Dawnee Giammittorio, Associate Director, the Franken Group06.01.18

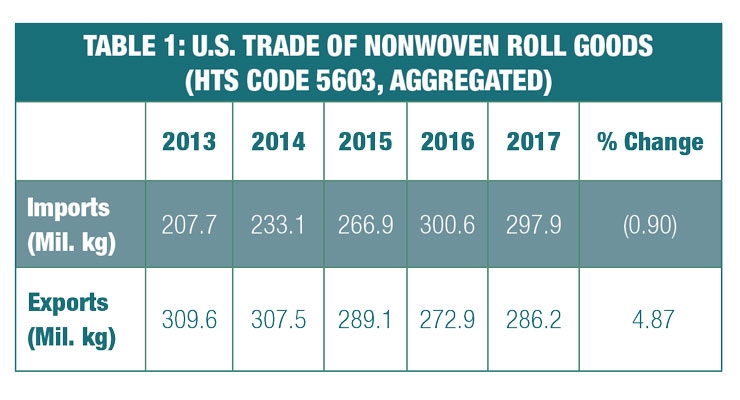

U.S. exports of nonwoven roll goods (categorized under Harmonized Tariff Schedule heading 5603) increased almost 5% in 2017, according to trade data recently released by the International Trade Commission. While this is welcome news following four consecutive years of decreases, the increase from 272.9 million kilograms (mil. kg) exported in 2016 to 286.2 in 2017 is still far below 2012 levels of 318.6 mil. kg. Imports of nonwoven roll goods to the U.S., in the meantime, fell slightly, by just under 1%, from 300.6 mil. kg. in 2016 to 297.9 in 2017. (See Table 1)

The dollar value of exports increased a corresponding 5% in 2017, again after consecutive years of falling values. Imports experienced a slight increase in value despite the slight decrease in volume. (See Table 2) Overall, a generally healthy report for the nonwovens industry in 2017.

Exports of U.S. goods to NAFTA countries continued the trend upward, accounting for 58.5% of all American exports increasing from 58.1% in 2016. In 2017, American exports to Mexico experienced a nominal increase while those to Canada jumped almost 12% from 2016 volumes. (See Table 3)

With over half of American nonwoven goods going to NAFTA destinations Mexico and Canada, the impact from the renegotiation of NAFTA is of great interest to the industry. Country representatives have been meeting regularly throughout the spring in hopes of finalizing a deal before politics, specifically Mexico’s elections in July and Congressional midterms in November, even further complicate negotiations. Negotiation observers report that changes to textile specific provisions will be neutral or favorable to the nonwovens industry.

Table 4 shows the top 10 export destinations for American nonwoven roll goods, and the top 10 countries importing to the United States. The four countries that received the most U.S exports remained the same in 2107. Noteworthy changes included: Belgium falling from fifth to seventh with a drop of 12% in volume of exports after an increase of 28% in 2016; the U.K. rising to number six from number eight with an almost 25% increase over 2016 amounts; and Germany remaining stable at eighth after a drop of 35% in export volume in 2016.

China was again the number one importer to the U.S. with only a slight decline in volume from 2016 amounts. India continued its upward trend following 2016’s increase of 35% with an 11% in 2017. Germany fell from second to third with a decline of 9%. Mexico continued its trend upward with a 65% leap in 2017 after an almost 29% increase in 2016.

In addition to renegotiating NAFTA, the Trump administration is focusing on trade deficits and bad trade deals. To that end, the U.S. Trade Representative (USTR) announced in March that an agreement in principle had been reached on the general terms of amendments and modifications to the U.S.-Republic of Korea Free Trade Agreement (KORUS FTA). While there is a textiles-related component of the agreement to update KORUS, no changes were made to any of the primary textiles provisions. Instead, the textiles component of the recent agreement will “expedite the commercial availability review process” of a forthcoming request from Korea to change the KORUS rules of origin to allow three inputs to be sourced from outside the FTA area. The three products are viscose rayon staple fibers, certain cuprammonium rayon filament yarns and cashmere yarn. The latter two were on the previous short supply list for KORUS, which expired January 1, 2017. The review of these products will begin with a Federal Register request for comments and will follow commercial availability review procedures in KORUS.

In addition to renegotiating old trade agreements which the president deems unfair to the U.S. and imposing additional tariffs on steel and aluminum imports, the president has also targeted thousands of Chinese products for additional tariffs in retaliation for trade violations. The 2018 Trade Policy Agenda prepared by the Office of the U.S. Trade Representative lists the administration’s priorities as: the aggressive enforcement of U.S. trade laws, the use of trade to support national security objectives, and an effort to limit the role of the World Trade Organization. Expect an eventful year for U.S. trade.

The highly-anticipated Miscellaneous Tariff Bill Act of 2018 (MTB) that would provide import duty relief for hundreds of U.S. imports including some viscose rayon staple fibers continues to languish on Capitol Hill, with no clear timeline for final passage.

The House of Representatives unanimously passed the bill on Jan. 16, and manufacturers have been calling on the Senate to move the stalled bill ever since. The Senate leadership had considered including the MTB in the omnibus spending package but ultimately decided not to, once again casting doubt on a path forward. The latest report out of Congress is that the Senate intends to “hotline” the MTB, a process that Senate leadership can use to move a bill quickly and call for unanimous consent.

