Tara Olivo, Associate Editor02.02.18

The last several years have seen a steady stream of needlepunch investments across the globe. Growth in core markets like filtration, automotive and geotextiles has manufacturers eager to expand capacity to meet growing demand for the technology.

“There is a growing demand in needle spunbond applications for geotextiles. Technical applications e.g. the filtration business and particularly the growing demand for PTFE filters is another category. In Asia we see an increasing demand for artificial leather mainly for clothing, furniture and for the automotive sector. This requires a higher number of new needle looms,” says André Imhof, COO of Autefa Solutions, a full line supplier offering a range of fiber preparation, carding, needling, thermobonding, hydroentanglement, drying and end-of-line equipment.

Recent investments in new needlepunch equipment span from the U.S. (Foss Floors) and Mexico (Autoneum) to Europe (TTL), Turkey (Hassan Tekstil) and Asia (Autotech), just to name a few.

Machinery producer Andritz Nonwoven is seeing strong growth for needlepunch especially in the automotive sector. “Nonwoven is extending its end uses, not only in car interiors, with light nonwoven fabric spunlaced and/or needlepunched as separating layers, but also around the engine, mainly for noise insulation purposes,” says Jean-Philippe Dumon, sales director, Nonwoven, Andritz Asselin-Thibeau. “With nonwovens being lighter and offering better sound insulation capabilities than other components, more opportunities are arising. Automotive is also using economical PET fibers, and inline velouring is becoming more popular in order to process them with minimum breakage. In this way, the fibers have less time to dry before completing the full needling process.”

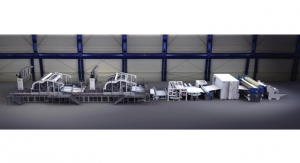

Andritz recently installed a complete, high-capacity needlepunch eXcelle line – from webforming to needlepunching – to EcoTechnilin. The British-owned company runs a factory in France and an R&D center in the U.K., and this newest line was delivered to a new factory in Poland.

According to Karim Behlouli, managing director at EcoTechnilin, Poland was an ideal location for the new facility because it is centrally located to serve customers in the Czech Republic, Slovakia, Poland and Germany.

EcoTechnilin mainly serves the automotive/transportation industry with its natural fiber (flax)/polypropylene-based products. “Flax is a very good choice because the strength of this fiber is very high and the density is low, so we can reduce the weight of the composite to reduce the car weight, the car consumption and, at the end, also reduce the CO2 emissions,” Behlouli says.

Overall, EcoTechnilin is optimistic about the company’s future, as it has already seen a recent trend of 20% growth each year. “We will continue to put a lot of money in R&D to develop new solutions in the building industry, filtration, aeronautics and others,” he adds.

The company’s new line has a production capacity of about 1000 kg/h and produces nonwovens made of natural fibers, glass fibers and polypropylene from 300 to 2400 gsm. This line complements its two other Andritz needlepunch lines in France, and the company now has more than 10,000 tons of annual capacity.

Another recent investor in Andritz technology is TTL (Technische Textilien Lörrach), Germany, which develops, manufactures and sells needlefelt for technical applications under its three divisions: industrial filtration, industrial laundry and industrial textiles.

The scope of supply includes opening and blending equipment, Dynamic card, and crosslapper in combination with Andritz technology for drafting, needling, and unwinding/combining. Andritz has also supplied the process control as well as the unique, closed-loop ProDyn system, thus providing continuous web monitoring and optimization of the end product.

While the company won’t say how many lines it is running, TTL’s CEO Roland Jaehn says the new line is replacing an older line. “[The new line] allows us to widen [our] product range and fulfill customers’ inquiries that we had to refuse until now,” he says.

The Andritz needlepunch neXline eXcelle line is expected to manufacture individual products for different dedicated technical applications, for example, for protection against fire and heat in the automotive and electrical industries.

Jaehn notes that while the needlepunch market is mature and potential in industrialized countries is limited, growth can be achieved in regions of the world that haven’t yet caught up with developed countries.

One of these regions is India, where Autotech Nonwovens recently invested in an Andritz line. According to Ankit Desai, director, Autotech Nonwovens, when the company was founded in 2012, the Indian automotive market was going through a lean patch. Sales were unusually stagnant for the passenger car segment between 2011-2013 and cost reduction was a priority. “The growth potential, however, was never under question and it was just a matter of time before the market would revive given the demographic trends of a young population combined with a high GDP growth rate. Today, as expected, the Indian automotive market is projected to exceed five million cars by 2020,” he says.

