Tara Olivo, Associate Editor08.04.21

Nonwovens producers and converters for food packaging applications have been developing new products centered on sustainability. They’re doing this through the use of natural fibers while reducing the amount of raw materials used overall in the products.

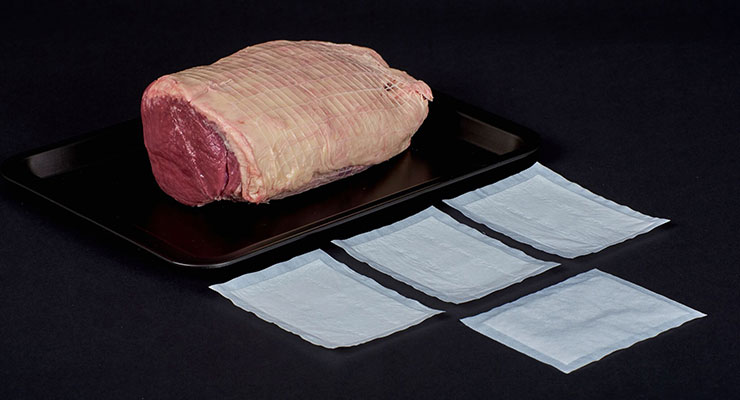

In food pads, airlaid, which utilizes a very high percentage of natural fibers, is the primary nonwoven used, but spunbond/SAP/spunbond laminates are also available in the market. Nonwoven food pads absorb liquid from perishables like meat and fruit to keep them fresh and extend shelf life, while also reducing food waste.

Nonwovens industry consultant Phil Mango projects that the total percentage of airlaid that goes into food pads is around 7% on a global basis. “The European food pad business is much larger from a nonwovens point of view than in North America,” he says. “Novipax is by far the largest producer of food pads in North America and they still use mostly non-airlaid or other nonwovens; they use some nonwovens, but it’s a very small percentage.”

There are a few conflicting problems that are limiting airlaid’s growth in North America, he explains. First, most of the existing equipment converts non-nonwoven type food pads. “There’s some inertia there where it’s always worked, why are they going to change it? It would mean capital investments in some cases.”

Secondly, in North America airlaid capacity has been limited. Mango estimates the current airlaid utilization rate is at 95%. Europe, on the other hand, has a number of small and medium size food pad producers—not one large food pad producer like in North America. There’s also more airlaid on a supply basis. “Europe probably has the most excess supply of airlaid, even if they are older lines, they’re probably in the low to mid 80s in airlaid utilization rate,” he adds.

According to INDA, the association of the nonwoven fabrics industry, airlaid is ideal for food pads because it has of the same requirements as a hygiene absorbent core: quick acquisition rates, no/low rewet, and absorbency capacity. “Controlling moisture within food packs aids shelf life and reduces waste,” says Brad Kalil, director of Market Intelligence & Economic Insights, INDA. “Packaging that incorporates nonwovens as components to aid pack breathability can manage the respiration and the shelf life of certain products, such as fruit.”

McAirlaid’s, Glatfelter and Domtar’s EAM Corporation are a few of the main airlaid manufacturers that currently produce materials for this market.

Glatfelter’s role in the food pad industry is focused in Europe and North America, where it holds close relationships with key food pad producers. Its food pad products offer various absorbency levels and processing options with or without superabsorbers and are easily laminated.

According to company executives, the need for packaged food and food pads has increased throughout the years and demand for Glatfelter’s products should continue to increase as plastic packaging is replaced by new innovative and sustainable airlaid products. Glatfelter’s airlaid absorbent cores for food pads are more environmentally friendly in comparison to competitors’ products that use raw materials derived from petroleum-based plastics, the company says.

Also seeing growth for nonwovens in the food pad category is Technical Absorbents, maker of Super Absorbent Fiber (SAF).

“During the Covid-19 pandemic sales of SAF fibers into this sector has continued to be strong, especially within Europe where the pandemic has resulted in less eating out and bigger demand at the supermarket,” says Paul Bradley, technical director, Technical Absorbents.

Technical Absorbents has sold its SAF technology into the food packaging sector for many years. This is mainly in fiber form to converters who then produce the fabrics and/or the cut pads. The SAF fibers are EFSA and FDA listed for use as an absorbent within food pad applications.

“When SAF fibers are converted they mix and entangle with other fibers,” explains Bradley. “The resulting pads have uniform absorption. Edge sealing or pouching isn’t required to keep the fibers in place and pads can simply be cut straight from a master roll. SAF fibers offer seamless versatility through blending with other fibrous materials to produce pads that are not only absorbent but also of pleasing appearance to the consumer as part of the modern presentation of pre-packaged foodstuffs.”

