Tara Olivo, Associate Editori07.31.17

Activity in the Middle Eastern nonwovens industry is growing. Sitting between Europe, Asia and North Africa, companies in the Middle East benefit from the local raw material supply and low manufacturing costs. To get an update on what’s new in this increasingly competitive geographical market, which has seen heightened investment in the last several years, Nonwovens Industry touched base with key nonwovens producers in the region.

Turkey

Straddling Eastern Europe and western Asia, Turkey’s advantageous geographical position makes it a regional hub to key export markets, including the Middle East and North Africa region and Western Europe. With several new lines coming onstream recently, Turkey continues to be an important player in the nonwovens industry.

Three new lines have been added by Gaziantep, Turkey-based Mogul, which recently celebrated the openings of two new plants; its first foreign investment—in the U.S.—as well as the opening of a new plant in Luleburgaz, Turkey.

The maker of spunbond, meltblown and spunlaced nonwovens unveiled Mogul South Carolina Nonwovens—an $18 million investment—in Grey Court, SC, in late March. The site operates a 3.2 meter, high-speed parallel laid spunlace line with 15,000 tons of annual capacity. The investment is intended to meet demand in the wipes, hygiene, filtration and automotive markets. From this base, Mogul says it will be able to better serve existing customers and capitalize on the growing need for high quality nonwovens in North and South America as well as in Asia-Pacific. Featuring 90,000 square feet of manufacturing space on 20 acres of land, the new site brings more than 70 jobs to the U.S., adding to the 500 employees that are currently part of the Mogul Nonwovens group.

“Mogul has always been a global player with the majority of sales exported to more than 50 countries globally, but to be an international player you also need to manufacture globally,” says Serkan Gogus, CEO of Mogul. “The U.S. is our largest single export market and one of the largest and sustaining economies in the world which played a role in the decision.”

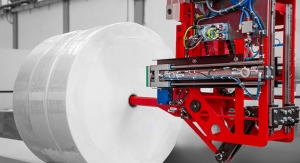

Meanwhile, the new Luleburgaz plant, outside of Istanbul, is now fully operational and is Mogul’s third plant in Turkey. Mogul already operates two plants in Gaziantep. An Andritz neXline spunlace line was installed, and designed with a crosslapped configuration in order to cater to a wide variety of end uses such as applications for the automotive sector, artificial leather, dry wipes or roofing substrates. Mogul also invested in an Andritz Spunjet line for the site to produce technical nonwovens from splittable bicomponent filaments.

Also part of Mogul’s growth strategy is new product development. “Diversification first gives us the chance to differentiate product mix and not to put all of our eggs in one basket, allowing us to reduce risks and then allowing us to be a one stop shop for our customers’ different needs. And diversification allows us to serve different applications and customers,” Gogus says.

Launched in February, Mogul describes Madaline as a nonwoven that can be treated like a traditional textile—with similar touch and drape and the capability to be stitched without fraying.

Madaline features state-of-the-art and patented bico technology to extrude unique filament designs and thereafter subject them to high-pressure water jets to simultaneously shear, fibrillate, entangle and consolidate microfilaments into a fabric. Its microfilaments are up to 100 times thinner than a human hair. The fabric’s dense structure provides good barrier and filtration properties and, thanks to its microfilaments, has good moisture management capability. It is absorbent, quick to dry and breathes well. Madaline can be used in a range of applications from clothing to home textiles and medical wipes to wallcoverings.

Durell spunlace from Mogul debuted in March and is manufactured at the Luleburgaz plant. The crosslapped product supplements Mogul’s existing production of Aqualace parallel-laid spunlace. According to Gogus, crosslapped spunlace technology differs from parallel laid spunlace in that the crosslapper forms a web by laying down the carded fiber at a 90-degree angle to the line’s direction. In a parallel-laid process the carded fiber is laid down parallel to the line’s direction. Through this crosslapping of the web, the resultant spunlace achieves similar tensile strength in both machine direction (MD) and cross direction (CD). Application areas include automotives, building materials, filtration, home textiles, wipes, medical, laminates, personal care, artificial leather, print media and disposable linens.