Several carmakers such as Ford, Tata and Suzuki are in the process of making investments in the western region of India (Gujarat), so Desai is hopeful about the future.

Autotech, which is based in Gujarat, can produce all ‘A’ surface face fabrics including, but not limited to, floor carpet, headliner, parcel tray, load shelf, seat back carpet and trunk and side trim. Autotech has more recently penetrated into other applications including automotive filter fabric, hot flue gas and liquid filtration applications.

The young company has already captured over 35% of market share in India for headliners. Autotech manufactures high quality, lightweight headliners that offer excellent wear and tear resistance, long durability and are economically competitive compared to other materials. These features have allowed OEMs to shift from the traditional bi or tri-laminate fabrics/foam backed fabrics thereby reducing weight and improving on cost and other benefits brought by lightweighting, according to Desai.

“With the shift towards differentiation as well as to give customers a premium, tailored and personalized feel to their cars, printed nonwovens are a strong alternative to much more expensive knitted/foam-backed headliner fabrics which are commonly used the luxury segment,” he says. “Printed nonwoven headliner fabrics allows OEM designers the flexibility to customize and personalize unique patterns and colors, add three-dimensional textures and antimicrobial finishes to their headliners while maintaining a high abrasion resistance and providing a premium feel to the cabin interior.”

Other than Freudenberg-Vilene, Autotech is the only Asian nonwovens manufacturer making printed nonwoven headliners in-house and was the first company to introduce this type of product locally produced in India, Desai says.

Since its capacity expansion with an Andritz neXline needlepunch line at the end of 2016, as well as other processing and finishing machinery from Europe, Autotech has been able to produce an entire range of automotive trims, filtration media and several industrial felts. “This is one-of-its-kind line in India,” Desai says.

On both this new line and its first line, Autotech will be able to manufacture fabrics from the range of 80 gsm to 2000 gsm in a range of fiber types and deniers. “With two complete new needlepunch machines in place capable of offering a single, bi/tri layer product coupled with processing facility to laminate and extrude, printing, calendaring and singeing – our product portfolio and business potential has expanded multifold,” he says.

While Autotech began its business with a focus on the Indian market, this latest capacity expansion will help supply exports of automotive fabrics this year. The company will also begin supplying hot flue gas filtration media to the U.S. market in 2018.

Another player in the automotive market, Autoneum, recently ordered an Andritz neXline needlepunch eXcelle line for its plant in San Luis Potosi, Mexico. The line will produce needlepunched velour felts from 300 to 900 gsm for the automotive market. The fabrics will be used in the manufacturing of carpet systems, inner dashes and floor insulators. Autoneum already operates several Andritz lines in Bloomsburg, PA, and Jeffersonville, IN, as well as several lines in Europe.

Meanwhile, German nonwovens producer Sandler is also seeing greater demand for needlepunched nonwovens in the automotive/transportation sector, where a wide range of the fabric is already bring applied in areas such as absorber materials in the cabin and the engine compartment, as well as nonwovens for seat upholstery. But, according to Gerhard Klier, sales director Technical Products, nonwovens continue to tap into new markets and new areas of application. “For example, nonwovens are currently making a name for themselves in aircraft or rail vehicles, and answering challenges presented by new transportation concepts such as electro mobility,” he says.

Sandler is also seeing greater demand for the fabric in interior acoustics, where open-plan office designs are in high demand, creating demand for efficient sound insulation. “Architects are looking for materials which provide this function while also supporting interior design,” Klier says. “Offering this combination, nonwovens are currently making inroads into this market and opening up new growth opportunities.”

Sandler manufactures efficient sound insulators in the form of self-supporting panels of various thicknesses and densities. They can be printed, embossed, laminated with colored fabric, cut to a specific shape or even enhanced with a coating made of natural materials such as hay or cornflowers. “These nonwovens provide ample opportunity for realizing individual design concepts,” Klier says.

While Sandler’s newest lines in Schwarzenbach, Germany, and Perry, GA (U.S.), aren’t producing needlepunch—the company’s most recent investment in the technology was at the Schwarzenbach site in 2013—Klier says that the company plans to expand its business with needlepunched nonwovens for acoustics in the North American market down the road.

