Karen McIntyre, Editor12.11.20

For much of the world, activity grinded to a screeching halt in February and March as people were forced to stay at home, restaurants and gyms closed and many types of manufacturing ceased operations. As things came to a standstill, the nonwovens industry found itself busier than ever as demand for items like face masks, medical garments and disinfectant wipes skyrocketed and new investments reached an unprecedented level. Soon news stories discussing meltblown supply were being run on the front pages of national newspapers; government officials were touring nonwovens plants and face mask manufacturing sites and people started hearing the word nonwoven.

Thanks to the Coronavirus, 2020 really became the year of nonwovens—the year that the rest of the world realized the important role nonwoven substrates play in protecting the public health. From face masks to wipes to diapers and other hygiene and medical materials, these products have and continue to make consumers lives healthier.

Unsurprisingly most of the key trends impacting the nonwovens industry in 2020 centered around the Coronavirus—meltblown investment, face mask demand, disinfectant wipes shortages—but the industry continues to be defined by new investments, new applications and acquisition, many of which will shape nonwovens into 2021 and beyond.

Covid/Industry Response

As this issue went to press, the global case count of the Covid-19 virus was reaching 63 million and deaths were more than 1.46 million. More than a year after the first reported cases, the virus was surging in many parts of the globe, impacting not just the public health but also the economy.

As the virus spread from Asia into Europe and ultimately to North and South America during the early months of 2020, many industries faced complete shutdowns as government issued stay-at-home orders. However, it was around this time that the global nonwovens industry kicked into high gear. Because many of the markets served by nonwovens—medical, healthcare, hygiene, wipes, etc.—were declared essential businesses, producers were not subject to the same restrictions as many other businesses. Furthermore, unprecedented demand for medical equipment like garments, face masks and respirators meant that many companies had to actually increase their production or pivot their operations to supply new markets.

According to Jacob Holm, the manufacturer of Sontara spunlaced fabrics, output for this material increased 65% amidst increased demand for personal protective equipment (PPE) in May. The company was able to do this by debottlenecking some existing lines and other improvements but soon announced a comprehensive global expansion plant, which will come onstream at the beginning of next year.

Like Jacob Holm, DuPont, which has supplied the medical market for years with its Tyvek flashspun nonwovens, moved quickly to increase its output as the Coronavirus drove up demand for medical materials. As the company shifted materials destined for construction markets and other applications to the medical market, DuPont announced it was adding capacity in Richmond, VA, and partnering with additional converters to get more gowns made in rapid time.

Even companies not traditionally involved in the medical and PPE markets moved swiftly to meet demand. Construction specialist Johns Manville began targeting meltblown made in Richland, MS, toward face mask applications and spunbond nonwovens made in Spartanburg, SC, toward medical applications.

“It’s really an all-hands-on-deck situation that we have managed very well so far,” says Martin Kleinebrecht, marketing and portfolio management leader nonwovens, EMEA/APAC.

Meltblown Investment

No other nonwovens technology has been impacted as much as meltblown by the Coronavirus pandemic. During 2020, nearly 40 meltblown lines have been planned in North America alone—and possibly 100 lines are being added worldwide.

In the early days of the pandemic, meltblown machinery supplier Reifenhauser announced it was able to shorten delivery time for meltblown lines to just 3.5 months, offering a quick and reliable solution for mask shortages around the globe.

“In situations like the current one, we gladly depart from customary procedures. Sticking to standards in a non-standard situation is out of place,” CEO Bernd Kunze says. “It goes without saying that we will do everything in our power to serve the needs quickly and in the accustomed high quality.”

Since then, countries around the globe have been investing in meltblown technologies, from Reicofil and other meltblown specialists. Unsurprisingly, Berry Global, the world’s largest nonwovens producer has been at the forefront of this expansion. The company was already in the midst of expanding its meltblown footprint when the first threats of the Coronavirus were felt. Since then, the company has begun work on new lines in Brazil, the U.S., China, the U.K. and Europe, and will ultimately have nine meltblown lines in operation around the world.

Like Berry, most of the world’s major nonwovens producers have added meltblown capacity this year. Lydall is in the process of adding two lines in Rochester, NH, and one in France; Fitesa is adding meltblown lines in Italy, Germany and South Carolina; Sandler is underway with an investment in Germany; Mogul is adding two meltblown lines in Turkey; Freudenberg is adding a line in Germany. Meanwhile, a number of newcomers to nonwovens have invested in new lines to help meet demand for face mask materials. These companies range from large multinational raw material suppliers to small, independent start ups, but they all have this in common—a goal to help meet demand for face mask material globally.

