Tara Olivo, Associate Editor10.08.18

The filtration market is one of the fastest growing segments of the nonwovens industry. Rising demand from consumers for cleaner air and drinking water, coupled with more stringent regulations across the globe, are among the key growth drivers in this segment. Because of this increasing demand, producers of filtration media are focusing on new product development, investments, and growth in new market areas to stay ahead of the competition in this important nonwovens segment.

Investment Continues for Ahlstrom-Munksjö

In its most recent report, Ahlstrom-Munksjö reported solid demand across many regions and end-use segments for filtration products, particularly in heavy-duty vehicles and industrial air.

The Finnish producer of sustainable and innovative fiber-based solutions responded to growth in this market with investments, particularly through capacity expansion in high-end filtration materials. In June, the company announced it would invest about €28 million to expand manufacturing capacity and product capabilities to help grow its filtration business. The project includes adding capacity in Turin, Italy, and rebuilding and modifying existing sites in Malmedy, Belgium, and Ställdalen, Sweden.

“This investment will enable us to create additional capacity in Turin, Italy, and will allow us to support growing demand for high-end filtration materials,” says Fulvio Capussotti, executive vice president of Business Area Filtration and Performance.

Ahlstrom-Munksjö has also reported demand for filtration media in South America and recently took the first step toward a potential capacity expansion in Louveira, Brazil, where it purchased a piece of land adjacent to its existing plant. The Louveira plant, which is in the San Paolo region of Brazil, employs about 110 people and makes filtration media for transportation and industrial applications.

This purchase followed news in 2016 of the company’s plans to increase its filtration portfolio with an investment in Madisonville, KY. When it was still known as Ahlstrom, the company invested approximately €23 million in its engine and industrial filtration product capabilities at the plant, which was completed during the first half of this year.

In product news, Ahlstrom-Munksjö announced in March the launch of Trinitex Advance W3200, a unique E12 filtration media specifically designed for pulse jet gas turbine applications. Trinitex Advance W3200 is an extension of the Trinitex Advance product range of high performance filtration media designed to purify air for different industrial applications, which first came to market in 2017.

Trinitex Advance W3200 has the ability to combine EPA (Efficiency Particulate Air) EN1822 E12 Efficiency Class, producing up to 30 times purer air than media with E10 Efficiency, while delivering unrivaled protection of the gas turbine in all demanding conditions, especially humid or industrial environments.

“We are very pleased to introduce the W3200 grade into our Trinitex Advance platform, bringing to market a filter media with exceptional performance levels for pulse jet gas turbine applications,” says Capussotti. “Delivering high performance filtration media for industrial filtration is a priority for our business area and we will continue to develop and strengthen our product offering.”

Noora Blasi, marketing communications manager, Filtration & Performance, adds, “Product development is a key success factor in filtration. As global and regional trends emerge evolve, the filtration industry is in constant need to adjust its offering and create solutions that will need these changing market needs. The filter media supplier plays a key role in this work and we are constantly working with our customer globally to understand and respond to their needs for future products. We have developed though out the years a deep understanding of filtration mechanism and filtration media and in collaboration with major stakeholders along the value chain, we use these unique know how and capabilities to develop new unique solutions for our customer and the final market.”

Bondex Expands Hydrolox Range

Bondex, of Trenton, SC, is part of the U.K.-based multi-national manufacturing company Andrew Industries. Brian Little, senior vice president, sales and marketing, says Bondex’s parent company has always viewed the filtration industry as a strategic market as the technical and commercial requirements align with its core competencies of quality, service and innovation, and both Bondex and Andrew are witnessing growth in this segment.

“The global economy continues to expand, in part due to growth in industrial production. As manufacturing growth continues, users demand higher performance filtration media which is necessary to meet emissions regulations and productivity goals,” Little says. “Achieving this balance in filtration efficiency and plant throughput is driving growth in pleatable filter media as well as new compositions and consolidation technologies.”