Like many manufacturers, Technical Absorbents is working to improve the sustainability of its products through improved efficiency. “The biggest impact is helping to reduce food wastage,” Bradley says. “The use of an absorbent pad improves food presentation and appearance – thus helping to extend product shelf-lives. The management of exudates is key to this and SAF is extremely effective at discretely absorbing and retaining these.”

Magic Invests in Airlaid

In Italy a long-standing converter of food pads has invested in its own airlaid equipment for food pads and other products. Magic Srl recently installed a Campen airlaid line that can produce several types of thermal bonded airlaid products with or without tissue and nonwovens as a carrier sheet. Before investing in the new machinery, Magic acquired airlaid from external suppliers.

A few years ago, Magic developed Spongel, a superabsorbent biodegradable powder, and from there the need to develop and produce their own airlaid arose. “Our need was to produce a new kind of high-absorbing and sustainable airlaid containing Spongel,” says Mauro Giani, owner and CEO of Magic Srl. “After Spongel development, we focused our efforts on the application of the powder in the airlaid material, and we realized that we needed to be able to control the whole production process.”

Magic’s food pads contain Airgel, an eco-friendly airlaid that, unlike others on the market, does not contain any chemical absorbent additives while ensuring the same performance levels. “Airgel is mainly composed of cellulose, a minimum percentage of bicomponent fibers and, above all, it contains Spongel, Magic’s patented super absorbent biodegradable powder: it is therefore biodegradable and compostable since cellulose and Spongel weight exceed 90% of the absorbing layer,” Giani says. “The high-tech airlaid machine from Campen transformed us from a converting company into a production company and made it possible for us to create Airgel, a very exclusive and innovative product with Spongel.”

According to Giani, the main trends in the packaging industry all turn around the circular economy, driven primarily by consumer awareness and by political pressure. “Post-consumer packaging must fulfill a long list of requirements to be recycled and packaging producers are more and more involved in developing materials designed for recycling and reuse,” he says. “Our commitment is therefore to follow this trend and to engage in research and development of sustainable products. We firmly believe that the role of a company in the society is no longer connected to the creation of commercial value alone: its present commitment is to act by respecting the environment and the community, having an active social role and representing an ethic reference point.”

Food pads is a growing market and it will potentially be even more so with sustainability and active-pack developments, he adds.

Elliott Launches UniDry Range

U.K.-based Elliott Absorbent Products has been converting food absorbents since the 1980s. One of its main products, Dryline, is an airlaid cellulose nonwoven. The Dryline Meat Pads range comes in one or two side coated options in both pads and on a roll. It’s latest innovation, though, is taking airlaid out of food pads.

The UniDry range is an ultra-thin, super absorbent range of sealed edge pads for fresh meat and fish, and, the company claims, has the lowest carbon footprint of any high absorbency pad on the market. While it doesn’t contain airlaid, the pad includes a hydrophilic nonwoven polypropylene base, which allows moisture to come in, but doesn’t allow moisture and superabosorbent to come out, according to Matt Hankins, managing director of Elliott Absorbent Products.

The Littleborough-based company says UniDry, which has been in development for several years, utilizes a proprietary “Infinity Core” that gives tremendous blood and water absorbency of between 7.5 liters and 26 liters per square meter.

Tests reveal that UniDry uses half the cellulose and plastic required to make traditional pads and due to its ultra-thin construction is easier to transport and store, cutting emissions from shipping miles by 66%, compared to traditional airlaid pads.

“UniDry is a major innovation, we are doing more with less and providing customers with a product that improves absorbency and shelf-life and boosts their sustainability performance,” Hankins says. “Existing airlaid pads are bulky and dusty with poor yields. The UniDry range will replace airlaid and SAF pads for absorbencies between 7500ml – 25,000ml (water/free swell).”

Hankins says the food pad business is a mature market, but where they’re getting growth is by taking airlaid business away from traditional pads and moving them to UniDry. UniDry is already being used by three major U.K. supermarkets.

Good Taste

In the beverage filtration category, wetlaid is the primary nonwovens technology used for products like tea bags and coffee filters. Wetlaid nonwovens are ideal here because they allow liquid to pass through while remaining water resistant. The material is produced in a process similar to paper making, and many wetlaid nonwovens are made with wood pulp or other natural fibers blended with synthetic fibers. Another advantage of wetlaid in this category is that it is easy to bond the material to form bags, sachets and filters.