“With U.S. policymakers currently considering or putting in motion policies to achieve self-sufficiency in PPE base material, understanding the dynamics of supply and demand of meltblown, a critical base material for PPE, in North America and other regions is critical at this time,” says Dave Rousse, INDA president.

Other Investments

While meltblown was firm in the lead when it came to new line investment, nonwovens producers spanning all types of technologies have announced new lines this year, creating an unprecedented rate of expansion.

In spunbond news, new lines are being planned by companies including Union Industries, Fibertex Personal Care, Fitesa and Berry Global, which will add a new line in Nanhai, China, in 2022.

“We are committed to further partnering with our customers to pursue growth opportunities around the world. The added capacity achieved through this asset is a next step in advancing our market leading position in healthcare material solutions,” says Curt Begle, president of Berry’s Health, Hygiene, and Specialties Division. “This investment comes on the heels of the successful commercialization of the first of its kind R5 asset in Berry’s Nanhai, China, facility, serving the high-loft soft material needs of the premium hygiene markets throughout the Asia region.”

These new lines, which span the globe, will meet future demand for medical products as well as hygiene materials, but some experts feel that surging capacity will lead to a buyers’ market a few years down the road.

Meanwhile, in spunlace, Jacob Holm announced in June it would add 500 million square meters of capacity globally in the next few years through a project known as Project Boost. This project will affect virtually all of Jacob Holm’s manufacturing sites and, in addition to adding capacity, it will increase the company’s ability to offer its customers sustainable solutions.

Sustainability is also the theme of recent investments announced by Suominen. The company will upgrade existing lines in Italy and South Carolina, moves that the company says are in line with its strategy targeting growth and profitability.

“Investment allows us to produce new innovative, top quality products which are the result of joint product development with one of our major customers,” says Petri Helsky, president and CEO of Suominen.

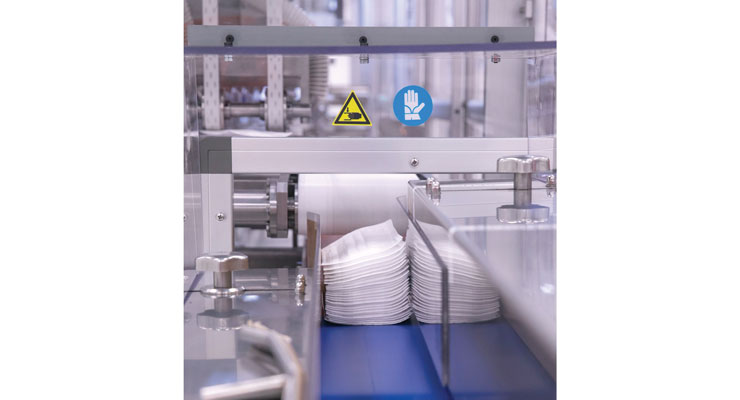

Hygiene Companies Make Face Masks

As nonwovens producers reacted quickly to ensure there is enough nonwovens capacity to meet the demands of the face mask market, companies spanning a range of consumer markets began ramping up mask production. Because of the similarities between the construction of masks and absorbent hygiene products, makers of diapers and feminine hygiene products are at the forefront of these efforts.

In April, Procter & Gamble announced it was converting manufacturing capacity to make face masks at nearly a dozen manufacturing sites globally. According to CEO David Taylor, mask production started in China and is now spreading to North America, Europe, Asia Pacific, the Middle East and Africa.

The efforts have increased the supply of masks for hospitals, first responders and other organizations by reducing market demand for production and industrial use; help create a safe working environment for P&G people, and, in the long term, it will allow the company to directly help many communities across the globe where there is unprecedented need for protective supplies.

One site where face mask production is reportedly underway is located in Mehoopany, PA, where production should began in mid-May.

“It will increase the supply of masks for hospitals, first responders and other organizations by reducing market demand for production and industrial use. It helps us create a safe working environment for P&G people, and long term, it will allow us to directly help many communities across the globe where there is unprecedented need for protective supplies,” says P&G Charmin and Family Care communications spokesman Loren Fanroy.