Up to the Task

As more and more needlepunch producers invest in new technology, manufacturers of the machinery and equipment that make up complete lines are keeping pace by improving their technologies.

For Andritz Nonwoven, it’s been important for the company to evolve its technology over the years, working in close cooperation with nonwovens producers. “We have designed new machines and solutions to improve fabric weight evenness, bring added value to nonwoven webs through additional fabric performance, and develop systems to optimize productivity and minimize maintenance requirements,” says Andritz’s Dumon.

Currently being launched in the market is its new ProWid system, a system that regulates the card web weight before the web enters the crosslapper in order to lay a fiber mat with lighter edges. It thus anticipates later fabric deformation caused by the bonding process. The CV percentage is generally improved by a factor of 2, in particular when the CV percentage is in excess of 3% without the ProWid system, Dumon says. ProWid can be delivered with an individual Andritz crosslapper to enhance performance in existing carding lines.

In order to enhance line flexibility, Andritz is also offering new solutions in supervision. “As supervision is becoming a must in production management to ensure traceability, parameters are now easier to set and record,” Dumon explains. “Our supervision system gives producers the capability to evaluate their manufacturing costs for every production batch.”

Meanwhile, Autefa Solutions has seen the importance of digitalization and Industry 4.0 entering the nonwovens market. According to Imhof, the product quality in Autefa’s needling lines can be monitored and improved with its Closed Loop Control System. A scanner determines the weight distribution of the final product while the control system corrects the profile in the crosslapper and the feeding section of the card. Autefa’s crosslapper Topliner in combination of Web Profile Control WebMax prevents the increased weight of the fabric in the edge areas. This compensates for the smile effect caused by material shrinkage. “WebMax profiling is also integrated into the Closed Loop Control System which ensures that the fabric is profiled equally in both material direction and cross direction,” he adds.

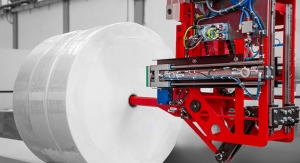

DiloGroup, which has designed needlepunch equipment since 1950s, also offers complete lines for the production of needlepunched nonwovens including fiber preparation, opening and blending equipment, carding, crosslapping, needling and winding.

A recent development from its DiloTemafa unit offers new possibilities for the gentle opening of longer fibers at high throughput speeds using several opening stages. Meanwhile, DiloSpinnbau, another unit of DiloGroup, offers more flexibility with the VectorQuadroCard. This development combines different types of cards within one card by a simple and fast changeover of the intermediate section. The newly designed delivery system is also flexible to allow the production of parallel, random or condensed webs. The new card feeding system Unifeed combines the principles of a volumetric system allowing fine dosing with the advantages of an open vibration chute feed.

Dilo’s horizontal crosslayer DLSC 200 from DiloMachines is another new offering, and sets new standards in crosslapping technology, according to the company, with an electro-mechanical web infeed speed of 200 m/min depending on the fibers used. These are just a few of the technological advancements Dilo has been working on recently.

According to Johann Philipp Dilo, CEO, DiloGroup, the company has seen more investment in recent years; in fact, its own business has grown in the past years, about 20% annually, because of demand. “The consumption of needlepunched material is growing in an average rate worldwide between 6% and 7% per annum,” he says. “This is because needlepunching technology is highly productive and versatile in terms of fiber types employed, process parameters and eventual fabric weight. Therefore, the needlepunch product can be easily adapted and engineered according to its intended function in an increasing range of applications.”

One company taking advantage of Dilo’s latest technology is Foss Floors of Rome, GA. Its new complete needlepunch line is suitable for the production of floor covering felts, and includes a DiloTemafa opening and blending line, DiloSpinnbau MC 3-5 carding machine three meter wide, a DiloMachines crosslapper DLBS 30/50 with CV1 system, two needlelooms DI-LOOM series together with an integrated process control system DILO-PCS.

Foss Floors operates several other Dilo production lines including high speed patterning DI-LOOP units.

Meanwhile, Turkish company Hassan Tekstil, which makes nonwovens used in the automotives, wipes, insulation and geotextile markets, has also invested in new Dilo equipment. The company recently ordered opening and blending equipment, a Multi-Feed card feeder, MultiCard and lap drafter, DLS crosslapper and highspeed hyper punch needlelooms in large working width. The investment will allow Hassan Tekstil to improve its product quality and increase its production capacity, according to Ahmet Sisman, managing director of Hassan Tekstil. Delivery is scheduled for March 2018 and it will begin production in October 2018.

