re a small company — roughly 70 people — but we can put together any kind of product in response to customer needs. We’re not scared of change. On the contrary: We’re always looking to try something new.”

Smaller Producers Crop Up

Gelok, a subsidiary of Principle Business Enterprises, has expanded its laminates business with the inclusion of airlaid nonwovens a line investment in Bowling Green, OH. This has allowed the company’s laminate material to be softer and more flexible to meet the needs of the feminine hygiene and light incontinence markets. The company creates products both for its parent company, a manufacturer of light incontinence, feminine hygiene and wound care products, and for external customers.

“By going into airlaid products, we have been able to extend our product line to create a softer more pliable material while staying in our main markets,” says Steve Lazenby, business development manager.

Gelok is marketing its airlaid laminate under the TotalCore brand name to differentiate itself from existing materials which are primarily sold under the Gelok brand names. The company started selling the material in late July or early August when its investment in a brand new airlaid line was completed. Already one-third of the line’s capacity is sold out and further investment is likely to occur in the next few years.

“There was a big learning curve when it comes to airlaid nonwovens,” Lazenby says. “With each opportunity we have to design a product, we need to look at processing parameters. We have a full team of engineers to develop new products.”

While Gelok still outsources some airlaid, its hydrobonded airlaid technology allows for a thinner product and by making it in-house, the company has been able to establish an expertise with the technology. “We’ve had a lot of favorable responses. There are lots of products in research and development. Customers are coming to us asking what they want. Our small production runs give us the flexibility to meet customer demands.”

Also entering the airlaid market through a smaller line is Galaxy, which added its first U.S. airlaid line in 2015 in Ware, MA, to better serve its North American customers from a supply chain and research and product development aspect.

“The technologies that we have developed over the years have allowed us to improve performance to weight ratios on our airlaids such as making them have a thinner profile with the same performance, as well as engineering specific function airlaids for different product and industry segments such as incontinence, baby care, feminine hygiene and our latest innovations in food packaging,” says Palmer Dinkel, vice president, Galaxy Industries. “Our custom technologies have given us the manufacturing capabilities to produce some of the thinnest highest performing cores for various fluids as well as producing some of the highest absorbing hydrogen bonded airlaids on the market today.”

Galaxy’s main markets are the hygiene and medical markets in the U.S. and Europe. “With the growth and development of value acceptance of high performing absorbent products these are key growing developing markets for us, which are showing steady growth,” Dinkel says.

With its recent airlaid expansion in the U.S., Galaxy is looking to further solidify and expand its presence in the country as well as in Western Europe. In fact, Dinkel says the company will be executing a series of staged investments around this expansion to further its R&D efforts for additional product development for high-end absorbent products in the medical market specific to the surgical operation environment and further innovations in absorbent packaging.

“Developing, introducing and creating new product segments is and continues to be Galaxy’s differential; our technologies and partnership with our manufacturers make us unique where we can integrate our technologies in a product,” Dinkel says. “We can use and offer our customers the full breadth of our continued innovation and technologies to push the performance and functions of various absorbent products.”

The inclusion of these two smaller players as well as investment among some of the larger manufacturers of airlaid nonwovens has proven that the airlaid market is experiencing a period of revitalization where manufacturers of products like wipes and pads are realizing its attributes.

“There definitely seems to be an uptick in airlaid,” Mango says. “Whether or not that materializes in big new capacity from a big player remains to be seen but there is definitely more interest than there has been in the past five or six years.”

As Glatfelter, whose roots are in the paper industry, extends its lead in the market, some industry experts are concerned that its dominance, combined with industry consolidation, could mean a lack of research and development dollars in the airlaid market.

“Consolidation is going to lead to cut backs on product development and innovation because what has happened is Glatfelter has a lot of contracts, which means most of the innovation is going to shift even further forward into the end users—the customers,” says industry consultant Philip Mango.

Currently, the global airlaid nonwovens market is valued at $1.8 billion and consumed 6.5 billion square meters or 506,600 tons in 2017, and is projected to grow to $2.5 billion, and consume 8.2 billion square meters or 654,500 tons by 2022, according to research firm Smithers Pira. Among the key trends forecast are a production switch to new machinery as older lines are shut down and a greater share of multibonded and airlaid capacity.

Certainly, this is evident in recent activities in North America as Glatfelter completes that market’s first significant expansion in more than a decade and Georgia-Pacific shuts down one of the first airlaid lines even built in North America. These two leaders clearly have different objectives. Glatfelter has decided to leave the specialty papers business, selling that business and focusing on higher value markets like airlaid nonwovens, products for coffee filters and wall coverings and is betting that airlaid will help it grow in new areas. Meanwhile, G-P, which is owned by Koch Industries, will focus on its consumer and industrial products business like tissues, papers towels and industrial wipes as well as fluff pulp.