The effort required installation of new equipment or adjustments to existing equipment, as well as new supplies and training. The company is directing donations with established partners who have the capability and reach to help those affected by the Covid-19 outbreak, P&G communications manager Tracey Long says. The masks won’t be sold and the company won’t be able to respond to individual requests for help.

The P&G Mehoopany plant makes Charmin toilet tissue and Bounty paper towels and napkins and well as the Pampers and Luvs diaper brands.

Other sites reportedly shifting to face mask production are P&G’s facilities in Cabuyao City in the Philippines and in Roorekee, India.

In addition to P&G, Sweden’s Essity has announced plans to make masks to supply the Swedish market and South American hygiene specialist CMPC has announced it will soon be able to make 18.5 million masks per month.

CMPC has added five mask lines in four countries — Chile, Brazil, Peru and Mexico. In each country, the masks will be delivered free of charge to public health services, and only the percentage necessary for the care of company workers will be reserved. Delivery is expected to begin in Chile in early May.

In September, Ontex unveiled a production line with a capacity of approximately 80 million face masks per year at its factory in Eeklo, Belgium. The line has been making one hundred thousand masks per day since August.

“We started producing face masks to help protect essential workers in hospitals and care homes, as well as our employees,” says Xavier Lambrecht, president of Ontex’s Healthcare Division. “Thanks to automation and more than 40 years of experience in personal hygiene, we can offer hospitals and care homes certified face masks at an attractive price.”

The new face mask production line was installed in only 100 days. The production line started making face masks in August and began producing type IIR medical face masks in October. Producing masks was Ontex’s own decision and the project does not benefit from any government funding.

Wipes Growth

Nearly two decades after Nonwovens Industry declared 2001 “The Year of the Wipe,” it seems investment is stronger than ever for this nonwovens application. As demand for disinfectant wipes has surged and new applications for wipes in industrial, personal and home care continue to be introduced, investment has been strong. In 2020, two of the world’s largest converters of nonwovens—Rockline Industries and Nice-Pak—both announced significant expansions to their North American operations.

In August, Rockline said it would install a new state-of-the-art, $20 million disinfecting wipe production line in Sheboygen, WI. The investment will reportedly nearly double the company’s production capacity. The new production line, known as the XC-105 Galaxy, will be one of the largest production lines for disinfecting wipes in the private brands wet wipes industry. It is expected to be complete in mid-2021.

“The Covid-19 pandemic has created a new level of awareness among the American people about the importance of proper surface disinfection,” says Randy Rudolph, president of Rockline Industries. “We are making a huge investment in the future by installing the Galaxy line to ensure that our customers will be able to meet consumers’ increasing demand for disinfecting wipes.”

Likewise, wipes maker Nice-Pak has announced plans to double manufacturing capacity of disinfectant wipes at its Jonesboro, AR, plant. The expansion will take place in stages beginning in January and finishing in August.

Upgrades will include the extension of existing lines and the addition of a new manufacturing line. Earlier this year Nice-Pak expanded output at this plant when it moved to 24-hour-per-day, seven-days-per week production schedule.

“Our products are essential for consumers to help stay healthy and well amid the Covid-19 pandemic,” says chairman and CEO Robert Julius. “We have been working non-stop to produce more wipes than ever before, and we commend the tremendous performance of our Jonesboro associates, who have been terrific in rising to the challenge.”

These expansions came as makers of disinfectant wipes face serious supply shortages. In November, Clorox announced that it continued to be challenged with meeting demand for its disinfectant wipes, despite increasing capacity and working with third party suppliers. The company is reportedly shipping nearly one million packages of Clorox wipes to stores every day, but this is not meeting demand.

The problem is strong consumer demand for products deemed effective in the fight against Covid-19—like disinfectant wipes and sprays—has forced big-box retailers like Target Corp. and Walmart Inc. to implement policies to limit the amount of these products customers can buy per visit. To further curb stockpiling, they’ve halted online sales of the products, instead directing shoppers to purchase them in-store.

Target has seen “unprecedented demand” for cleaning supplies and says products are quickly selling out after they hit the shelves, according to an emailed statement. Similarly, Walmart is working with its supply chain department to meet demand as the company keeps a “close eye” on product availability.

