09.11.17

Weinheim, Germany

www.freudenberg-pm.com

2017 Nonwovens Sales: $2.1 billion

(including sales from Freudenberg Performance Materials,

Freudenberg Filtration Technologies and Japan Vilene)

Key Personnel

Frank Heislitz, CEO; Thomas Herr, CFO; John McNabb, COO

Plants

Weinheim, Germany; Neuenburg, Germany; Kaiserslautern, Germany; Greetland, U.K.; Swindon, U.K.; Littleborough, Wales, U.K.; Colmar, France; Barcelona, Spain; Nizhiniy, Novgorod, Russia; Sant´ Omero, Italy; Cossato, Italy; Novedrate, Italy; Pisticci, Italy; Suzhou, China; Nantong, China; Chennai, India; Pyungtaek, South Korea; Yang Mei, Taiwan; Tayuan, Taiwan; San Martin/Buenos Aires, Argentina; Durham, NC; Jacarei, Brazil; Cape Town, South Africa; Macon, GA

ISO Status

All locations are ISO 9001 and ISO 14001 certified; locations serving the automotive industry are TS 16469 certified; all sites are OHSAS 18001 certified

Processes

Drylaid staple fiber, wetlaid, spunbond, meltblown, needlepunch, thermal bond, chemical bond, water entanglement

Brands

Comfortemp, Evolon, SoundTex, Vlieseline, Terbond, Texbond

Major Markets

Automotive, apparel, construction, building interiors, energy, medical, hygiene and special applications, shoe and leather goods

Nonwovens sales at Freudenberg Group, including contributions from the Performance Materials division, Filtration Technologies and Japan Vilene, reached €1.909 billion ($2.1 billion) in 2017. According to executives the year was mostly positive despite weakened demand in some markets and regions. Highlights include growth in medical and special applications like Freudenberg’s microfilament Evolon technology, a strong first half for the European construction market and growth in the apparel markets of China and India.

Challenges included slower than expected growth in hygiene and shoe components in South America, due to macroeconomic factors.

In fact, conditions in Argentina deteriorated to the point where Freudenberg decided to shutter its hygiene production operations at Villa Zagala at the end of the second quarter. Production of materials made at the site, which exclusively target the hygiene market, has been transferred to Freudenberg’s plant in Jacarei, Brazil.

“This decision was necessitated by the joint effects of market characteristics over recent years in combination with structural conditions in Argentina that have been unfavorable for this type of business,” CEO Frank Heislitz says. “We continue to serve our clients in the usual way from a modern facility with a highly efficient production system as part of our strategy of asset consolidation. Other Freudenberg Group companies and the shoe and interlinings divisions belonging to Freudenberg Performance Materials have and will continue their operations as usual.”

The closure of the hygiene production was not the first measure Freudenberg made to secure itself against difficult conditions in Argentina. In 2016, the company launched a major restructuring of its hygiene operations, where it is a niche player making acquisition and distribution layer materials for diapers and feminine hygiene items. This effort initially was successful and executives said the initial turnaround in South America was a major contributor to profit growth in the division in 2016.

In other restructuring efforts, Freudenberg has taken steps to improve its flexibility to respond to changing market conditions and customer demands. In Weinheim, Germany, the company decided to outsource its warehousing and logistics operations to increase flexibility.

“Restructuring in Weinheim has allowed external partners to handle logistics better than we can. More agile production allows us to react more quickly,” says Heislitz.

Amidst these efforts, Freudenberg continues to enlarge the scope of its business through investment. In March 2018, the company announced it would add a production line in Tayuan Tao-Yuan, Taiwan. Expansion of this capacity will allow the company to meet growing demand in the traditional automotive and carpet markets in Asia. The investment will add about 11,000 metric tons to Freudenberg’s Taiwan capacity. It is expected to be complete by 2020.

“The expansion of our capabilities underscores our long-term commitment to Asia. We want to continue to support our customers in the automotive and carpet markets with innovative and sustainable solutions that will help them grow,” Heislitz says.