According to INDA, in 2019, the liquid food and beverage processing filtration end uses consumed a third of the area of the nonwoven material used in liquid filtration, while transportation accounted for the greatest in tonnage, accounting for just over a third of the tons in 2019.

In tons, it is estimated the liquid Food and Beverage Processing segment increased 3.4% annually between 2014 through 2019. Looking forward, from 2020 through 2021, the segment is forecast to expand 2.8% annually.

Glatfelter produces a broad range of beverage filtration and filter papers for tea and coffee applications, including non-heat sealable and industrially compostable heat sealable papers. The engineered, high-quality filter papers are made with a blend of wood and abaca fibers and other smaller quantities of wet strength agents that require sealable polymers. These plant-based tea and coffee filter papers are known as Dynagreen solutions.

Abaca is a key ingredient in Glatfelter’s beverage filtration, and its long fibers ensure particle retention properties, as well as superior infusion characteristics that are very important for tea lovers, the company says.

Glatfelter’s single-serve tea and coffee solutions are also resource efficient and perform better than reusable solutions when it comes to waste. Using Dynagreen coffee pads in lieu of aluminum capsules is even more sustainable when looking at the end-life product performance.

Aluminum capsules are often thrown away in the residual waste bin for incineration. However, the Dynagreen coffee pads can be thrown away in the bio-waste bin, where the product will biodegrade under controlled conditions. This is important for the quality of the final compost, where the coffee works as a soil improving component.

In the last decade, the food and beverage industry has become increasingly driven by convenience and the emergence of on-the-go lifestyles. Recently, however, Glatfelter has seen sustainability becoming a meaningful driver in the industry. When making purchasing decisions, the end-consumer no longer looks solely at the convenience of the products, but also at how the products are likely to impact the environment. According to Glatfelter, consumers are requesting more transparency and commitment towards sustainability, not only from producers, but from the entire supply chain. Sustainable products are no longer a niche request, consumers now expect it, the company says.

One Earth, a maker of tea and coffee filter material, also sees the need for more sustainable, environmentally friendly and biodegradable products as the biggest factor driving growth in the beverage filtration market.

The One Earth product line features One Earth nonwoven filter material and One Earth nonwoven fast brew filter material. Primarily these materials are used for tea, coffee, food and beverage, however, the material is also used in food packaging, beauty products and health care, according to Erin Heryford, managing director, One Earth. The product line, in addition to filter media, also consists of string, tag, and envelope. The entire product line is sourced from non-GMO sugar cane and is certified compostable in 21 days or less, non-GMO, USDA 100% Biobased, and plastic free.

“Unlike competing tea filtration products, One Earth is manufactured using a dry process with no water waste or dirty water going back into the environment,” says Stephen Foss, president of Nonwoven Network, LLC. “In addition, we recycle all unused One Earth material back into creating new material. The One Earth patented fiber structure is inherently hydrophilic, which provides fast moisture flow through the web.”

In food pads, airlaid, which utilizes a very high percentage of natural fibers, is the primary nonwoven used, but spunbond/SAP/spunbond laminates are also available in the market. Nonwoven food pads absorb liquid from perishables like meat and fruit to keep them fresh and extend shelf life, while also reducing food waste.

Nonwovens industry consultant Phil Mango projects that the total percentage of airlaid that goes into food pads is around 7% on a global basis. “The European food pad business is much larger from a nonwovens point of view than in North America,” he says. “Novipax is by far the largest producer of food pads in North America and they still use mostly non-airlaid or other nonwovens; they use some nonwovens, but it’s a very small percentage.”

There are a few conflicting problems that are limiting airlaid’s growth in North America, he explains. First, most of the existing equipment converts non-nonwoven type food pads. “There’s some inertia there where it’s always worked, why are they going to change it? It would mean capital investments in some cases.”

Secondly, in North America airlaid capacity has been limited. Mango estimates the current airlaid utilization rate is at 95%. Europe, on the other hand, has a number of small and medium size food pad producers—not one large food pad producer like in North America. There’s also more airlaid on a supply basis. “Europe probably has the most excess supply of airlaid, even if they are older lines, they’re probably in the low to mid 80s in airlaid utilization rate,” he adds.

According to INDA, the association of the nonwoven fabrics industry, airlaid is ideal for food pads because it has of the same requirements as a hygiene absorbent core: quick acquisition rates, no/low rewet, and absorbency capacity. “Controlling moisture within food packs aids shelf life and reduces waste,” says Brad Kalil, director of Market Intelligence & Economic Insights, INDA. “Packaging that incorporates nonwovens as components to aid pack breathability can manage the respiration and the shelf life of certain products, such as fruit.”

