Karen McIntyre, Editor11.12.20

Fifty years ago, Rodman Media, a small publishing company in Northern New Jersey saw potential in a burgeoning industry supplying disposable diapers and some other new consumer markets and decided to start a trade magazine devoted to it. In January 1970, when the first issue of Disposable Soft Goods rolled off the presses, the term nonwovens was still in its infancy, as were many of its markets. Procter & Gamble had launched Pampers diapers nine years earlier but they were bulky, heavy products composed of fluff pulp with a rayon topsheet, and parents were reluctant to use them. By 1970 design changes helped encourage more customers but it would be years before the reached full penetration levels in developed markets.

Of course, other markets for nonwovens were also developing around that time like tea bag materials and feminine hygiene items. During the past five decades, the magazine that eventually became known as Nonwovens Industry has reported on nearly every new product, new technology and new development that has shaped this market, now a massive multi-national industry. Here is a brief timeline of some of these developments.

1970

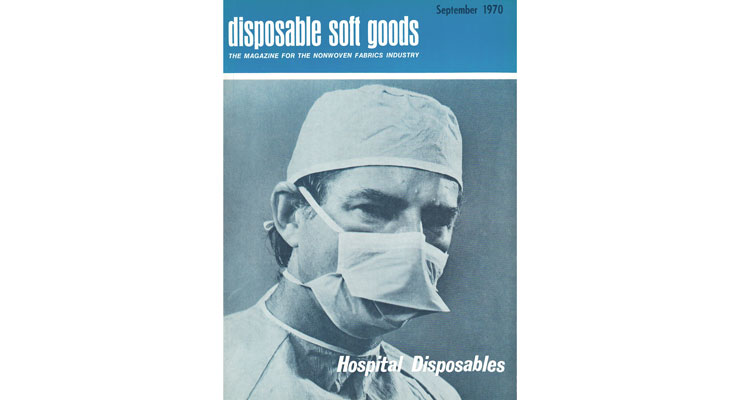

In January 1970, the first issue of “Disposable Soft Goods,” the trade publication that would later become Nonwovens Industry is published by Rodman Publishing Corporation. At the time, the magazine reported that disposable diapers will continue to represent an increasing proportion of the diaper service market and already total $75 million in sales.

The nonwovens industry had been around since the mid-1940s when Kendall developed a calendered cotton and thermoplastic fiber fabric for tea bags. Dexter was also making tea bag material using textile fibers mixed with traditional paper fibers on wetlaid machinery. Also, in that decade, Johnson & Johnson produced the first rayon nonwoven covered feminine hygiene pad, replacing gauze, a rough and irritating material.

Other early nonwovens technologies include Kimberly-Clark’s Kimlon, a two-layered cross-laminated structure with each layer consisting of a thin, lightweight web bonded with an elastomer; Scott Paper’s Dura-Weve disposable nonwoven dress and DuPont’s Reemay polyester spunbond and Tyvek spunbond polytethylene fabrics.

1971

The European Disposables Association (EDA) is established as an affiliate of the Disposables Association. The association later becomes known as the European Disposables and Nonwovens Association (EDANA). Today, the Brussels, Belgium-based organization is known simply as EDANA with the tagline, the voice of nonwovens, and has expanded its scope globally.

1972

Disposable Soft Goods becomes known as Nonwovens and Disposable Soft Goods to more accurately reflect editorial coverage of all types of nonwovens, not just those used in disposables. Also changing its name that year was the Disposables Association, which became known as the International Nonwovens and Disposables Association, or INDA. The year before, the association organized the first IDEA show, an event that continues to be held every three years.

1973

DuPont makes its first commercial shipment of Sontara spunlaced nonwovens. DuPont will continue to expand and improve this technology until 2017 when it is sold to Jacob Holm. The same year, EDANA holds IDEA ’73 in Basel, Switzerland. This show will eventually be known as INDEX when it is held in Amsterdam in 1976.

Around this time, K-C also developed spunbond-meltblown-spunbond (SMS) technology, which is commonly known as spunmelt. This process would eventually become the world’s largest nonwovens process and a key component of leading nonwovens markets like diapers and medical fabrics.

1974

In August, Nonwovens Industry undergoes another name change and is will be known as Formed Fabrics Industry for the next three years. This change came as the industry desired to find a more descriptive name for nonwovens technology.

1976

Procter & Gamble introduced Luvs disposable diapers adding them to their existing Pampers diaper brand which at the time had a 65% marketshare. Luvs continues to offer P&G’s diaper customers a more value centric brand today, and between the two brands, P&G continues to hold the largest share of the global disposable baby diaper market.

1977

In November, this magazine finally became known as Nonwovens Industry, the name it has kept for more than four decades. While the name nonwovens has often been criticized for not accurately reflecting the technological scope of the industry, it has stuck. Today the industry is valued at nearly $50 billion.