Freudenberg currently supplies Asia with primary and secondary carrier materials for automotive carpet moldings and inlay mats, as well as dry running mats, carpets and carpet tiles. The high-performance materials are easy to form and thus contribute to economical processing. In addition, their high dimensional stability ensures a precise fit and they are extremely durable.

This capacity expansion will also enable Freudenberg to develop the company’s regional position.

“Asia is a very important market for us as a global player. Through our technologically leading solutions, we want to continue to grow with our customers in this region and at the same time make a significant technological contribution to their success,” says Lin Gow Ming, president of Freudenberg Far Eastern Spunweb Co. Ltd.

“Our process technology and spinning technology is constantly being improved to meet customer requirements,” Heislitz says. “With the new line we can further reduce weights, which is particularly in demand in automotives and carpet tiles, without sacrificing tufting performance.”

In addition to the Taiwan site, Freudenberg operates a spunbond operation in Durham, NC, where it has recently upgraded a PA2 line, allowing it to make more uniform substrates impacting the tufting performance of materials for carpet backing, automotives, carpet tiles and shoe components markets.

“Upgrading the new line was a logical step,” Heislitz says. “We improve the line to bring the latest technology to meet customer demand for light-weight carpet tiles and carpet backing.”

Meanwhile, in Freudenberg’s construction business, the company completed work on a new line in Macon, GA in mid-2017. The new line, which represents a new technology for Freudenberg, will allow the company to offer glass reinforced polyester spunbond nonwovens to satisfy demand in the roofing markets. The line, which is supplementing output from three staple fiber lines already located in Macon, was originally going to replace existing capacity but strong market conditions kept all four lines up and running.

Other areas of strength for Freudenberg’s nonwovens business include filtration, interiors and medical, particularly in advanced wound care, which is a growing market for Freudenberg.

“A big factor in the medical market is the aging populations. Growth is being driven by things like diabetes and obesity,” Heislitz says. “It’s not just wound care because that is a commodity.”

In 2015, Freudenberg expanded into foam technology through the acquisition of Polymer Health Technology, a Wales, U.K.-based supplier of polyurethane foams for advanced wound care applications, allowing it to broaden its offerings to the market. Freudenberg is now working on merging its nonwovens expertise with these new capabilities in the foam market to develop valued added products for this market.

Freudenberg’s strategy was the same when it acquired Hansel, a German-based manufacturer of knitted interlinings in 2015. While Hansel did not participate in nonwovens, its expertise in adjacent markets helped Freudenberg expand its offerings in the apparel segments.

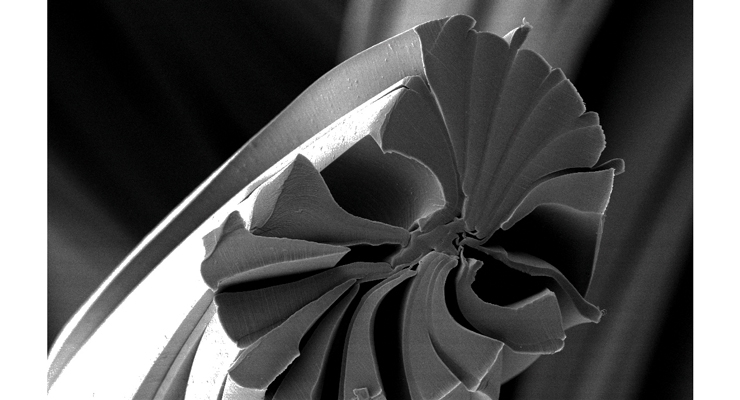

Another market growing in importance is battery separators. As this market shifts its preference from nickel to lithium ion, Freudenberg already provides a solution to create value with its ceramic-coated polyester materials. “We already had out first customers in 2017 and this has gotten us through the learning curve,” Heislitz says. “Even for other applications and demands Freudenberg offers its fuel cell technology, which is becoming a very significant business for us.”

