Karen McIntyre, Editor02.02.18

Spunmelt continues to grow. The most cost effective and flexible of nonwovens technologies, spunbond and spunmelt technologies also represent the highest share of the market in general, largely due to its prominent role in the hygiene market, which continues to grow despite competition from thermal bonded, spunlace and carded nonwovens.

“Spunmelt continues to displace other traditional materials in diaper components, for example tissue for core wraps, and Berry expects it to be adopted into further hygiene applications because of its versatility and cost-effectiveness. Legacy carded and paper-based materials will soon make way for spunmelt alternatives,” says Brodie Bauders, vice president, global hygiene at Berry Global. “Demand for spunmelt is continuing to grow across every region. We also see significant growth ahead in new applications seeking softer, lighter, high-loft materials and the high value that spunmelt offers.”

One of the leading manufacturers of spunmelt nonwovens globally, Berry operates more than 50 lines located around the world.

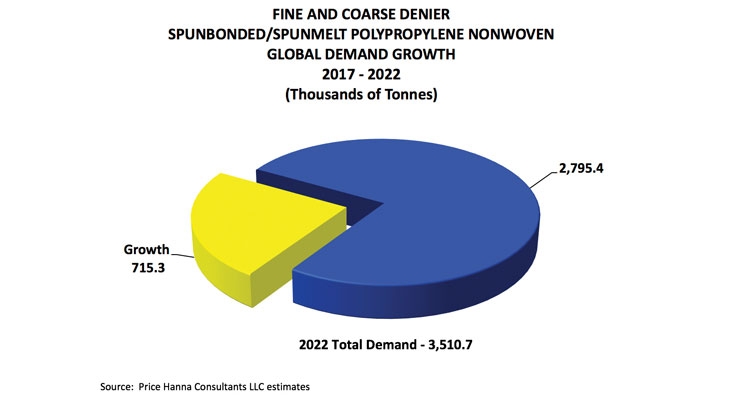

According to data provided by Price Hanna Consultants, capacity of spunbond/spunmelt polypropylene will grow 1.8% to reach 4.8 million tons by 2022 as manufacturers throughout the world continue to install new lines to supply demand growth in both the hygiene and non-hygiene markets and to operate the most modern technology.

David Price, principal of Price Hanna, says he views the markets in Greater Europe and North and South America to be oversupplied while China and other parts of Asia are a less so. Attractive demand growth for nonwovens made on this technology in China, Asia and Africa will drive new capacity installations over the next few years. Oversupply in Greater Europe, and the Americas will lessen over time as new capacity is absorbed and the pace of demand growth increases in South America. The retirement of early generation capacity could increase capacity utilization more quickly if accelerated.

“Demand for these nonwovens in disposable hygiene end uses continues to be the primary source of growth in China, India and Africa so that is where the opportunities for new capacity installations exist,” he says.

Indeed, new installations have already been announced by Toray and Berry in China. Avgol will soon begin commercial operations of new capacity in India. Toray and possibly other global producers are likely to add capacity in India as well. These installations follow recently completed investments from Fibertex Personal Care in Malaysia and Mitsui in Japan. Other investments will soon to be realized by Mitsui in Japan and Toray in South Korea in advance of planned new capacity installations by Asahi in Thailand and other producers in China.

These installations will feed high growth rates in China and other parts of Asia which are estimated in the high single digits. “Demand growth is not 20% like it once was in China but is still in the 10% range,” Price says. “The biggest growth driver is the continued penetration of disposable diapers, particularly in the rural regions where market penetration for these products is still relatively low.”

Talking Technology

The development and launch of Reifenhauser’s Reicofil 5, the newest platform upgrade to the company’s spunbond technology in more than a decade, is the big news of 2017. Already, some of the biggest names in nonwovens—Berry Global, Gulsan and Pegas—have announced they will install the technology. Despite oversupply in some global regions, more companies are likely to follow suit.

“Just like any technology, R5 technology will advance and be further refined over time with the basic elements remaining in place---higher productivity, lower denier, higher quality and the potential to realize lower cost of manufacture once full capacity utilization is achieved,” says Price. “It’s the smart technology for the future.”

