04.04.24

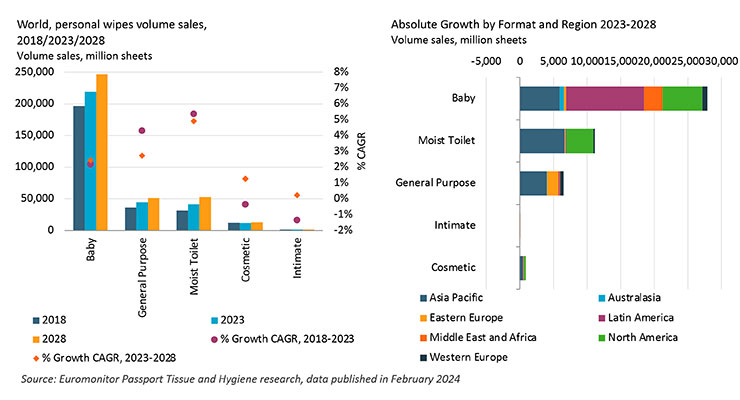

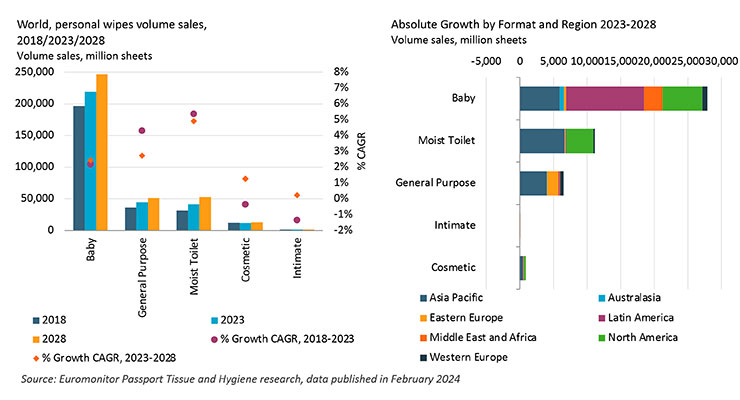

Beyond 2023, retail disposable personal wet wipes are expected to see healthy growth globally at about 3% year-on-year, supported by Asia Pacific, which is expected to contribute more than a third of incremental volume increase over the 2023-2028 forecast period, particularly in general purpose, baby and moist toilet wipes.

Strong demographic tailwinds, such as urbanization, underpin consumers’ growing health awareness and desire for convenience, efficacy and simplicity in daily self-care routines, which bodes well for wipes’ growth.

Asia Pacific is home to nearly two-thirds of the world’s population, with over 2.2 billion citizens residing in major cities. Over 2022-2040, urban households will experience growth of 21%, resulting in six out of 10 households being situated in urban areas across the region. Asia Pacific will see the second fastest rate of urbanization globally, after the Middle East and Africa.

China – the key engine of the region’s growth in wipes – will remain the largest urban market, adding over 150 million new urban households by 2040. Chinese cities are proving to be the most promising consumer markets across the region, with a large and growing pool of consumers with rising income levels, supported by economic strength, innovation capabilities and high employment rates. As such, wet wipes, as a response to modern urbanites’ striving for wellness and health with less hassle, are expected to continue to grow.

While the U.S. remains the largest baby wipes market, with just under a quarter of global sales, it is developing markets such as Mexico, India, Indonesia and Brazil that are predicted to account for collectively 71% of global incremental volume growth in baby wipes from 2023-2028, despite making up just 21% of total sales in 2023. By 2028, all three are expected to move up the ranks within the top 10 markets, as mature developed peers the U.K., Spain and South Korea cede places.

Rising disposable incomes, hygiene expectations, and product versatility and affordability are key drivers, especially in those developing markets where baby wipes are still considered a discretionary purchase.