One of the more recent developments from Bondex is a unique process technology that produces its Hydrolox and Hydrolox HCE products. Using ultra-high pressure hydroentangling, Hydrolox represents a new paradigm of mechanically robust felt with finer pore sizes than needle felt which delivers superior filtration efficiency than the incumbent filter felt. Meanwhile, Hydrolox HCE, which stands for “high collection efficiency,” utilizes the Bondex process technology in combination with fine fiber and splittable fibers to deliver filtration efficiency that are equal to membrane laminated needlefelt.

Bondex, which launched Hydrolox in 2017, expanded the Hydrolox portfolio beyond aramid, polyester and PPS to now include blends with PTFE, which will be commercialized this fall. “We anticipate that our aramid/PTFE Hydrolox HCE product will deliver filtration efficiency equal to membrane which can serve a wide variety of applications where membrane laminated needlefelt would otherwise be compromised,” Little says.

Bondex also developed a pleatable polyester Hydrolox product to respond to growing market needs in pleatable filtration media.

“Our market intelligence informs us of the growing needs for superior filtration performance. We have designed Hydrolox to address these needs without sacrificing permeability in a mechanically robust solution,” Little explains. “As industry needs continue to change, the filtration market desires partnerships which can develop innovative solutions in order to deliver growth. We see Bondex and the Hydrolox family of products providing value to customers with these challenges.”

As the market continues to grow, the company continuously makes investments in order to enhance its filtration portfolio. Recently it installed a new Brückner Stentor, and with this Bondex can now offer oleophobic, hydrophobic, acid resistant, and other water-based treatments to its products. The company has also recently added high temperature lamination capabilities to provide ePTFE laminated to woven glass and aramid felt materials.

Kimberly-Clark Focuses on Indoor Air Quality

Growing awareness of health dangers associated with dust, mold, pollution, bacteria and allergens in indoor air is helping fuel growth in the filtration market, according to manufacturing giant Kimberly-Clark. “Globally, we continue to see interest in improving health and productivity and a growing awareness about how time spent at work, at school and in public indoor spaces can affect health and productivity,” says Juliana Khouri, category marketing manager, Partnership Products, Kimberly-Clark Professional. “Air filters with high particle capture efficiencies – especially of submicron particles – are critical for achieving good indoor air quality (IAQ) and helping building occupants avoid the cost of productivity and health problems associated with poor IAQ.”

Kimberly-Clark offers nonwoven air filtration media, including both high-loft and low-loft nonwoven filter media with an electret charge. Its high-loft bicomponent spunbond media, sold under the Intrepid brand, is typically used in MERV 7-15 pleat, pocket and mini-pleat filters for commercial and institutional HVAC systems, while our low-loft media is typically used in rigid pleat applications including car cabin air filters and air purifiers.

“Kimberly-Clark Professional air filtration media is meeting demands for improved indoor air quality and reduced energy consumption/costs,” says Khouri. “The key to meeting those demands is the electret charge imparted to our nonwoven filter media, which provides high initial and sustained particle capture efficiencies with a low airflow resistance.”

Currently, Kimberly-Clark is in the process of launching a new commercialization project: “Solution Squad,” a specialized team of experts who work hand-in-hand with its customers to help them create superior filters and gain a competitive edge. “When customers activate the Solution Squad, a Kimberly-Clark Advocate responds within 24 hours to arrange a no-obligation phone consultation to learn more about the customer’s filter design, performance specifications and manufacturing process,” Khouri explains.

Despite filtration being a competitive market, with many filters specified and sold based strictly on purchase price, it is an attractive market for the company. “Kimberly-Clark Professional can differentiate itself with not only a superior product that gives filter manufacturers a competitive edge, but also with the support we can bring to the table as a true partner who knows what it takes to help them succeed in the marketplace,” Khouri says. “There are also synergies between the media we supply to the air filtration market – with our focus on delivering cleaner air for healthier, more productive building occupants – and Kimberly-Clark’s corporate and social focus on creating long-term impact with essential products that improves people’s lives.”

Lydall Acquires PCC’s Filtration Business

Lydall Inc. recently grew its filtration business through acquisition when it purchased the Precision Filtration division of Precision Custom Coatings based in Totowa, NJ.