McAirlaid’s, Glatfelter and Domtar’s EAM Corporation are a few of the main airlaid manufacturers that currently produce materials for this market.

Glatfelter’s role in the food pad industry is focused in Europe and North America, where it holds close relationships with key food pad producers. Its food pad products offer various absorbency levels and processing options with or without superabsorbers and are easily laminated.

According to company executives, the need for packaged food and food pads has increased throughout the years and demand for Glatfelter’s products should continue to increase as plastic packaging is replaced by new innovative and sustainable airlaid products. Glatfelter’s airlaid absorbent cores for food pads are more environmentally friendly in comparison to competitors’ products that use raw materials derived from petroleum-based plastics, the company says.

Also seeing growth for nonwovens in the food pad category is Technical Absorbents, maker of Super Absorbent Fiber (SAF).

“During the Covid-19 pandemic sales of SAF fibers into this sector has continued to be strong, especially within Europe where the pandemic has resulted in less eating out and bigger demand at the supermarket,” says Paul Bradley, technical director, Technical Absorbents.

Technical Absorbents has sold its SAF technology into the food packaging sector for many years. This is mainly in fiber form to converters who then produce the fabrics and/or the cut pads. The SAF fibers are EFSA and FDA listed for use as an absorbent within food pad applications.

“When SAF fibers are converted they mix and entangle with other fibers,” explains Bradley. “The resulting pads have uniform absorption. Edge sealing or pouching isn’t required to keep the fibers in place and pads can simply be cut straight from a master roll. SAF fibers offer seamless versatility through blending with other fibrous materials to produce pads that are not only absorbent but also of pleasing appearance to the consumer as part of the modern presentation of pre-packaged foodstuffs.”

Like many manufacturers, Technical Absorbents is working to improve the sustainability of its products through improved efficiency. “The biggest impact is helping to reduce food wastage,” Bradley says. “The use of an absorbent pad improves food presentation and appearance – thus helping to extend product shelf-lives. The management of exudates is key to this and SAF is extremely effective at discretely absorbing and retaining these.”

Magic Invests in Airlaid

In Italy a long-standing converter of food pads has invested in its own airlaid equipment for food pads and other products. Magic Srl recently installed a Campen airlaid line that can produce several types of thermal bonded airlaid products with or without tissue and nonwovens as a carrier sheet. Before investing in the new machinery, Magic acquired airlaid from external suppliers.

A few years ago, Magic developed Spongel, a superabsorbent biodegradable powder, and from there the need to develop and produce their own airlaid arose. “Our need was to produce a new kind of high-absorbing and sustainable airlaid containing Spongel,” says Mauro Giani, owner and CEO of Magic Srl. “After Spongel development, we focused our efforts on the application of the powder in the airlaid material, and we realized that we needed to be able to control the whole production process.”

Magic’s food pads contain Airgel, an eco-friendly airlaid that, unlike others on the market, does not contain any chemical absorbent additives while ensuring the same performance levels. “Airgel is mainly composed of cellulose, a minimum percentage of bicomponent fibers and, above all, it contains Spongel, Magic’s patented super absorbent biodegradable powder: it is therefore biodegradable and compostable since cellulose and Spongel weight exceed 90% of the absorbing layer,” Giani says. “The high-tech airlaid machine from Campen transformed us from a converting company into a production company and made it possible for us to create Airgel, a very exclusive and innovative product with Spongel.”

According to Giani, the main trends in the packaging industry all turn around the circular economy, driven primarily by consumer awareness and by political pressure. “Post-consumer packaging must fulfill a long list of requirements to be recycled and packaging producers are more and more involved in developing materials designed for recycling and reuse,” he says. “Our commitment is therefore to follow this trend and to engage in research and development of sustainable products. We firmly believe that the role of a company in the society is no longer connected to the creation of commercial value alone: its present commitment is to act by respecting the environment and the community, having an active social role and representing an ethic reference point.”

Food pads is a growing market and it will potentially be even more so with sustainability and active-pack developments, he adds.

Elliott Launches UniDry Range

U.K.-based Elliott Absorbent Products has been converting food absorbents since the 1980s. One of its main products, Dryline, is an airlaid cellulose nonwoven. The Dryline Meat Pads range comes in one or two side coated options in both pads and on a roll. It’s latest innovation, though, is taking airlaid out of food pads.

