01.06.21

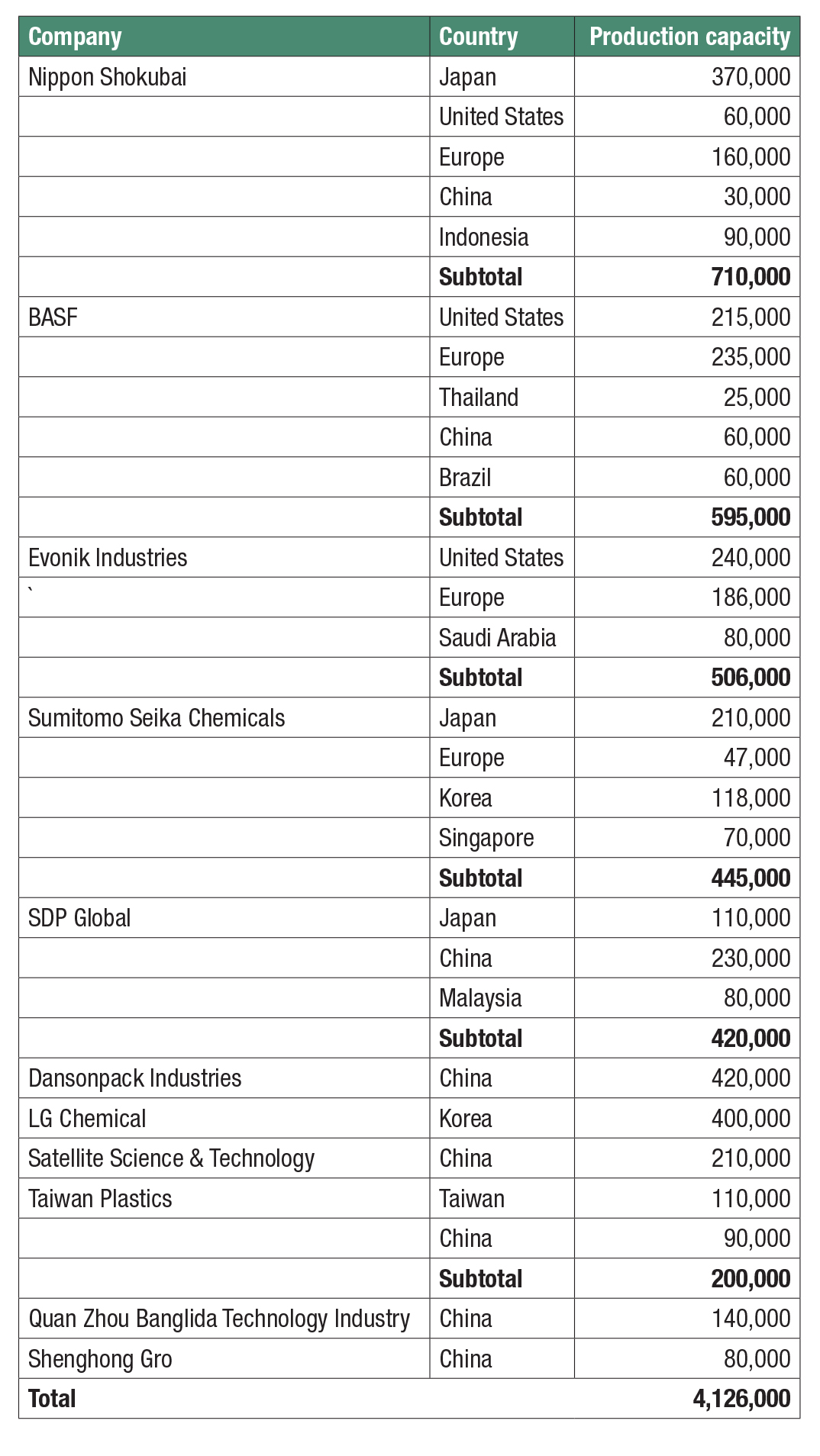

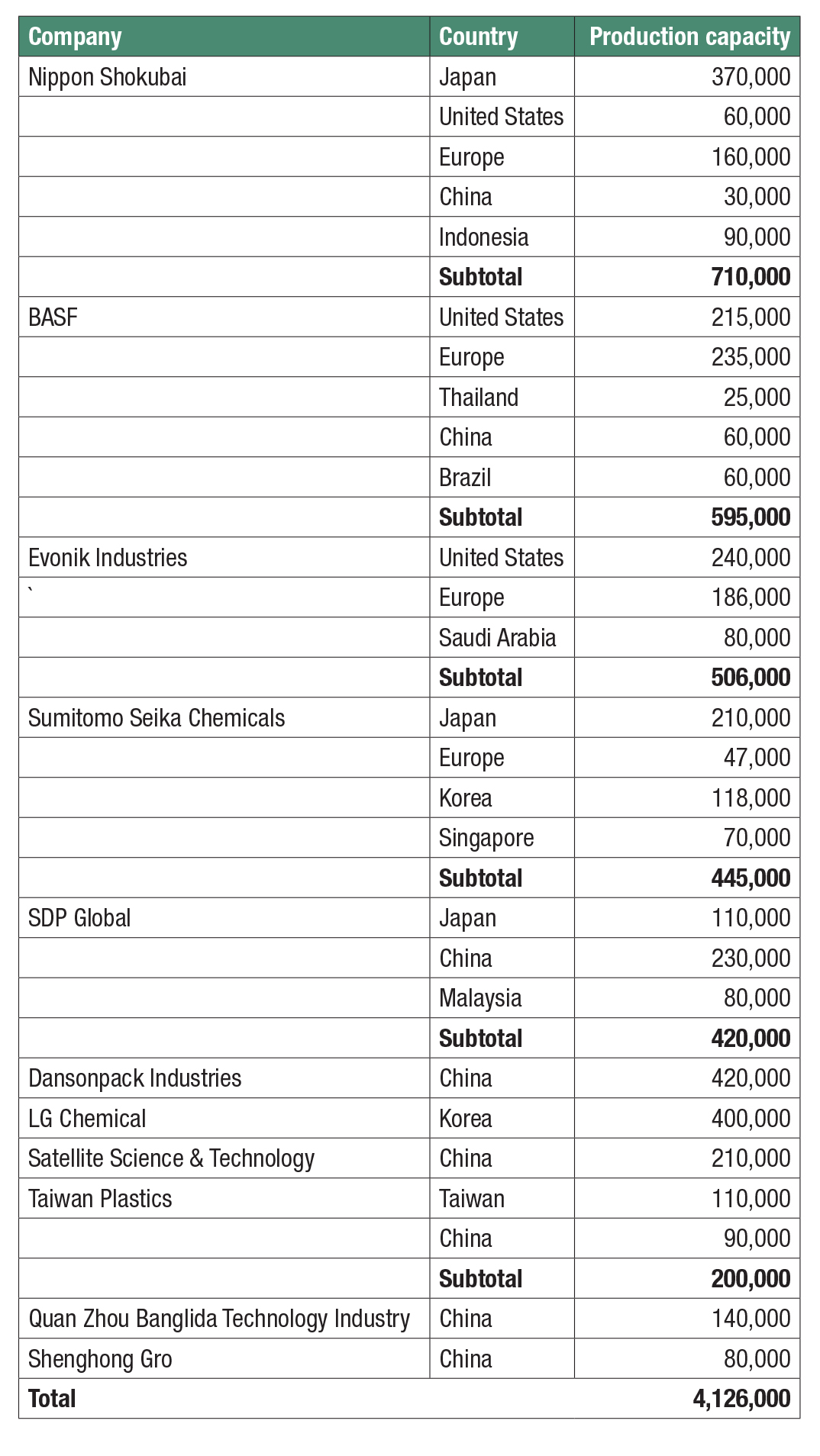

Table 1 shows the production capacities of major superabsorbency polymer (SAP) makers in the world. The total production capacity (in October 2020) of the 11 companies represented in the table is 4,126,000 tons/year. The quantity of world SAP demand was estimated to be around three million tons in 2019, and this figure represented an overcapacity situation. The main factor of the capacity surplus is the expansion of facilities in China. SAP production capacity in China is at least 1,260,000 tons/year at present.

Under these circumstances, production capacity in China was superabundant, on the other hand, the use of the materials was low. This led to price competition among manufacturers. Each of the SAP makers in China have strengthened their exports as a countermeasure. The export ratio has risen to 70% at Dansonpack Industries and Satellite Science & Technology has increased exports to 40%. Other SAP makers have accomplished 15-30% of export ratios, consequently, these have caused price competition in the global market.

Within this situation Nippon Shokubai, a top producer, planned a merger with Sanyo Chemical Industries, the parent company of SDP Global, which intensified the price competition in the global market. To aim to strengthen the competitiveness of the global market, it was necessary to increase the business scale by unifying the SAP businesses of both companies. Although, the merger had not yet been finalized because of the worsened economic environment due to the spread infection of the new coronavirus, the project of integration will be reexamined again because the relationship of mutual trust of both companies has not failed.

Production capacity of the major SAP makers, such as Nippon Shokubai, BASF AG, Evonik Industries, Sumitomo Seika Chemicals and SDP Global, did not change significantly between 2019 and 2020 and there are no expansions planned. However, it is certain that world SAP demand should increase in the future, and the companies would reinforce their facilities. Chinese SAP makers might build more facilities, which could worsen price competition. On that account, major makers would push forward to develop high added value of the SAP and develop the products with high function, intending to discriminate against the products of general purpose articles. As the baby diapers are divided into high-quality articles and more standard products, the SAP would be necessary to be classified into the different performances corresponding to the usage.

