Karen McIntyre, Editor12.10.19

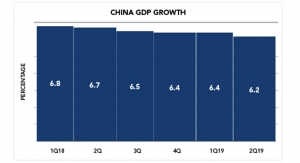

The role of nonwovens in automotives continues to grow as car designers look for lighter weight options that have a sustainability story and offer increased comfort and reduced noise to drivers and passengers. Even as the automotives market faces a global slowdown, which has been particularly hard felt in Asia, suppliers of nonwovens to automotive companies remain optimistic that their products will continue to grow in this market.

“Due to the fact that we at Sandler always aim to offer new and innovative products, we have seen growth in automotive markets in the last years. We expect that the situation will get more complex over the next years,” says Gerhard Klier, director of technical products at Sandler. “New challenges for vehicle producers arise. Hybrid or completely electronic vehicles need new or other solutions than combusting engines.”

Growth has also been driven by the increasing role of nonwovens in the automotives. Due their versatility, nonwovens are being used in more applications where they replace other materials, often in a sustainable way. Nonwovens can combine different properties, for example a good sound absorber can be a good thermal insulator as well. Nonwovens can be produced from up to 100% recycled raw materials without chemical agents.

With its products found in more than 60 automotive models worldwide, Sandler offers and supplies a huge amount of diversified nonwovens to the automotives industry, produced with different technologies. They are used in different applications and areas, like sound absorbing materials for the interior and exterior, and also as the basis for molded and self-supporting parts like wheel arch liners, underbody shields or headliners. Other products are used as filter media for cabin air filter elements or fuel filters.

“Nonwovens can be versatile, like flat sheets as e.g. sound absorbing pads but also as two-dimensional die cut part or as a 3D molded part combining different properties in one product. Our nonwovens are mainly made from polyester fibers. Polyester is a clear and exact-to-handle raw material. So designers can ‘play’ with material and ideas.”

However, competition can be difficult in this market, which is driven by low prices and good quality. In response, Sandler continues to offer new designs for automotives. Its molded parts are used in textile underbody solutions to make vehicles lighter and quieter, not just for the people inside the vehicle but people outside of the car. “We are working on the next generation of sound absorbing materials and thermal insulating materials. One of the most important facts is that we do this all the time – in the past, currently and we will continue in the future – with a focus on sustainability, eco-friendliness, and for a safe environment,” Klier says.

Global Expansion

Fibertex Nonwovens has focused on acquisition to boost its role in the growing automotives market. Just a few months after making a large acquisition in the Brazilian automotives market, the Denmark-based nonwovens producer announced it would increase production there by 20% to accommodate growing demand for special-purpose products for the automotive.

“The process of taking over the factory in Brazil has far exceeded our expectations. Our South American customers have given us a really warm welcome, and we’re already facing an urgent lack of capacity,” says Fibertex Nonwovens CEO Jørgen Bech Madsen. “We‘ve been planning to expand capacity since acquiring Duci, but the need has arisen faster than we anticipated, and we will begin to upgrade the existing production line immediately. We know from previous experience in expanding our other factory sites that an upgrade can increase our output capacity by 20%. In addition, we will accelerate planning for other expansion projects.”

Estimated at close to DKK 15 million, the investment came onstream in summer 2019. Bech Madsen explains that Fibertex Nonwovens had already sold the extra capacity to the growing Brazilian market, which is the world’s sixth-largest and accounts for more than half of the entire South American market. The spunlacing technology made by Fibertex Nonwovens in Brazil is manufactured by just one other company in South America. Fibertex already makes this type of nonwoven at sites in France and Turkey, and its experience in this segment was a key factor in its success.

“We’ve accumulated our nonwovens experience over quite a number of years, but there is a big difference between simple high-volume products, such as geotextiles, and the special-purpose products used for filtration, acoustic solutions, interior and exterior applications in cars and other purposes, special wipes or products for the shoe-making industry. We are a global leader in special-purpose products, and obviously, work is well under way to apply our knowledge and production methods at our new facility in Brazil. They give us some unique market advantages,” Bech Madsen continues.

In fact, demand for special-purpose products is growing faster than any other part of the industry, and not just in the Brazilian market. Several other South American markets, including Argentina, are reporting strong growth in industrial production.