Precision Filtration is a long-time producer of high-quality, air filtration media principally serving the commercial and residential HVAC markets with MERV 7 – 11 products. The addition of these products and capabilities enables Lydall to provide its customers with a full range of air filtration media from low efficiency MERV 7 through high-performing ULPA. Additionally, this acquisition further enhances Lydall’s flexibility in manufacturing, planning and logistics for its new and existing customers. Full integration into Lydall is expected by the end of this year.

“We are extremely excited about the acquisition of the filtration business of Precision Custom Coatings as it coincides perfectly with our strategy of continuing to grow our product offering in the filtration space with high-quality products that are valued by our customers,” Paul Marold, president Lydall Performance Materials, said at the time of the announcement. “Precision Custom Coatings has developed excellent products while nurturing strong relationships with a customer base that is complementary to ours. This will lead to a seamless transition to Lydall Performance Materials.”

Lydall has been focused on investment in recent years. It most recently acquired Interface Performance Materials, which manufactures complete sealing solutions. In 2016 Lydall acquired German needlepuncher MGF Gutsche and Texel, a Canadian needlepuncher, as well as the baghouse filtration operations of Andrew Industries in 2015.

Mann+Hummel Expands into New Markets

Since its founding in 1941 as an automotive components supplier, Ludwigsburg, Germany-based Mann+Hummel has made significant contributions towards developments in filter technology. The company today offers a wide-range of filter systems including systems and components for automotive original equipment, products for the automotive aftermarket, industrial filters and water filtration.

According to Miriam Teige, manager Corporate Communications, Mann+Hummel, the company is aiming to get more independent from the automotive industry—currently about 90% of its business is for internal combustion engines and related business. Mann+Hummel is taking steps to grow outside of automotive by increasing M&A activity in other markets outside the automotive industry, including in building filtration with its recent acquisition of Tri-Dim Filter Corporation.

Mann+Hummel completed the acquisition of Tri-Dim, a Louisa, VA-based air filtration company, at the end of August. Tri-Dim specializes in air filtration for a variety of commercial and industrial spaces including hospitals, schools, automotive factories and paint rooms, data centers, food and beverage settings, and many more commercial environments.

“Mann+Hummel is committed to expanding in the air and water filtration industries, and we are thrilled with the addition of the Tri-Dim team,” Håkan Ekberg, group vice president of Mann+Hummel’s Life Sciences & Environment business unit, said at the time of the acquisition.

Tri-Dim is a provider of a full-line of HVAC filtration products and services, including air & liquid filtration, heating/air conditioning supplies, cleanroom filtration, air purification equipment, gas phase filtration, and air testing & remediation.

“This strategic move is an exciting next step in our continued commitment to product innovation, customer service and growth, mainly in the U.S., where Tri-Dim has more than 10 locations,” says Teige. “Tri-Dim will be able to leverage the purchasing power of Mann+Hummel for common filtration components, like filtration media for example. We also hope to enact some of Mann+Hummel’s best practices in operations, distribution and logistics systems, giving Tri-Dim a foundation for accelerated growth.”

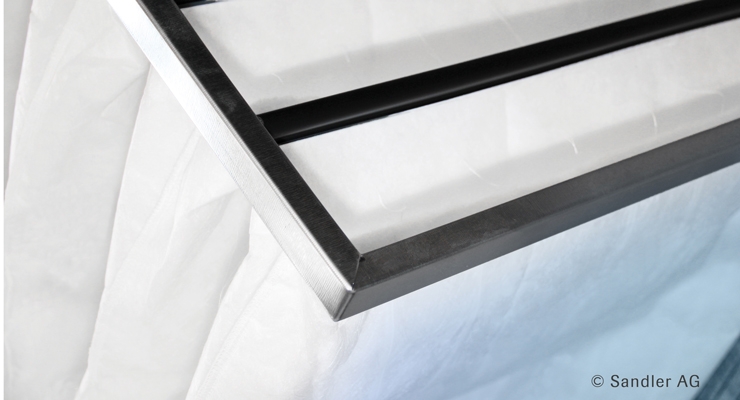

Sandler Sees Opportunities for Growth

Some of the major factors shaping the filtration market and inducing continued growth are the growth of metropolitan areas, the increase in the number of vehicles on the roads, as well as more stringent regulations on indoor air quality, which all require new product solutions, according to Peter Reich, associate sales director Filtration Products at Sandler.

