Tara Olivo, Associate Editor12.11.20

Consumer interest in electronic vehicles continues to grow. In a 2019 survey of U.S. consumers, the nonprofit consumer advocacy group Consumer Reports found that Americans overwhelmingly want to see more electric cars available to buy and believe that electric vehicles (EVs) have real benefits, such as a reduction in oil use, a reduction in pollution and financial savings on fuel and maintenance. According to the survey, 72% of respondents said automakers should provide more kinds of electric vehicles, including SUVs, pickup trucks and minivans.

Automakers are heeding the call. While Telsa has dominated the market for EVs, General Motors, maker of the GMC, Cadillac and Chevrolet brands, is playing catch up. Last month, the company’s chairman and CEO Mary Barra revealed that it would offer 30 all-electric models globally by 2025. Forty percent of the company’s U.S. entries will be battery electric vehicles by the end of 2025. Barra also announced an increase in GM’s financial commitment to EVs and autonomous vehicles (AVs) to $27 billion through 2025 – up from the $20 billion planned before the onset of the Covid-19 pandemic.

“Climate change is real, and we want to be part of the solution by putting everyone in an electric vehicle,” Barra said at the time of the announcement. “We are transitioning to an all-electric portfolio from a position of strength and we’re focused on growth. We can accelerate our EV plans because we are rapidly building a competitive advantage in batteries, software, vehicle integration, manufacturing and customer experience.”

More EVs means more opportunities for nonwovens suppliers. Autonomous, hybrid and completely electronic vehicles need some new or different solutions than combustion engines, and nonwovens producers and converters have been developing products that make these vehicles more efficient, more comfortable, less noisy and more sustainable.

“As the design of electric and autonomous cars progress and performance expectations escalate, the differences in the behavioral characteristics of the vehicle will drive the necessity to deliver solutions which were previously not required,” says Clive Hitchcock, the newly appointed CCO, Automotive & Wipes, of Fibertex Nonwovens. “Nonwoven components, given their versatility in technical design and construction, are already providing the necessary answers to these challenges.”

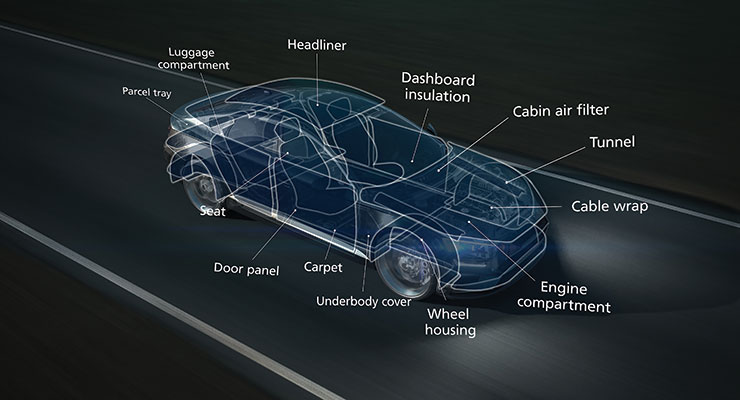

Fibertex Nonwovens has a long-standing and strong position in the automotive market, with a diverse range of products covering all aspects of automotive manufacture. The company’s nonwovens are used in the manufacture of cars for various purposes: To reduce the weight of the car, to improve comfort and enhance aesthetics and for general insulation and fire retardancy. Fibertex products improve the experience and comfort for the driver and passengers through advanced acoustics solutions—including a new generation of acoustic materials that deliver high acoustic performance at even lower weight—and high efficient filter media.

In fact, Fibertex anticipates that there will be more filters in electric vehicles, particularly relating to cabin air quality. “We believe that filtration technologies in automotives will evolve towards mechanical filtration products, using nanofiber technology, as this ensures that there is no efficiency loss during the lifetime of the filter, which normally results from electrical discharge caused by pollution and humidity, as is the case with electrostatically charged filters,” Hitchcock says.

In electric cars the noise level is different to that of cars with combustion engines, according to Gerhard Klier, sales director Technical Products, Sandler. Meanwhile, autonomous vehicles feature a different interior layout and therefore new components. “For these applications new materials are needed and this creates opportunities for growth,” he says.

The German nonwovens producer believes innovations in this sector should also be sustainable, supporting the “green” or “blue” philosophy of these cars, and they need to be lightweight as well. “Nonwovens, particularly single-polymer materials, address these demands,” Klier says. “Their adaptability makes them the ideal basis for innovation, being adjustable to new component geometries as well as new requirements regarding sound absorption. Nonwovens with new functions and additional features will open doors to other applications, like designing hygienic surfaces in autonomous vehicles e.g. used in public metropolitan areas.”