1978

In 1978, Kimberly-Clark introduced Huggies diapers which would become P&G’s main rival in the global baby diaper for the next four decades. The introduction of Huggies, comes after a largest period of expansion for the company with investments in Alabama, Canada and Mexico.

Huggies reportedly featured an hourglass shape and elastic leg openings, making it more similar to Pampers.

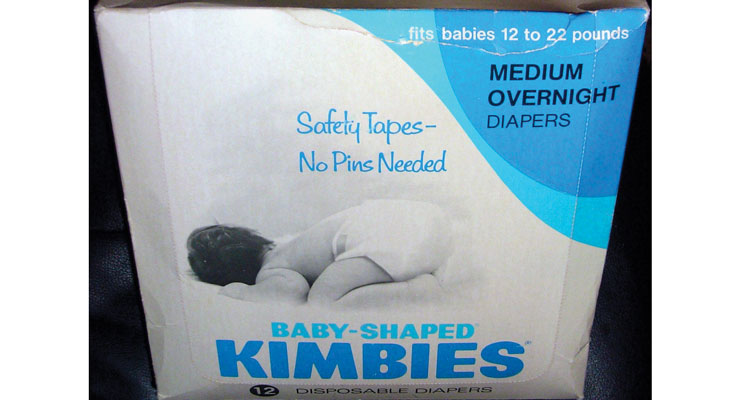

Prior to this introduction, K-C had been present in the diaper market since 1968 with its Kimbies brand, which was redesigned in 1976 and renamed Kimbies Super Dry. Despite these improvements, sales of Kimbies remained flat and the brand was removed in 1977.

Huggies were available nationwide in the U.S. by 1982.

1979

New nonwovens-based technologies included Kendall’s new Maralya line of airlaid nonwovens targeting the coverstock, towelette, backing and reinforcing markets as well as Hytrex filters made from 100% polypropylene. Baby diaper sales in the U.S. reached $1 billion while European sales clocked in at $800 million.

1981

In December 1981, the Wall Street Journal reported that scientists had found evidence linking highly absorbent tampons to toxic shock syndrome. Toxic shock syndrome became familiar to consumers in the late 1970s and early 1980s.

Researchers at the University of Wisconsin revealed that tampons induce a strain of bacterial present at most times in the human body and the waste of this bacteria is suspected as the cause for TSS. This study was partially funded by P&G.

1982

In 1982, standards for tampons were established. After the FDA mandates these standards, the ASTM task force was formed. The task force featured representatives of the FDA, tampon manufacturers, physicians, clinicians and consumer representations. The FDA wants the standards to address biocompatibility, absorbency and leachability.

By September, the FDA had required that tampons carry a warning advising consumers about the signs of TSS and mention there is a higher risk for women under 30 and teenagers. The warnings must also mention the inadvisably of using tampons that provide more absorbency than is required and state that TSS can be avoided if tampons are not used. FDA had first proposed regulation in October 1980 and many manufacturers had already adopted labeling practices.

1984

In 1984, INDEX found its home in Geneva, Switzerland, when it was held at the brand new (at the time) PalExpo, adjacent to Geneva’s International Airport. Organizer EDANA so found a partner in organizing the event—ORGEXPO.

That year, proposed ban on the sale of any infant or personal care or feminine hygiene products containing plastic or other nonbiodegradable material in the NJ State legislature shows that the industry has faced environmentally-fueled criticism for decades. This legislation, which was ultimately denied, specifically aimed at plastic applicators and disposable diapers for which they contended a feasible alternative existed. Tampons in particular were singled out because they are visible on store shelves and Jersey beaches.

At the time, there was concern that other states would follow suit and, while this issue did eventually fade away, concerns over the environmental impact of nonwovens have plagued the industry for decades.

In November 1984, Procter & Gamble test marketed a new modification to its diapers. The new diapers did not stand out for their new design features, including a shaped plastic back and a shaped fluff core with thermal bonded coverstock and double lines of elastic around each leg opening, as much as for the inclusion of superabsorbent powder, which resulted in a thin and absorbent pad. P&G introduced this development at a time when it was losing share in the diaper market to Kimberly-Clark’s Huggies brand.

While superabsorbents had been around for a while, their use had been confined to adult products like K-C’s Depend and PBE’s Tranquility product. Over the next 25 years, the use of superabsorbents in disposable diapers would nearly eclipse the use of fluff pulp leading to a thinner-than-ever product.

1985

After 12 years of development, the first Reicofil spunbond line is put into operation in China. This line, which is still producing nonwovens today, was the first of hundreds of Reicofil spunbond and spunmelt lines that have produced millions of tons of nonwovens for markets like diapers, feminine hygiene products, medical gowns and even durable markets. Parent company Reifenhauser launched improvements on the technology in 1992, 1997, 2002 and 2017. Its latest generation Reicofil 5 technology offers higher speeds, higher output and lower energy usage. Lines featuring this technology are already running in Europe and Asia.