Moving Forward

Manchester, CT-based Lydall Inc. has been hard at work integrating its latest acquisitions—Canadian needlepuncher Texel and German-based needlepunch manufacturer Gutsche. With these purchases, Lydall has been able to diversify both from a product and market perspective, as well as geographically—today the company’s Technical Nonwovens segment runs facilities in the U.S., Canada, Germany, the U.K. and China. The successful integration thus far has allowed the companies to share information in terms of product capabilities, manufacturing, best practices and supplier relationships, which has helped Lydall to position its business well to better serve its customers. Texel and Gutsche were integrated into Lydall’s Technical Nonwovens segment, which serves two primary segments—Industrial Filtration and Advanced Materials.

Within Industrial Filtration, Lydall primarily serves the air and liquid filtration markets, while in Advanced Materials, the company supplies to markets such as geosynthetics, automotive, medical, safety apparel and others. Specifically, Lydall continues to witness growing opportunities in air filtration and automotive.

On the air filtration side, reducing emissions into the environment has been an increasing demand from customers. Lydall air filtration media are used to control air emissions and dust pollution from various industrial processes, including power, cement, asphalt, incineration, food, pharmaceuticals, and other industries. In general, Lydall’s customers are looking to minimize the impact of their manufacturing on both the local and global environment, but increasing requirements from regulatory agencies are also growing the need for better performing filtration products. The company has recognized this need to reduce emission levels across the globe over the last three to five years and expects this trend to continue in various regional markets.

New proprietary product designs developed by Lydall have helped to attain its customers’ goals in this sector. Its latest technologies include Microfelt, Zerolox and Microvel, high performance air filtration products that help to significantly reduce emissions. In many cases, these products can exceed the dust control regulatory requirements by a substantial amount – up to 80% or more reduction versus specific government regulations. These products help Lydall’s customers’ facilities meet current requirements and the environmental needs of today, but also address regulations that may come along in the future.

Meanwhile, in the automotive market, Lydall continues to see opportunities to convert traditional vehicle components that may have been made from metal and solid plastic materials to felt-based products. Here, there continues to be a focus on reducing weight in vehicles, improving acoustic performance and increasing the recyclability of components. And because of the unique characteristics of needlepunch, Lydall can provide different performance functions in one solution; acoustic performance, weight reduction and aesthetic properties can be developed all in one design versus traditional solutions made with two to three components to achieve the same result, the company says.

“There is a growing demand in needle spunbond applications for geotextiles. Technical applications e.g. the filtration business and particularly the growing demand for PTFE filters is another category. In Asia we see an increasing demand for artificial leather mainly for clothing, furniture and for the automotive sector. This requires a higher number of new needle looms,” says André Imhof, COO of Autefa Solutions, a full line supplier offering a range of fiber preparation, carding, needling, thermobonding, hydroentanglement, drying and end-of-line equipment.

Recent investments in new needlepunch equipment span from the U.S. (Foss Floors) and Mexico (Autoneum) to Europe (TTL), Turkey (Hassan Tekstil) and Asia (Autotech), just to name a few.

Machinery producer Andritz Nonwoven is seeing strong growth for needlepunch especially in the automotive sector. “Nonwoven is extending its end uses, not only in car interiors, with light nonwoven fabric spunlaced and/or needlepunched as separating layers, but also around the engine, mainly for noise insulation purposes,” says Jean-Philippe Dumon, sales director, Nonwoven, Andritz Asselin-Thibeau. “With nonwovens being lighter and offering better sound insulation capabilities than other components, more opportunities are arising. Automotive is also using economical PET fibers, and inline velouring is becoming more popular in order to process them with minimum breakage. In this way, the fibers have less time to dry before completing the full needling process.”

Andritz recently installed a complete, high-capacity needlepunch eXcelle line – from webforming to needlepunching – to EcoTechnilin. The British-owned company runs a factory in France and an R&D center in the U.K., and this newest line was delivered to a new factory in Poland.

According to Karim Behlouli, managing director at EcoTechnilin, Poland was an ideal location for the new facility because it is centrally located to serve customers in the Czech Republic, Slovakia, Poland and Germany.

EcoTechnilin mainly serves the automotive/transportation industry with its natural fiber (flax)/polypropylene-based products. “Flax is a very good choice because the strength of this fiber is very high and the density is low, so we can reduce the weight of the composite to reduce the car weight, the car consumption and, at the end, also reduce the CO2 emissions,” Behlouli says.