Particularly, he adds, the increasingly stringent demands on indoor air quality have also brought about new international standards on filtration performance, such as the ISO 16890 standard. “Product development in the filtration industry is responding to these changes. Filter media have to offer both high filtration performance and energy efficiency,” he explains.

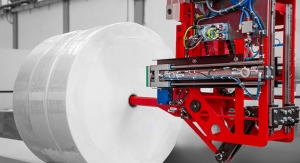

The continued trend towards fully synthetic filter media in this market is creating additional growth opportunities for Sandler, Reich says.

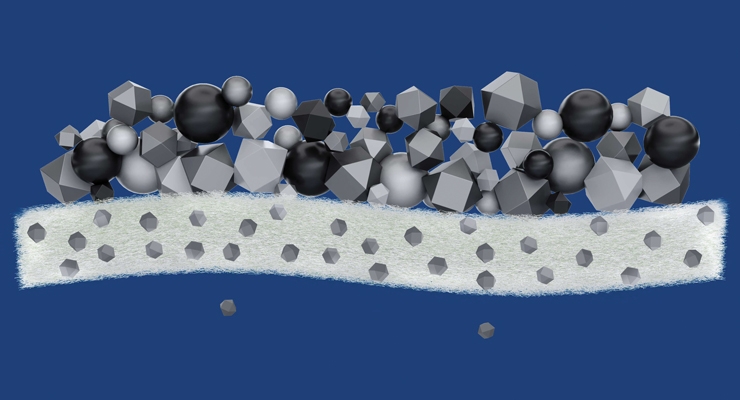

In the filtration market Sandler develops and produces synthetic filter media for HVAC applications, the transportation industry, synthetic vacuum cleaner bags, customized special filters for liquid filtration as well as medical and hygiene applications. The product range comprises fiber-based nonwovens and meltblown filter media for filters classed G1–E11 / MERV 1-16 and for all efficiency ranges according to ISO 16890. Sandler’s pocket and pleat filter media are made of finest fibers, produced using submicron fibers and featuring a large inner surface that facilitates mechanical deposition effects. “They combine a permanently high filtration performance and a long operating life. The nonwovens maintain their efficiency even after discharge,” Reich explains.

Among its latest developments are filter media for use in activated carbon filters. “With these products, the functionality of activated carbon filters and the optimum particle filtration provided by nonwoven media can be combined in a durable product—for example for cabin air filtration in vehicles,” he says.

Filtration has always been an important business segment for Sandler and—as in all of its market segments—the manufacturer cooperates closely with its customers in developing new products, Reich adds.

“In general, the filtration industry holds a lot of potential and demand for innovation; product development is ongoing; new norms and standards change the market,” he says. “The importance of this sector is likely to continue to grow in light of new legislation and environmental concerns. There is potential for growth and new challenges arise regarding major trends such as electromobility and regarding new players from countries such as China. All in all, that certainly makes it an interesting market to do business in.”

TWE Group Offers a Range of Media

In the air filtration market, Emsdetten, Germany-based TWE Group is supplying filter media that are converted into filters such as pocket filters, filter cassettes and pads. “With the introduction of the new norm ISO 16890, new 100% synthetic media is required with a higher filtration efficiency,” says Marcel Boersma, sales manager Air Filtration, TWE Group.

TWE’s R&D department has been working hard to achieve this and will release new products third quarter of 2019.

“With these new products we do not only think we have more chances in the market, but we also believe we can be of added value by making these products 100% synthetic,” Boersma explains. “This is a major step forward to step into the market which is dominated by glass based media. Glass fibers have a long tradition in the filtration business, but we believe synthetic fiber based media are better for health of the ones working with the media and process it into a complete filter.”

