Jason Surman, Vice President of Sales, Web Industries Inc.11.10.17

In today’s nonwoven health and hygiene products industry, OEMs and leading brands are laser focused on core competencies, costs and delivering their value proposition to consumers. And when launching new products, they are faced with important decisions about how to most economically and efficiently turn innovations into reality. How much do they tackle within the four walls of their operations? When does it make sense to partner with outside specialists?

Following is an overview of key factors to address when answering these questions.

Specialized Machinery for Diverse Material Weights, Widths

Whether the end use is feminine hygiene products, adult incontinence protection or baby diapers, new raw material introductions can present manufacturing challenges. In some cases, OEMs are using thicker core materials. For example, new core materials can contain SAP (super absorbent polymers) as a ready to use material, and these can be thicker than previously used core materials. Then there are today’s soft, fabric-like topsheets, many of which are extremely thin and stretchable, as well as innovative ADLs (acquisition dispersion layer), which transport liquid to the product’s absorbent core. With many products being introduced in the market, there can be increased processing challenges around these unique new materials that need to be addressed.

For any given consumer product, a brand may be working with nonwovens, films and foams having very different properties and characteristics. It can be difficult for a single manufacturer to invest in all of the right equipment to optimally process these diverse materials. Consider the issue of spooling vs. festooning. Traditionally, some OEMs used festooned materials; the festooning process leaves materials neatly folded over themselves. However, some newer materials are very delicate and can become creased or deformed if they are festooned. To prepare them to be fed onto an OEM manufacturing line, they ideally should be wound onto spools instead. This can require investment in new equipment, and be outside core strategies and capabilities. When looking for flexibility and scale, a third party converter may offer the best solution.

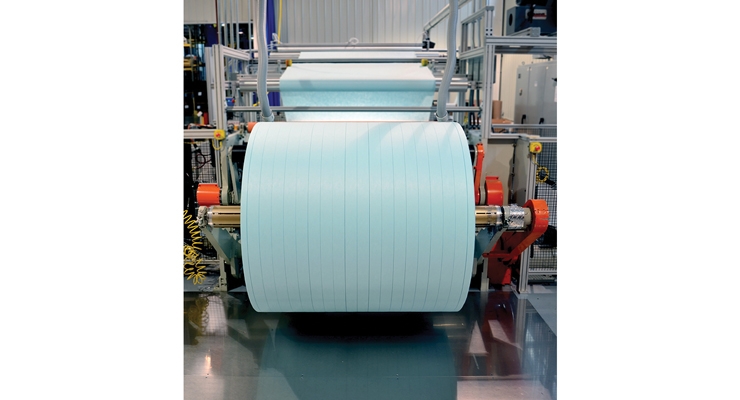

Many newer materials must be handled gently to achieve a stable spool without damaging, stretching or breaking the nonwoven. For thicker materials, it’s important to create spools of extra-large diameter to help maximize efficiency and reduce processing costs. Using this spooling example as a reference point, some questions to consider before investing in new material handling machinery are:

Another Perspective During Product Development

A best practice is to engage with a materials formatting partner early in product development. Before doing so, strong non-disclosure agreements should be in place, and the OEM will want to have reliable references or a track record of positive past work experience with the converter. Only a proven, trustworthy partner should be invited to weigh in on sensitive R&D matters.

How is this early involvement advantageous? In many cases, the converter can help an OEM ensure that the right material for end product needs will also meet expectations for production and total cost targets. For example, a new, thicker material may cost significantly more than another material to process because of the difference in input width and length, as well as the output spool length. Material handling partners that engage early on can help OEMs anticipate such challenges and work together towards the best solution.

The same principle applies to nonwoven printing, which has become increasingly popular as personal product brands compete for consumers’ attention. As OEMs elevate the look, feel and performance of their hygiene products, they often want the best of both worlds:

Also, inline inkjet printing may only be suitable to support very simple, one-color designs on the nonwoven material, such as a diaper topsheet. Yet it may be strategically important for the OEM’s brand to stand out to shoppers with a more upscale-looking multicolored, multidimensional print.

Here again, there can be big benefits if the OEM and its material formatting partner collaborate in the beginning phases of product development. Formatters can assist in material and graphics selection decisions that accommodate the desired performance and an economically viable production scenario.

Another printing consideration, especially with nonwovens, is a choice of water-based or solvent-based ink systems. While water-based inks are environmentally friendly, solvent-based ink systems can help promote improved rub off, a major consideration in processing printing materials. Solvent-based ink printing systems can be challenging due to safety and environmental requirements, such as air permits and solvent contamination, and add cost and complexity to operations. Choosing a third party printer can help reduce this complexity and bring about the best option for performance, cost and design appeal.

Preparedness for Known Constraints and the Unknown

Whether a health and hygiene product manufacturer is launching a new product or simply trying to streamline existing operations, there are good reasons to forge alliances with outside materials formatting specialists. Such partners can serve as an extension of an OEM’s manufacturing base during times of short-term capacity constraints. In some instances, these constraints can be anticipated as the OEM projects the need to reserve in-house machinery for scaling up new product production.

In other cases, it may be impossible to forecast how any one part of the OEM’s operations could become overwhelmed with demand or go down due to natural disasters or other unforeseen circumstances. In planning for these contingencies, it’s wise to qualify a converting partner during times of steady state. Then there will be a reliable resource available for future needs, ensuring redundancy in case of emergencies or spikes in demand. This can apply to everything from extrusion to slitting/rewinding to spooling, printing, kitting and packaging.