In Kahramanmaras, Turkey, Teknomelt, a producer of meltblown and spunbond nonwovens, operates out of one site in the city. M. Sami Oner, export manager of Teknomelt, says many industries and manufacturing plants call this city home, mostly in the textile industry, but Teknomelt is the sole nonwovens manufacture there. “A main advantage is that our city is close to the main ports in the region,” he says.

Volume wise, Teknomelt’s key markets are hygiene and medical, followed by absorbent products and wipes. According to Oner, the hygiene market is growing with new investments every year, but he says it’s important to understand where this growth is coming from. Some roll goods manufacturers are establishing diaper-manufacturing plants, he explains, though growth records show new investments and growth for diaper producers and nonwovens producers are shown separately. “But if you look deeply, some of them are related—with the same company outputs that have raw material (nonwovens) and hygiene products manufacturing capabilities.”

Growth is also being seen in the medical market, with new product introductions and increasing demand, along with the expectation of high quality products because of hygiene regulations. “Not only is producing and selling enough, but providing after sale support is becoming very important,” Oner explains. “New products are usually introduced to market with cooperation between buyer groups and suppliers to understand the [situation] and provide the right material for it.”

Each year, Teknomelt, which was established in 2009, tries to either make upgrades and new investments or add new products to its offerings. In 2014, the company started to make meltblown wipes with a “crow’s foot” pattern. This year, the company launched three new products—abrasive wipes, meltblown wipes with enhanced durability with multi layer construction, and an extra thick material made of meltblown for sound insulation in automotives.

“We are still one of the youngest but fast growing nonwoven manufacturers in Turkey,” Oner says. “Every two years we apply for a fastest growing companies competition organized by government agencies, and in 2014 we took 31st place and in 2016 we were 52nd among the top 100 in Turkey. This encourages us, and we know that it is only possible with the help of our team that is focusing on quality and productivity with customer oriented approaches. We try to maintain our place and make it better every year.”

Meanwhile, General Nonwovens, which operates out of two factories in Gaziantep, Turkey, manufactures polypropylene (PP) spunbond nonwovens, polyester (PET) spunbond nonwovens, polylactic acid (PLA) spunbond nonwovens, spunbond-meltblown-spunbond (SMS) nonwovens, and air through bonded nonwovens (ADL and ATB).

Several brands are manufactured by General Nonwovens including HyGen, which is used in the hygiene industry for topsheets, backsheets, ADL, leg cuffs, front ears and core-wraps. The producer also offers a very soft air through bond fabric for companies looking for soft-touch fabric used in premium disposable product end uses. Other brands include FilterGen for the filtration industry, TexGen for coated and laminated fabrics, as well as home textiles, AutoGen for the automotive industry and IndiGen for industrial and technical textiles applications.

New from General Nonwovens are PLA spunbond fabrics that are biodegradable and are made of renewable materials such as cornstarch or sugarcane. These 100% PLA spunbond fabrics are decomposable and environmental friendly. Because these fabrics are thermally bonded, they do not have any binder chemicals, according to Alican Yilankirkan, business development director, General Nonwovens.

New supersoft highloft ATB products from the HyGen brand were also introduced recently, and are used both as a topsheet layer, which is in contact with a baby’s skin, as well as the outer layer as a component of a super-soft breathable textile backsheet.

Yilankirkan says the company exports about 50% of its products to European countries and the U.S., while a limited portion serves Middle East markets. The other half of its output is consumed locally.

“Nonwoven production in Turkey is growing at a very high rate and therefore the competition becomes more and more visible every year,” Yilankirkan says. “However, General Nonwovens as a company with roots not only in the nonwovens industry, but also in different fields of trade and industry, is well prepared to manage the business with its high-qualified team supported with a strong product pipeline.”