TWE’s newest innovation in the liquid filtration market is ParaJet evo, a development from its ParaJet portfolio. These products are made of a fiber blend of polyester and micro polyester fibers, cross-laid and hydroentangled. This filter allows a higher separation efficiency thanks to its new fiber mix. It is used in application areas such as the metal working industry, automotive industry, rolling mills, wire drawing industry, tool manufacturers and filter unit producers.

According to TWE, ParaJet evo offers several advantages. Among them are better cleanliness and lower particle contamination at components, tools, machines and emulsions; improved filtering properties that influence the effectiveness of the emulsion positively; increasing emulsion life and reduced cleaning costs; downstream fine filters need to be exchanged less frequently; plant downtimes are reduced; increased quality of the finished product; even the smallest particles can be filtered and reduced abrasion, which reduces wear on machines and tools.

From Boersma’s point of view, the growth potential in the filtration market is massive. “Our aim is to become an important partner for our customers and with that become a more significant part of the group. The filtration market is also more demanding, in terms of efficiency and accuracy. Therefore our filtration product range is the largest of all business units. Also the range of customers is so diverse. The filtration market is challenging, this is one of the pillars of TWE: we love to be challenged,” he says.

Investment Continues for Ahlstrom-Munksjö

In its most recent report, Ahlstrom-Munksjö reported solid demand across many regions and end-use segments for filtration products, particularly in heavy-duty vehicles and industrial air.

The Finnish producer of sustainable and innovative fiber-based solutions responded to growth in this market with investments, particularly through capacity expansion in high-end filtration materials. In June, the company announced it would invest about €28 million to expand manufacturing capacity and product capabilities to help grow its filtration business. The project includes adding capacity in Turin, Italy, and rebuilding and modifying existing sites in Malmedy, Belgium, and Ställdalen, Sweden.

“This investment will enable us to create additional capacity in Turin, Italy, and will allow us to support growing demand for high-end filtration materials,” says Fulvio Capussotti, executive vice president of Business Area Filtration and Performance.

Ahlstrom-Munksjö has also reported demand for filtration media in South America and recently took the first step toward a potential capacity expansion in Louveira, Brazil, where it purchased a piece of land adjacent to its existing plant. The Louveira plant, which is in the San Paolo region of Brazil, employs about 110 people and makes filtration media for transportation and industrial applications.

This purchase followed news in 2016 of the company’s plans to increase its filtration portfolio with an investment in Madisonville, KY. When it was still known as Ahlstrom, the company invested approximately €23 million in its engine and industrial filtration product capabilities at the plant, which was completed during the first half of this year.

In product news, Ahlstrom-Munksjö announced in March the launch of Trinitex Advance W3200, a unique E12 filtration media specifically designed for pulse jet gas turbine applications. Trinitex Advance W3200 is an extension of the Trinitex Advance product range of high performance filtration media designed to purify air for different industrial applications, which first came to market in 2017.

Trinitex Advance W3200 has the ability to combine EPA (Efficiency Particulate Air) EN1822 E12 Efficiency Class, producing up to 30 times purer air than media with E10 Efficiency, while delivering unrivaled protection of the gas turbine in all demanding conditions, especially humid or industrial environments.

“We are very pleased to introduce the W3200 grade into our Trinitex Advance platform, bringing to market a filter media with exceptional performance levels for pulse jet gas turbine applications,” says Capussotti. “Delivering high performance filtration media for industrial filtration is a priority for our business area and we will continue to develop and strengthen our product offering.”

Noora Blasi, marketing communications manager, Filtration & Performance, adds, “Product development is a key success factor in filtration. As global and regional trends emerge evolve, the filtration industry is in constant need to adjust its offering and create solutions that will need these changing market needs. The filter media supplier plays a key role in this work and we are constantly working with our customer globally to understand and respond to their needs for future products. We have developed though out the years a deep understanding of filtration mechanism and filtration media and in collaboration with major stakeholders along the value chain, we use these unique know how and capabilities to develop new unique solutions for our customer and the final market.”