According to Reicofil sales director Markus Müller, the real driver in interest for Reicofil 5, besides its increased speed and widened production window as well as the opportunity for large capacities (up to 35,000 tons per year), is the advantage in running finer fibers with standard resins, which means you can make much thinner filaments on the product side without using expensive metallocene resins.

Besides this, every RF5 by default comes with an anti-contamination package.

“Contamination is a huge issue in the diaper industry,” Müller says. “The big diaper companies are extremely sensitive when it comes to contamination of any kind, even a loose fiber. With social media it only takes a second for something strange on a diaper to be broadcast around the world and after a few minutes you see the corresponding stock price decrease.”

However, on top of all, says Müller, the biggest benefit in RF5 is thee huge digitalization or Industry 4.0 package, which will pave the path for future nonwoven productions. Digital Assistant, Performance Cockpit, Predictive Maintenance, Nonwoven Grading – just to mention a few features – will make roll goods productions easier, cleaner, safer and thus much more efficient.

While Müller would not go into specifics, he said with three RF5 lines on order and five other RF5 projects in firm discussions, the interest in the new technology is strong globally, even in world regions considered to be somewhat saturated when it comes to spunmelt. “It shows you that even when a market according to name-plate capacity is oversupplied in certain regions, opportunities still exist when you come up with new products and new solutions. Yet, when demand is really low Reicofil also offers the Smart lines, having capacities as low as 3500 tons per year to up to 9000 tons per year and delivering RF4-quality nonwovens.”

So far, just Gulsan has said it will add the largest, five-beam version of the technology to its Turkey plant, boosting that site’s capacity by 35,000 tons. Berry has reportedly ordered a 20,000-ton-per-year-line and Pegas’s R5 will be semi-commercial and part of a new global innovation center, which will help the company achieve significant success in research, testing and commercialization of new products with applications in current and new markets.

“By signing this memorandum, we have reached an important milestone of the project that we have worked on intensively with Reicofil for the last two years with the objective of developing a new type of technology,” CFO Frantisek Rezac says. “This new technology is based on the Reicofil 5 platform and the ‘no-basement’ concept. It utilizes proven bicomponent technologies, offers a wide range of fiber types and fiber profiles, while enabling the use of input raw materials different to those that we currently process. A significant element of this technology is also the nonwoven textile bonding system, which is an alternative to the presently used conventional systems.”

Expansion Continues

Spunmelt manufacturer Avgol is about to complete work on two spunmelt lines—one in Israel and one in India—to help it achieve growth in developing economies. A line in Dimona, Israel, will not only help boost growth in the Middle East in Europe but will capitalize on trade agreements between Israel and Brazil to fuel growth in Latin America. Meanwhile, India will help expand the company’s global exposure. “Moving into the Indian market is going to be something that is very exciting for Avgol and I think it’s being watched by a lot of people,” David Meldrem, CEO, says. “We are continuing efforts to move the Avgol brand around the world.”

Avgol also operates spunmelt manufacturing sites in North Carolina, Russia and Barkan, Israel. Last year, the company’s sales volumes grew 7.5% despite challenging conditions.

“Although demand for nonwovens continues to grow around the world—estimated at 3-5% growth, we have seen our good news of sales going on as our major two customers are facing their own challenges,” Meldrem says.

These two customers, Procter & Gamble and Kimberly-Clark, have been losing marketshare in some hygiene categories amidst growth in e-commerce sales and private labels, however as they respond to this pressure with stronger marketing efforts, Meldrem is confident this loss in marketshare will be recovered.

In the meantime, Avgol continues to work hard to widen its customer base.

“In 2017, we have seen some new customers starting to come on board. Continue to widen our customer base going forward. During the past few months, we have reached an agreement with a major hygiene customer that will nearly double our sales to them—predominantly in North America.”