Nonwovens already fulfill many requirements of EVs and autonomous vehicles, he explains, since they generally are comparatively lightweight materials, supporting the weight reduction efforts of OEMs (Original Equipment Manufacturers). And, their open-pore structure makes them excellent sound and heat insulators.

Sandler’s materials are developed further, or newly developed, in close cooperation with customers and OEMs, adapting them to the specific requirements of the respective application. “Cooperation along the supply chain, however, has always been a driver for growth, not just with regards to new mobility concepts. And of course filter media, based on nonwoven technologies offer additional potential for growth. They open possibilities for cleaner air in the passenger compartment,” he adds.

Dr. Frank Heislitz, CEO of Freudenberg Performance Materials, points out a number of reasons why the designs of EVs and AVs are driving growth for nonwoven components in vehicles: with OEM’s lightweight designs, nonwovens are replacing more and more other materials such as thermoplastics, thermoset, glass fiber and PUR. These types of vehicles also have different acoustic requirements. “The noise level in e-cars is lower as there is no combustion engine that drowns out driving/wind noise,” he explains.

Also, the attractive design of facing materials/decorative nonwoven textiles will be more important, he adds, “especially in autonomous cars as these will become kind of second living-room or office.”

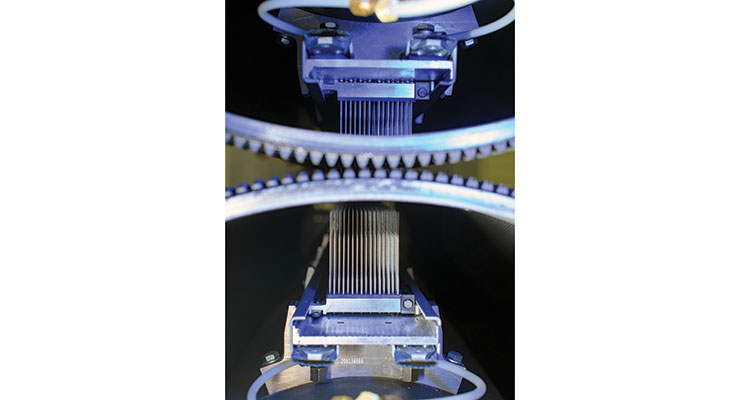

New mobility also offers new application areas around battery and fuel cell, e.g. gas diffusion layers. Freudenberg is one of the first companies worldwide to manufacture gas diffusion layers (GDL) completely in-house with its own production facilities. GDL are an essential component of fuel cells. They ensure that the hydrogen fuel is converted into power as efficiently as possible.

“Freudenberg’s gas diffusion layers help to improve the efficiency of fuel cells,” Dr. Heislitz says. “Their high uniformity in structure and thickness increases electrical and thermal conductivity and improves the transport of gases and liquids in the fuel cell. Further strengths of Freudenberg’s gas diffusion layers compared with other products are superior downstream processing and exceptional surface properties.”

Covid Conundrums

In March, major automakers including General Motors and Ford Motor decided to halt production of vehicles, as plant workers feared infection of the novel coronavirus and fewer consumers were shopping for vehicles at the time. As a result, nonwovens producers and component manufacturers ramped down production for the market. Then, when auto production gradually began to resume in May, demand for nonwovens used in vehicles, while certainly not as high as pre-Covid levels, started to return.

The global market for nonwovens in automotive manufacture will be worth $2.84 billion in 2020, and consume 652,900 tons according to recent data from the Smithers study, The Future of Nonwovens for Industrial Applications to 2025. Use is split between five major applications: fabrics, filtration, flooring, headliners and insulation.

The value in 2020 represents a fall compared to 2019. Smithers reports that this has been caused by disruption to the global auto manufacturing industry caused by Covid-19, and a slump in new car sales. Smithers latest forecast is for the automotive nonwovens segment to return to growth in 2021 and see a compound annual growth rate (CAGR) of 4.4%, by value, to reach $3.54 billion in 2025.

“The pandemic, most notably the general shutdown in spring, had a number of repercussions on all sectors of the industry,” says Sandler’s Klier. “Manufacturers lost sales and this effect was passed down the supply chain. Sandler has also seen orders decline in some segments, among them the automotive industry. In several sectors, companies had to reduce their employees’ working hours or even lay off part of their staff. With people losing their income, consumption is bound to decline and therefore, there will probably be long-term effects on demand in general. As far as the automotives industry is concerned, the market has started to rebound, but there is a long way still to go and competition is high.”

Like in other industries, major developments that were going on before the Covid-19 pandemic will now become even more important and will be accelerated, according to Freudenberg’s Dr. Heislitz. “In the long run, the importance of cars may increase since it they are most often seen as safest mode of transport,” he says. “However, this does not necessarily imply that the importance on owning a car will rise accordingly.”