Turkey, especially in the last decade, has become a center for nonwovens, he adds. “Almost all type of nonwovens are widely available in Turkey. These not only include commodity products but also specialties. Turkey has a very good strategic location supported with highly educated and skilled workforce and a good infrastructure. These parameters combined with the entrepreneurship vision of the families in this business lead Turkey to be center for nonwovens.”

The most recent news from another Gaziantep-based nonwovens producer, Gulsan Group, is the purchase of a new Reifenhäuser Reicofil 5 line. Reicofil 5 supercedes Reicofil 4+ technology and sets new standards for spunbond and composite nonwovens, according to Reifenhäuser. The new line, which will be located in Gaziantep, Turkey, will feature six beams, will be 5.2 meters wide and will add 35,000 tons of capacity to Gulsan’s operation. It will serve the hygiene and markets.

This news follows a previous announcement from Gulsan, in February 2017, that it would add a new Reicofil 4+ line at its Cairo, Egypt, site, which is on track to start in 2018.

These two latest investments will bring Gulsan Turkey’s total capacity to 120,000 tons and Egypt’s total capacity to 40,000 tons per year.

According to the company, these new investment decisions for Turkey and Egypt have been made to support Gulsan’s future growth in the industry and in the region with highly sophisticated and up-to-date production technologies to its business partners and reinforces the company’s position as one of the leading manufacturers of spunmelt materials with total of 160,000 tons per year capacity in the EMEA (Europe, Middle East and Africa) region.

Saudi Arabia

In Saudi Arabia, Saudi Arabian Advanced Fabrics (SAAF) operates at two sites, one on the East coast of the country near Dammam and one on the West coast near Jeddah. A producer of spunmelt and treated nonwovens, SAAF’s core markets are medical and hygiene.

“The location of KSA (Kingdom of Saudi Arabia) is very strategic for SAAF as it is a gateway to the Middle East region as well as Asia, Africa, Europe and the USA and sits alongside the largest source of raw material—oil—in the world,” explains Darren Stein, sales director Hygiene, SAAF. “The all-round benefit of local raw material supply, converting and supply chain makes KSA a really great location for nonwoven production.”

In the medical market, SAAF makes SMS fabrics for gowns and drapes, and CSR sterilization wrap, offering high tensile strength, elongation, and good air permeability that enables superior performance for this application. SAAF’s Medalon product used for surgeons and other operating room staff offers a degree of protection, for both the patient and healthcare worker that is not found in traditional products, according to the company. Treated in-house, Medalon offers a high level of barrier to fluid penetration with a hydro head exceeding most products on the market, good antistatic properties and full alcohol repellency.

On the hygiene side, SAAF is a major supplier to diaper and feminine hygiene manufacturers that are looking for cost effective fabrics that are either hydrophilic (topsheet) or hydrophobic (BLC/backsheet), as well as core containment fabrics.

“SAAF is constantly evaluating expansion opportunities,” Stein says. “[Our] focus is on both new products and machinery upgrades—changes that will give SAAF a further competitive advantage by taking products and capabilities to the next level.”

In Dammam and Rabigh, Saudi Arabia, Saudi German Co. For Nonwoven Products (SGN) manufactures spunbond and spunmelt SMS materials from Reifenhäuser technologies. The manufacturer also has a distribution center in Antwerp, Belgium, that services its European business as a local supply. Targeting the hygiene, industrial and agricultural markets, Nigel Gautry, marketing and sales manager, SGN, says that 21-year-old company is entering the medical market with nonwovens for gowns, drapes and sterile barrier systems.

“We decided to enter the medical market as this is a market that is perfectly aligned to our core strategy of improving health and happiness,” Gautry explains. “Medical interventions are increasing and the demand for single-use medical fabrics are in greater demand, especially in the developing markets close to our shores.”