Berry Global, a leading maker of nonwovens, continues to invest in its spunmelt business, announcing last year it would purchase a state-of-the-art Reicofil 5 asset for Asia. The investment will add 20,000 tons of capacity for the hygiene and healthcare markets when it starts up in China in 2019. The new line brings the total number of Berry’s spunmelt lines to more than 50.

Berry also continues to improve its lines throughout North and South America. In Europe, the company recently completed a $20 million upgrade to a Hygiene Center of Excellence in Terno d’Isola, Italy, which has helped Berry provide a wide offering and leading development and testing facilities in the hygiene market.

“This focus on investment to improve versatility, choice and innovation fits with Berry’s strategic intent to reduce complexity, provide focus, boost production quality and capacity to better serve its customers at a competitive cost,” says Bob Dale, vice president of Capital Engineering. “Spunmelt is an exciting technology, and we’re seeing diversification opportunities not only in hygiene, but in other applications too.”

The applications include the healthcare market where the technology can offer high liquid and microbial barrier attributes as well as strength and softness, and filtration and other technical markets. Berry also signaled its commitment to the agro market with a brand new Agriculture Center of Excellence in Biesheim, France, which utilizes high-quality spunmelt technology to provide worldwide solutions to the agriculture industry, underscoring the company’s commitment to enable its customers to grow.

“By creating Centers of Excellence for key markets, core technologies and applications in strategic locations around the world, we are helping our customers to win both regionally and globally,” Dale says.

In the future, Berry will grow, not only because of its willingness to invest in new technology but its ability to provide the service and support aspects that keep quality, consistency and customer satisfaction high.

“Spunmelt remains a competitive market, so we will continue to invest in innovation and technology to meet ever-increasing customer and consumer expectations,” Dale says. “We’re committed to investing in the newest and best technologies, but we’re also investing in the best people, and encouraging them to innovate and excel.”

Toray Advanced Materials is betting on continued growth in Asia and by all accounts is winning. In 2016, the company’s sales grew 11% to $341 million and the company expects this growth trajectory to continue in upcoming years.

Already, the region’s largest manufacturer of spunbond nonwovens, Toray announced in November 2017 it would add a second plant in China near the city of Foshan, in Guangdong Province in South China. Toray established a new company, Toray Polytech (Foshan) Co., Ltd. (TPF), and plans to set up a production facility with an initial annual capacity of 20,000 tons of spunbond nonwovens there. The facility is expected to start operations in fiscal year 2019. It will be the second polypropylene spunbond production facility in China for Toray. The company currently operates a four-line plant in Nantong, which is known as Toray Polytech (Nantong) Co., Ltd.

The new facility will meet growing demand for spunbond material from the disposable baby diaper market in China, which is growing as incomes rise and the birth rate increases following the end of the one-child policy in the country. The South China region currently accounts for nearly 60% of demand in the country and Toray is currently serving customers in the region from its Nantong site. The establishment of a site in South China will reaffirm Toray’s goal of being a leading supplier of polypropylene spunbond nonwovens in Asia.

In addition to its Chinese presence, Toray has spunbond production facilities in Indonesia, where it completed work on a second line last year, and Korea, where a new line is set to come onstream in 2018, and it is said to be adding a line in India.

“It is important to dominate the market in advance to achieve a steady growth in the hygiene business,”head of marketing Jason Lee says. “Toray strives to maintain its status as Asia’s No. 1 leader in the hygiene industry. For this reason, TAK plans to expand capacity in Asia focusing on Korea, China, and Indonesia.”

While Lee did not elaborate on where or when the investments will take place, he did say that the company has a plan to bring its total capacity to over 200,000 tons compared to its current capacity which will be approximately 135,000 tons once the new Korean line comes onstream. This will put Toray in an even better position to serve its customers.

“For global manufacturers, decisions to select suppliers are made based on the supply quantity, quality, delivery time and skill level of products,” Lee says. “Despite over-supply in the Asian market, there are only a few companies that provide high-quality products. Therefore it is still insufficient to fulfill the demands for differentiated polypropylene spunbond products required by global manufacturers.”