For e-mobility, autonomous driving and shared mobility, OEMs facing financial difficulties will have to prioritize their investments and other resources and will focus even more and faster on future technologies, he explains. “Strategic partnerships will be important since OEMs and automotive suppliers do not have all resources in-house themselves.”

This will provide opportunities for nonwovens applications in the car due to light-weight, recyclability and design requirements. Nonwovens manufacturers with unique technologies and innovative capabilities will also likely be preferred development partners, he adds.

Hitchcock, of Fibertex Nonwovens, says in Europe, especially in France and the Czech Republic, the coronavirus situation affected operations. However, they are seeing a recovery in the automotive industry and the European automotive industry is expected gradually to increase volumes, although at a somewhat lower operational level than anticipated at the start of the year.

For BMP, a converter that focuses on automatic transmission fluid filtration products and the development of next generation air filtration products, Covid-19 has presented the company with unique challenges in terms of its No. 1 priority; keeping employees safe, while meeting the ongoing needs of its customers. “BMP has been successful in meeting both objectives given our global footprint and actions where BMP employed multiple BMP production plants during Covid-19 based upon developing requirements,” says Peter J. Rodrigue, global automotive market manager, BMP.

The short term effects of the pandemic, he says, have been managing a global supply chain and customer marketplace that early in Covid-19 implemented immediate reductions in demand for products, then followed by urgent increases in demand within a couple of months’ time frame. Additionally, various U.S. states and countries around the world mandated a range of human resource and capacity constraints targeted at reducing the spread of Covid-19. “The automotive market does appear to be rebounding now and we are optimistic that the gains will continue steadily into 2021,” he adds.

Detlev Käppel, director, sales department of nonwovens producer Tenowo, describes the automotive industry shutdown at the end of the first quarter of the year as unprecedented. “As a market leader to this industry, we had to face a heavy impact for sales and output,” he explains. “After three month of doldrums, the industry came back step by step. We expect the remaining month to be quite strong, similar to before the crisis begun. However the global supply chain still can be bumpy in some way.”

Tenowo managed to use its market experience and technology range to fill the capacity gap with new products to fight the Covid-19 pandemic. The company developed resistant gowns at Tenowo U.S., face masks and other medical materials at its plants in Germany and China, and at its latest acquisition Resintex in Italy. “Actually, we can say Covid-19 also pushed us to alter our perception for other market segments to push,” Käppel says. “In a nutshell, the mid- and long-term effects remain to be seen. After the Covid-19 period we will be back to CO2 and the climate crisis.”

In China, Tenowo’s automotive business picked up earlier this year and Tenowo Huzhou is almost working to capacity 24/7. “Our global presence really gave us the edge over some other competitors as we can supply and serve our customers globally and independently from our plants in Europe, Asia and USA,” he adds.

The pandemic clearly impacted nonwoven supply chains in the medical market, with the onshoring of medical material and personal protective equipment production but will the impact of the virus cause the diversification of supply chains in the automotive market as well?

Klier says we are already facing diversification. “Due to the general development of nonwovens in the last decade this industry is well prepared to act sustainably and innovatively at the same time,” he says. “The nonwovens industry is one of the most flexible industries in all markets. China is an important market for all, producers and consumers as well, but there are other markets with high potential for nonwovens producers outside of China.”

From his point of view, Hitchcock of Fibertex says the pandemic has certainly flagged the importance of resilience in the supply chain, which may lead to diversification and opportunities for suppliers closer to the point of final manufacture. “Supply chains with longer lead times and transit routes may present as a risk to agility and flexibility in these uncertain times,” he adds.

Ray Piascik, director of sales and marketing, Beckmann Converting, says that numerous companies are exploring “onshoring” and localization of raw material and services sourcing as part of their go-forward strategies. “Cost structures certainly will change. To the degree that players in the automotive industry can differentiate their product offerings and require more specialized materials and services, opportunities for suppliers outside of China should increase.”

BMP believes a longer-term effect of the pandemic will prompt companies in the supply chain to analyze regional supplier options more closely when possible as well as multiple sources for similar products. “We think one result of these changing dynamics will benefit companies with a global footprint and or those companies willing to establish satellite supply locations to be near to key customers,” Rodrigue says. “Suppliers outside of China should be in a good position to develop new business opportunities that may have otherwise been more difficult to cultivate due to a regional supplier model shift.”

Sustainability Story

There are number of ways in which nonwovens can help OEMs reach various sustainability goals. For one, parts can be made from recycled fibers or be recycled themselves. Nonwovens producers and converters are also investing in sustainable production processes. Further, by being lightweight, nonwovens reduce the overall weight of the vehicle, which decreases fuel consumption and consequently cuts CO2 emissions.