The MTB provides critical duty relief for manufacturing inputs not available in the United States. For decades, Congress renewed the benefits for three-year terms, however, when most recent package expired at end of 2012, Congress failed to pass a new MTB package due to concerns about whether the petition process constituted earmarking. After several years of unsuccessful attempts to revamp the process, Congress passed MTB reform legislation in 2016 which created a more transparent process where individual petitions are submitted to and vetted by the International Trade Commission rather than a member of Congress.

The MTB omnibus bill currently under consideration in the Senate is the first to have gone through this rigorous new process. Historically, the nonwovens industry has enjoyed valuable duty benefits provided by previous MTBs for some categories of viscose rayon staple fibers. Several petitions (though not all) for rayon, as well as other needed raw materials, are included in the current bill. The longer that the Senate takes to pass the MTB, the more it will cost manufacturers to produce their goods and compete.

The Franken Group, LLC is a government and public affairs consulting firm based in Arlington, Virginia.

The dollar value of exports increased a corresponding 5% in 2017, again after consecutive years of falling values. Imports experienced a slight increase in value despite the slight decrease in volume. (See Table 2) Overall, a generally healthy report for the nonwovens industry in 2017.

Exports of U.S. goods to NAFTA countries continued the trend upward, accounting for 58.5% of all American exports increasing from 58.1% in 2016. In 2017, American exports to Mexico experienced a nominal increase while those to Canada jumped almost 12% from 2016 volumes. (See Table 3)

With over half of American nonwoven goods going to NAFTA destinations Mexico and Canada, the impact from the renegotiation of NAFTA is of great interest to the industry. Country representatives have been meeting regularly throughout the spring in hopes of finalizing a deal before politics, specifically Mexico’s elections in July and Congressional midterms in November, even further complicate negotiations. Negotiation observers report that changes to textile specific provisions will be neutral or favorable to the nonwovens industry.

Table 4 shows the top 10 export destinations for American nonwoven roll goods, and the top 10 countries importing to the United States. The four countries that received the most U.S exports remained the same in 2107. Noteworthy changes included: Belgium falling from fifth to seventh with a drop of 12% in volume of exports after an increase of 28% in 2016; the U.K. rising to number six from number eight with an almost 25% increase over 2016 amounts; and Germany remaining stable at eighth after a drop of 35% in export volume in 2016.

China was again the number one importer to the U.S. with only a slight decline in volume from 2016 amounts. India continued its upward trend following 2016’s increase of 35% with an 11% in 2017. Germany fell from second to third with a decline of 9%. Mexico continued its trend upward with a 65% leap in 2017 after an almost 29% increase in 2016.

In addition to renegotiating NAFTA, the Trump administration is focusing on trade deficits and bad trade deals. To that end, the U.S. Trade Representative (USTR) announced in March that an agreement in principle had been reached on the general terms of amendments and modifications to the U.S.-Republic of Korea Free Trade Agreement (KORUS FTA). While there is a textiles-related component of the agreement to update KORUS, no changes were made to any of the primary textiles provisions. Instead, the textiles component of the recent agreement will “expedite the commercial availability review process” of a forthcoming request from Korea to change the KORUS rules of origin to allow three inputs to be sourced from outside the FTA area. The three products are viscose rayon staple fibers, certain cuprammonium rayon filament yarns and cashmere yarn. The latter two were on the previous short supply list for KORUS, which expired January 1, 2017. The review of these products will begin with a Federal Register request for comments and will follow commercial availability review procedures in KORUS.

In addition to renegotiating old trade agreements which the president deems unfair to the U.S. and imposing additional tariffs on steel and aluminum imports, the president has also targeted thousands of Chinese products for additional tariffs in retaliation for trade violations. The 2018 Trade Policy Agenda prepared by the Office of the U.S. Trade Representative lists the administration’s priorities as: the aggressive enforcement of U.S. trade laws, the use of trade to support national security objectives, and an effort to limit the role of the World Trade Organization. Expect an eventful year for U.S. trade.

The highly-anticipated Miscellaneous Tariff Bill Act of 2018 (MTB) that would provide import duty relief for hundreds of U.S. imports including some viscose rayon staple fibers continues to languish on Capitol Hill, with no clear timeline for final passage.

The House of Representatives unanimously passed the bill on Jan. 16, and manufacturers have been calling on the Senate to move the stalled bill ever since. The Senate leadership had considered including the MTB in the omnibus spending package but ultimately decided not to, once again casting doubt on a path forward. The latest report out of Congress is that the Senate intends to “hotline” the MTB, a process that Senate leadership can use to move a bill quickly and call for unanimous consent.

The MTB provides critical duty relief for manufacturing inputs not available in the United States. For decades, Congress renewed the benefits for three-year terms, however, when most recent package expired at end of 2012, Congress failed to pass a new MTB package due to concerns about whether the petition process constituted earmarking. After several years of unsuccessful attempts to revamp the process, Congress passed MTB reform legislation in 2016 which created a more transparent process where individual petitions are submitted to and vetted by the International Trade Commission rather than a member of Congress.

The MTB omnibus bill currently under consideration in the Senate is the first to have gone through this rigorous new process. Historically, the nonwovens industry has enjoyed valuable duty benefits provided by previous MTBs for some categories of viscose rayon staple fibers. Several petitions (though not all) for rayon, as well as other needed raw materials, are included in the current bill. The longer that the Senate takes to pass the MTB, the more it will cost manufacturers to produce their goods and compete.

The Franken Group, LLC is a government and public affairs consulting firm based in Arlington, Virginia.