Clorox CEO Linda Rendle has said that maximizing the supply of wipes and other cleaning products seeing high demand is the company’s top priority. Among the company’s strategies to boost capacity has been reducing product offerings to focus on those that can be made faster.

Ontex’s North American Expansion

One of Europe’s largest hygiene manufacturers, Ontex has been slowly increasing its global footprint in recent years and actions taken in 2020 indicate that the Belgium-based company has its eyes on North America. Earlier this year, Ontex announced that it would begin operations at a new personal hygiene manufacturing plant in Rockingham County, NC, in mid-2021—its first U.S. operation. The Belgium-based hygiene specialist has also entered into an agreement with Albaad Massuot Yitzhak to acquire its feminine hygiene production assets in Rockingham County.

“Following the previously-announced decision to invest in manufacturing in the eastern part of the country to complement shipments from abroad, we are proud to announce the forthcoming opening of Ontex’s first U.S. production site as well as the acquisition of feminine hygiene production assets,” Ontex CEO Charles Bouaziz says. “With these meaningful steps, we accelerate the execution of our strategic priority to increase our U.S. presence.”

The North Carolina location was selected because approximately half the U.S. population lives within a 1000 km/650-mile radius. The strategic location of Rockingham County, the quality of the workforce, as well as state and local incentives were compelling factors in the company’s decision to locate the new facility in Rockingham County. Ontex, which produces and sells personal hygiene products in baby care, feminine care and adult care, will become a key local employer.

Ontex first entered the North American market in 2016 when it bought Mexican diaper maker Grupo Mabe and expanded into Brazil with the acquisition of Hypermarcas in 2018.

And, it appears Ontex may be poised to expand its U.S. presence further. According to a report published in the Bloomberg financial news service in November, Ontex is considering a bid for Domtar Corp.’s personal care business. The deal could value the unit, which has operations in the U.S. and Europe, at as much as $1.1 billion, according to people with knowledge of the matter.

Domtar’s personal care unit, which is generating about $110 million in annual earnings before interest, taxes, depreciation, and amortization, is also attracting private equity interest, according to the report. The unit has grown sharply in recent years thanks largely to a slate of acquisitions which include Attends adult incontinence businesses in North America and Europe, Associate Home Products, a U.S. private label diaper maker, Labatorio Indas, a Spanish hygiene specialist and Butterfly BodyLiners a start-up in the bowel leakage space.

Hygiene Supply Consolidation

Consolidation has continued within the hygiene industry supply chain, a trend started a few years ago when Berry Plastics purchased Avintiv, creating not just the world’s largest nonwovens producer but also combining a supplier of nonwovens and films, two essential components of hygiene products. Berry even expanded its role in the films segment in 2018 when it purchased Clopay, a maker of breathable film technology.

Since this consolidation, speculation has been ripe that Berry will eventually shorten the steps in hygiene products manufacturing be creating a hybrid film/nonwoven product to simplify the chassis of the diaper. At the very least, the merger has united companies with similar customers, allowing the companies to capitalize on certain synergies.

This year, another nonwovens producer, Fitesa, also expanded its films business with the purchase of Tredegar Corporation’s Personal Care Films business, including manufacturing sites located in Terre Haute, IN; Kerkrade, The Netherlands; Rétság, Hungary; Diadema, Brazil and Pune, India. The acquisition strengthens Fitesa’s films, elastics and laminates business, which has included the Pantex business since 2017.

“We are happy to announce this investment which reinforces our commitment to innovation and growth. We are continuously looking for opportunities to improve the value we create for our customers, employees, communities and shareholders,” says Silverio Baranzano, Fitesa’s CEO.

Single-Use Plastic Ruling

The impact of the Single Use Plastics Directive, which was adopted by the European Parliament in 2018, on many nonwovens markets but particularly the wipes one, has become an area of concern in the nonwovens industry. The directive seeks to significantly reduce the amount of single use plastics (SUPs) going into European landfills by limiting the use of SUPs in certain categories and all out banning the use of certain SUPs like single use straws as the EU seeks to transition to a circular economy.

For wet wipes—as well as filtered cigarettes and feminine hygiene items—the biggest impact will be felt in labeling requirements that need to inform consumers about the appropriate disposal of the product and about the negative impacts of SUPs and littering on the environment. Additionally, EU members will be required to develop awareness programs educating consumers on reusable alternatives to products containing SUPs.

