Kin Ohmura01.05.18

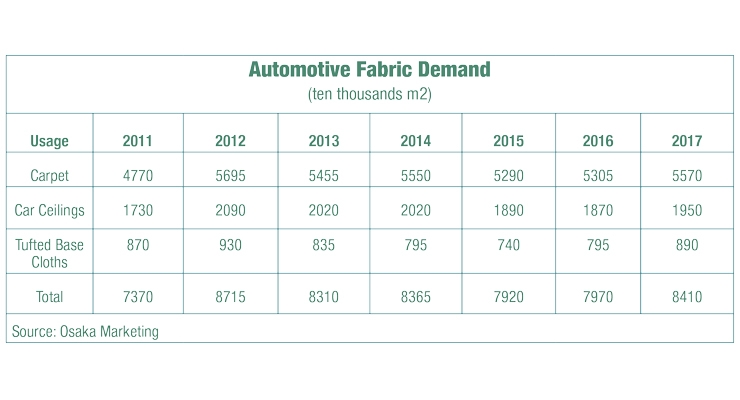

Although the automotive market is a major user of nonwoven fabrics, it can be a difficult market in Japan because production rates are constantly fluctuating, influencing levels of demand. The table below shows the quantity of demand for nonwoven fabrics for car carpets, covering materials for car ceilings and tufted base cloths.

Nonwoven-based carpeting is used for the floor of the automotive interior and in the trunk. These materials are generally made using a needlepunch process and this technology is competing against tufted carpets. In terms of demand, nonwovens have surpassed tufted carpet, exceeding 50 million square meters.

As for the liner materials that stick to the ceiling surface of the interior, needlepunch is more commonly used than tricot fabrics. While tricot materials are still used in the luxury model cars, nonwovens are used in lower and middle class models because they are more cost effective.

Although the demand for nonwovens exceeded 20 million square meters from 2012 to 2014, it declined to less than 20 million square meters after 2015 because of the increasing production of tricot materials and a decrease in automotive production in general.

Polyester spunbond fabric is also used as the base cloth for tufted carpeting, however, the carpet within the car interior is more frequently using needlepunched nonwovens.

Many companies are producing needlepunch nonwovens for carpets. These include Otsuka, Sun Chemical, Suminoe Textile, Tyobo Material and Kureha.

These five companies occupy 66% of the whole market. Six companies—Japan Vilene, Otsuka, Suminoe Textile, Dynic, Kureah and Kanai Juyo Kogyo—have produced nonwoven fabrics for car ceilings and Japan Vilene and Otsuka account for 74% of the total share.

Spunbond nonwovens for tufted base cloths have been sold by Unitika, Toyobo and Freudenberg Spunweb Japan. These three companies have equal share. Freudenberg Spunweb Japan imports them from Taiwan and sells them in Japan.

The automotive market in Japan has matured and the future growth in demand should not be expected.

Therefore, nonwovens manufacturers are working to strengthen their overseas market, matching offshore production to car manufacturers. Therefore, even though nonwovens production in Japan for this use is stagnant, they can growth their businesses.

Nonwoven-based carpeting is used for the floor of the automotive interior and in the trunk. These materials are generally made using a needlepunch process and this technology is competing against tufted carpets. In terms of demand, nonwovens have surpassed tufted carpet, exceeding 50 million square meters.

As for the liner materials that stick to the ceiling surface of the interior, needlepunch is more commonly used than tricot fabrics. While tricot materials are still used in the luxury model cars, nonwovens are used in lower and middle class models because they are more cost effective.

Although the demand for nonwovens exceeded 20 million square meters from 2012 to 2014, it declined to less than 20 million square meters after 2015 because of the increasing production of tricot materials and a decrease in automotive production in general.

Polyester spunbond fabric is also used as the base cloth for tufted carpeting, however, the carpet within the car interior is more frequently using needlepunched nonwovens.

Many companies are producing needlepunch nonwovens for carpets. These include Otsuka, Sun Chemical, Suminoe Textile, Tyobo Material and Kureha.

These five companies occupy 66% of the whole market. Six companies—Japan Vilene, Otsuka, Suminoe Textile, Dynic, Kureah and Kanai Juyo Kogyo—have produced nonwoven fabrics for car ceilings and Japan Vilene and Otsuka account for 74% of the total share.

Spunbond nonwovens for tufted base cloths have been sold by Unitika, Toyobo and Freudenberg Spunweb Japan. These three companies have equal share. Freudenberg Spunweb Japan imports them from Taiwan and sells them in Japan.

The automotive market in Japan has matured and the future growth in demand should not be expected.

Therefore, nonwovens manufacturers are working to strengthen their overseas market, matching offshore production to car manufacturers. Therefore, even though nonwovens production in Japan for this use is stagnant, they can growth their businesses.