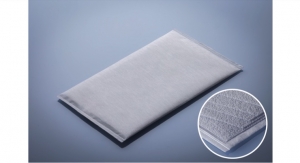

Meanwhile, in November 2017, Freudenberg introduced Evolon New Generation, which builds on the success of its unique Evolon microfilament technology first introduced in 1999. Evolon New Generation is made from super-microfilaments that are half the thickness and twice the density of those used in the original Evolon, opening up entirely new applications in the fields of bedding, technical packaging and many others.

Executives says the technical possibilities of Evolon New Generation are enormous. ”It was time to do something new in Evolon,” Heislitz says. “In some applications we were facing higher customer demands and the new technology addresses this. We have not fully utilized the full potential of [this] new Evolon.”

www.freudenberg-pm.com

2017 Nonwovens Sales: $2.1 billion

(including sales from Freudenberg Performance Materials,

Freudenberg Filtration Technologies and Japan Vilene)

Key Personnel

Frank Heislitz, CEO; Thomas Herr, CFO; John McNabb, COO

Plants

Weinheim, Germany; Neuenburg, Germany; Kaiserslautern, Germany; Greetland, U.K.; Swindon, U.K.; Littleborough, Wales, U.K.; Colmar, France; Barcelona, Spain; Nizhiniy, Novgorod, Russia; Sant´ Omero, Italy; Cossato, Italy; Novedrate, Italy; Pisticci, Italy; Suzhou, China; Nantong, China; Chennai, India; Pyungtaek, South Korea; Yang Mei, Taiwan; Tayuan, Taiwan; San Martin/Buenos Aires, Argentina; Durham, NC; Jacarei, Brazil; Cape Town, South Africa; Macon, GA

ISO Status

All locations are ISO 9001 and ISO 14001 certified; locations serving the automotive industry are TS 16469 certified; all sites are OHSAS 18001 certified

Processes

Drylaid staple fiber, wetlaid, spunbond, meltblown, needlepunch, thermal bond, chemical bond, water entanglement

Brands

Comfortemp, Evolon, SoundTex, Vlieseline, Terbond, Texbond

Major Markets

Automotive, apparel, construction, building interiors, energy, medical, hygiene and special applications, shoe and leather goods

Nonwovens sales at Freudenberg Group, including contributions from the Performance Materials division, Filtration Technologies and Japan Vilene, reached €1.909 billion ($2.1 billion) in 2017. According to executives the year was mostly positive despite weakened demand in some markets and regions. Highlights include growth in medical and special applications like Freudenberg’s microfilament Evolon technology, a strong first half for the European construction market and growth in the apparel markets of China and India.

Challenges included slower than expected growth in hygiene and shoe components in South America, due to macroeconomic factors.

In fact, conditions in Argentina deteriorated to the point where Freudenberg decided to shutter its hygiene production operations at Villa Zagala at the end of the second quarter. Production of materials made at the site, which exclusively target the hygiene market, has been transferred to Freudenberg’s plant in Jacarei, Brazil.

“This decision was necessitated by the joint effects of market characteristics over recent years in combination with structural conditions in Argentina that have been unfavorable for this type of business,” CEO Frank Heislitz says. “We continue to serve our clients in the usual way from a modern facility with a highly efficient production system as part of our strategy of asset consolidation. Other Freudenberg Group companies and the shoe and interlinings divisions belonging to Freudenberg Performance Materials have and will continue their operations as usual.”

The closure of the hygiene production was not the first measure Freudenberg made to secure itself against difficult conditions in Argentina. In 2016, the company launched a major restructuring of its hygiene operations, where it is a niche player making acquisition and distribution layer materials for diapers and feminine hygiene items. This effort initially was successful and executives said the initial turnaround in South America was a major contributor to profit growth in the division in 2016.

In other restructuring efforts, Freudenberg has taken steps to improve its flexibility to respond to changing market conditions and customer demands. In Weinheim, Germany, the company decided to outsource its warehousing and logistics operations to increase flexibility.

“Restructuring in Weinheim has allowed external partners to handle logistics better than we can. More agile production allows us to react more quickly,” says Heislitz.