“Historically, the nonwovens market has grown at three times the rate of our GDP, and there is still a huge potential. The average Brazilian consumer spends only about one-third of what an American or European consumer does, and this is where nonwovens play an important role,” explains Carlos Benatto, the CEO of Fibertex Nonwovens’ Brazilian subsidiary.

That growth rate applies not least to Brazil’s large automotive industry in which virtually all American, European and Japanese carmakers play an active part. Fibertex Nonwovens is a market leader when it comes to supplying nonwovens to the auto industry. The average European car contains about 30 m2 of special-purpose nonwovens, including everything from headliners, seats and parcel trays to exterior applications used in wheel housings, motor insulation or underbody parts, and the investment in Brazil gives Fibertex Nonwovens a unique platform from which to serve existing and new automotive customers.

Meanwhile, in North America, Fibertex Nonwovens recently announced plans to upgrade an existing line in South Africa and relocated it to the U.S. to meet increasing demand for automotive applications in the region. Fibertex currently has two sites in the U.S., a spunlace operation in South Carolina acquired earlier this year and a needlepunch site in Illinois which largely targets the automotive markets.

Bech Madsen agrees that conditions in the market have been challenged by soft and declining market conditions but Fibertex Nonwovens has been able to strengthen its position.

“The role of nonwovens in automotive applications is expanding. The key factors behind the expansion are improved acoustical solutions and reducing weight to increase comfort. Tailor-made nonwovens can address these performance criteria,” he says.

Nonwovens can offer advantages to car designers like improve fuel economy, better security, an improved drivers experience and overall cost efficiency.

Fibertex has recently introduced a new range of acoustics products within acoustic applications addressing both the classical cars and electrical cars. The new products can be used in various automotive acoustic applications, including motor insulation, wheel arches, headliners and other sound dampening parts, to improve passenger cabin comfort and reduce pass-by noise.

Global expansion continues to be priority for Freudenberg Performance Materials, and its automotives business is no exception. Last month, the German nonwovens producer acquired Filc, a Slovenian producer of needlepunch nonwovens with a focus on automotives and construction.

“Filc has great needlepunch know-how which we will benefit from, especially in terms of composites. Filc‘s exceptionally good adhesive coating abilities will allow us to offer customer solutions in adjacent segments in the construction business,” explains Dr. Frank Heislitz, Freudenberg Performance Materials CEO. “In addition, we will expand our technical expertise in acoustics, both in construction and automotive, and provide customers a broad technology portfolio with lamination, printing, and coating.”

With Filc, Freudenberg Performance Materials is expanding its role as a major global nonwovens supplier for the automotive industry. Freudenberg offers various innovative products and technologies that not only serve customer requests such as high performance lightweight solutions but also support the breakthrough of e-mobility.

“Automotive is one of the world’s largest markets for industrial performance materials applications with more than 2 billion euros market potential,” Heislitz says. “Overall, the volume of nonwovens in the automotive market is growing by more than 7% each year. This is faster than the growth of the global vehicle production.”

One important driver for this growth is the substitution of conventional materials (e.g., injection-molded parts, heavy layers, steel …) with innovative performance materials. Lightweight performance materials solutions support the trend towards e-mobility.

“Sustainability is one of the main drivers for the strong growth of the automotive market,” Heislitz says. “One aim is to substitute more and more conventional materials with lighter ones leading to reducing CO2 emissions and enabling the breakthrough of e-mobility. Nonwovens are excellently suited for solutions in this area.”

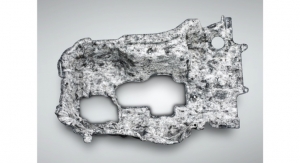

Much of the materials Freudenberg makes for the automotives industry contain recycled raw materials. For instance, Freudenberg’s spunlaid nonwovens based on Lutradur technology for automotive carpets, insert mats and interior and trunk linings contain up to 90% of recycled polyester, and its unique multi-layer composite for molded underbody panels and wheel liners are 100% recyclable and can be utilized in closed loop systems.

Additionally, nonwovens for the automotive industry are lighter than conventional materials. Lutraflor technology is 40% lower in weight than conventional automotive carpets. Freudenberg’s composite for molded underbody panels and wheel liners offer weight savings of 15-40% and Evolon microfilament textiles have an outstanding strength to weight ratio offering potential to reduce the weight of components. These weight reductions allow the materials to help to save fuel and reduce CO2 emissions.