Glatfelter Goes For It

Glatfelter’s acquisition of G-P’s European business was complete in September at a purchase price of $185 million. The deal includes Georgia-Pacific’s operations located in Steinfurt, Germany, along with sales offices located in France and Italy, which G-P acquired though its purchase of Buckeye Technologies four years ago. The Steinfurt facility produces high-quality airlaid products for the tabletop, wipes, hygiene, food pad and other nonwoven materials markets, competing in the marketplace with nonwoven technologies and substrates, as well as other materials focused primarily on consumer based end-use applications. The Steinfurt facility is a state-of-the-art, 32,000-metric-ton-capacity manufacturing facility that employs approximately 220 people.

“Glatfelter’s agreement to acquire the European nonwovens business demonstrates our commitment to building leading positions in global growth markets for engineered materials,” says Dante C. Parrini, chairman and chief executive officer of Glatfelter. “Steinfurt’s products and technologies complement our current airlaid business very well and the acquisition provides synergistic capacity increase opportunities and an improved cost structure to support our ability to serve customers in growing consumer and industrial markets.

From a financial perspective, the investment provides an attractive return on capital, is immediately accretive and will deliver attractive EBITDA margins in a growing market.”

In 2017, the business generated net sales of $99 million and EBITDA of $18 million. The company expects to realize synergies in excess of approximately $6 million per year within three years, and expects to incur one-time costs of approximately $7 million for transaction fees and integration.

Also boosting Glatfelter’s business is the recent completion of its state-of-the-art airlaid facility in Fort Smith, AR, which began operations earlier this year. This newly-constructed facility, the division’s first located in the U.S., complements its facilities in Gatineau, Canada, and Falkenhagen, Germany. The additional 22,000 short tons of production capacity increases the company’s total global airlaid materials capacity to approximately 129,000 short tons, making Glatfelter the largest producer of airlaid materials in the world.

Glatfelter’s airlaid materials are found in a wide range of personal care products, including feminine hygiene and adult incontinence products, specialty wipes, tabletop, and homecare applications. The Fort Smith facility primarily supplies material to the specialty wipes market and is conveniently located near Rockline Industries, a major maker of wipes.

“We are excited to bring this new capacity and capabilities to our customers serving the growing North American market,” says Parrini. “I am grateful for the support of the community and impressed with the caliber of workforce we have been able to attract from the Fort Smith area, which has allowed us to open the facility on-time and produce high-quality products from the outset.”

These two investments significantly increase Glatfelter’s global share of the airlaid market with a 26% share, compared to 10% for G-P, the world’s second largest producer. This is a big change from the situation five years ago when Buckeye, before it was purchased by G-P, commanded a 16.5% share and Glatfelter had a 19% share.

And now, with G-P’s decision to close its Green Bay, WI, latex bonded airlaid line, the chasm between number one and number two will increase even more. Now, G-P’s sole airlaid operation will be located in Gaston, NC, a line built by Buckeye in the early 2000s which at the time was considered a mega-machine capable of making 42,000 tons of airlaid nonwovens per year. Much of this output serves G-P’s industrial wipes business internally.

“G-P was taking 50% of the Green Bay output for itself. Even though it was built in the 1970s, it was an efficient latex line in the world because they had many so many improvements to it,” Mango says.

And, Glatfelter’s share will be particularly high in Europe now that G-P is out of the market, leaving just some smaller producers like McAirlaids and Germany and Duni in Sweden. These two companies tend to stay outside of the larger markets for airlaid like hygiene and wipes. McAirlaids is strong in areas like food packaging and incontinence as well as a few niche markets while Duni narrowed its focus exclusively on tabletop products in 2015 through a plant consolidation in Sweden. Last last year, the company announced it was increasing its airlaid capacity by 25% through an existing line upgrade. At the time of the announcement, Duni said that demand for premium napkin materials was on the rise in Europe. The company’s airlaid material is largely used in Duni’s own napkin brands including Dunilin and Dunisoft.

Engineered Absorbent Materials (EAM)

Domtar, a maker of paper of absorbent hygiene products, also owns the nonwovens assets of EAM (Engineered Absorbent Materials) including its NovaThin Technology. While Domtar uses some of its EAM capacity to fuel its absorbent hygiene business, it continues to sell a portion of this output within the feminine hygiene and adult incontinence markets.

Located in Jesup, GA, EAM is a hotspot for innovation and product development. Its client list includes some of the world’s largest and most successful consumer product manufacturers.

Lee West, global vice president of procurement and IT at Domtar Personal Care and general manager of EAM, says, “Domtar has made significant investments in EAM since it was acquired in 2012. This has allowed us to grow and continue to innovate for our customers. Locally and globally, we have a lot to be proud of.”

EAM manufactures high-quality absorbent cores that are used for many applications, including baby diapers, food packaging, medical and healthcare solutions, feminine hygiene and adult incontinence. Of particular note is the Butterfly body liner, a bowel leakage product purchased by Domtar in 2016. The product had already used the EAM core technology, making the two companies an ideal partner. Domtar has also reportedly restaged its Indasec light incontinence brand to feature EAM core technology. To help facilitate this product improvement, Domtar has added EAM capabilities to its plant in Toledo, Spain, and has indicated that eventually all its lines will be able to accommodate the technology.