The UniDry range is an ultra-thin, super absorbent range of sealed edge pads for fresh meat and fish, and, the company claims, has the lowest carbon footprint of any high absorbency pad on the market. While it doesn’t contain airlaid, the pad includes a hydrophilic nonwoven polypropylene base, which allows moisture to come in, but doesn’t allow moisture and superabosorbent to come out, according to Matt Hankins, managing director of Elliott Absorbent Products.

The Littleborough-based company says UniDry, which has been in development for several years, utilizes a proprietary “Infinity Core” that gives tremendous blood and water absorbency of between 7.5 liters and 26 liters per square meter.

Tests reveal that UniDry uses half the cellulose and plastic required to make traditional pads and due to its ultra-thin construction is easier to transport and store, cutting emissions from shipping miles by 66%, compared to traditional airlaid pads.

“UniDry is a major innovation, we are doing more with less and providing customers with a product that improves absorbency and shelf-life and boosts their sustainability performance,” Hankins says. “Existing airlaid pads are bulky and dusty with poor yields. The UniDry range will replace airlaid and SAF pads for absorbencies between 7500ml – 25,000ml (water/free swell).”

Hankins says the food pad business is a mature market, but where they’re getting growth is by taking airlaid business away from traditional pads and moving them to UniDry. UniDry is already being used by three major U.K. supermarkets.

Good Taste

In the beverage filtration category, wetlaid is the primary nonwovens technology used for products like tea bags and coffee filters. Wetlaid nonwovens are ideal here because they allow liquid to pass through while remaining water resistant. The material is produced in a process similar to paper making, and many wetlaid nonwovens are made with wood pulp or other natural fibers blended with synthetic fibers. Another advantage of wetlaid in this category is that it is easy to bond the material to form bags, sachets and filters.

According to INDA, in 2019, the liquid food and beverage processing filtration end uses consumed a third of the area of the nonwoven material used in liquid filtration, while transportation accounted for the greatest in tonnage, accounting for just over a third of the tons in 2019.

In tons, it is estimated the liquid Food and Beverage Processing segment increased 3.4% annually between 2014 through 2019. Looking forward, from 2020 through 2021, the segment is forecast to expand 2.8% annually.

Glatfelter produces a broad range of beverage filtration and filter papers for tea and coffee applications, including non-heat sealable and industrially compostable heat sealable papers. The engineered, high-quality filter papers are made with a blend of wood and abaca fibers and other smaller quantities of wet strength agents that require sealable polymers. These plant-based tea and coffee filter papers are known as Dynagreen solutions.

Abaca is a key ingredient in Glatfelter’s beverage filtration, and its long fibers ensure particle retention properties, as well as superior infusion characteristics that are very important for tea lovers, the company says.

Glatfelter’s single-serve tea and coffee solutions are also resource efficient and perform better than reusable solutions when it comes to waste. Using Dynagreen coffee pads in lieu of aluminum capsules is even more sustainable when looking at the end-life product performance.

Aluminum capsules are often thrown away in the residual waste bin for incineration. However, the Dynagreen coffee pads can be thrown away in the bio-waste bin, where the product will biodegrade under controlled conditions. This is important for the quality of the final compost, where the coffee works as a soil improving component.

In the last decade, the food and beverage industry has become increasingly driven by convenience and the emergence of on-the-go lifestyles. Recently, however, Glatfelter has seen sustainability becoming a meaningful driver in the industry. When making purchasing decisions, the end-consumer no longer looks solely at the convenience of the products, but also at how the products are likely to impact the environment. According to Glatfelter, consumers are requesting more transparency and commitment towards sustainability, not only from producers, but from the entire supply chain. Sustainable products are no longer a niche request, consumers now expect it, the company says.

One Earth, a maker of tea and coffee filter material, also sees the need for more sustainable, environmentally friendly and biodegradable products as the biggest factor driving growth in the beverage filtration market.

The One Earth product line features One Earth nonwoven filter material and One Earth nonwoven fast brew filter material. Primarily these materials are used for tea, coffee, food and beverage, however, the material is also used in food packaging, beauty products and health care, according to Erin Heryford, managing director, One Earth. The product line, in addition to filter media, also consists of string, tag, and envelope. The entire product line is sourced from non-GMO sugar cane and is certified compostable in 21 days or less, non-GMO, USDA 100% Biobased, and plastic free.

“Unlike competing tea filtration products, One Earth is manufactured using a dry process with no water waste or dirty water going back into the environment,” says Stephen Foss, president of Nonwoven Network, LLC. “In addition, we recycle all unused One Earth material back into creating new material. The One Earth patented fiber structure is inherently hydrophilic, which provides fast moisture flow through the web.”