Ultimately, the OEM and all of its supply chain partners benefit if the end product can be processed as quickly and cost effectively as possible, delivering great value to the consumer and increasing sales.

Jason Surman is vice president of sales for Web Industries Inc., a Marlborough, MA-based provider of flexible material converting and end-product manufacturing services for the advanced composites, medical, health and hygiene, multi-layer insulation, and wire and cable markets. He can be reached at JSurman@webindustries.com or tel.: 508-573-7974.

Following is an overview of key factors to address when answering these questions.

Specialized Machinery for Diverse Material Weights, Widths

Whether the end use is feminine hygiene products, adult incontinence protection or baby diapers, new raw material introductions can present manufacturing challenges. In some cases, OEMs are using thicker core materials. For example, new core materials can contain SAP (super absorbent polymers) as a ready to use material, and these can be thicker than previously used core materials. Then there are today’s soft, fabric-like topsheets, many of which are extremely thin and stretchable, as well as innovative ADLs (acquisition dispersion layer), which transport liquid to the product’s absorbent core. With many products being introduced in the market, there can be increased processing challenges around these unique new materials that need to be addressed.

For any given consumer product, a brand may be working with nonwovens, films and foams having very different properties and characteristics. It can be difficult for a single manufacturer to invest in all of the right equipment to optimally process these diverse materials. Consider the issue of spooling vs. festooning. Traditionally, some OEMs used festooned materials; the festooning process leaves materials neatly folded over themselves. However, some newer materials are very delicate and can become creased or deformed if they are festooned. To prepare them to be fed onto an OEM manufacturing line, they ideally should be wound onto spools instead. This can require investment in new equipment, and be outside core strategies and capabilities. When looking for flexibility and scale, a third party converter may offer the best solution.

Many newer materials must be handled gently to achieve a stable spool without damaging, stretching or breaking the nonwoven. For thicker materials, it’s important to create spools of extra-large diameter to help maximize efficiency and reduce processing costs. Using this spooling example as a reference point, some questions to consider before investing in new material handling machinery are:

- Is there space for additional equipment? If not, what are the costs of adding more space?

- What additional labor costs will be associated with operating the new machinery?

- Is there enough volume of work to spread these costs across different shifts?

- Does the addition of this new capability enhance the business’ core competency?

Another Perspective During Product Development

A best practice is to engage with a materials formatting partner early in product development. Before doing so, strong non-disclosure agreements should be in place, and the OEM will want to have reliable references or a track record of positive past work experience with the converter. Only a proven, trustworthy partner should be invited to weigh in on sensitive R&D matters.

How is this early involvement advantageous? In many cases, the converter can help an OEM ensure that the right material for end product needs will also meet expectations for production and total cost targets. For example, a new, thicker material may cost significantly more than another material to process because of the difference in input width and length, as well as the output spool length. Material handling partners that engage early on can help OEMs anticipate such challenges and work together towards the best solution.

The same principle applies to nonwoven printing, which has become increasingly popular as personal product brands compete for consumers’ attention. As OEMs elevate the look, feel and performance of their hygiene products, they often want the best of both worlds:

- Ultra-thin, soft materials for enhanced consumer comfort and discretion; and

- A unique print that resonates with the consumer and differentiates the hygiene product from the competition on the shelf.

Also, inline inkjet printing may only be suitable to support very simple, one-color designs on the nonwoven material, such as a diaper topsheet. Yet it may be strategically important for the OEM’s brand to stand out to shoppers with a more upscale-looking multicolored, multidimensional print.

Here again, there can be big benefits if the OEM and its material formatting partner collaborate in the beginning phases of product development. Formatters can assist in material and graphics selection decisions that accommodate the desired performance and an economically viable production scenario.

Another printing consideration, especially with nonwovens, is a choice of water-based or solvent-based ink systems. While water-based inks are environmentally friendly, solvent-based ink systems can help promote improved rub off, a major consideration in processing printing materials. Solvent-based ink printing systems can be challenging due to safety and environmental requirements, such as air permits and solvent contamination, and add cost and complexity to operations. Choosing a third party printer can help reduce this complexity and bring about the best option for performance, cost and design appeal.

Preparedness for Known Constraints and the Unknown

Whether a health and hygiene product manufacturer is launching a new product or simply trying to streamline existing operations, there are good reasons to forge alliances with outside materials formatting specialists. Such partners can serve as an extension of an OEM’s manufacturing base during times of short-term capacity constraints. In some instances, these constraints can be anticipated as the OEM projects the need to reserve in-house machinery for scaling up new product production.

In other cases, it may be impossible to forecast how any one part of the OEM’s operations could become overwhelmed with demand or go down due to natural disasters or other unforeseen circumstances. In planning for these contingencies, it’s wise to qualify a converting partner during times of steady state. Then there will be a reliable resource available for future needs, ensuring redundancy in case of emergencies or spikes in demand. This can apply to everything from extrusion to slitting/rewinding to spooling, printing, kitting and packaging.

Ultimately, the OEM and all of its supply chain partners benefit if the end product can be processed as quickly and cost effectively as possible, delivering great value to the consumer and increasing sales.

Jason Surman is vice president of sales for Web Industries Inc., a Marlborough, MA-based provider of flexible material converting and end-product manufacturing services for the advanced composites, medical, health and hygiene, multi-layer insulation, and wire and cable markets. He can be reached at JSurman@webindustries.com or tel.: 508-573-7974.