“Sustainability is one of the main drivers for the strong growth of the automotive market,” says Dr. Heislitz of Freudenberg Performance Materials. “Particularly important are recyclable, low VOC/FOG or VOC/FOG free and lightweight solutions. Nonwovens are excellently suited for solutions in these areas and offer a high performance at the same time.”

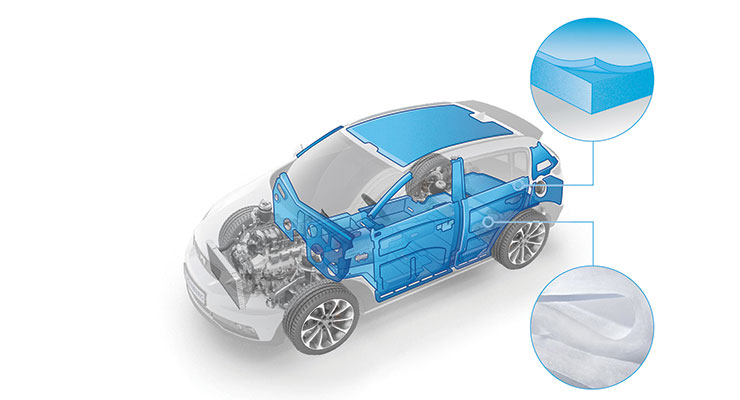

Freudenberg nonwovens for the automotive industry have a good share of recycled raw materials. For instance, Freudenberg’s spunlaid nonwovens based on Lutradur technology for automotive carpets, insert mats and interior and trunk linings contain up to 90% of recycled polyester. Also, its unique multi-layer composite for molded underbody panels and wheel liners are 100% recyclable and can be utilized in closed loop systems.

Freudenberg’s nonwovens for the automotive industry are also lighter than conventional materials, helping save fuel and reduce CO2 emission. These nonwovens based on Lutraflor technology are used for automotive carpets, insert mats and interior and trunk linings. Compared to conventional automotive carpets, these nonwovens provide weight savings of up to 40%.

Other products that provide weight reduction potential include Freudenberg’s multi-layer composite for molded underbody panels and wheel liners, its Evolon microfilament textiles, automotive acoustic pads, as well as its headliner facing materials that are also used for trunk liners and seat backs.

Due to their versatility, nonwovens open the door to new applications and replace other materials, and—what is important—in most of the cases they do so in a sustainable way, according to Sandler’s Klier. “Nonwovens can combine different properties, e.g. a good sound absorber can be a good thermal insulator as well,” he continues. “Nonwovens can be produced from up to 100% recycled raw materials and without any chemical agents. There are numerous possibilities. Nonwovens can be multifunctional, like flat sheets as e.g. sound absorbing pads, but also as two-dimensional die cut part or as a 3-D molded part combining different properties in one product.”

Sandler’s nonwovens are mainly made from polyester fibers. Polyester is an easy-to-handle, versatile raw material, so designers can “play” with material and ideas. “Being lightweight, high-performance materials, nonwovens contribute to reducing the total weight of a car, thus helping to lower fuel consumption and reduce CO2 emissions,” Klier explains. “In line with our philosophy ‘Less is Best to Nature,’ we focus on reducing component weight while still offering high functionality.”

Additionally, the larger part of Sandler’s nonwovens for the automotive industry are single-polymer materials, made of 100% polyester. These materials are fully recyclable after use. Where it’s possible, Sandler partly use recycled fibers, for example made from PET drinking bottles, in manufacturing these nonwovens. Further, nonwoven edge trims from its production are sent directly for reprocessing and are reused in production, supporting closed material cycles. Edge trims which cannot be directly reused, are being collected and later used as post production raw materials and added to fiber blends as well.

Apart from the utilized raw materials, Sandler’s nonwovens also support environmental protection during use. “Absorbers for application in engine covers, for example, not only dampen engine noise, they also function as heat insulators and slow the cooling-off of the engine,” Klier says. “Thereby, cold starts are prevented, and fuel consumption is reduced. And last but not least, the reduction of noise is also working the other way around: The noise generated by vehicles is also dampened and so they are contributing to lowering unhealthy sound levels, not only to passengers inside but for pedestrians outside the vehicle as well.”

Nonwovens, due to their nature and composition, always offer a chance to substitute other products or develop cost effective solutions for existing problems, according to Käppel of Tenowo. “Weight and cost savings, acoustic performance, environmental friendly and sustainability are attributes for which nonwovens stand for,” he says.

Tenowo has developed and supplied products that have complied with required standards for many years. The nonwovens producer uses recycled fibers made out of bottle flakes and developed foam replacement Multiknit stitchbonded nonwovens for car seats that are widely established at many OEMs nowadays. “Internally we committed ourselves to emission reduced manufacturing processes and started our R&D product development procedures through a newly data based system for pre-selection for the use of environmental friendly raw materials including chemicals,” he adds.