Amidst these efforts, Freudenberg continues to enlarge the scope of its business through investment. In March 2018, the company announced it would add a production line in Tayuan Tao-Yuan, Taiwan. Expansion of this capacity will allow the company to meet growing demand in the traditional automotive and carpet markets in Asia. The investment will add about 11,000 metric tons to Freudenberg’s Taiwan capacity. It is expected to be complete by 2020.

“The expansion of our capabilities underscores our long-term commitment to Asia. We want to continue to support our customers in the automotive and carpet markets with innovative and sustainable solutions that will help them grow,” Heislitz says.

Freudenberg currently supplies Asia with primary and secondary carrier materials for automotive carpet moldings and inlay mats, as well as dry running mats, carpets and carpet tiles. The high-performance materials are easy to form and thus contribute to economical processing. In addition, their high dimensional stability ensures a precise fit and they are extremely durable.

This capacity expansion will also enable Freudenberg to develop the company’s regional position.

“Asia is a very important market for us as a global player. Through our technologically leading solutions, we want to continue to grow with our customers in this region and at the same time make a significant technological contribution to their success,” says Lin Gow Ming, president of Freudenberg Far Eastern Spunweb Co. Ltd.

“Our process technology and spinning technology is constantly being improved to meet customer requirements,” Heislitz says. “With the new line we can further reduce weights, which is particularly in demand in automotives and carpet tiles, without sacrificing tufting performance.”

In addition to the Taiwan site, Freudenberg operates a spunbond operation in Durham, NC, where it has recently upgraded a PA2 line, allowing it to make more uniform substrates impacting the tufting performance of materials for carpet backing, automotives, carpet tiles and shoe components markets.

“Upgrading the new line was a logical step,” Heislitz says. “We improve the line to bring the latest technology to meet customer demand for light-weight carpet tiles and carpet backing.”

Meanwhile, in Freudenberg’s construction business, the company completed work on a new line in Macon, GA in mid-2017. The new line, which represents a new technology for Freudenberg, will allow the company to offer glass reinforced polyester spunbond nonwovens to satisfy demand in the roofing markets. The line, which is supplementing output from three staple fiber lines already located in Macon, was originally going to replace existing capacity but strong market conditions kept all four lines up and running.

Other areas of strength for Freudenberg’s nonwovens business include filtration, interiors and medical, particularly in advanced wound care, which is a growing market for Freudenberg.

“A big factor in the medical market is the aging populations. Growth is being driven by things like diabetes and obesity,” Heislitz says. “It’s not just wound care because that is a commodity.”

In 2015, Freudenberg expanded into foam technology through the acquisition of Polymer Health Technology, a Wales, U.K.-based supplier of polyurethane foams for advanced wound care applications, allowing it to broaden its offerings to the market. Freudenberg is now working on merging its nonwovens expertise with these new capabilities in the foam market to develop valued added products for this market.

Freudenberg’s strategy was the same when it acquired Hansel, a German-based manufacturer of knitted interlinings in 2015. While Hansel did not participate in nonwovens, its expertise in adjacent markets helped Freudenberg expand its offerings in the apparel segments.

Another market growing in importance is battery separators. As this market shifts its preference from nickel to lithium ion, Freudenberg already provides a solution to create value with its ceramic-coated polyester materials. “We already had out first customers in 2017 and this has gotten us through the learning curve,” Heislitz says. “Even for other applications and demands Freudenberg offers its fuel cell technology, which is becoming a very significant business for us.”

Meanwhile, in November 2017, Freudenberg introduced Evolon New Generation, which builds on the success of its unique Evolon microfilament technology first introduced in 1999. Evolon New Generation is made from super-microfilaments that are half the thickness and twice the density of those used in the original Evolon, opening up entirely new applications in the fields of bedding, technical packaging and many others.

Executives says the technical possibilities of Evolon New Generation are enormous. ”It was time to do something new in Evolon,” Heislitz says. “In some applications we were facing higher customer demands and the new technology addresses this. We have not fully utilized the full potential of [this] new Evolon.”