1987

In October, International Paper purchased Kendall, creating one of the largest nonwovens manufacturers in the world with a sales volume of $200 million.

Included in the IP purchase were the nonwovens, cotton bleaching, graphic arts, animal care and data resources businesses. Kendall was the seventh largest U.S. nonwovens manufacturer with sales of $100 million. In addition to these sales, the purchase gave IP long term supply agreements and also gave IP a means to diversify into new nonwovens area. At the time of the purchase IP was seen as a key supplier of coverstock and dryer fabric to P&G. Kendall’s spunlace technology and its specialty industrial business helped with vertical integration. Kendall had nonwovens plants in Georgia and South Carolina

1988

INDA, the Association of the Nonwoven Fabrics Industry, moved from its long-time home on Broadway in New York City to Cary, NC. At the time, INDA executives said the decision was financial. Rent in Manhattan was expected to jump from $22 per square foot (seems like a bargain today) to between $30-35 per square foot.

1989

Kimberly-Clark introduces Pull-Ups training pants, not only extending its Huggies baby care brand but creating a new category that would extend the time a child wears a disposable product. This development was made possible by the creation of elastic laminate side panels, patented by K-C in 1988, and Pull-Ups led to other sub-categories for diapers including swim diapers and nighttime diapers for older children.

The next year, K-C extended the Huggies diaper brand with the introduction of a baby wipe. At the time, the product was designed to clean like a washcloth and was expected to capitalize on the success of Huggies diapers. K-C wouldn’t speculate on the technology behind wipes and would only say that it blends natural and synthetic fibers to produce a moist and durable product.

1993

In late 1993, Amoco Fibers and Fabrics purchased Phillips Fibers, a maker of nonwovens. At the time, Amoco, was the 22nd largest manufacturer of nonwovens in the world and Phillips was the 16th largest manufacturer.

1994

In 1994, the emergence of nonwoven-based food packaging materials was reported. Japan Vilene, which was then the largest Japanese manufacturer of nonwovens, announced it had developed a nonwoven material for food packaging applications. The composite nonwoven was said to keep freshness inside the package for applications such as beef packaging. The composite consisted of two sheets of nonwovens with a superabsorbent polymer sandwiched between.

Just one month after launch, the material reached a demand of 100,000 meters per month.

1995

Early in the year, BBA Nonwovens purchased Fiberweb, capping off a string of acquisitions that made the U.K.-based company the third largest maker of nonwovens in the world. Other companies under the BBA umbrella at that time were Reemay, Terram and Tycon. BBA would continue to invest and expand for the next several years before eventually selling its business in pieces and exiting the business.

1997

Early in April, Mogul built the first polypropylene spunbond line in Turkey targeting medical and hygiene industries. Since then, Mogul has continued to add nonwovens lines containing a variety of processes while several other nonwovens producers including Gulsan Group and General Nonwovens have contributed to the growth of the Turkish nonwovens industry.

2000

One of the early trailblazers in nonwovens, Dexter exited the business in 2000 when it sold its specialty papers and nonwoven materials business to the Finnish company Ahlstrom Paper Group, for a reported $275 million. The sale included Dexter’s largest wetlaid operation in Windsor Locks, CT.

Ahlstrom spent the next few years following the Dexter acquisition significantly increasing its business both through new investments and acquisitions. These investments largely centered on two key markets, filtration and wipes, and, while filtration continues to be an important market for the company, which merged with Munksjo in 2017, Ahlstrom sold its wipes business to Suominen 2011.

2001

Everyone was talking about airlaid this year as major producers all seemed to be in major investment mode. Buckeye Technologies started production on what was then—and probably still is—the world’s largest airlaid line in Gaston, NC. Meanwhile, Concert Industries added a new line in Falkenhagen, Germany, as well as a new site in Gatineau, Quebec, with two side-by-side airlaid lines, and the company then known as BBA added an airlaid line in Tianjin, China.

Speculation was ripe that this widespread investment could only mean one thing—that a major diaper brand was switching to an airlaid core. This didn’t happen and the airlaid industry faced several years of tough times trying to absorb this capacity leading to line closures and massive industry consolidation. Today, Concert Industries is owned by Glatfelter and Buckeye was purchased by Georgia-Pacific—although G-P’s European operations have since been purchased by Glatfelter. It was not until 2018, that a company—Glatfelter—announced a significant investment in North America, and today the industry seems to be back on track.

2002

As massive proliferation hit the disposable wipes category, industry experts estimated annual growth of 10-15%. Particularly strong were the tissue and makeup removal wipes categories growing 17% and the household wipes segment, which was growing 20%. While wipes growth has slowed since then, new applications continue to be unearthed daily and wipes continue to be a mainstay in consumer lives.

2004

In August, Avgol formed a joint venture with Hubei Investment Co. for the development of spunmelt nonwovens in Jingmen City, China. The collaboration between Avgol, an Israeli company with operations in the U.S. and Russia, with a Chinese partner showed how important China was becoming to the global nonwovens industry.