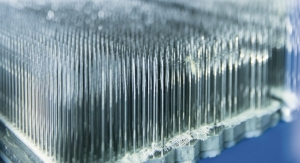

Freudenberg is one of the first companies worldwide to manufacture gas diffusion layers (GDL) completely in-house with its own production facilities. GDL are essential components of fuel cells. They ensure that the hydrogen fuel is converted into power as efficiently as possible. Freudenberg’s gas diffusion layers help to improve the efficiency of fuel cells. Their high uniformity in structure and thickness increases electrical and thermal conductivity and improves the transport of gases and liquids in the fuel cell.

Further strengths of Freudenberg’s gas diffusion layers compared with other products are superior downstream processing and exceptional surface properties. They provide better acoustic absorption, lighter weight and improved resilience. The pads can be customized based on the customer requirements since the material thickness and the selected fibers alter the properties of the nonwoven material. The materials used are “fine-tuned” to ideally cover the specific frequency spectrum desired by car manufacturers. “Freudenberg’s under-body-shields offer the best combination of spunlaid and staple-fiber technology in order to create a product with substantially higher tear strength and stiffness as well as lower weight and better acoustics.”

Alpha-Liner is the latest innovation from automotives supplier Autoneum – a multifunctional wheelhouse outer liner that reduces tire noise with high efficiency and thus makes the vehicle quieter and lighter. Alpha-Liner is based on Autoneum’s newly developed technology, with which noise absorption can be adapted to the specific requirements of the vehicle model for the first time. To achieve this effect, a thin coated surface is applied on the tire side. The porosity of the coating can then be controlled according to the necessary absorption properties, the bottom part of the wheel-house outer liner requires stronger noise treatment, which maximizes acoustic absorption.

Each reduced decibel is decisive as external or pass-by noise in particular is increasingly regulated in Europe, Japan, but also in China. From 2024, newly registered vehicles in the European Union will be allowed to generate a maximum of 68 decibels of external noise, a challenge for manufacturers and suppliers alike in light of the current threshold of 72 decibels and already highly acoustically optimized cars. To achieve this substantial noise reduction, Alpha-Liner will make an important contribution.

Wheelhouse outer liners made of Alpha-Liner offer additional advantages as well. They are easy to clean and robust thanks to the plasticized surface, making them more resistant to stone chipping and ice accumulation in the wheelhouse. Compared to corresponding components made of plastic, Alpha-Liner convinces with a lower weight, ensuring a greater driving range especially for electric vehicles. In addition, the components are produced in a sustainable manner. Production scrap of the wheelhouse outer liners, which are primarily made of recycled PET fibers, can be fully recovered and recycled.

Autoneum is also expanding its product portfolio with textile battery undercovers made of Ultra-Silent that optimally meet the specific requirements for acoustic and thermal management of electric vehicles. With sales of electric cars picking up speed worldwide, demand for innovations that are particularly suited for this vehicle category is also growing. Components are required whose low weight enable a greater driving range and that regulate noise levels at the same time. In order to support vehicle manufacturers in the production of lightweight and environmentally-friendly e-models.

Electromobility is on the rise around the world. While the number of newly registered electric vehicles is also growing substantially in Europe and North America, the largest production and sales market is China: More than 40 percent of all electric vehicles produced globally are manufactured in the Middle Kingdom, in part due to government subsidies. However, an expansion of charging infrastructure and improved driving range are decisive for the global break-through of this vehicle category. As the market and technology leader in acoustic and thermal management, Autoneum already today offers various multifunctional components such as carpet systems, inner dashes and underbody systems, which have a positive impact on the driving range thanks to their light weight and which are specially tailored to the acoustic and thermal management needs of electric vehicles.

With battery undercovers made of Ultra-Silent, the Company has adapted this textile underbody technology for use in electric vehicles for the first time. The components act as insulators helping to lower sound that enters the passenger cabin, for instance caused by tires, and also pass-by noise. Sound-reducing components are essential for electric models as well because external and internal sources such as fans, pumps and electronic drive components are more audible due to the lack of engine noise and accordingly influence driving comfort. At the same time, the textile battery undercovers also convince thanks to their low weight: They are up to 50 percent lighter than corresponding components made of plastic and thus ensure a greater driving range.