Because this legislation is targeting Europe, EDANA has been working overtime on the issue but INDA and its North American member companies are anticipating these efforts impact on North America. While federal action is unlikely, already more than 20 states have introduced 100-plus bills concerning plastics. Probably the most ambitious is the California Circular Economy and Plastic Reduction Act, which seeks to significantly reduce the use of SUPs in packaging and products by 2030. This would be achieved through source reduction, recycling and composting.

According to INDA president Dave Rousse, the North American nonwovens industry needs to make sure that federal and state legislation in the U.S. does not simply replicate European language because the two regions do not face the same issues when it comes to waste. To that point, INDA and its members have formed a Plastics Initiative working group that will tackle the issue from several standpoints including monitoring legislative issues, working with manufacturers and creating a definition of plastics.

Thanks to the Coronavirus, 2020 really became the year of nonwovens—the year that the rest of the world realized the important role nonwoven substrates play in protecting the public health. From face masks to wipes to diapers and other hygiene and medical materials, these products have and continue to make consumers lives healthier.

Unsurprisingly most of the key trends impacting the nonwovens industry in 2020 centered around the Coronavirus—meltblown investment, face mask demand, disinfectant wipes shortages—but the industry continues to be defined by new investments, new applications and acquisition, many of which will shape nonwovens into 2021 and beyond.

Covid/Industry Response

As this issue went to press, the global case count of the Covid-19 virus was reaching 63 million and deaths were more than 1.46 million. More than a year after the first reported cases, the virus was surging in many parts of the globe, impacting not just the public health but also the economy.

As the virus spread from Asia into Europe and ultimately to North and South America during the early months of 2020, many industries faced complete shutdowns as government issued stay-at-home orders. However, it was around this time that the global nonwovens industry kicked into high gear. Because many of the markets served by nonwovens—medical, healthcare, hygiene, wipes, etc.—were declared essential businesses, producers were not subject to the same restrictions as many other businesses. Furthermore, unprecedented demand for medical equipment like garments, face masks and respirators meant that many companies had to actually increase their production or pivot their operations to supply new markets.

According to Jacob Holm, the manufacturer of Sontara spunlaced fabrics, output for this material increased 65% amidst increased demand for personal protective equipment (PPE) in May. The company was able to do this by debottlenecking some existing lines and other improvements but soon announced a comprehensive global expansion plant, which will come onstream at the beginning of next year.

Like Jacob Holm, DuPont, which has supplied the medical market for years with its Tyvek flashspun nonwovens, moved quickly to increase its output as the Coronavirus drove up demand for medical materials. As the company shifted materials destined for construction markets and other applications to the medical market, DuPont announced it was adding capacity in Richmond, VA, and partnering with additional converters to get more gowns made in rapid time.

Even companies not traditionally involved in the medical and PPE markets moved swiftly to meet demand. Construction specialist Johns Manville began targeting meltblown made in Richland, MS, toward face mask applications and spunbond nonwovens made in Spartanburg, SC, toward medical applications.

“It’s really an all-hands-on-deck situation that we have managed very well so far,” says Martin Kleinebrecht, marketing and portfolio management leader nonwovens, EMEA/APAC.

Meltblown Investment

No other nonwovens technology has been impacted as much as meltblown by the Coronavirus pandemic. During 2020, nearly 40 meltblown lines have been planned in North America alone—and possibly 100 lines are being added worldwide.

In the early days of the pandemic, meltblown machinery supplier Reifenhauser announced it was able to shorten delivery time for meltblown lines to just 3.5 months, offering a quick and reliable solution for mask shortages around the globe.

“In situations like the current one, we gladly depart from customary procedures. Sticking to standards in a non-standard situation is out of place,” CEO Bernd Kunze says. “It goes without saying that we will do everything in our power to serve the needs quickly and in the accustomed high quality.”

Since then, countries around the globe have been investing in meltblown technologies, from Reicofil and other meltblown specialists. Unsurprisingly, Berry Global, the world’s largest nonwovens producer has been at the forefront of this expansion. The company was already in the midst of expanding its meltblown footprint when the first threats of the Coronavirus were felt. Since then, the company has begun work on new lines in Brazil, the U.S., China, the U.K. and Europe, and will ultimately have nine meltblown lines in operation around the world.