2006

Fibertex entered the Asian market with a new spunmelt line in Malaysia. This southeast Asian country became central to Fibertex’s hygiene business, which is now known as Fibertex Personal Care, over the next several years where it now operates five lines capable of making 90,000 tons of nonwovens at two sites per year there. In September 2020, the company said it would add line number six to target additional growth in the region.

2008

In December, the private label hygiene market saw two major companies unite when First Quality bought the retail business of Covidien for approximately $335 million. At the time, Covidien’s Retail Products business, reported sales of about $750 million and products included adult incontinence, feminine hygiene, wet and dry wipes and baby diaper products. It also expanded the scope of First Quality’s retail offerings which did not have a significant stake in the baby diaper market, a market it entered earlier that year.

2010

In March, Procter & Gamble launched the Dry Max pulpless diaper design, which was reportedly 20% thinner than previous generation diaper designs. Introduced through P&G’s premium tier diaper brands, Swaddlers and Cruisers, the technology eventually was used throughout P&G’s diaper portfolio.

In the years since this innovation, diapers have become consistently thinner as manufacturers have increased SAP percentages and decreased pulp. This has not only allowed less material to enter landfills and lowered transportation costs, it has also kept babies more comfortable and allowed stores to maximize shelf space.

2011

In 2011, pulp and paper specialist Domtar Corporation began building a sizable personal care business when it purchased privately-held Attends Healthcare, Inc., a manufacturer and supplier of incontinence products, a deal that included a 775,000 square foot facility with nine production lines and a state-of-the-art distribution center in Greenville, NC. Attends had annual sales of approximately $200 million.

The next year, Domtar purchased Attends’ Healthcare business, adding significant sales and scope as well as sites in Sweden, Scotland and Germany. In 2013, Domtar purchased Associated Hygienic Products (AHP), the largest manufacturer and supplier of store brand infant diapers in the U.S. Over the next several years, Domtar made a number of smaller acquisitions in the personal hygiene market. Today the company’s personal care sales are just under $1 billion and represent about 18% of the group’s sales. However, in August the company announced it was putting the unit under review and reports have since emerged that Ontex could be a possible suitor.

2012

In September, TWE Group significantly expanded its nonwovens operation by buying the Libeltex Group—including plants in France, Belgium and Sweden—from the Vita Group. The German company, with roots in needlepunch technology, already had manufacturing sites in five countries including Germany and China, and this investment made hygiene its largest market.

In 2015, TWE would buy another former Vita Group business, Vita Nonwovens, with three plants in the U.S. This operation targets durable operations.

2013

In July, the U.S. Environmental Protection Agency released a long awaited rule modifying federal hazardous waste management regulations that apply to non-laundered and laundered wipes. The ruling better levels the playing field between the two wipers when it comes to disposing and reverses regulations enacted in the 1970s to govern the treatment, storage and disposal of hazardous waste in the U.S. This was a big win for the nonwovens industry in a fight that dates back to 1985 when Kimberly-Clark made a formal complaint.

2013

The November acquisition of Fiberweb by Polymer Group Inc. not only made PGI the world’s largest nonwovens producer, it also marked the end of Fiberweb, a nonwovens company that had been around in one form or another for decades.

As PGI, which later became Avintiv and was eventually acquired by Berry Global, took its spot at the top of the nonwovens industry (following other significant acquisitions including Dounor and Companhia Providencia), Fiberweb sold the last remaining part of its business. Prior to this, the U.K.-based company had sold its hygiene-related assets to its joint venture partner Fitesa including nonwovens lines throughout Europe, North America and China.

2014

In August, Procter & Gamble re-entered the adult incontinence market with the launch of Always Discreet liners, pads and disposable underwear. The launch, which built off the success of the company’s Always feminine hygiene brand, came about 15 years after the company’s first exit from the market it helped create in the 1970s. In 1999, P&G sold its Attends brand to PaperPak Industries.

During the 15 years that P&G was absent from the market, North American adult incontinence sales have tripled to reach $1.5 billion, according to experts. Global sales, now at $7 billion, are growing about 8.4% annually, faster than any other paper-based household products

2015

China’s preference for premium-style diapers caused many western diaper manufacturers to change their strategies in the country, pulling back value offerings and replacing them with sophisticated products. This development not only impacted the Chinese market, demand for ultrasoft diapers spread around the globe, causing many nonwovens companies to develop supersoft spunbond materials for the diaper market.

2016

In 2016, INDA released the Fourth Edition of the Flushability Assessment Guidelines, known as the GD4. INDA, along with EDANA in Europe, has been leading the wipes industry in establishing these guidelines since the early 2000s when industry stakeholders began to see that flushable wipes were being unfairly blamed for sewer clogs around the world.