With an average annual growth rate of 8%, the Asian market has been an attractive one for investment for many nonwovens producers. Fibertex Personal Care has been highly successful with its Malaysian facility, which was first opened in 2002. Now said to be the largest non-Asian supplier of nonwovens to Japan, Fibertex Personal Care recently completed work on its fifth Malaysian line at a second site, bringing capacity in the country to about 90,000 tons.

The new site will allow Fibertex Personal Care to focus on value-added products and improve existing products, according to CEO Mikael Staal Axelsen. “The consumers and thereby the industry require hygiene products that are lighter, softer and with finer structures, and we have reached an advanced stage in the processing improvement race which becomes more and more predominant in our business.”

Fibertex Personal Care has also added these capabilities to its European operation. Last year, it upgraded one of its two existing lines in Aalborg, Denmark, to create a softer product and bring products made at the site up to par with its Malaysian site.

Some suppliers to the hygiene market, like Berry Global, have invested in carded nonwovens technologies to supplement their existing spunmelt offerings to hygiene and offer softer products, while others like Avgol and Fibertex Personal Care have focused on creating a softer spunmelt product to meet this demand.

Last year, Avgol launched a range of soft spunmelt products in response to this trend. Suitable for topsheet, backsheet and leg cuff applications, as well as ear and landing zone substrates, Avgol Lux was in development for years and is the result of significant research and development investment across a number of product performance parameters, optimizing softness and mechanical properties.

The Lux family of products includes Avgol SB & SMS Lux – Soft touch, Avsilk SB & SMS Lux – silky smooth softness and Avsoft & Avspun SB & SMS Lux – cotton softness. Avgol initially launched this line of products in Asia, where demand for softness began first in Japan, soon spread into China and is now influencing other parts of the world.

“In Japan, demand for premium diapers will never end because the people there are so picky when it comes to hygiene and especially baby products – and they will afford it,” Reicofil’s Müller says. “Fortunately, this has also extended into China and there is a huge amount of middle class people – more than two hundred million – who can afford nice diapers.”

According to Müller, spunbond technology has faced challenges from carded nonwovens in the diaper market as it has demanded softer and especially loftier products. In response, Reicofil is offering Semi High Loft, High Loft and Full High Loft technology to help its customers create such products too. Semi High Loft and High Loft can be incorporated into new and even existing Reicofil lines, provided they have bico capability. Full High Loft however would require a new line in any case.

“The main competition to spunbond is carded technology, which actually had a kind of renaissance in the past few years because of this huge requirement for soft and loft. But looking at the cost structure of a carded nonwovens compared to our products, there is a huge difference,” he says.

“We will not be able to reach the qualities of a carded product but we can come very close at a much lower cost, and then it is the decision of the hygiene converter to say if it is good enough for them.”

“Spunmelt continues to displace other traditional materials in diaper components, for example tissue for core wraps, and Berry expects it to be adopted into further hygiene applications because of its versatility and cost-effectiveness. Legacy carded and paper-based materials will soon make way for spunmelt alternatives,” says Brodie Bauders, vice president, global hygiene at Berry Global. “Demand for spunmelt is continuing to grow across every region. We also see significant growth ahead in new applications seeking softer, lighter, high-loft materials and the high value that spunmelt offers.”

One of the leading manufacturers of spunmelt nonwovens globally, Berry operates more than 50 lines located around the world.

According to data provided by Price Hanna Consultants, capacity of spunbond/spunmelt polypropylene will grow 1.8% to reach 4.8 million tons by 2022 as manufacturers throughout the world continue to install new lines to supply demand growth in both the hygiene and non-hygiene markets and to operate the most modern technology.

David Price, principal of Price Hanna, says he views the markets in Greater Europe and North and South America to be oversupplied while China and other parts of Asia are a less so. Attractive demand growth for nonwovens made on this technology in China, Asia and Africa will drive new capacity installations over the next few years. Oversupply in Greater Europe, and the Americas will lessen over time as new capacity is absorbed and the pace of demand growth increases in South America. The retirement of early generation capacity could increase capacity utilization more quickly if accelerated.

