Kin Ohmura, Osaka Marekting05.06.21

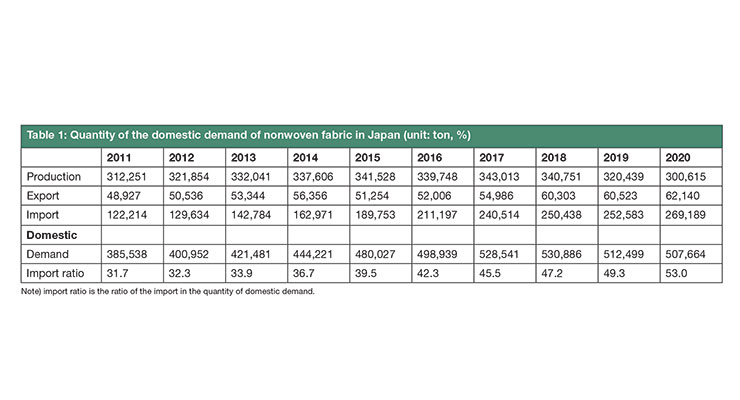

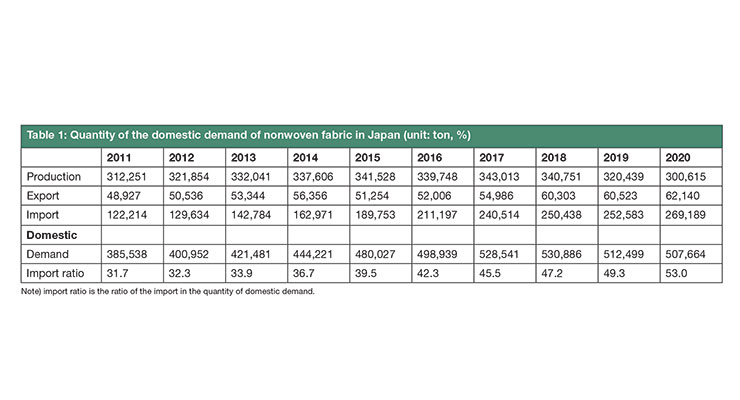

Domestic production of nonwovens in Japan was 300,615 tons in 2020. Meanwhile exports were 62,140 tons and the imports were 269,189 tons. The quantity of domestic demand was 507,664 tons in 2020, and it was 0.9% decrease compared with the previous year. Although demand for nonwoven fabric in Japan had increased consistently until 2019, it was forced to decrease in 2019 through 2020.

Furthermore, the ratio of imported nonwoven fabric in the domestic demand had been 53%, and in the end, the shares of the imported nonwoven fabric had exceeded 50% in 2020.

Table 1 shows the amount of the production of nonwoven fabric, such as the exports, imports, quantity of domestic demand and the ratio of the imports in the domestic demand in Japan.

Domestic demand for nonwoven fabric was forced to slump, due to the spreading infection of the new coronavirus in 2020.

Demand for nonwovens in diapers, which is influenced by production levels of the diaper market, decreased 12.5% to 395,343 tons in 2020 on the heels of reduced exports. Exports decreased 22.6% to 198,595 tons in 2020. Additionally, demand for nonwovens used in the automotive market decreased significantly, down 16.7% to just over 8 million tons.

However, the production of masks and isolation gowns has increased as infection measures of the new coronavirus, and the demand for nonwoven fabric for those purposes has increased. These increases were able to offset double-digit declines in demand for diaper and automotive materials.

Although, the demand for Japanese-made nonwoven fabric is returning in 2021, it might not be expected to reach the same high growth rate as before the coronavirus. In China, the greatest export destination of Japanese made baby diapers, the quality of the domestic made materials used in diapers has been improved, driving up demand for locally made products. Under these circumstances, recovery of the demand for diapers made in Japan is not likely, and increases in the production of baby diapers in Japan is not expected to be strong. However, the production of cars is expected to increase, and nonwovens used in protection against the coronavirus, such as masks and gowns, would keep up with demand sequentially.

Furthermore, the ratio of imported nonwoven fabric in the domestic demand had been 53%, and in the end, the shares of the imported nonwoven fabric had exceeded 50% in 2020.

Table 1 shows the amount of the production of nonwoven fabric, such as the exports, imports, quantity of domestic demand and the ratio of the imports in the domestic demand in Japan.

Domestic demand for nonwoven fabric was forced to slump, due to the spreading infection of the new coronavirus in 2020.

Demand for nonwovens in diapers, which is influenced by production levels of the diaper market, decreased 12.5% to 395,343 tons in 2020 on the heels of reduced exports. Exports decreased 22.6% to 198,595 tons in 2020. Additionally, demand for nonwovens used in the automotive market decreased significantly, down 16.7% to just over 8 million tons.

However, the production of masks and isolation gowns has increased as infection measures of the new coronavirus, and the demand for nonwoven fabric for those purposes has increased. These increases were able to offset double-digit declines in demand for diaper and automotive materials.

Although, the demand for Japanese-made nonwoven fabric is returning in 2021, it might not be expected to reach the same high growth rate as before the coronavirus. In China, the greatest export destination of Japanese made baby diapers, the quality of the domestic made materials used in diapers has been improved, driving up demand for locally made products. Under these circumstances, recovery of the demand for diapers made in Japan is not likely, and increases in the production of baby diapers in Japan is not expected to be strong. However, the production of cars is expected to increase, and nonwovens used in protection against the coronavirus, such as masks and gowns, would keep up with demand sequentially.