These guidelines offer not only testing methods to certify wipes as flushable, they also offer labeling practices that require wipes be clearly marked if they should not be flushed. Most recently, the group has mandated the “Do Not Flush” symbol and placement on packaging for these products.

2019

Companies throughout the nonwovens industry supply chain braced themselves for the Single Use Plastics Directive, which was adopted by the European Parliament, as well as similar measures being evaluated by several U.S. states.

The impact on many nonwovens markets but particularly the wipes one has become an area of concern in the nonwovens industry. The directive seeks to significantly reduce the amount of single use plastics (SUPs) going into European landfills by limiting the use of SUPs in certain categories and all out banning the use of certain SUPs like single use straws as the EU seeks to transition to a circular economy. For wet wipes—as well as filtered cigarettes and feminine hygiene items—the biggest impact will be felt in labeling requirements that need to inform consumers about the appropriate disposal of the product and about the negative impacts of SUPs and littering on the environment. In advance of this ruling, many companies are looking at alternative raw materials and new options for end of life.

2020

The industry’s swift and far reaching response to the Coronavirus pandemic made headlines this year as the world faced shortages of disposable masks, respirators and other personal protective equipment. Many companies responded by shifting gears and repurposing existing lines and product lines toward production of medical materials and face masks while others invested in new production lines, which came online quickly thanks to shortened lead times.

The unprecedented level of investment in new technologies is expected to influence the industry for years to come.

Of course, other markets for nonwovens were also developing around that time like tea bag materials and feminine hygiene items. During the past five decades, the magazine that eventually became known as Nonwovens Industry has reported on nearly every new product, new technology and new development that has shaped this market, now a massive multi-national industry. Here is a brief timeline of some of these developments.

1970

In January 1970, the first issue of “Disposable Soft Goods,” the trade publication that would later become Nonwovens Industry is published by Rodman Publishing Corporation. At the time, the magazine reported that disposable diapers will continue to represent an increasing proportion of the diaper service market and already total $75 million in sales.

The nonwovens industry had been around since the mid-1940s when Kendall developed a calendered cotton and thermoplastic fiber fabric for tea bags. Dexter was also making tea bag material using textile fibers mixed with traditional paper fibers on wetlaid machinery. Also, in that decade, Johnson & Johnson produced the first rayon nonwoven covered feminine hygiene pad, replacing gauze, a rough and irritating material.

Other early nonwovens technologies include Kimberly-Clark’s Kimlon, a two-layered cross-laminated structure with each layer consisting of a thin, lightweight web bonded with an elastomer; Scott Paper’s Dura-Weve disposable nonwoven dress and DuPont’s Reemay polyester spunbond and Tyvek spunbond polytethylene fabrics.

1971

The European Disposables Association (EDA) is established as an affiliate of the Disposables Association. The association later becomes known as the European Disposables and Nonwovens Association (EDANA). Today, the Brussels, Belgium-based organization is known simply as EDANA with the tagline, the voice of nonwovens, and has expanded its scope globally.

1972

Disposable Soft Goods becomes known as Nonwovens and Disposable Soft Goods to more accurately reflect editorial coverage of all types of nonwovens, not just those used in disposables. Also changing its name that year was the Disposables Association, which became known as the International Nonwovens and Disposables Association, or INDA. The year before, the association organized the first IDEA show, an event that continues to be held every three years.

1973

DuPont makes its first commercial shipment of Sontara spunlaced nonwovens. DuPont will continue to expand and improve this technology until 2017 when it is sold to Jacob Holm. The same year, EDANA holds IDEA ’73 in Basel, Switzerland. This show will eventually be known as INDEX when it is held in Amsterdam in 1976.

Around this time, K-C also developed spunbond-meltblown-spunbond (SMS) technology, which is commonly known as spunmelt. This process would eventually become the world’s largest nonwovens process and a key component of leading nonwovens markets like diapers and medical fabrics.

1974

In August, Nonwovens Industry undergoes another name change and is will be known as Formed Fabrics Industry for the next three years. This change came as the industry desired to find a more descriptive name for nonwovens technology.

1976

Procter & Gamble introduced Luvs disposable diapers adding them to their existing Pampers diaper brand which at the time had a 65% marketshare. Luvs continues to offer P&G’s diaper customers a more value centric brand today, and between the two brands, P&G continues to hold the largest share of the global disposable baby diaper market.

1977

In November, this magazine finally became known as Nonwovens Industry, the name it has kept for more than four decades. While the name nonwovens has often been criticized for not accurately reflecting the technological scope of the industry, it has stuck. Today the industry is valued at nearly $50 billion.

1978

In 1978, Kimberly-Clark introduced Huggies diapers which would become P&G’s main rival in the global baby diaper for the next four decades. The introduction of Huggies, comes after a largest period of expansion for the company with investments in Alabama, Canada and Mexico.

Huggies reportedly featured an hourglass shape and elastic leg openings, making it more similar to Pampers.