“Demand for these nonwovens in disposable hygiene end uses continues to be the primary source of growth in China, India and Africa so that is where the opportunities for new capacity installations exist,” he says.

Indeed, new installations have already been announced by Toray and Berry in China. Avgol will soon begin commercial operations of new capacity in India. Toray and possibly other global producers are likely to add capacity in India as well. These installations follow recently completed investments from Fibertex Personal Care in Malaysia and Mitsui in Japan. Other investments will soon to be realized by Mitsui in Japan and Toray in South Korea in advance of planned new capacity installations by Asahi in Thailand and other producers in China.

These installations will feed high growth rates in China and other parts of Asia which are estimated in the high single digits. “Demand growth is not 20% like it once was in China but is still in the 10% range,” Price says. “The biggest growth driver is the continued penetration of disposable diapers, particularly in the rural regions where market penetration for these products is still relatively low.”

Talking Technology

The development and launch of Reifenhauser’s Reicofil 5, the newest platform upgrade to the company’s spunbond technology in more than a decade, is the big news of 2017. Already, some of the biggest names in nonwovens—Berry Global, Gulsan and Pegas—have announced they will install the technology. Despite oversupply in some global regions, more companies are likely to follow suit.

“Just like any technology, R5 technology will advance and be further refined over time with the basic elements remaining in place---higher productivity, lower denier, higher quality and the potential to realize lower cost of manufacture once full capacity utilization is achieved,” says Price. “It’s the smart technology for the future.”

According to Reicofil sales director Markus Müller, the real driver in interest for Reicofil 5, besides its increased speed and widened production window as well as the opportunity for large capacities (up to 35,000 tons per year), is the advantage in running finer fibers with standard resins, which means you can make much thinner filaments on the product side without using expensive metallocene resins.

Besides this, every RF5 by default comes with an anti-contamination package.

“Contamination is a huge issue in the diaper industry,” Müller says. “The big diaper companies are extremely sensitive when it comes to contamination of any kind, even a loose fiber. With social media it only takes a second for something strange on a diaper to be broadcast around the world and after a few minutes you see the corresponding stock price decrease.”

However, on top of all, says Müller, the biggest benefit in RF5 is thee huge digitalization or Industry 4.0 package, which will pave the path for future nonwoven productions. Digital Assistant, Performance Cockpit, Predictive Maintenance, Nonwoven Grading – just to mention a few features – will make roll goods productions easier, cleaner, safer and thus much more efficient.

While Müller would not go into specifics, he said with three RF5 lines on order and five other RF5 projects in firm discussions, the interest in the new technology is strong globally, even in world regions considered to be somewhat saturated when it comes to spunmelt. “It shows you that even when a market according to name-plate capacity is oversupplied in certain regions, opportunities still exist when you come up with new products and new solutions. Yet, when demand is really low Reicofil also offers the Smart lines, having capacities as low as 3500 tons per year to up to 9000 tons per year and delivering RF4-quality nonwovens.”

So far, just Gulsan has said it will add the largest, five-beam version of the technology to its Turkey plant, boosting that site’s capacity by 35,000 tons. Berry has reportedly ordered a 20,000-ton-per-year-line and Pegas’s R5 will be semi-commercial and part of a new global innovation center, which will help the company achieve significant success in research, testing and commercialization of new products with applications in current and new markets.

“By signing this memorandum, we have reached an important milestone of the project that we have worked on intensively with Reicofil for the last two years with the objective of developing a new type of technology,” CFO Frantisek Rezac says. “This new technology is based on the Reicofil 5 platform and the ‘no-basement’ concept. It utilizes proven bicomponent technologies, offers a wide range of fiber types and fiber profiles, while enabling the use of input raw materials different to those that we currently process. A significant element of this technology is also the nonwoven textile bonding system, which is an alternative to the presently used conventional systems.”