The nonwovens converter BMP agrees that fibers and nonwovens production processing technologies are helping to achieve sustainability goals. “Automotive systems continue to require tightening tolerances and specifications, pushing filter manufacturers to design and develop materials that have increasing filtration efficiency, and decreasing pressure drop—all resulting in higher performing systems and leading to improved sustainability,” Rodrigue says.

For its part, Beckmann Converting delivers important value to automotive and other original product manufacturers and textile suppliers through volume production contracts and new product development services in the toll laminating space for multiple layer textile composites. The company specializes in ultrasonic laminating processes, utilizing proprietary equipment and technologies that provide unique competitive advantages in meeting demanding customer requirements. Ultrasonic laminating lines can process raw materials up to 126” wide with finished product incorporating from two layers up to seven layers combining nonwovens, films, knits, wovens and meshes.

“By eliminating the use of adhesive materials, ultrasonic bonding is truly a ‘green’ process that aligns with sustainability goals in the automotive industry,” says Piascik. “It allows the individual layers to retain their unique properties including strength, loft, breathability, filtration and chemical resistance while optimizing composite performance.”

Beckmann Converting recently developed certain novel capabilities in ultrasonic bonding of textiles that could open pathways to new solutions in the automotive industry.

Automakers are heeding the call. While Telsa has dominated the market for EVs, General Motors, maker of the GMC, Cadillac and Chevrolet brands, is playing catch up. Last month, the company’s chairman and CEO Mary Barra revealed that it would offer 30 all-electric models globally by 2025. Forty percent of the company’s U.S. entries will be battery electric vehicles by the end of 2025. Barra also announced an increase in GM’s financial commitment to EVs and autonomous vehicles (AVs) to $27 billion through 2025 – up from the $20 billion planned before the onset of the Covid-19 pandemic.

“Climate change is real, and we want to be part of the solution by putting everyone in an electric vehicle,” Barra said at the time of the announcement. “We are transitioning to an all-electric portfolio from a position of strength and we’re focused on growth. We can accelerate our EV plans because we are rapidly building a competitive advantage in batteries, software, vehicle integration, manufacturing and customer experience.”

More EVs means more opportunities for nonwovens suppliers. Autonomous, hybrid and completely electronic vehicles need some new or different solutions than combustion engines, and nonwovens producers and converters have been developing products that make these vehicles more efficient, more comfortable, less noisy and more sustainable.

“As the design of electric and autonomous cars progress and performance expectations escalate, the differences in the behavioral characteristics of the vehicle will drive the necessity to deliver solutions which were previously not required,” says Clive Hitchcock, the newly appointed CCO, Automotive & Wipes, of Fibertex Nonwovens. “Nonwoven components, given their versatility in technical design and construction, are already providing the necessary answers to these challenges.”

Fibertex Nonwovens has a long-standing and strong position in the automotive market, with a diverse range of products covering all aspects of automotive manufacture. The company’s nonwovens are used in the manufacture of cars for various purposes: To reduce the weight of the car, to improve comfort and enhance aesthetics and for general insulation and fire retardancy. Fibertex products improve the experience and comfort for the driver and passengers through advanced acoustics solutions—including a new generation of acoustic materials that deliver high acoustic performance at even lower weight—and high efficient filter media.

In fact, Fibertex anticipates that there will be more filters in electric vehicles, particularly relating to cabin air quality. “We believe that filtration technologies in automotives will evolve towards mechanical filtration products, using nanofiber technology, as this ensures that there is no efficiency loss during the lifetime of the filter, which normally results from electrical discharge caused by pollution and humidity, as is the case with electrostatically charged filters,” Hitchcock says.

In electric cars the noise level is different to that of cars with combustion engines, according to Gerhard Klier, sales director Technical Products, Sandler. Meanwhile, autonomous vehicles feature a different interior layout and therefore new components. “For these applications new materials are needed and this creates opportunities for growth,” he says.

The German nonwovens producer believes innovations in this sector should also be sustainable, supporting the “green” or “blue” philosophy of these cars, and they need to be lightweight as well. “Nonwovens, particularly single-polymer materials, address these demands,” Klier says. “Their adaptability makes them the ideal basis for innovation, being adjustable to new component geometries as well as new requirements regarding sound absorption. Nonwovens with new functions and additional features will open doors to other applications, like designing hygienic surfaces in autonomous vehicles e.g. used in public metropolitan areas.”

Nonwovens already fulfill many requirements of EVs and autonomous vehicles, he explains, since they generally are comparatively lightweight materials, supporting the weight reduction efforts of OEMs (Original Equipment Manufacturers). And, their open-pore structure makes them excellent sound and heat insulators.