Undercovers made of Ultra-Silent are installed underneath the battery casing, providing the battery cells with the best possible protection against significant cooling or heating and ensuring a constant temperature with a correspondingly optimized battery capacity. As a result, the components help to improve battery performance. They are also resistant to water, stone chipping and vibrations and thus help to protect the battery casing. In order to calibrate the temperature resistance and material stiffness of undercovers, Autoneum uses a broad range of internally developed simulation tools.

“Due to the fact that we at Sandler always aim to offer new and innovative products, we have seen growth in automotive markets in the last years. We expect that the situation will get more complex over the next years,” says Gerhard Klier, director of technical products at Sandler. “New challenges for vehicle producers arise. Hybrid or completely electronic vehicles need new or other solutions than combusting engines.”

Growth has also been driven by the increasing role of nonwovens in the automotives. Due their versatility, nonwovens are being used in more applications where they replace other materials, often in a sustainable way. Nonwovens can combine different properties, for example a good sound absorber can be a good thermal insulator as well. Nonwovens can be produced from up to 100% recycled raw materials without chemical agents.

With its products found in more than 60 automotive models worldwide, Sandler offers and supplies a huge amount of diversified nonwovens to the automotives industry, produced with different technologies. They are used in different applications and areas, like sound absorbing materials for the interior and exterior, and also as the basis for molded and self-supporting parts like wheel arch liners, underbody shields or headliners. Other products are used as filter media for cabin air filter elements or fuel filters.

“Nonwovens can be versatile, like flat sheets as e.g. sound absorbing pads but also as two-dimensional die cut part or as a 3D molded part combining different properties in one product. Our nonwovens are mainly made from polyester fibers. Polyester is a clear and exact-to-handle raw material. So designers can ‘play’ with material and ideas.”

However, competition can be difficult in this market, which is driven by low prices and good quality. In response, Sandler continues to offer new designs for automotives. Its molded parts are used in textile underbody solutions to make vehicles lighter and quieter, not just for the people inside the vehicle but people outside of the car. “We are working on the next generation of sound absorbing materials and thermal insulating materials. One of the most important facts is that we do this all the time – in the past, currently and we will continue in the future – with a focus on sustainability, eco-friendliness, and for a safe environment,” Klier says.

Global Expansion

Fibertex Nonwovens has focused on acquisition to boost its role in the growing automotives market. Just a few months after making a large acquisition in the Brazilian automotives market, the Denmark-based nonwovens producer announced it would increase production there by 20% to accommodate growing demand for special-purpose products for the automotive.

“The process of taking over the factory in Brazil has far exceeded our expectations. Our South American customers have given us a really warm welcome, and we’re already facing an urgent lack of capacity,” says Fibertex Nonwovens CEO Jørgen Bech Madsen. “We‘ve been planning to expand capacity since acquiring Duci, but the need has arisen faster than we anticipated, and we will begin to upgrade the existing production line immediately. We know from previous experience in expanding our other factory sites that an upgrade can increase our output capacity by 20%. In addition, we will accelerate planning for other expansion projects.”

Estimated at close to DKK 15 million, the investment came onstream in summer 2019. Bech Madsen explains that Fibertex Nonwovens had already sold the extra capacity to the growing Brazilian market, which is the world’s sixth-largest and accounts for more than half of the entire South American market. The spunlacing technology made by Fibertex Nonwovens in Brazil is manufactured by just one other company in South America. Fibertex already makes this type of nonwoven at sites in France and Turkey, and its experience in this segment was a key factor in its success.

“We’ve accumulated our nonwovens experience over quite a number of years, but there is a big difference between simple high-volume products, such as geotextiles, and the special-purpose products used for filtration, acoustic solutions, interior and exterior applications in cars and other purposes, special wipes or products for the shoe-making industry. We are a global leader in special-purpose products, and obviously, work is well under way to apply our knowledge and production methods at our new facility in Brazil. They give us some unique market advantages,” Bech Madsen continues.

In fact, demand for special-purpose products is growing faster than any other part of the industry, and not just in the Brazilian market. Several other South American markets, including Argentina, are reporting strong growth in industrial production.

“Historically, the nonwovens market has grown at three times the rate of our GDP, and there is still a huge potential. The average Brazilian consumer spends only about one-third of what an American or European consumer does, and this is where nonwovens play an important role,” explains Carlos Benatto, the CEO of Fibertex Nonwovens’ Brazilian subsidiary.