Expansion Continues

Spunmelt manufacturer Avgol is about to complete work on two spunmelt lines—one in Israel and one in India—to help it achieve growth in developing economies. A line in Dimona, Israel, will not only help boost growth in the Middle East in Europe but will capitalize on trade agreements between Israel and Brazil to fuel growth in Latin America. Meanwhile, India will help expand the company’s global exposure. “Moving into the Indian market is going to be something that is very exciting for Avgol and I think it’s being watched by a lot of people,” David Meldrem, CEO, says. “We are continuing efforts to move the Avgol brand around the world.”

Avgol also operates spunmelt manufacturing sites in North Carolina, Russia and Barkan, Israel. Last year, the company’s sales volumes grew 7.5% despite challenging conditions.

“Although demand for nonwovens continues to grow around the world—estimated at 3-5% growth, we have seen our good news of sales going on as our major two customers are facing their own challenges,” Meldrem says.

These two customers, Procter & Gamble and Kimberly-Clark, have been losing marketshare in some hygiene categories amidst growth in e-commerce sales and private labels, however as they respond to this pressure with stronger marketing efforts, Meldrem is confident this loss in marketshare will be recovered.

In the meantime, Avgol continues to work hard to widen its customer base.

“In 2017, we have seen some new customers starting to come on board. Continue to widen our customer base going forward. During the past few months, we have reached an agreement with a major hygiene customer that will nearly double our sales to them—predominantly in North America.”

Berry Global, a leading maker of nonwovens, continues to invest in its spunmelt business, announcing last year it would purchase a state-of-the-art Reicofil 5 asset for Asia. The investment will add 20,000 tons of capacity for the hygiene and healthcare markets when it starts up in China in 2019. The new line brings the total number of Berry’s spunmelt lines to more than 50.

Berry also continues to improve its lines throughout North and South America. In Europe, the company recently completed a $20 million upgrade to a Hygiene Center of Excellence in Terno d’Isola, Italy, which has helped Berry provide a wide offering and leading development and testing facilities in the hygiene market.

“This focus on investment to improve versatility, choice and innovation fits with Berry’s strategic intent to reduce complexity, provide focus, boost production quality and capacity to better serve its customers at a competitive cost,” says Bob Dale, vice president of Capital Engineering. “Spunmelt is an exciting technology, and we’re seeing diversification opportunities not only in hygiene, but in other applications too.”

The applications include the healthcare market where the technology can offer high liquid and microbial barrier attributes as well as strength and softness, and filtration and other technical markets. Berry also signaled its commitment to the agro market with a brand new Agriculture Center of Excellence in Biesheim, France, which utilizes high-quality spunmelt technology to provide worldwide solutions to the agriculture industry, underscoring the company’s commitment to enable its customers to grow.

“By creating Centers of Excellence for key markets, core technologies and applications in strategic locations around the world, we are helping our customers to win both regionally and globally,” Dale says.

In the future, Berry will grow, not only because of its willingness to invest in new technology but its ability to provide the service and support aspects that keep quality, consistency and customer satisfaction high.

“Spunmelt remains a competitive market, so we will continue to invest in innovation and technology to meet ever-increasing customer and consumer expectations,” Dale says. “We’re committed to investing in the newest and best technologies, but we’re also investing in the best people, and encouraging them to innovate and excel.”

Toray Advanced Materials is betting on continued growth in Asia and by all accounts is winning. In 2016, the company’s sales grew 11% to $341 million and the company expects this growth trajectory to continue in upcoming years.

Already, the region’s largest manufacturer of spunbond nonwovens, Toray announced in November 2017 it would add a second plant in China near the city of Foshan, in Guangdong Province in South China. Toray established a new company, Toray Polytech (Foshan) Co., Ltd. (TPF), and plans to set up a production facility with an initial annual capacity of 20,000 tons of spunbond nonwovens there. The facility is expected to start operations in fiscal year 2019. It will be the second polypropylene spunbond production facility in China for Toray. The company currently operates a four-line plant in Nantong, which is known as Toray Polytech (Nantong) Co., Ltd.