Like Berry, most of the world’s major nonwovens producers have added meltblown capacity this year. Lydall is in the process of adding two lines in Rochester, NH, and one in France; Fitesa is adding meltblown lines in Italy, Germany and South Carolina; Sandler is underway with an investment in Germany; Mogul is adding two meltblown lines in Turkey; Freudenberg is adding a line in Germany. Meanwhile, a number of newcomers to nonwovens have invested in new lines to help meet demand for face mask materials. These companies range from large multinational raw material suppliers to small, independent start ups, but they all have this in common—a goal to help meet demand for face mask material globally.

“With U.S. policymakers currently considering or putting in motion policies to achieve self-sufficiency in PPE base material, understanding the dynamics of supply and demand of meltblown, a critical base material for PPE, in North America and other regions is critical at this time,” says Dave Rousse, INDA president.

Other Investments

While meltblown was firm in the lead when it came to new line investment, nonwovens producers spanning all types of technologies have announced new lines this year, creating an unprecedented rate of expansion.

In spunbond news, new lines are being planned by companies including Union Industries, Fibertex Personal Care, Fitesa and Berry Global, which will add a new line in Nanhai, China, in 2022.

“We are committed to further partnering with our customers to pursue growth opportunities around the world. The added capacity achieved through this asset is a next step in advancing our market leading position in healthcare material solutions,” says Curt Begle, president of Berry’s Health, Hygiene, and Specialties Division. “This investment comes on the heels of the successful commercialization of the first of its kind R5 asset in Berry’s Nanhai, China, facility, serving the high-loft soft material needs of the premium hygiene markets throughout the Asia region.”

These new lines, which span the globe, will meet future demand for medical products as well as hygiene materials, but some experts feel that surging capacity will lead to a buyers’ market a few years down the road.

Meanwhile, in spunlace, Jacob Holm announced in June it would add 500 million square meters of capacity globally in the next few years through a project known as Project Boost. This project will affect virtually all of Jacob Holm’s manufacturing sites and, in addition to adding capacity, it will increase the company’s ability to offer its customers sustainable solutions.

Sustainability is also the theme of recent investments announced by Suominen. The company will upgrade existing lines in Italy and South Carolina, moves that the company says are in line with its strategy targeting growth and profitability.

“Investment allows us to produce new innovative, top quality products which are the result of joint product development with one of our major customers,” says Petri Helsky, president and CEO of Suominen.

Hygiene Companies Make Face Masks

As nonwovens producers reacted quickly to ensure there is enough nonwovens capacity to meet the demands of the face mask market, companies spanning a range of consumer markets began ramping up mask production. Because of the similarities between the construction of masks and absorbent hygiene products, makers of diapers and feminine hygiene products are at the forefront of these efforts.

In April, Procter & Gamble announced it was converting manufacturing capacity to make face masks at nearly a dozen manufacturing sites globally. According to CEO David Taylor, mask production started in China and is now spreading to North America, Europe, Asia Pacific, the Middle East and Africa.

The efforts have increased the supply of masks for hospitals, first responders and other organizations by reducing market demand for production and industrial use; help create a safe working environment for P&G people, and, in the long term, it will allow the company to directly help many communities across the globe where there is unprecedented need for protective supplies.

One site where face mask production is reportedly underway is located in Mehoopany, PA, where production should began in mid-May.

“It will increase the supply of masks for hospitals, first responders and other organizations by reducing market demand for production and industrial use. It helps us create a safe working environment for P&G people, and long term, it will allow us to directly help many communities across the globe where there is unprecedented need for protective supplies,” says P&G Charmin and Family Care communications spokesman Loren Fanroy.

The effort required installation of new equipment or adjustments to existing equipment, as well as new supplies and training. The company is directing donations with established partners who have the capability and reach to help those affected by the Covid-19 outbreak, P&G communications manager Tracey Long says. The masks won’t be sold and the company won’t be able to respond to individual requests for help.

The P&G Mehoopany plant makes Charmin toilet tissue and Bounty paper towels and napkins and well as the Pampers and Luvs diaper brands.

Other sites reportedly shifting to face mask production are P&G’s facilities in Cabuyao City in the Philippines and in Roorekee, India.

In addition to P&G, Sweden’s Essity has announced plans to make masks to supply the Swedish market and South American hygiene specialist CMPC has announced it will soon be able to make 18.5 million masks per month.