Sandler’s materials are developed further, or newly developed, in close cooperation with customers and OEMs, adapting them to the specific requirements of the respective application. “Cooperation along the supply chain, however, has always been a driver for growth, not just with regards to new mobility concepts. And of course filter media, based on nonwoven technologies offer additional potential for growth. They open possibilities for cleaner air in the passenger compartment,” he adds.

Dr. Frank Heislitz, CEO of Freudenberg Performance Materials, points out a number of reasons why the designs of EVs and AVs are driving growth for nonwoven components in vehicles: with OEM’s lightweight designs, nonwovens are replacing more and more other materials such as thermoplastics, thermoset, glass fiber and PUR. These types of vehicles also have different acoustic requirements. “The noise level in e-cars is lower as there is no combustion engine that drowns out driving/wind noise,” he explains.

Also, the attractive design of facing materials/decorative nonwoven textiles will be more important, he adds, “especially in autonomous cars as these will become kind of second living-room or office.”

New mobility also offers new application areas around battery and fuel cell, e.g. gas diffusion layers. Freudenberg is one of the first companies worldwide to manufacture gas diffusion layers (GDL) completely in-house with its own production facilities. GDL are an essential component of fuel cells. They ensure that the hydrogen fuel is converted into power as efficiently as possible.

“Freudenberg’s gas diffusion layers help to improve the efficiency of fuel cells,” Dr. Heislitz says. “Their high uniformity in structure and thickness increases electrical and thermal conductivity and improves the transport of gases and liquids in the fuel cell. Further strengths of Freudenberg’s gas diffusion layers compared with other products are superior downstream processing and exceptional surface properties.”

Covid Conundrums

In March, major automakers including General Motors and Ford Motor decided to halt production of vehicles, as plant workers feared infection of the novel coronavirus and fewer consumers were shopping for vehicles at the time. As a result, nonwovens producers and component manufacturers ramped down production for the market. Then, when auto production gradually began to resume in May, demand for nonwovens used in vehicles, while certainly not as high as pre-Covid levels, started to return.

The global market for nonwovens in automotive manufacture will be worth $2.84 billion in 2020, and consume 652,900 tons according to recent data from the Smithers study, The Future of Nonwovens for Industrial Applications to 2025. Use is split between five major applications: fabrics, filtration, flooring, headliners and insulation.

The value in 2020 represents a fall compared to 2019. Smithers reports that this has been caused by disruption to the global auto manufacturing industry caused by Covid-19, and a slump in new car sales. Smithers latest forecast is for the automotive nonwovens segment to return to growth in 2021 and see a compound annual growth rate (CAGR) of 4.4%, by value, to reach $3.54 billion in 2025.

“The pandemic, most notably the general shutdown in spring, had a number of repercussions on all sectors of the industry,” says Sandler’s Klier. “Manufacturers lost sales and this effect was passed down the supply chain. Sandler has also seen orders decline in some segments, among them the automotive industry. In several sectors, companies had to reduce their employees’ working hours or even lay off part of their staff. With people losing their income, consumption is bound to decline and therefore, there will probably be long-term effects on demand in general. As far as the automotives industry is concerned, the market has started to rebound, but there is a long way still to go and competition is high.”

Like in other industries, major developments that were going on before the Covid-19 pandemic will now become even more important and will be accelerated, according to Freudenberg’s Dr. Heislitz. “In the long run, the importance of cars may increase since it they are most often seen as safest mode of transport,” he says. “However, this does not necessarily imply that the importance on owning a car will rise accordingly.”

For e-mobility, autonomous driving and shared mobility, OEMs facing financial difficulties will have to prioritize their investments and other resources and will focus even more and faster on future technologies, he explains. “Strategic partnerships will be important since OEMs and automotive suppliers do not have all resources in-house themselves.”

This will provide opportunities for nonwovens applications in the car due to light-weight, recyclability and design requirements. Nonwovens manufacturers with unique technologies and innovative capabilities will also likely be preferred development partners, he adds.

Hitchcock, of Fibertex Nonwovens, says in Europe, especially in France and the Czech Republic, the coronavirus situation affected operations. However, they are seeing a recovery in the automotive industry and the European automotive industry is expected gradually to increase volumes, although at a somewhat lower operational level than anticipated at the start of the year.

For BMP, a converter that focuses on automatic transmission fluid filtration products and the development of next generation air filtration products, Covid-19 has presented the company with unique challenges in terms of its No. 1 priority; keeping employees safe, while meeting the ongoing needs of its customers. “BMP has been successful in meeting both objectives given our global footprint and actions where BMP employed multiple BMP production plants during Covid-19 based upon developing requirements,” says Peter J. Rodrigue, global automotive market manager, BMP.