The new facility will meet growing demand for spunbond material from the disposable baby diaper market in China, which is growing as incomes rise and the birth rate increases following the end of the one-child policy in the country. The South China region currently accounts for nearly 60% of demand in the country and Toray is currently serving customers in the region from its Nantong site. The establishment of a site in South China will reaffirm Toray’s goal of being a leading supplier of polypropylene spunbond nonwovens in Asia.

In addition to its Chinese presence, Toray has spunbond production facilities in Indonesia, where it completed work on a second line last year, and Korea, where a new line is set to come onstream in 2018, and it is said to be adding a line in India.

“It is important to dominate the market in advance to achieve a steady growth in the hygiene business,”head of marketing Jason Lee says. “Toray strives to maintain its status as Asia’s No. 1 leader in the hygiene industry. For this reason, TAK plans to expand capacity in Asia focusing on Korea, China, and Indonesia.”

While Lee did not elaborate on where or when the investments will take place, he did say that the company has a plan to bring its total capacity to over 200,000 tons compared to its current capacity which will be approximately 135,000 tons once the new Korean line comes onstream. This will put Toray in an even better position to serve its customers.

“For global manufacturers, decisions to select suppliers are made based on the supply quantity, quality, delivery time and skill level of products,” Lee says. “Despite over-supply in the Asian market, there are only a few companies that provide high-quality products. Therefore it is still insufficient to fulfill the demands for differentiated polypropylene spunbond products required by global manufacturers.”

With an average annual growth rate of 8%, the Asian market has been an attractive one for investment for many nonwovens producers. Fibertex Personal Care has been highly successful with its Malaysian facility, which was first opened in 2002. Now said to be the largest non-Asian supplier of nonwovens to Japan, Fibertex Personal Care recently completed work on its fifth Malaysian line at a second site, bringing capacity in the country to about 90,000 tons.

The new site will allow Fibertex Personal Care to focus on value-added products and improve existing products, according to CEO Mikael Staal Axelsen. “The consumers and thereby the industry require hygiene products that are lighter, softer and with finer structures, and we have reached an advanced stage in the processing improvement race which becomes more and more predominant in our business.”

Fibertex Personal Care has also added these capabilities to its European operation. Last year, it upgraded one of its two existing lines in Aalborg, Denmark, to create a softer product and bring products made at the site up to par with its Malaysian site.

Some suppliers to the hygiene market, like Berry Global, have invested in carded nonwovens technologies to supplement their existing spunmelt offerings to hygiene and offer softer products, while others like Avgol and Fibertex Personal Care have focused on creating a softer spunmelt product to meet this demand.

Last year, Avgol launched a range of soft spunmelt products in response to this trend. Suitable for topsheet, backsheet and leg cuff applications, as well as ear and landing zone substrates, Avgol Lux was in development for years and is the result of significant research and development investment across a number of product performance parameters, optimizing softness and mechanical properties.

The Lux family of products includes Avgol SB & SMS Lux – Soft touch, Avsilk SB & SMS Lux – silky smooth softness and Avsoft & Avspun SB & SMS Lux – cotton softness. Avgol initially launched this line of products in Asia, where demand for softness began first in Japan, soon spread into China and is now influencing other parts of the world.

“In Japan, demand for premium diapers will never end because the people there are so picky when it comes to hygiene and especially baby products – and they will afford it,” Reicofil’s Müller says. “Fortunately, this has also extended into China and there is a huge amount of middle class people – more than two hundred million – who can afford nice diapers.”

According to Müller, spunbond technology has faced challenges from carded nonwovens in the diaper market as it has demanded softer and especially loftier products. In response, Reicofil is offering Semi High Loft, High Loft and Full High Loft technology to help its customers create such products too. Semi High Loft and High Loft can be incorporated into new and even existing Reicofil lines, provided they have bico capability. Full High Loft however would require a new line in any case.

“The main competition to spunbond is carded technology, which actually had a kind of renaissance in the past few years because of this huge requirement for soft and loft. But looking at the cost structure of a carded nonwovens compared to our products, there is a huge difference,” he says.

“We will not be able to reach the qualities of a carded product but we can come very close at a much lower cost, and then it is the decision of the hygiene converter to say if it is good enough for them.”