CMPC has added five mask lines in four countries — Chile, Brazil, Peru and Mexico. In each country, the masks will be delivered free of charge to public health services, and only the percentage necessary for the care of company workers will be reserved. Delivery is expected to begin in Chile in early May.

In September, Ontex unveiled a production line with a capacity of approximately 80 million face masks per year at its factory in Eeklo, Belgium. The line has been making one hundred thousand masks per day since August.

“We started producing face masks to help protect essential workers in hospitals and care homes, as well as our employees,” says Xavier Lambrecht, president of Ontex’s Healthcare Division. “Thanks to automation and more than 40 years of experience in personal hygiene, we can offer hospitals and care homes certified face masks at an attractive price.”

The new face mask production line was installed in only 100 days. The production line started making face masks in August and began producing type IIR medical face masks in October. Producing masks was Ontex’s own decision and the project does not benefit from any government funding.

Wipes Growth

Nearly two decades after Nonwovens Industry declared 2001 “The Year of the Wipe,” it seems investment is stronger than ever for this nonwovens application. As demand for disinfectant wipes has surged and new applications for wipes in industrial, personal and home care continue to be introduced, investment has been strong. In 2020, two of the world’s largest converters of nonwovens—Rockline Industries and Nice-Pak—both announced significant expansions to their North American operations.

In August, Rockline said it would install a new state-of-the-art, $20 million disinfecting wipe production line in Sheboygen, WI. The investment will reportedly nearly double the company’s production capacity. The new production line, known as the XC-105 Galaxy, will be one of the largest production lines for disinfecting wipes in the private brands wet wipes industry. It is expected to be complete in mid-2021.

“The Covid-19 pandemic has created a new level of awareness among the American people about the importance of proper surface disinfection,” says Randy Rudolph, president of Rockline Industries. “We are making a huge investment in the future by installing the Galaxy line to ensure that our customers will be able to meet consumers’ increasing demand for disinfecting wipes.”

Likewise, wipes maker Nice-Pak has announced plans to double manufacturing capacity of disinfectant wipes at its Jonesboro, AR, plant. The expansion will take place in stages beginning in January and finishing in August.

Upgrades will include the extension of existing lines and the addition of a new manufacturing line. Earlier this year Nice-Pak expanded output at this plant when it moved to 24-hour-per-day, seven-days-per week production schedule.

“Our products are essential for consumers to help stay healthy and well amid the Covid-19 pandemic,” says chairman and CEO Robert Julius. “We have been working non-stop to produce more wipes than ever before, and we commend the tremendous performance of our Jonesboro associates, who have been terrific in rising to the challenge.”

These expansions came as makers of disinfectant wipes face serious supply shortages. In November, Clorox announced that it continued to be challenged with meeting demand for its disinfectant wipes, despite increasing capacity and working with third party suppliers. The company is reportedly shipping nearly one million packages of Clorox wipes to stores every day, but this is not meeting demand.

The problem is strong consumer demand for products deemed effective in the fight against Covid-19—like disinfectant wipes and sprays—has forced big-box retailers like Target Corp. and Walmart Inc. to implement policies to limit the amount of these products customers can buy per visit. To further curb stockpiling, they’ve halted online sales of the products, instead directing shoppers to purchase them in-store.

Target has seen “unprecedented demand” for cleaning supplies and says products are quickly selling out after they hit the shelves, according to an emailed statement. Similarly, Walmart is working with its supply chain department to meet demand as the company keeps a “close eye” on product availability.

Clorox CEO Linda Rendle has said that maximizing the supply of wipes and other cleaning products seeing high demand is the company’s top priority. Among the company’s strategies to boost capacity has been reducing product offerings to focus on those that can be made faster.

Ontex’s North American Expansion

One of Europe’s largest hygiene manufacturers, Ontex has been slowly increasing its global footprint in recent years and actions taken in 2020 indicate that the Belgium-based company has its eyes on North America. Earlier this year, Ontex announced that it would begin operations at a new personal hygiene manufacturing plant in Rockingham County, NC, in mid-2021—its first U.S. operation. The Belgium-based hygiene specialist has also entered into an agreement with Albaad Massuot Yitzhak to acquire its feminine hygiene production assets in Rockingham County.