The short term effects of the pandemic, he says, have been managing a global supply chain and customer marketplace that early in Covid-19 implemented immediate reductions in demand for products, then followed by urgent increases in demand within a couple of months’ time frame. Additionally, various U.S. states and countries around the world mandated a range of human resource and capacity constraints targeted at reducing the spread of Covid-19. “The automotive market does appear to be rebounding now and we are optimistic that the gains will continue steadily into 2021,” he adds.

Detlev Käppel, director, sales department of nonwovens producer Tenowo, describes the automotive industry shutdown at the end of the first quarter of the year as unprecedented. “As a market leader to this industry, we had to face a heavy impact for sales and output,” he explains. “After three month of doldrums, the industry came back step by step. We expect the remaining month to be quite strong, similar to before the crisis begun. However the global supply chain still can be bumpy in some way.”

Tenowo managed to use its market experience and technology range to fill the capacity gap with new products to fight the Covid-19 pandemic. The company developed resistant gowns at Tenowo U.S., face masks and other medical materials at its plants in Germany and China, and at its latest acquisition Resintex in Italy. “Actually, we can say Covid-19 also pushed us to alter our perception for other market segments to push,” Käppel says. “In a nutshell, the mid- and long-term effects remain to be seen. After the Covid-19 period we will be back to CO2 and the climate crisis.”

In China, Tenowo’s automotive business picked up earlier this year and Tenowo Huzhou is almost working to capacity 24/7. “Our global presence really gave us the edge over some other competitors as we can supply and serve our customers globally and independently from our plants in Europe, Asia and USA,” he adds.

The pandemic clearly impacted nonwoven supply chains in the medical market, with the onshoring of medical material and personal protective equipment production but will the impact of the virus cause the diversification of supply chains in the automotive market as well?

Klier says we are already facing diversification. “Due to the general development of nonwovens in the last decade this industry is well prepared to act sustainably and innovatively at the same time,” he says. “The nonwovens industry is one of the most flexible industries in all markets. China is an important market for all, producers and consumers as well, but there are other markets with high potential for nonwovens producers outside of China.”

From his point of view, Hitchcock of Fibertex says the pandemic has certainly flagged the importance of resilience in the supply chain, which may lead to diversification and opportunities for suppliers closer to the point of final manufacture. “Supply chains with longer lead times and transit routes may present as a risk to agility and flexibility in these uncertain times,” he adds.

Ray Piascik, director of sales and marketing, Beckmann Converting, says that numerous companies are exploring “onshoring” and localization of raw material and services sourcing as part of their go-forward strategies. “Cost structures certainly will change. To the degree that players in the automotive industry can differentiate their product offerings and require more specialized materials and services, opportunities for suppliers outside of China should increase.”

BMP believes a longer-term effect of the pandemic will prompt companies in the supply chain to analyze regional supplier options more closely when possible as well as multiple sources for similar products. “We think one result of these changing dynamics will benefit companies with a global footprint and or those companies willing to establish satellite supply locations to be near to key customers,” Rodrigue says. “Suppliers outside of China should be in a good position to develop new business opportunities that may have otherwise been more difficult to cultivate due to a regional supplier model shift.”

Sustainability Story

There are number of ways in which nonwovens can help OEMs reach various sustainability goals. For one, parts can be made from recycled fibers or be recycled themselves. Nonwovens producers and converters are also investing in sustainable production processes. Further, by being lightweight, nonwovens reduce the overall weight of the vehicle, which decreases fuel consumption and consequently cuts CO2 emissions.

“Sustainability is one of the main drivers for the strong growth of the automotive market,” says Dr. Heislitz of Freudenberg Performance Materials. “Particularly important are recyclable, low VOC/FOG or VOC/FOG free and lightweight solutions. Nonwovens are excellently suited for solutions in these areas and offer a high performance at the same time.”

Freudenberg nonwovens for the automotive industry have a good share of recycled raw materials. For instance, Freudenberg’s spunlaid nonwovens based on Lutradur technology for automotive carpets, insert mats and interior and trunk linings contain up to 90% of recycled polyester. Also, its unique multi-layer composite for molded underbody panels and wheel liners are 100% recyclable and can be utilized in closed loop systems.

Freudenberg’s nonwovens for the automotive industry are also lighter than conventional materials, helping save fuel and reduce CO2 emission. These nonwovens based on Lutraflor technology are used for automotive carpets, insert mats and interior and trunk linings. Compared to conventional automotive carpets, these nonwovens provide weight savings of up to 40%.

Other products that provide weight reduction potential include Freudenberg’s multi-layer composite for molded underbody panels and wheel liners, its Evolon microfilament textiles, automotive acoustic pads, as well as its headliner facing materials that are also used for trunk liners and seat backs.