Prior to this introduction, K-C had been present in the diaper market since 1968 with its Kimbies brand, which was redesigned in 1976 and renamed Kimbies Super Dry. Despite these improvements, sales of Kimbies remained flat and the brand was removed in 1977.

Huggies were available nationwide in the U.S. by 1982.

1979

New nonwovens-based technologies included Kendall’s new Maralya line of airlaid nonwovens targeting the coverstock, towelette, backing and reinforcing markets as well as Hytrex filters made from 100% polypropylene. Baby diaper sales in the U.S. reached $1 billion while European sales clocked in at $800 million.

1981

In December 1981, the Wall Street Journal reported that scientists had found evidence linking highly absorbent tampons to toxic shock syndrome. Toxic shock syndrome became familiar to consumers in the late 1970s and early 1980s.

Researchers at the University of Wisconsin revealed that tampons induce a strain of bacterial present at most times in the human body and the waste of this bacteria is suspected as the cause for TSS. This study was partially funded by P&G.

1982

In 1982, standards for tampons were established. After the FDA mandates these standards, the ASTM task force was formed. The task force featured representatives of the FDA, tampon manufacturers, physicians, clinicians and consumer representations. The FDA wants the standards to address biocompatibility, absorbency and leachability.

By September, the FDA had required that tampons carry a warning advising consumers about the signs of TSS and mention there is a higher risk for women under 30 and teenagers. The warnings must also mention the inadvisably of using tampons that provide more absorbency than is required and state that TSS can be avoided if tampons are not used. FDA had first proposed regulation in October 1980 and many manufacturers had already adopted labeling practices.

1984

In 1984, INDEX found its home in Geneva, Switzerland, when it was held at the brand new (at the time) PalExpo, adjacent to Geneva’s International Airport. Organizer EDANA so found a partner in organizing the event—ORGEXPO.

That year, proposed ban on the sale of any infant or personal care or feminine hygiene products containing plastic or other nonbiodegradable material in the NJ State legislature shows that the industry has faced environmentally-fueled criticism for decades. This legislation, which was ultimately denied, specifically aimed at plastic applicators and disposable diapers for which they contended a feasible alternative existed. Tampons in particular were singled out because they are visible on store shelves and Jersey beaches.

At the time, there was concern that other states would follow suit and, while this issue did eventually fade away, concerns over the environmental impact of nonwovens have plagued the industry for decades.

In November 1984, Procter & Gamble test marketed a new modification to its diapers. The new diapers did not stand out for their new design features, including a shaped plastic back and a shaped fluff core with thermal bonded coverstock and double lines of elastic around each leg opening, as much as for the inclusion of superabsorbent powder, which resulted in a thin and absorbent pad. P&G introduced this development at a time when it was losing share in the diaper market to Kimberly-Clark’s Huggies brand.

While superabsorbents had been around for a while, their use had been confined to adult products like K-C’s Depend and PBE’s Tranquility product. Over the next 25 years, the use of superabsorbents in disposable diapers would nearly eclipse the use of fluff pulp leading to a thinner-than-ever product.

1985

After 12 years of development, the first Reicofil spunbond line is put into operation in China. This line, which is still producing nonwovens today, was the first of hundreds of Reicofil spunbond and spunmelt lines that have produced millions of tons of nonwovens for markets like diapers, feminine hygiene products, medical gowns and even durable markets. Parent company Reifenhauser launched improvements on the technology in 1992, 1997, 2002 and 2017. Its latest generation Reicofil 5 technology offers higher speeds, higher output and lower energy usage. Lines featuring this technology are already running in Europe and Asia.

1987

In October, International Paper purchased Kendall, creating one of the largest nonwovens manufacturers in the world with a sales volume of $200 million.

Included in the IP purchase were the nonwovens, cotton bleaching, graphic arts, animal care and data resources businesses. Kendall was the seventh largest U.S. nonwovens manufacturer with sales of $100 million. In addition to these sales, the purchase gave IP long term supply agreements and also gave IP a means to diversify into new nonwovens area. At the time of the purchase IP was seen as a key supplier of coverstock and dryer fabric to P&G. Kendall’s spunlace technology and its specialty industrial business helped with vertical integration. Kendall had nonwovens plants in Georgia and South Carolina

1988

INDA, the Association of the Nonwoven Fabrics Industry, moved from its long-time home on Broadway in New York City to Cary, NC. At the time, INDA executives said the decision was financial. Rent in Manhattan was expected to jump from $22 per square foot (seems like a bargain today) to between $30-35 per square foot.

1989

Kimberly-Clark introduces Pull-Ups training pants, not only extending its Huggies baby care brand but creating a new category that would extend the time a child wears a disposable product. This development was made possible by the creation of elastic laminate side panels, patented by K-C in 1988, and Pull-Ups led to other sub-categories for diapers including swim diapers and nighttime diapers for older children.

