Kin Ohmura, Osaka Marketing02.01.22

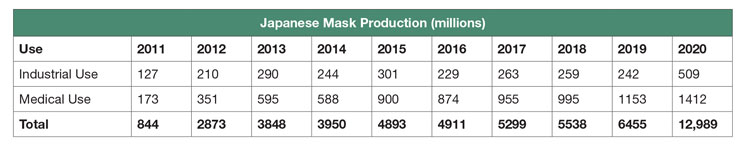

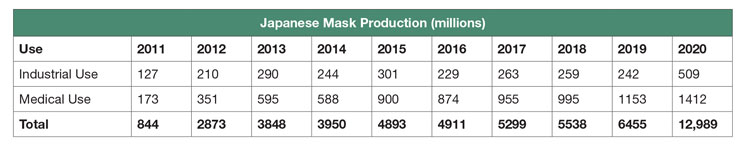

The demand for face masks increased explosively with the spread of the new coronavirus in Japan in 2020. Table 1 shows the number of masks in manufacturerd in Japan in 2020. The total amount of the production expanded to 12,989 million pieces, which was double the 6455 million pieces made in Japan in 2019. The amount of production shown in the table includes not only the masks produced in Japan but also the overseas products made by

Japanese mask makers and exported to Japan.

The domestic production of masks in 2020 was 3526 million pieces, and the number of products manufactured overseas and imported to Japan was 9463 million pieces. Thus, the ratio of domestic to exported materials was 27% to 73%. As for usage, general consumer use of household masks was predominantly as much as 11,068 million pieces in 2020. However, the amount of production in table 1 shows the production of members of the Japan Face

Mask Industry Association, so products made by non-members are not included. It is considered that the volumes of the products of the masks of including those made by non-affiliated companies would exceed 20 billion pieces in 2020. Although most of the masks sold in Japan were imported goods, an accurate picture of imported face masks was specified in trade statistics in 2021. According to the statistics, the imported masks made from nonwoven fabrics was 12,469 million pieces, from January to September 2021, which is already equal scale to the total amount of the production of 2020 in table 1. This shows that imports and sales by companies that aren’t in the industrial association are significant.

Masks in Japan were understocked because of the rapidly increasing demand caused by infection prevention measures in 2020. Consequently, the Japanese Government granted subsidies to promote the development of domestic facilities and to encourage the entry of new companies to the market. As a result, the capacity of domestic supply had been reinforced, and the amount of production had increased to 3,526 million pieces in 2020 from 1483 million pieces in 2019. Moreover, domestic production of meltblown nonwoven fabric, which is used in the filter of the masks, increased significantly.

However, demand for domestic production of masks failed to rise because the import of low-priced masks, made in China, had increased since late 2020, and the demand for domestic masks failed to rise. On that account, some mask makers that entered newly or enlarged facilities in 2020 have been forced to cut back or curtail operations. Other companies that are not able to slow down their operations will likely fail once the coronavirus is over.

Japanese mask makers and exported to Japan.

The domestic production of masks in 2020 was 3526 million pieces, and the number of products manufactured overseas and imported to Japan was 9463 million pieces. Thus, the ratio of domestic to exported materials was 27% to 73%. As for usage, general consumer use of household masks was predominantly as much as 11,068 million pieces in 2020. However, the amount of production in table 1 shows the production of members of the Japan Face

Mask Industry Association, so products made by non-members are not included. It is considered that the volumes of the products of the masks of including those made by non-affiliated companies would exceed 20 billion pieces in 2020. Although most of the masks sold in Japan were imported goods, an accurate picture of imported face masks was specified in trade statistics in 2021. According to the statistics, the imported masks made from nonwoven fabrics was 12,469 million pieces, from January to September 2021, which is already equal scale to the total amount of the production of 2020 in table 1. This shows that imports and sales by companies that aren’t in the industrial association are significant.

Masks in Japan were understocked because of the rapidly increasing demand caused by infection prevention measures in 2020. Consequently, the Japanese Government granted subsidies to promote the development of domestic facilities and to encourage the entry of new companies to the market. As a result, the capacity of domestic supply had been reinforced, and the amount of production had increased to 3,526 million pieces in 2020 from 1483 million pieces in 2019. Moreover, domestic production of meltblown nonwoven fabric, which is used in the filter of the masks, increased significantly.

However, demand for domestic production of masks failed to rise because the import of low-priced masks, made in China, had increased since late 2020, and the demand for domestic masks failed to rise. On that account, some mask makers that entered newly or enlarged facilities in 2020 have been forced to cut back or curtail operations. Other companies that are not able to slow down their operations will likely fail once the coronavirus is over.