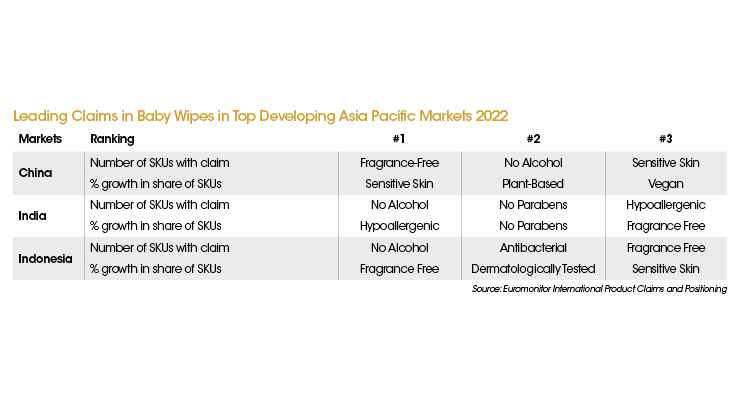

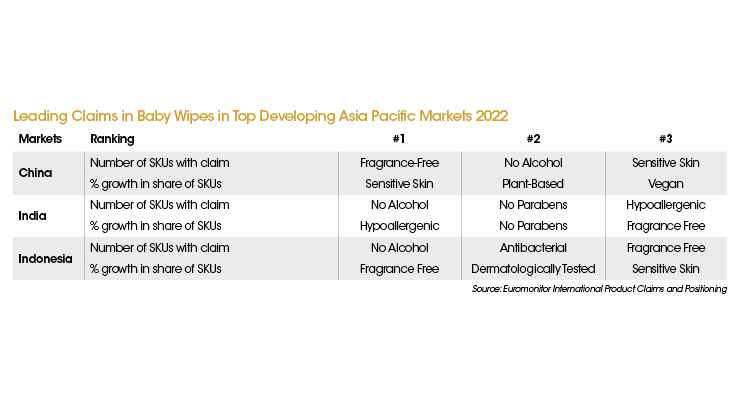

Indonesia has seen a growing emphasis on antibacterial properties, with natural antibacterial ingredients like tea tree oil and skin-softening ingredients among key areas of innovation.

China has seen an expanding digital share of plant-based and vegan claims, due to their inherent association with health and skin friendliness, appealing to urban shoppers with allergy and skin concerns, as well as pet owners who use baby wipes for pet care.

More broadly, the growing clean movement embodied, by increased “pure-water wipes,” as well as natural ingredients, also fuels baby wipes’ appeal and premium opportunities. For example, Megasari Makmur PT in Indonesia launched new variants of its Mitu Fresh n’ Clean brand containing chrysanthemum extract, camomile and vitamin E to prevent skin irritation, while Irish Breeze introduced WaterWipes in India, marketing it as “The World’s Purest Baby Wipes,” with 99.9% water and 0.1% grapefruit seed extract. In Brazil, FW, owner of the brand Feel Clean, launched baby wipes under the Piquitucho brand featuring lemongrass and aloe vera extracts.

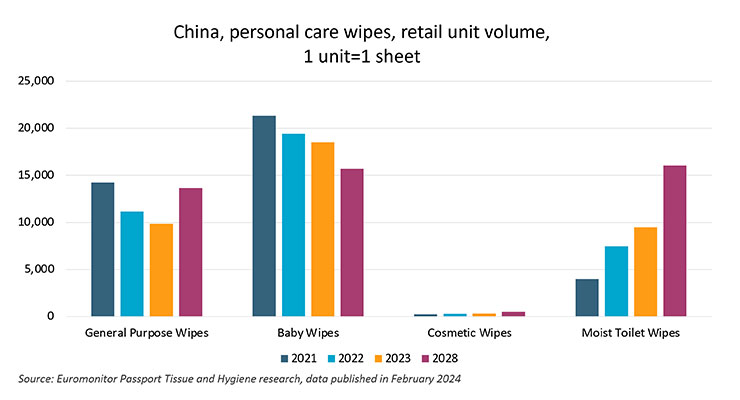

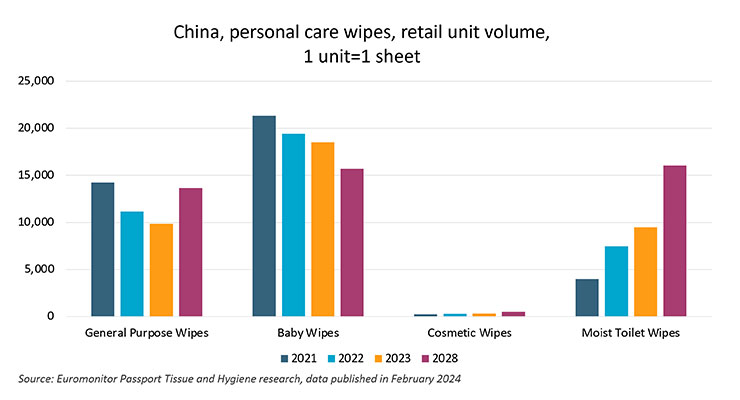

However, notably, China is predicted to see the most incremental volume growth of all countries in moist toilet wipes, followed by the largest market US between 2023-2028. Combined, they are expected to contribute more than 90% of the global incremental volume increase over 2023-2028. That said, by 2028, China’s per capita moist toilet wipes volume usage will be about only a sixth of that in the U.S., suggesting ample unaddressed market potential.