Overall, EcoTechnilin is optimistic about the company’s future, as it has already seen a recent trend of 20% growth each year. “We will continue to put a lot of money in R&D to develop new solutions in the building industry, filtration, aeronautics and others,” he adds.

The company’s new line has a production capacity of about 1000 kg/h and produces nonwovens made of natural fibers, glass fibers and polypropylene from 300 to 2400 gsm. This line complements its two other Andritz needlepunch lines in France, and the company now has more than 10,000 tons of annual capacity.

Another recent investor in Andritz technology is TTL (Technische Textilien Lörrach), Germany, which develops, manufactures and sells needlefelt for technical applications under its three divisions: industrial filtration, industrial laundry and industrial textiles.

The scope of supply includes opening and blending equipment, Dynamic card, and crosslapper in combination with Andritz technology for drafting, needling, and unwinding/combining. Andritz has also supplied the process control as well as the unique, closed-loop ProDyn system, thus providing continuous web monitoring and optimization of the end product.

While the company won’t say how many lines it is running, TTL’s CEO Roland Jaehn says the new line is replacing an older line. “[The new line] allows us to widen [our] product range and fulfill customers’ inquiries that we had to refuse until now,” he says.

The Andritz needlepunch neXline eXcelle line is expected to manufacture individual products for different dedicated technical applications, for example, for protection against fire and heat in the automotive and electrical industries.

Jaehn notes that while the needlepunch market is mature and potential in industrialized countries is limited, growth can be achieved in regions of the world that haven’t yet caught up with developed countries.

One of these regions is India, where Autotech Nonwovens recently invested in an Andritz line. According to Ankit Desai, director, Autotech Nonwovens, when the company was founded in 2012, the Indian automotive market was going through a lean patch. Sales were unusually stagnant for the passenger car segment between 2011-2013 and cost reduction was a priority. “The growth potential, however, was never under question and it was just a matter of time before the market would revive given the demographic trends of a young population combined with a high GDP growth rate. Today, as expected, the Indian automotive market is projected to exceed five million cars by 2020,” he says.

Several carmakers such as Ford, Tata and Suzuki are in the process of making investments in the western region of India (Gujarat), so Desai is hopeful about the future.

Autotech, which is based in Gujarat, can produce all ‘A’ surface face fabrics including, but not limited to, floor carpet, headliner, parcel tray, load shelf, seat back carpet and trunk and side trim. Autotech has more recently penetrated into other applications including automotive filter fabric, hot flue gas and liquid filtration applications.

The young company has already captured over 35% of market share in India for headliners. Autotech manufactures high quality, lightweight headliners that offer excellent wear and tear resistance, long durability and are economically competitive compared to other materials. These features have allowed OEMs to shift from the traditional bi or tri-laminate fabrics/foam backed fabrics thereby reducing weight and improving on cost and other benefits brought by lightweighting, according to Desai.

“With the shift towards differentiation as well as to give customers a premium, tailored and personalized feel to their cars, printed nonwovens are a strong alternative to much more expensive knitted/foam-backed headliner fabrics which are commonly used the luxury segment,” he says. “Printed nonwoven headliner fabrics allows OEM designers the flexibility to customize and personalize unique patterns and colors, add three-dimensional textures and antimicrobial finishes to their headliners while maintaining a high abrasion resistance and providing a premium feel to the cabin interior.”

Other than Freudenberg-Vilene, Autotech is the only Asian nonwovens manufacturer making printed nonwoven headliners in-house and was the first company to introduce this type of product locally produced in India, Desai says.

Since its capacity expansion with an Andritz neXline needlepunch line at the end of 2016, as well as other processing and finishing machinery from Europe, Autotech has been able to produce an entire range of automotive trims, filtration media and several industrial felts. “This is one-of-its-kind line in India,” Desai says.

On both this new line and its first line, Autotech will be able to manufacture fabrics from the range of 80 gsm to 2000 gsm in a range of fiber types and deniers. “With two complete new needlepunch machines in place capable of offering a single, bi/tri layer product coupled with processing facility to laminate and extrude, printing, calendaring and singeing – our product portfolio and business potential has expanded multifold,” he says.