Bondex Expands Hydrolox Range

Bondex, of Trenton, SC, is part of the U.K.-based multi-national manufacturing company Andrew Industries. Brian Little, senior vice president, sales and marketing, says Bondex’s parent company has always viewed the filtration industry as a strategic market as the technical and commercial requirements align with its core competencies of quality, service and innovation, and both Bondex and Andrew are witnessing growth in this segment.

“The global economy continues to expand, in part due to growth in industrial production. As manufacturing growth continues, users demand higher performance filtration media which is necessary to meet emissions regulations and productivity goals,” Little says. “Achieving this balance in filtration efficiency and plant throughput is driving growth in pleatable filter media as well as new compositions and consolidation technologies.”

One of the more recent developments from Bondex is a unique process technology that produces its Hydrolox and Hydrolox HCE products. Using ultra-high pressure hydroentangling, Hydrolox represents a new paradigm of mechanically robust felt with finer pore sizes than needle felt which delivers superior filtration efficiency than the incumbent filter felt. Meanwhile, Hydrolox HCE, which stands for “high collection efficiency,” utilizes the Bondex process technology in combination with fine fiber and splittable fibers to deliver filtration efficiency that are equal to membrane laminated needlefelt.

Bondex, which launched Hydrolox in 2017, expanded the Hydrolox portfolio beyond aramid, polyester and PPS to now include blends with PTFE, which will be commercialized this fall. “We anticipate that our aramid/PTFE Hydrolox HCE product will deliver filtration efficiency equal to membrane which can serve a wide variety of applications where membrane laminated needlefelt would otherwise be compromised,” Little says.

Bondex also developed a pleatable polyester Hydrolox product to respond to growing market needs in pleatable filtration media.

“Our market intelligence informs us of the growing needs for superior filtration performance. We have designed Hydrolox to address these needs without sacrificing permeability in a mechanically robust solution,” Little explains. “As industry needs continue to change, the filtration market desires partnerships which can develop innovative solutions in order to deliver growth. We see Bondex and the Hydrolox family of products providing value to customers with these challenges.”

As the market continues to grow, the company continuously makes investments in order to enhance its filtration portfolio. Recently it installed a new Brückner Stentor, and with this Bondex can now offer oleophobic, hydrophobic, acid resistant, and other water-based treatments to its products. The company has also recently added high temperature lamination capabilities to provide ePTFE laminated to woven glass and aramid felt materials.

Kimberly-Clark Focuses on Indoor Air Quality

Growing awareness of health dangers associated with dust, mold, pollution, bacteria and allergens in indoor air is helping fuel growth in the filtration market, according to manufacturing giant Kimberly-Clark. “Globally, we continue to see interest in improving health and productivity and a growing awareness about how time spent at work, at school and in public indoor spaces can affect health and productivity,” says Juliana Khouri, category marketing manager, Partnership Products, Kimberly-Clark Professional. “Air filters with high particle capture efficiencies – especially of submicron particles – are critical for achieving good indoor air quality (IAQ) and helping building occupants avoid the cost of productivity and health problems associated with poor IAQ.”

Kimberly-Clark offers nonwoven air filtration media, including both high-loft and low-loft nonwoven filter media with an electret charge. Its high-loft bicomponent spunbond media, sold under the Intrepid brand, is typically used in MERV 7-15 pleat, pocket and mini-pleat filters for commercial and institutional HVAC systems, while our low-loft media is typically used in rigid pleat applications including car cabin air filters and air purifiers.

“Kimberly-Clark Professional air filtration media is meeting demands for improved indoor air quality and reduced energy consumption/costs,” says Khouri. “The key to meeting those demands is the electret charge imparted to our nonwoven filter media, which provides high initial and sustained particle capture efficiencies with a low airflow resistance.”