The next year, K-C extended the Huggies diaper brand with the introduction of a baby wipe. At the time, the product was designed to clean like a washcloth and was expected to capitalize on the success of Huggies diapers. K-C wouldn’t speculate on the technology behind wipes and would only say that it blends natural and synthetic fibers to produce a moist and durable product.

1993

In late 1993, Amoco Fibers and Fabrics purchased Phillips Fibers, a maker of nonwovens. At the time, Amoco, was the 22nd largest manufacturer of nonwovens in the world and Phillips was the 16th largest manufacturer.

1994

In 1994, the emergence of nonwoven-based food packaging materials was reported. Japan Vilene, which was then the largest Japanese manufacturer of nonwovens, announced it had developed a nonwoven material for food packaging applications. The composite nonwoven was said to keep freshness inside the package for applications such as beef packaging. The composite consisted of two sheets of nonwovens with a superabsorbent polymer sandwiched between.

Just one month after launch, the material reached a demand of 100,000 meters per month.

1995

Early in the year, BBA Nonwovens purchased Fiberweb, capping off a string of acquisitions that made the U.K.-based company the third largest maker of nonwovens in the world. Other companies under the BBA umbrella at that time were Reemay, Terram and Tycon. BBA would continue to invest and expand for the next several years before eventually selling its business in pieces and exiting the business.

1997

Early in April, Mogul built the first polypropylene spunbond line in Turkey targeting medical and hygiene industries. Since then, Mogul has continued to add nonwovens lines containing a variety of processes while several other nonwovens producers including Gulsan Group and General Nonwovens have contributed to the growth of the Turkish nonwovens industry.

2000

One of the early trailblazers in nonwovens, Dexter exited the business in 2000 when it sold its specialty papers and nonwoven materials business to the Finnish company Ahlstrom Paper Group, for a reported $275 million. The sale included Dexter’s largest wetlaid operation in Windsor Locks, CT.

Ahlstrom spent the next few years following the Dexter acquisition significantly increasing its business both through new investments and acquisitions. These investments largely centered on two key markets, filtration and wipes, and, while filtration continues to be an important market for the company, which merged with Munksjo in 2017, Ahlstrom sold its wipes business to Suominen 2011.

2001

Everyone was talking about airlaid this year as major producers all seemed to be in major investment mode. Buckeye Technologies started production on what was then—and probably still is—the world’s largest airlaid line in Gaston, NC. Meanwhile, Concert Industries added a new line in Falkenhagen, Germany, as well as a new site in Gatineau, Quebec, with two side-by-side airlaid lines, and the company then known as BBA added an airlaid line in Tianjin, China.

Speculation was ripe that this widespread investment could only mean one thing—that a major diaper brand was switching to an airlaid core. This didn’t happen and the airlaid industry faced several years of tough times trying to absorb this capacity leading to line closures and massive industry consolidation. Today, Concert Industries is owned by Glatfelter and Buckeye was purchased by Georgia-Pacific—although G-P’s European operations have since been purchased by Glatfelter. It was not until 2018, that a company—Glatfelter—announced a significant investment in North America, and today the industry seems to be back on track.

2002

As massive proliferation hit the disposable wipes category, industry experts estimated annual growth of 10-15%. Particularly strong were the tissue and makeup removal wipes categories growing 17% and the household wipes segment, which was growing 20%. While wipes growth has slowed since then, new applications continue to be unearthed daily and wipes continue to be a mainstay in consumer lives.

2004

In August, Avgol formed a joint venture with Hubei Investment Co. for the development of spunmelt nonwovens in Jingmen City, China. The collaboration between Avgol, an Israeli company with operations in the U.S. and Russia, with a Chinese partner showed how important China was becoming to the global nonwovens industry.

2006

Fibertex entered the Asian market with a new spunmelt line in Malaysia. This southeast Asian country became central to Fibertex’s hygiene business, which is now known as Fibertex Personal Care, over the next several years where it now operates five lines capable of making 90,000 tons of nonwovens at two sites per year there. In September 2020, the company said it would add line number six to target additional growth in the region.

2008

In December, the private label hygiene market saw two major companies unite when First Quality bought the retail business of Covidien for approximately $335 million. At the time, Covidien’s Retail Products business, reported sales of about $750 million and products included adult incontinence, feminine hygiene, wet and dry wipes and baby diaper products. It also expanded the scope of First Quality’s retail offerings which did not have a significant stake in the baby diaper market, a market it entered earlier that year.

2010

In March, Procter & Gamble launched the Dry Max pulpless diaper design, which was reportedly 20% thinner than previous generation diaper designs. Introduced through P&G’s premium tier diaper brands, Swaddlers and Cruisers, the technology eventually was used throughout P&G’s diaper portfolio.

In the years since this innovation, diapers have become consistently thinner as manufacturers have increased SAP percentages and decreased pulp. This has not only allowed less material to enter landfills and lowered transportation costs, it has also kept babies more comfortable and allowed stores to maximize shelf space.