“Following the previously-announced decision to invest in manufacturing in the eastern part of the country to complement shipments from abroad, we are proud to announce the forthcoming opening of Ontex’s first U.S. production site as well as the acquisition of feminine hygiene production assets,” Ontex CEO Charles Bouaziz says. “With these meaningful steps, we accelerate the execution of our strategic priority to increase our U.S. presence.”

The North Carolina location was selected because approximately half the U.S. population lives within a 1000 km/650-mile radius. The strategic location of Rockingham County, the quality of the workforce, as well as state and local incentives were compelling factors in the company’s decision to locate the new facility in Rockingham County. Ontex, which produces and sells personal hygiene products in baby care, feminine care and adult care, will become a key local employer.

Ontex first entered the North American market in 2016 when it bought Mexican diaper maker Grupo Mabe and expanded into Brazil with the acquisition of Hypermarcas in 2018.

And, it appears Ontex may be poised to expand its U.S. presence further. According to a report published in the Bloomberg financial news service in November, Ontex is considering a bid for Domtar Corp.’s personal care business. The deal could value the unit, which has operations in the U.S. and Europe, at as much as $1.1 billion, according to people with knowledge of the matter.

Domtar’s personal care unit, which is generating about $110 million in annual earnings before interest, taxes, depreciation, and amortization, is also attracting private equity interest, according to the report. The unit has grown sharply in recent years thanks largely to a slate of acquisitions which include Attends adult incontinence businesses in North America and Europe, Associate Home Products, a U.S. private label diaper maker, Labatorio Indas, a Spanish hygiene specialist and Butterfly BodyLiners a start-up in the bowel leakage space.

Hygiene Supply Consolidation

Consolidation has continued within the hygiene industry supply chain, a trend started a few years ago when Berry Plastics purchased Avintiv, creating not just the world’s largest nonwovens producer but also combining a supplier of nonwovens and films, two essential components of hygiene products. Berry even expanded its role in the films segment in 2018 when it purchased Clopay, a maker of breathable film technology.

Since this consolidation, speculation has been ripe that Berry will eventually shorten the steps in hygiene products manufacturing be creating a hybrid film/nonwoven product to simplify the chassis of the diaper. At the very least, the merger has united companies with similar customers, allowing the companies to capitalize on certain synergies.

This year, another nonwovens producer, Fitesa, also expanded its films business with the purchase of Tredegar Corporation’s Personal Care Films business, including manufacturing sites located in Terre Haute, IN; Kerkrade, The Netherlands; Rétság, Hungary; Diadema, Brazil and Pune, India. The acquisition strengthens Fitesa’s films, elastics and laminates business, which has included the Pantex business since 2017.

“We are happy to announce this investment which reinforces our commitment to innovation and growth. We are continuously looking for opportunities to improve the value we create for our customers, employees, communities and shareholders,” says Silverio Baranzano, Fitesa’s CEO.

Single-Use Plastic Ruling

The impact of the Single Use Plastics Directive, which was adopted by the European Parliament in 2018, on many nonwovens markets but particularly the wipes one, has become an area of concern in the nonwovens industry. The directive seeks to significantly reduce the amount of single use plastics (SUPs) going into European landfills by limiting the use of SUPs in certain categories and all out banning the use of certain SUPs like single use straws as the EU seeks to transition to a circular economy.

For wet wipes—as well as filtered cigarettes and feminine hygiene items—the biggest impact will be felt in labeling requirements that need to inform consumers about the appropriate disposal of the product and about the negative impacts of SUPs and littering on the environment. Additionally, EU members will be required to develop awareness programs educating consumers on reusable alternatives to products containing SUPs.

Because this legislation is targeting Europe, EDANA has been working overtime on the issue but INDA and its North American member companies are anticipating these efforts impact on North America. While federal action is unlikely, already more than 20 states have introduced 100-plus bills concerning plastics. Probably the most ambitious is the California Circular Economy and Plastic Reduction Act, which seeks to significantly reduce the use of SUPs in packaging and products by 2030. This would be achieved through source reduction, recycling and composting.

According to INDA president Dave Rousse, the North American nonwovens industry needs to make sure that federal and state legislation in the U.S. does not simply replicate European language because the two regions do not face the same issues when it comes to waste. To that point, INDA and its members have formed a Plastics Initiative working group that will tackle the issue from several standpoints including monitoring legislative issues, working with manufacturers and creating a definition of plastics.