Currently, Kimberly-Clark is in the process of launching a new commercialization project: “Solution Squad,” a specialized team of experts who work hand-in-hand with its customers to help them create superior filters and gain a competitive edge. “When customers activate the Solution Squad, a Kimberly-Clark Advocate responds within 24 hours to arrange a no-obligation phone consultation to learn more about the customer’s filter design, performance specifications and manufacturing process,” Khouri explains.

Despite filtration being a competitive market, with many filters specified and sold based strictly on purchase price, it is an attractive market for the company. “Kimberly-Clark Professional can differentiate itself with not only a superior product that gives filter manufacturers a competitive edge, but also with the support we can bring to the table as a true partner who knows what it takes to help them succeed in the marketplace,” Khouri says. “There are also synergies between the media we supply to the air filtration market – with our focus on delivering cleaner air for healthier, more productive building occupants – and Kimberly-Clark’s corporate and social focus on creating long-term impact with essential products that improves people’s lives.”

Lydall Acquires PCC’s Filtration Business

Lydall Inc. recently grew its filtration business through acquisition when it purchased the Precision Filtration division of Precision Custom Coatings based in Totowa, NJ.

Precision Filtration is a long-time producer of high-quality, air filtration media principally serving the commercial and residential HVAC markets with MERV 7 – 11 products. The addition of these products and capabilities enables Lydall to provide its customers with a full range of air filtration media from low efficiency MERV 7 through high-performing ULPA. Additionally, this acquisition further enhances Lydall’s flexibility in manufacturing, planning and logistics for its new and existing customers. Full integration into Lydall is expected by the end of this year.

“We are extremely excited about the acquisition of the filtration business of Precision Custom Coatings as it coincides perfectly with our strategy of continuing to grow our product offering in the filtration space with high-quality products that are valued by our customers,” Paul Marold, president Lydall Performance Materials, said at the time of the announcement. “Precision Custom Coatings has developed excellent products while nurturing strong relationships with a customer base that is complementary to ours. This will lead to a seamless transition to Lydall Performance Materials.”

Lydall has been focused on investment in recent years. It most recently acquired Interface Performance Materials, which manufactures complete sealing solutions. In 2016 Lydall acquired German needlepuncher MGF Gutsche and Texel, a Canadian needlepuncher, as well as the baghouse filtration operations of Andrew Industries in 2015.

Mann+Hummel Expands into New Markets

Since its founding in 1941 as an automotive components supplier, Ludwigsburg, Germany-based Mann+Hummel has made significant contributions towards developments in filter technology. The company today offers a wide-range of filter systems including systems and components for automotive original equipment, products for the automotive aftermarket, industrial filters and water filtration.

According to Miriam Teige, manager Corporate Communications, Mann+Hummel, the company is aiming to get more independent from the automotive industry—currently about 90% of its business is for internal combustion engines and related business. Mann+Hummel is taking steps to grow outside of automotive by increasing M&A activity in other markets outside the automotive industry, including in building filtration with its recent acquisition of Tri-Dim Filter Corporation.

Mann+Hummel completed the acquisition of Tri-Dim, a Louisa, VA-based air filtration company, at the end of August. Tri-Dim specializes in air filtration for a variety of commercial and industrial spaces including hospitals, schools, automotive factories and paint rooms, data centers, food and beverage settings, and many more commercial environments.

“Mann+Hummel is committed to expanding in the air and water filtration industries, and we are thrilled with the addition of the Tri-Dim team,” Håkan Ekberg, group vice president of Mann+Hummel’s Life Sciences & Environment business unit, said at the time of the acquisition.

Tri-Dim is a provider of a full-line of HVAC filtration products and services, including air & liquid filtration, heating/air conditioning supplies, cleanroom filtration, air purification equipment, gas phase filtration, and air testing & remediation.

“This strategic move is an exciting next step in our continued commitment to product innovation, customer service and growth, mainly in the U.S., where Tri-Dim has more than 10 locations,” says Teige. “Tri-Dim will be able to leverage the purchasing power of Mann+Hummel for common filtration components, like filtration media for example. We also hope to enact some of Mann+Hummel’s best practices in operations, distribution and logistics systems, giving Tri-Dim a foundation for accelerated growth.”