While Autotech began its business with a focus on the Indian market, this latest capacity expansion will help supply exports of automotive fabrics this year. The company will also begin supplying hot flue gas filtration media to the U.S. market in 2018.

Another player in the automotive market, Autoneum, recently ordered an Andritz neXline needlepunch eXcelle line for its plant in San Luis Potosi, Mexico. The line will produce needlepunched velour felts from 300 to 900 gsm for the automotive market. The fabrics will be used in the manufacturing of carpet systems, inner dashes and floor insulators. Autoneum already operates several Andritz lines in Bloomsburg, PA, and Jeffersonville, IN, as well as several lines in Europe.

Meanwhile, German nonwovens producer Sandler is also seeing greater demand for needlepunched nonwovens in the automotive/transportation sector, where a wide range of the fabric is already bring applied in areas such as absorber materials in the cabin and the engine compartment, as well as nonwovens for seat upholstery. But, according to Gerhard Klier, sales director Technical Products, nonwovens continue to tap into new markets and new areas of application. “For example, nonwovens are currently making a name for themselves in aircraft or rail vehicles, and answering challenges presented by new transportation concepts such as electro mobility,” he says.

Sandler is also seeing greater demand for the fabric in interior acoustics, where open-plan office designs are in high demand, creating demand for efficient sound insulation. “Architects are looking for materials which provide this function while also supporting interior design,” Klier says. “Offering this combination, nonwovens are currently making inroads into this market and opening up new growth opportunities.”

Sandler manufactures efficient sound insulators in the form of self-supporting panels of various thicknesses and densities. They can be printed, embossed, laminated with colored fabric, cut to a specific shape or even enhanced with a coating made of natural materials such as hay or cornflowers. “These nonwovens provide ample opportunity for realizing individual design concepts,” Klier says.

While Sandler’s newest lines in Schwarzenbach, Germany, and Perry, GA (U.S.), aren’t producing needlepunch—the company’s most recent investment in the technology was at the Schwarzenbach site in 2013—Klier says that the company plans to expand its business with needlepunched nonwovens for acoustics in the North American market down the road.

Up to the Task

As more and more needlepunch producers invest in new technology, manufacturers of the machinery and equipment that make up complete lines are keeping pace by improving their technologies.

For Andritz Nonwoven, it’s been important for the company to evolve its technology over the years, working in close cooperation with nonwovens producers. “We have designed new machines and solutions to improve fabric weight evenness, bring added value to nonwoven webs through additional fabric performance, and develop systems to optimize productivity and minimize maintenance requirements,” says Andritz’s Dumon.

Currently being launched in the market is its new ProWid system, a system that regulates the card web weight before the web enters the crosslapper in order to lay a fiber mat with lighter edges. It thus anticipates later fabric deformation caused by the bonding process. The CV percentage is generally improved by a factor of 2, in particular when the CV percentage is in excess of 3% without the ProWid system, Dumon says. ProWid can be delivered with an individual Andritz crosslapper to enhance performance in existing carding lines.

In order to enhance line flexibility, Andritz is also offering new solutions in supervision. “As supervision is becoming a must in production management to ensure traceability, parameters are now easier to set and record,” Dumon explains. “Our supervision system gives producers the capability to evaluate their manufacturing costs for every production batch.”

Meanwhile, Autefa Solutions has seen the importance of digitalization and Industry 4.0 entering the nonwovens market. According to Imhof, the product quality in Autefa’s needling lines can be monitored and improved with its Closed Loop Control System. A scanner determines the weight distribution of the final product while the control system corrects the profile in the crosslapper and the feeding section of the card. Autefa’s crosslapper Topliner in combination of Web Profile Control WebMax prevents the increased weight of the fabric in the edge areas. This compensates for the smile effect caused by material shrinkage. “WebMax profiling is also integrated into the Closed Loop Control System which ensures that the fabric is profiled equally in both material direction and cross direction,” he adds.

DiloGroup, which has designed needlepunch equipment since 1950s, also offers complete lines for the production of needlepunched nonwovens including fiber preparation, opening and blending equipment, carding, crosslapping, needling and winding.

A recent development from its DiloTemafa unit offers new possibilities for the gentle opening of longer fibers at high throughput speeds using several opening stages. Meanwhile, DiloSpinnbau, another unit of DiloGroup, offers more flexibility with the VectorQuadroCard. This development combines different types of cards within one card by a simple and fast changeover of the intermediate section. The newly designed delivery system is also flexible to allow the production of parallel, random or condensed webs. The new card feeding system Unifeed combines the principles of a volumetric system allowing fine dosing with the advantages of an open vibration chute feed.