Current penetration in China’s wipes is mostly through e-commerce channels, which is suitable for an emerging category like moist toilet wipes as people are more used to stocking up and seeking deals online, a shopping habit only exacerbated by the pandemic. This is why brands like Babycare and Deeyeo—both experts in online marketing—have succeeded and continue to succeed in promoting their baby wipes and moist toilet wipes, respectively. Both are good at targeting their audience and augmenting the benefits of their products including good for sensitive skins, germ-killing and flushable.

Meanwhile, leading players including Fujian Hengan, Vinda, and Gold Hongye Paper are all aiming at enhancing their online presence across e-commerce platforms from Tmall and JD.com to Pinduoduo and Douyin to ensure that price-sensitive consumers are also captured.

Ingredient-led premiumization has focused on antibacterial properties and odour control, while other features and portable packaging options for on-the-go occasions are still underexplored areas that could offer significant opportunities.

Essity has seen a growing portion of total personal wipes sales come from Asia Pacific, with the region’s share of its sales rising from about 20% in 2018 to just under 40% in 2023, with its local market share doubling between 2018 and 2023 to reach 10%. Such growth was owing to well-established global brand reputation, as well as its investment in product quality and influencer-supported digital marketing. However, its recent sale of Vinda stake will shape its local category strategy and competitive performance in the coming years.

In comparison, despite only entering the Chinese wipes market in 2020, Chinese local player Henan Yixiang Hygiene Technology has seen its market share in personal wipes approaching the second-largest player Essity (previous owner of Vinda) and reaching just over 9% in 2023, benefitting from growing popularity of its Deeyeo moist toilet wipes brand.

www.euromonitor.com

Strong demographic tailwinds, such as urbanization, underpin consumers’ growing health awareness and desire for convenience, efficacy and simplicity in daily self-care routines, which bodes well for wipes’ growth.

Asia Pacific is home to nearly two-thirds of the world’s population, with over 2.2 billion citizens residing in major cities. Over 2022-2040, urban households will experience growth of 21%, resulting in six out of 10 households being situated in urban areas across the region. Asia Pacific will see the second fastest rate of urbanization globally, after the Middle East and Africa.

China – the key engine of the region’s growth in wipes – will remain the largest urban market, adding over 150 million new urban households by 2040. Chinese cities are proving to be the most promising consumer markets across the region, with a large and growing pool of consumers with rising income levels, supported by economic strength, innovation capabilities and high employment rates. As such, wet wipes, as a response to modern urbanites’ striving for wellness and health with less hassle, are expected to continue to grow.

Baby Wipes’ Prospects Notable in Developing Asia Pacific

Baby wipes is the largest category in personal wipes, and saw recovered positive, albeit marginal, volume growth in 2023, and is forecast to resume steady 3% year-on-year growth globally. Baby wipes will see incremental forecast growth largely driven by Latin America and Asia Pacific due to increased self-care awareness, the clean ingredient trend, demand for convenience and cost-efficient cleaning and positive birth trends in certain markets.While the U.S. remains the largest baby wipes market, with just under a quarter of global sales, it is developing markets such as Mexico, India, Indonesia and Brazil that are predicted to account for collectively 71% of global incremental volume growth in baby wipes from 2023-2028, despite making up just 21% of total sales in 2023. By 2028, all three are expected to move up the ranks within the top 10 markets, as mature developed peers the U.K., Spain and South Korea cede places.

Rising disposable incomes, hygiene expectations, and product versatility and affordability are key drivers, especially in those developing markets where baby wipes are still considered a discretionary purchase.