Sandler Sees Opportunities for Growth

Some of the major factors shaping the filtration market and inducing continued growth are the growth of metropolitan areas, the increase in the number of vehicles on the roads, as well as more stringent regulations on indoor air quality, which all require new product solutions, according to Peter Reich, associate sales director Filtration Products at Sandler.

Particularly, he adds, the increasingly stringent demands on indoor air quality have also brought about new international standards on filtration performance, such as the ISO 16890 standard. “Product development in the filtration industry is responding to these changes. Filter media have to offer both high filtration performance and energy efficiency,” he explains.

The continued trend towards fully synthetic filter media in this market is creating additional growth opportunities for Sandler, Reich says.

In the filtration market Sandler develops and produces synthetic filter media for HVAC applications, the transportation industry, synthetic vacuum cleaner bags, customized special filters for liquid filtration as well as medical and hygiene applications. The product range comprises fiber-based nonwovens and meltblown filter media for filters classed G1–E11 / MERV 1-16 and for all efficiency ranges according to ISO 16890. Sandler’s pocket and pleat filter media are made of finest fibers, produced using submicron fibers and featuring a large inner surface that facilitates mechanical deposition effects. “They combine a permanently high filtration performance and a long operating life. The nonwovens maintain their efficiency even after discharge,” Reich explains.

Among its latest developments are filter media for use in activated carbon filters. “With these products, the functionality of activated carbon filters and the optimum particle filtration provided by nonwoven media can be combined in a durable product—for example for cabin air filtration in vehicles,” he says.

Filtration has always been an important business segment for Sandler and—as in all of its market segments—the manufacturer cooperates closely with its customers in developing new products, Reich adds.

“In general, the filtration industry holds a lot of potential and demand for innovation; product development is ongoing; new norms and standards change the market,” he says. “The importance of this sector is likely to continue to grow in light of new legislation and environmental concerns. There is potential for growth and new challenges arise regarding major trends such as electromobility and regarding new players from countries such as China. All in all, that certainly makes it an interesting market to do business in.”

TWE Group Offers a Range of Media

In the air filtration market, Emsdetten, Germany-based TWE Group is supplying filter media that are converted into filters such as pocket filters, filter cassettes and pads. “With the introduction of the new norm ISO 16890, new 100% synthetic media is required with a higher filtration efficiency,” says Marcel Boersma, sales manager Air Filtration, TWE Group.

TWE’s R&D department has been working hard to achieve this and will release new products third quarter of 2019.

“With these new products we do not only think we have more chances in the market, but we also believe we can be of added value by making these products 100% synthetic,” Boersma explains. “This is a major step forward to step into the market which is dominated by glass based media. Glass fibers have a long tradition in the filtration business, but we believe synthetic fiber based media are better for health of the ones working with the media and process it into a complete filter.”

TWE’s newest innovation in the liquid filtration market is ParaJet evo, a development from its ParaJet portfolio. These products are made of a fiber blend of polyester and micro polyester fibers, cross-laid and hydroentangled. This filter allows a higher separation efficiency thanks to its new fiber mix. It is used in application areas such as the metal working industry, automotive industry, rolling mills, wire drawing industry, tool manufacturers and filter unit producers.

According to TWE, ParaJet evo offers several advantages. Among them are better cleanliness and lower particle contamination at components, tools, machines and emulsions; improved filtering properties that influence the effectiveness of the emulsion positively; increasing emulsion life and reduced cleaning costs; downstream fine filters need to be exchanged less frequently; plant downtimes are reduced; increased quality of the finished product; even the smallest particles can be filtered and reduced abrasion, which reduces wear on machines and tools.

From Boersma’s point of view, the growth potential in the filtration market is massive. “Our aim is to become an important partner for our customers and with that become a more significant part of the group. The filtration market is also more demanding, in terms of efficiency and accuracy. Therefore our filtration product range is the largest of all business units. Also the range of customers is so diverse. The filtration market is challenging, this is one of the pillars of TWE: we love to be challenged,” he says.