That growth rate applies not least to Brazil’s large automotive industry in which virtually all American, European and Japanese carmakers play an active part. Fibertex Nonwovens is a market leader when it comes to supplying nonwovens to the auto industry. The average European car contains about 30 m2 of special-purpose nonwovens, including everything from headliners, seats and parcel trays to exterior applications used in wheel housings, motor insulation or underbody parts, and the investment in Brazil gives Fibertex Nonwovens a unique platform from which to serve existing and new automotive customers.

Meanwhile, in North America, Fibertex Nonwovens recently announced plans to upgrade an existing line in South Africa and relocated it to the U.S. to meet increasing demand for automotive applications in the region. Fibertex currently has two sites in the U.S., a spunlace operation in South Carolina acquired earlier this year and a needlepunch site in Illinois which largely targets the automotive markets.

Bech Madsen agrees that conditions in the market have been challenged by soft and declining market conditions but Fibertex Nonwovens has been able to strengthen its position.

“The role of nonwovens in automotive applications is expanding. The key factors behind the expansion are improved acoustical solutions and reducing weight to increase comfort. Tailor-made nonwovens can address these performance criteria,” he says.

Nonwovens can offer advantages to car designers like improve fuel economy, better security, an improved drivers experience and overall cost efficiency.

Fibertex has recently introduced a new range of acoustics products within acoustic applications addressing both the classical cars and electrical cars. The new products can be used in various automotive acoustic applications, including motor insulation, wheel arches, headliners and other sound dampening parts, to improve passenger cabin comfort and reduce pass-by noise.

Global expansion continues to be priority for Freudenberg Performance Materials, and its automotives business is no exception. Last month, the German nonwovens producer acquired Filc, a Slovenian producer of needlepunch nonwovens with a focus on automotives and construction.

“Filc has great needlepunch know-how which we will benefit from, especially in terms of composites. Filc‘s exceptionally good adhesive coating abilities will allow us to offer customer solutions in adjacent segments in the construction business,” explains Dr. Frank Heislitz, Freudenberg Performance Materials CEO. “In addition, we will expand our technical expertise in acoustics, both in construction and automotive, and provide customers a broad technology portfolio with lamination, printing, and coating.”

With Filc, Freudenberg Performance Materials is expanding its role as a major global nonwovens supplier for the automotive industry. Freudenberg offers various innovative products and technologies that not only serve customer requests such as high performance lightweight solutions but also support the breakthrough of e-mobility.

“Automotive is one of the world’s largest markets for industrial performance materials applications with more than 2 billion euros market potential,” Heislitz says. “Overall, the volume of nonwovens in the automotive market is growing by more than 7% each year. This is faster than the growth of the global vehicle production.”

One important driver for this growth is the substitution of conventional materials (e.g., injection-molded parts, heavy layers, steel …) with innovative performance materials. Lightweight performance materials solutions support the trend towards e-mobility.

“Sustainability is one of the main drivers for the strong growth of the automotive market,” Heislitz says. “One aim is to substitute more and more conventional materials with lighter ones leading to reducing CO2 emissions and enabling the breakthrough of e-mobility. Nonwovens are excellently suited for solutions in this area.”

Much of the materials Freudenberg makes for the automotives industry contain recycled raw materials. For instance, Freudenberg’s spunlaid nonwovens based on Lutradur technology for automotive carpets, insert mats and interior and trunk linings contain up to 90% of recycled polyester, and its unique multi-layer composite for molded underbody panels and wheel liners are 100% recyclable and can be utilized in closed loop systems.

Additionally, nonwovens for the automotive industry are lighter than conventional materials. Lutraflor technology is 40% lower in weight than conventional automotive carpets. Freudenberg’s composite for molded underbody panels and wheel liners offer weight savings of 15-40% and Evolon microfilament textiles have an outstanding strength to weight ratio offering potential to reduce the weight of components. These weight reductions allow the materials to help to save fuel and reduce CO2 emissions.