2011

In 2011, pulp and paper specialist Domtar Corporation began building a sizable personal care business when it purchased privately-held Attends Healthcare, Inc., a manufacturer and supplier of incontinence products, a deal that included a 775,000 square foot facility with nine production lines and a state-of-the-art distribution center in Greenville, NC. Attends had annual sales of approximately $200 million.

The next year, Domtar purchased Attends’ Healthcare business, adding significant sales and scope as well as sites in Sweden, Scotland and Germany. In 2013, Domtar purchased Associated Hygienic Products (AHP), the largest manufacturer and supplier of store brand infant diapers in the U.S. Over the next several years, Domtar made a number of smaller acquisitions in the personal hygiene market. Today the company’s personal care sales are just under $1 billion and represent about 18% of the group’s sales. However, in August the company announced it was putting the unit under review and reports have since emerged that Ontex could be a possible suitor.

2012

In September, TWE Group significantly expanded its nonwovens operation by buying the Libeltex Group—including plants in France, Belgium and Sweden—from the Vita Group. The German company, with roots in needlepunch technology, already had manufacturing sites in five countries including Germany and China, and this investment made hygiene its largest market.

In 2015, TWE would buy another former Vita Group business, Vita Nonwovens, with three plants in the U.S. This operation targets durable operations.

2013

In July, the U.S. Environmental Protection Agency released a long awaited rule modifying federal hazardous waste management regulations that apply to non-laundered and laundered wipes. The ruling better levels the playing field between the two wipers when it comes to disposing and reverses regulations enacted in the 1970s to govern the treatment, storage and disposal of hazardous waste in the U.S. This was a big win for the nonwovens industry in a fight that dates back to 1985 when Kimberly-Clark made a formal complaint.

2013

The November acquisition of Fiberweb by Polymer Group Inc. not only made PGI the world’s largest nonwovens producer, it also marked the end of Fiberweb, a nonwovens company that had been around in one form or another for decades.

As PGI, which later became Avintiv and was eventually acquired by Berry Global, took its spot at the top of the nonwovens industry (following other significant acquisitions including Dounor and Companhia Providencia), Fiberweb sold the last remaining part of its business. Prior to this, the U.K.-based company had sold its hygiene-related assets to its joint venture partner Fitesa including nonwovens lines throughout Europe, North America and China.

2014

In August, Procter & Gamble re-entered the adult incontinence market with the launch of Always Discreet liners, pads and disposable underwear. The launch, which built off the success of the company’s Always feminine hygiene brand, came about 15 years after the company’s first exit from the market it helped create in the 1970s. In 1999, P&G sold its Attends brand to PaperPak Industries.

During the 15 years that P&G was absent from the market, North American adult incontinence sales have tripled to reach $1.5 billion, according to experts. Global sales, now at $7 billion, are growing about 8.4% annually, faster than any other paper-based household products

2015

China’s preference for premium-style diapers caused many western diaper manufacturers to change their strategies in the country, pulling back value offerings and replacing them with sophisticated products. This development not only impacted the Chinese market, demand for ultrasoft diapers spread around the globe, causing many nonwovens companies to develop supersoft spunbond materials for the diaper market.

2016

In 2016, INDA released the Fourth Edition of the Flushability Assessment Guidelines, known as the GD4. INDA, along with EDANA in Europe, has been leading the wipes industry in establishing these guidelines since the early 2000s when industry stakeholders began to see that flushable wipes were being unfairly blamed for sewer clogs around the world.

These guidelines offer not only testing methods to certify wipes as flushable, they also offer labeling practices that require wipes be clearly marked if they should not be flushed. Most recently, the group has mandated the “Do Not Flush” symbol and placement on packaging for these products.

2019

Companies throughout the nonwovens industry supply chain braced themselves for the Single Use Plastics Directive, which was adopted by the European Parliament, as well as similar measures being evaluated by several U.S. states.

The impact on many nonwovens markets but particularly the wipes one has become an area of concern in the nonwovens industry. The directive seeks to significantly reduce the amount of single use plastics (SUPs) going into European landfills by limiting the use of SUPs in certain categories and all out banning the use of certain SUPs like single use straws as the EU seeks to transition to a circular economy. For wet wipes—as well as filtered cigarettes and feminine hygiene items—the biggest impact will be felt in labeling requirements that need to inform consumers about the appropriate disposal of the product and about the negative impacts of SUPs and littering on the environment. In advance of this ruling, many companies are looking at alternative raw materials and new options for end of life.

2020

The industry’s swift and far reaching response to the Coronavirus pandemic made headlines this year as the world faced shortages of disposable masks, respirators and other personal protective equipment. Many companies responded by shifting gears and repurposing existing lines and product lines toward production of medical materials and face masks while others invested in new production lines, which came online quickly thanks to shortened lead times.

The unprecedented level of investment in new technologies is expected to influence the industry for years to come.