Non-Toxic, Antibacterial and Clean Claims Drive Growth in Top Asia-Pacific Developing Markets

Non-toxic formulas, reflected in common claims like “fragrance-free”, “no alcohol” and “no parabens,” remain popular in baby wipes in Asia, with local climate and consumer concerns influencing local dynamics.Indonesia has seen a growing emphasis on antibacterial properties, with natural antibacterial ingredients like tea tree oil and skin-softening ingredients among key areas of innovation.

China has seen an expanding digital share of plant-based and vegan claims, due to their inherent association with health and skin friendliness, appealing to urban shoppers with allergy and skin concerns, as well as pet owners who use baby wipes for pet care.

More broadly, the growing clean movement embodied, by increased “pure-water wipes,” as well as natural ingredients, also fuels baby wipes’ appeal and premium opportunities. For example, Megasari Makmur PT in Indonesia launched new variants of its Mitu Fresh n’ Clean brand containing chrysanthemum extract, camomile and vitamin E to prevent skin irritation, while Irish Breeze introduced WaterWipes in India, marketing it as “The World’s Purest Baby Wipes,” with 99.9% water and 0.1% grapefruit seed extract. In Brazil, FW, owner of the brand Feel Clean, launched baby wipes under the Piquitucho brand featuring lemongrass and aloe vera extracts.

Moist Toilet Wipes Remains Developed World-Centric but China is Rapidly Catching Up

Moist toilet wipes is the fastest growing, though still small, category in retail disposable wet wipes. Stockpiling-induced toilet paper shortages and home seclusion in 2020 forced many consumers to re-examine bathroom routines, leading to significant first-time customer conversions. Though still far from reaching the mainstream, these wipes are increasingly considered a convenient complementary cleaning aid to toilet paper to fulfil hygiene needs such as deeper cleansing, refreshment, odor control and moisturization, typically after toilet paper usage. The category remains very much dominated by the developed world, with North America and Western Europe accounting for more than two thirds of global total in 2023, supported by well-equipped toilet and plumbing infrastructure, product awareness and higher disposable income.

However, notably, China is predicted to see the most incremental volume growth of all countries in moist toilet wipes, followed by the largest market US between 2023-2028. Combined, they are expected to contribute more than 90% of the global incremental volume increase over 2023-2028. That said, by 2028, China’s per capita moist toilet wipes volume usage will be about only a sixth of that in the U.S., suggesting ample unaddressed market potential.

Top Growth China Market to Witness a Bathroom Renaissance

Moist toilet wipes has been a thriving category, although still an emerging one in even the top growth markets, presenting ample value creation opportunities given the still low penetration rate among the population. In China, the leading growth market, homegrown brands have been beefing up their digital marketing and innovation, gaining a growing following among consumers, who up to a few years ago were only familiar with a few well-known global brands, such as Kleenex and Vinda,Current penetration in China’s wipes is mostly through e-commerce channels, which is suitable for an emerging category like moist toilet wipes as people are more used to stocking up and seeking deals online, a shopping habit only exacerbated by the pandemic. This is why brands like Babycare and Deeyeo—both experts in online marketing—have succeeded and continue to succeed in promoting their baby wipes and moist toilet wipes, respectively. Both are good at targeting their audience and augmenting the benefits of their products including good for sensitive skins, germ-killing and flushable.

Meanwhile, leading players including Fujian Hengan, Vinda, and Gold Hongye Paper are all aiming at enhancing their online presence across e-commerce platforms from Tmall and JD.com to Pinduoduo and Douyin to ensure that price-sensitive consumers are also captured.

Ingredient-led premiumization has focused on antibacterial properties and odour control, while other features and portable packaging options for on-the-go occasions are still underexplored areas that could offer significant opportunities.

Essity has seen a growing portion of total personal wipes sales come from Asia Pacific, with the region’s share of its sales rising from about 20% in 2018 to just under 40% in 2023, with its local market share doubling between 2018 and 2023 to reach 10%. Such growth was owing to well-established global brand reputation, as well as its investment in product quality and influencer-supported digital marketing. However, its recent sale of Vinda stake will shape its local category strategy and competitive performance in the coming years.

In comparison, despite only entering the Chinese wipes market in 2020, Chinese local player Henan Yixiang Hygiene Technology has seen its market share in personal wipes approaching the second-largest player Essity (previous owner of Vinda) and reaching just over 9% in 2023, benefitting from growing popularity of its Deeyeo moist toilet wipes brand.

www.euromonitor.com