Freudenberg is one of the first companies worldwide to manufacture gas diffusion layers (GDL) completely in-house with its own production facilities. GDL are essential components of fuel cells. They ensure that the hydrogen fuel is converted into power as efficiently as possible. Freudenberg’s gas diffusion layers help to improve the efficiency of fuel cells. Their high uniformity in structure and thickness increases electrical and thermal conductivity and improves the transport of gases and liquids in the fuel cell.

Further strengths of Freudenberg’s gas diffusion layers compared with other products are superior downstream processing and exceptional surface properties. They provide better acoustic absorption, lighter weight and improved resilience. The pads can be customized based on the customer requirements since the material thickness and the selected fibers alter the properties of the nonwoven material. The materials used are “fine-tuned” to ideally cover the specific frequency spectrum desired by car manufacturers. “Freudenberg’s under-body-shields offer the best combination of spunlaid and staple-fiber technology in order to create a product with substantially higher tear strength and stiffness as well as lower weight and better acoustics.”

Alpha-Liner is the latest innovation from automotives supplier Autoneum – a multifunctional wheelhouse outer liner that reduces tire noise with high efficiency and thus makes the vehicle quieter and lighter. Alpha-Liner is based on Autoneum’s newly developed technology, with which noise absorption can be adapted to the specific requirements of the vehicle model for the first time. To achieve this effect, a thin coated surface is applied on the tire side. The porosity of the coating can then be controlled according to the necessary absorption properties, the bottom part of the wheel-house outer liner requires stronger noise treatment, which maximizes acoustic absorption.

Each reduced decibel is decisive as external or pass-by noise in particular is increasingly regulated in Europe, Japan, but also in China. From 2024, newly registered vehicles in the European Union will be allowed to generate a maximum of 68 decibels of external noise, a challenge for manufacturers and suppliers alike in light of the current threshold of 72 decibels and already highly acoustically optimized cars. To achieve this substantial noise reduction, Alpha-Liner will make an important contribution.

Wheelhouse outer liners made of Alpha-Liner offer additional advantages as well. They are easy to clean and robust thanks to the plasticized surface, making them more resistant to stone chipping and ice accumulation in the wheelhouse. Compared to corresponding components made of plastic, Alpha-Liner convinces with a lower weight, ensuring a greater driving range especially for electric vehicles. In addition, the components are produced in a sustainable manner. Production scrap of the wheelhouse outer liners, which are primarily made of recycled PET fibers, can be fully recovered and recycled.

Autoneum is also expanding its product portfolio with textile battery undercovers made of Ultra-Silent that optimally meet the specific requirements for acoustic and thermal management of electric vehicles. With sales of electric cars picking up speed worldwide, demand for innovations that are particularly suited for this vehicle category is also growing. Components are required whose low weight enable a greater driving range and that regulate noise levels at the same time. In order to support vehicle manufacturers in the production of lightweight and environmentally-friendly e-models.

Electromobility is on the rise around the world. While the number of newly registered electric vehicles is also growing substantially in Europe and North America, the largest production and sales market is China: More than 40 percent of all electric vehicles produced globally are manufactured in the Middle Kingdom, in part due to government subsidies. However, an expansion of charging infrastructure and improved driving range are decisive for the global break-through of this vehicle category. As the market and technology leader in acoustic and thermal management, Autoneum already today offers various multifunctional components such as carpet systems, inner dashes and underbody systems, which have a positive impact on the driving range thanks to their light weight and which are specially tailored to the acoustic and thermal management needs of electric vehicles.

With battery undercovers made of Ultra-Silent, the Company has adapted this textile underbody technology for use in electric vehicles for the first time. The components act as insulators helping to lower sound that enters the passenger cabin, for instance caused by tires, and also pass-by noise. Sound-reducing components are essential for electric models as well because external and internal sources such as fans, pumps and electronic drive components are more audible due to the lack of engine noise and accordingly influence driving comfort. At the same time, the textile battery undercovers also convince thanks to their low weight: They are up to 50 percent lighter than corresponding components made of plastic and thus ensure a greater driving range.

Undercovers made of Ultra-Silent are installed underneath the battery casing, providing the battery cells with the best possible protection against significant cooling or heating and ensuring a constant temperature with a correspondingly optimized battery capacity. As a result, the components help to improve battery performance. They are also resistant to water, stone chipping and vibrations and thus help to protect the battery casing. In order to calibrate the temperature resistance and material stiffness of undercovers, Autoneum uses a broad range of internally developed simulation tools.