Dilo’s horizontal crosslayer DLSC 200 from DiloMachines is another new offering, and sets new standards in crosslapping technology, according to the company, with an electro-mechanical web infeed speed of 200 m/min depending on the fibers used. These are just a few of the technological advancements Dilo has been working on recently.

According to Johann Philipp Dilo, CEO, DiloGroup, the company has seen more investment in recent years; in fact, its own business has grown in the past years, about 20% annually, because of demand. “The consumption of needlepunched material is growing in an average rate worldwide between 6% and 7% per annum,” he says. “This is because needlepunching technology is highly productive and versatile in terms of fiber types employed, process parameters and eventual fabric weight. Therefore, the needlepunch product can be easily adapted and engineered according to its intended function in an increasing range of applications.”

One company taking advantage of Dilo’s latest technology is Foss Floors of Rome, GA. Its new complete needlepunch line is suitable for the production of floor covering felts, and includes a DiloTemafa opening and blending line, DiloSpinnbau MC 3-5 carding machine three meter wide, a DiloMachines crosslapper DLBS 30/50 with CV1 system, two needlelooms DI-LOOM series together with an integrated process control system DILO-PCS.

Foss Floors operates several other Dilo production lines including high speed patterning DI-LOOP units.

Meanwhile, Turkish company Hassan Tekstil, which makes nonwovens used in the automotives, wipes, insulation and geotextile markets, has also invested in new Dilo equipment. The company recently ordered opening and blending equipment, a Multi-Feed card feeder, MultiCard and lap drafter, DLS crosslapper and highspeed hyper punch needlelooms in large working width. The investment will allow Hassan Tekstil to improve its product quality and increase its production capacity, according to Ahmet Sisman, managing director of Hassan Tekstil. Delivery is scheduled for March 2018 and it will begin production in October 2018.

Moving Forward

Manchester, CT-based Lydall Inc. has been hard at work integrating its latest acquisitions—Canadian needlepuncher Texel and German-based needlepunch manufacturer Gutsche. With these purchases, Lydall has been able to diversify both from a product and market perspective, as well as geographically—today the company’s Technical Nonwovens segment runs facilities in the U.S., Canada, Germany, the U.K. and China. The successful integration thus far has allowed the companies to share information in terms of product capabilities, manufacturing, best practices and supplier relationships, which has helped Lydall to position its business well to better serve its customers. Texel and Gutsche were integrated into Lydall’s Technical Nonwovens segment, which serves two primary segments—Industrial Filtration and Advanced Materials.

Within Industrial Filtration, Lydall primarily serves the air and liquid filtration markets, while in Advanced Materials, the company supplies to markets such as geosynthetics, automotive, medical, safety apparel and others. Specifically, Lydall continues to witness growing opportunities in air filtration and automotive.

On the air filtration side, reducing emissions into the environment has been an increasing demand from customers. Lydall air filtration media are used to control air emissions and dust pollution from various industrial processes, including power, cement, asphalt, incineration, food, pharmaceuticals, and other industries. In general, Lydall’s customers are looking to minimize the impact of their manufacturing on both the local and global environment, but increasing requirements from regulatory agencies are also growing the need for better performing filtration products. The company has recognized this need to reduce emission levels across the globe over the last three to five years and expects this trend to continue in various regional markets.

New proprietary product designs developed by Lydall have helped to attain its customers’ goals in this sector. Its latest technologies include Microfelt, Zerolox and Microvel, high performance air filtration products that help to significantly reduce emissions. In many cases, these products can exceed the dust control regulatory requirements by a substantial amount – up to 80% or more reduction versus specific government regulations. These products help Lydall’s customers’ facilities meet current requirements and the environmental needs of today, but also address regulations that may come along in the future.

Meanwhile, in the automotive market, Lydall continues to see opportunities to convert traditional vehicle components that may have been made from metal and solid plastic materials to felt-based products. Here, there continues to be a focus on reducing weight in vehicles, improving acoustic performance and increasing the recyclability of components. And because of the unique characteristics of needlepunch, Lydall can provide different performance functions in one solution; acoustic performance, weight reduction and aesthetic properties can be developed all in one design versus traditional solutions made with two to three components to achieve the same result, the company says.