Thanks to their exceptional flexibility, thinness and super absorbency, EAM’s absorbent cores help ensure dignity, health and comfort for millions of people. Such high-quality products are the hallmark of a company that continually pushes the limits of absorbent materials technology.

Paul Ducker leads research and development at EAM. His name appears on several process and product patents, along with the names of other scientists and engineers at Domtar. In fact, collaboration is critical to the team’s success.

One notable partner is Harry Chmielewski, a senior research scientist who works in the Domtar research lab in Raleigh, NC. “Harry was the lead inventor on our multilayered laminate core (MLC), one of our recent patented innovations,” Ducker says.

Constructed of ultra-thin layers of different absorbent materials, the MLC improves fit, decreases leakage, reduces package size and allows for more efficient use of raw materials. “It’s as soft and flexible as a paper towel, with multiple benefits for the customer,” Ducker says.

EAM’s absorbent materials are sold under two brand names: NovaThin and NovaZorb. The secret to the company’s success is its ability to customize its absorbent cores for a variety of applications to meet customers’ specific needs.

Lori Venn, EAM’s vice president of sales and marketing, points out that it’s not only the variety of end uses that drives innovation, but also the breadth of markets. “We have customers across six continents — everywhere except Antarctica,” she says. “Much of the innovation we do is in collaboration with our clients. We don’t make an off-the-shelf product.”

Plant manager Kim Sumner agreed, noting how well EAM aligns to Domtar’s values of agility, caring and innovation. “We’re a small company — roughly 70 people — but we can put together any kind of product in response to customer needs. We’re not scared of change. On the contrary: We’re always looking to try something new.”

Smaller Producers Crop Up

Gelok, a subsidiary of Principle Business Enterprises, has expanded its laminates business with the inclusion of airlaid nonwovens a line investment in Bowling Green, OH. This has allowed the company’s laminate material to be softer and more flexible to meet the needs of the feminine hygiene and light incontinence markets. The company creates products both for its parent company, a manufacturer of light incontinence, feminine hygiene and wound care products, and for external customers.

“By going into airlaid products, we have been able to extend our product line to create a softer more pliable material while staying in our main markets,” says Steve Lazenby, business development manager.

Gelok is marketing its airlaid laminate under the TotalCore brand name to differentiate itself from existing materials which are primarily sold under the Gelok brand names. The company started selling the material in late July or early August when its investment in a brand new airlaid line was completed. Already one-third of the line’s capacity is sold out and further investment is likely to occur in the next few years.

“There was a big learning curve when it comes to airlaid nonwovens,” Lazenby says. “With each opportunity we have to design a product, we need to look at processing parameters. We have a full team of engineers to develop new products.”

While Gelok still outsources some airlaid, its hydrobonded airlaid technology allows for a thinner product and by making it in-house, the company has been able to establish an expertise with the technology. “We’ve had a lot of favorable responses. There are lots of products in research and development. Customers are coming to us asking what they want. Our small production runs give us the flexibility to meet customer demands.”

Also entering the airlaid market through a smaller line is Galaxy, which added its first U.S. airlaid line in 2015 in Ware, MA, to better serve its North American customers from a supply chain and research and product development aspect.

“The technologies that we have developed over the years have allowed us to improve performance to weight ratios on our airlaids such as making them have a thinner profile with the same performance, as well as engineering specific function airlaids for different product and industry segments such as incontinence, baby care, feminine hygiene and our latest innovations in food packaging,” says Palmer Dinkel, vice president, Galaxy Industries. “Our custom technologies have given us the manufacturing capabilities to produce some of the thinnest highest performing cores for various fluids as well as producing some of the highest absorbing hydrogen bonded airlaids on the market today.”

Galaxy’s main markets are the hygiene and medical markets in the U.S. and Europe. “With the growth and development of value acceptance of high performing absorbent products these are key growing developing markets for us, which are showing steady growth,” Dinkel says.

With its recent airlaid expansion in the U.S., Galaxy is looking to further solidify and expand its presence in the country as well as in Western Europe. In fact, Dinkel says the company will be executing a series of staged investments around this expansion to further its R&D efforts for additional product development for high-end absorbent products in the medical market specific to the surgical operation environment and further innovations in absorbent packaging.

“Developing, introducing and creating new product segments is and continues to be Galaxy’s differential; our technologies and partnership with our manufacturers make us unique where we can integrate our technologies in a product,” Dinkel says. “We can use and offer our customers the full breadth of our continued innovation and technologies to push the performance and functions of various absorbent products.”

The inclusion of these two smaller players as well as investment among some of the larger manufacturers of airlaid nonwovens has proven that the airlaid market is experiencing a period of revitalization where manufacturers of products like wipes and pads are realizing its attributes.

“There definitely seems to be an uptick in airlaid,” Mango says. “Whether or not that materializes in big new capacity from a big player remains to be seen but there is definitely more interest than there has been in the past five or six years.”