Due to their versatility, nonwovens open the door to new applications and replace other materials, and—what is important—in most of the cases they do so in a sustainable way, according to Sandler’s Klier. “Nonwovens can combine different properties, e.g. a good sound absorber can be a good thermal insulator as well,” he continues. “Nonwovens can be produced from up to 100% recycled raw materials and without any chemical agents. There are numerous possibilities. Nonwovens can be multifunctional, like flat sheets as e.g. sound absorbing pads, but also as two-dimensional die cut part or as a 3-D molded part combining different properties in one product.”

Sandler’s nonwovens are mainly made from polyester fibers. Polyester is an easy-to-handle, versatile raw material, so designers can “play” with material and ideas. “Being lightweight, high-performance materials, nonwovens contribute to reducing the total weight of a car, thus helping to lower fuel consumption and reduce CO2 emissions,” Klier explains. “In line with our philosophy ‘Less is Best to Nature,’ we focus on reducing component weight while still offering high functionality.”

Additionally, the larger part of Sandler’s nonwovens for the automotive industry are single-polymer materials, made of 100% polyester. These materials are fully recyclable after use. Where it’s possible, Sandler partly use recycled fibers, for example made from PET drinking bottles, in manufacturing these nonwovens. Further, nonwoven edge trims from its production are sent directly for reprocessing and are reused in production, supporting closed material cycles. Edge trims which cannot be directly reused, are being collected and later used as post production raw materials and added to fiber blends as well.

Apart from the utilized raw materials, Sandler’s nonwovens also support environmental protection during use. “Absorbers for application in engine covers, for example, not only dampen engine noise, they also function as heat insulators and slow the cooling-off of the engine,” Klier says. “Thereby, cold starts are prevented, and fuel consumption is reduced. And last but not least, the reduction of noise is also working the other way around: The noise generated by vehicles is also dampened and so they are contributing to lowering unhealthy sound levels, not only to passengers inside but for pedestrians outside the vehicle as well.”

Nonwovens, due to their nature and composition, always offer a chance to substitute other products or develop cost effective solutions for existing problems, according to Käppel of Tenowo. “Weight and cost savings, acoustic performance, environmental friendly and sustainability are attributes for which nonwovens stand for,” he says.

Tenowo has developed and supplied products that have complied with required standards for many years. The nonwovens producer uses recycled fibers made out of bottle flakes and developed foam replacement Multiknit stitchbonded nonwovens for car seats that are widely established at many OEMs nowadays. “Internally we committed ourselves to emission reduced manufacturing processes and started our R&D product development procedures through a newly data based system for pre-selection for the use of environmental friendly raw materials including chemicals,” he adds.

The nonwovens converter BMP agrees that fibers and nonwovens production processing technologies are helping to achieve sustainability goals. “Automotive systems continue to require tightening tolerances and specifications, pushing filter manufacturers to design and develop materials that have increasing filtration efficiency, and decreasing pressure drop—all resulting in higher performing systems and leading to improved sustainability,” Rodrigue says.

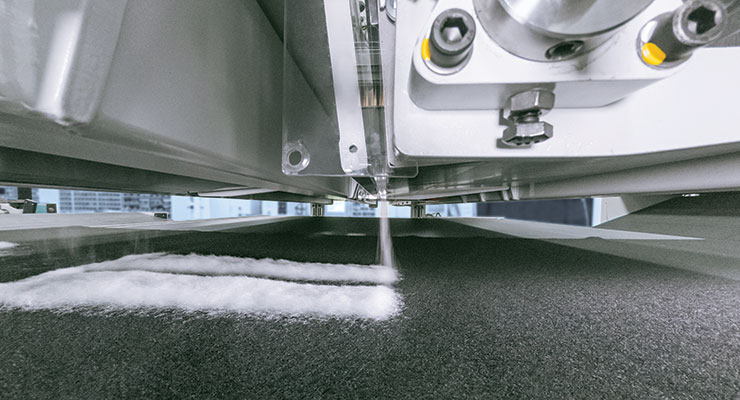

For its part, Beckmann Converting delivers important value to automotive and other original product manufacturers and textile suppliers through volume production contracts and new product development services in the toll laminating space for multiple layer textile composites. The company specializes in ultrasonic laminating processes, utilizing proprietary equipment and technologies that provide unique competitive advantages in meeting demanding customer requirements. Ultrasonic laminating lines can process raw materials up to 126” wide with finished product incorporating from two layers up to seven layers combining nonwovens, films, knits, wovens and meshes.

“By eliminating the use of adhesive materials, ultrasonic bonding is truly a ‘green’ process that aligns with sustainability goals in the automotive industry,” says Piascik. “It allows the individual layers to retain their unique properties including strength, loft, breathability, filtration and chemical resistance while optimizing composite performance.”

Beckmann Converting recently developed certain novel capabilities in ultrasonic bonding of textiles that could open pathways to new solutions in the automotive industry.