Table 1. Production Capacity of the major SAP makers

Note: The production capacity of the table shows the figures in October 2020

Under these circumstances, production capacity in China was superabundant, on the other hand, the use of the materials was low. This led to price competition among manufacturers. Each of the SAP makers in China have strengthened their exports as a countermeasure. The export ratio has risen to 70% at Dansonpack Industries and Satellite Science & Technology has increased exports to 40%. Other SAP makers have accomplished 15-30% of export ratios, consequently, these have caused price competition in the global market.

Within this situation Nippon Shokubai, a top producer, planned a merger with Sanyo Chemical Industries, the parent company of SDP Global, which intensified the price competition in the global market. To aim to strengthen the competitiveness of the global market, it was necessary to increase the business scale by unifying the SAP businesses of both companies. Although, the merger had not yet been finalized because of the worsened economic environment due to the spread infection of the new coronavirus, the project of integration will be reexamined again because the relationship of mutual trust of both companies has not failed.

Production capacity of the major SAP makers, such as Nippon Shokubai, BASF AG, Evonik Industries, Sumitomo Seika Chemicals and SDP Global, did not change significantly between 2019 and 2020 and there are no expansions planned. However, it is certain that world SAP demand should increase in the future, and the companies would reinforce their facilities. Chinese SAP makers might build more facilities, which could worsen price competition. On that account, major makers would push forward to develop high added value of the SAP and develop the products with high function, intending to discriminate against the products of general purpose articles. As the baby diapers are divided into high-quality articles and more standard products, the SAP would be necessary to be classified into the different performances corresponding to the usage.

Table 1. Production Capacity of the major SAP makers

Note: The production capacity of the table shows the figures in October 2020