New product introductions from SGN include a range of absorbent materials for absorbent drapes and for disinfection wiping materials with high bulk, low lint and high absorbency with textile like feel. In hygiene, SGN UltraSoft is a high bulk, soft material for topsheet applications in baby and feminine care, while SGN UltraSilk is a high bulk, silky soft feel nonwoven which can be used for backsheet and topsheet applications in baby and feminine care.

Gautry says the Kingdom of Saudi Arabia is an ideal location for nonwovens manufacturing because it’s the center of polymer production with low manufacturing costs, which can compete with other geographies. “Geographically [it’s] centrally located for delivery to all continents,” he adds.

Israel

Focusing on the global hygiene market, Avgol, headquartered in Tel Aviv, Israel, delivers a range of products to the baby diaper, adult incontinence and feminine hygiene sectors. The spunmelt nonwovens producer supplies 32 countries from existing production sites in Tel Aviv, Israel; Mocksville, NC in the U.S.; Hubei, China; and Tula, Russia. The company recently reported to the Tel Aviv Stock Exchange that it had signed an agreement for the sale of its rights in its factory in Barkan, Israel, for NIS 52.5 million ($15 million). The deal excludes the six production lines at the plant, which will remain under Avgol’s ownership.

The sale includes a lease-back agreement under which Avgol will lease the property and buildings for two years for NIS 4.68 million ($1.3 million) per year, with options to extend the lease for three periods of two years each. Avgol says that assuming the deal is completed it will post a one-time pre-tax capital gain of $10 million. Completion is expected by the end of this year.

The sale of the Barkan factory is in line with the decision by Avgol’s board to eventually concentrate its Israeli production in its new factory in Dimona, Israel. The $60 million manufacturing site in Dimona is part of Avgol’s ambition to grow its customer base in Europe, the Middle East, Africa and South America. A new state-of-the-art Reicofil 4 line with SSMMS and twin calendar configuration was commissioned at the site in March and is currently commercializing, according to Shane Vincent, vice president global sales & marketing, Avgol.

The opening of the new Israeli site, located in the Negev desert, forms part of a huge multi-million dollar investment and expansion program by Avgol. A second production line was installed at its Russian site last year and a fifth line is being commissioned at its site in Mocksville, NC.

“In order to further grow our multi-national presence, we need to have world-class operations that allow us to deliver the very best new product developments, that are demanded by our customers, on a consistent basis around the world,” Vincent says.

In new product news, Avgol introduced Skinguard topsheet material for the global adult incontinence market at this year’s INDEX show. The fabric is treated with copper oxide to stimulate the production of collagen and other key proteins, stabilize skin layers and improve the look of skin. The result is advanced skin protection and enhancement, improved odor control and long lasting effect throughout the life of the product.

Meanwhile, Kibbutz Shamir, Israel-based Shalag Nonwovens’ main business is in air-through bonded and calender bonded technologies, but also produces small volumes of stitchbonded and needlepunched nonwovens through the subsidiary Noam Urim. The company also manufactures with thermal bonded and air through bonded technologies in Oxford, NC, in the U.S. Shalag largely focuses on the hygiene market, including baby diapers, feminine hygiene and adult incontinence products.

Gabi Gal, Shalag’s director of sales and marketing, says the company is currently upgrading one of its old calender bonded lines in Israel to a new air through bonded line, which will increase its air through bonded capacity in Israel by 50%. The reasoning behind the move is that Shalag sees more opportunities with ATB nonwovens than with calender bonded, according to Gal. The line is expected to be complete in April 2018.

Turkey

Straddling Eastern Europe and western Asia, Turkey’s advantageous geographical position makes it a regional hub to key export markets, including the Middle East and North Africa region and Western Europe. With several new lines coming onstream recently, Turkey continues to be an important player in the nonwovens industry.

Three new lines have been added by Gaziantep, Turkey-based Mogul, which recently celebrated the openings of two new plants; its first foreign investment—in the U.S.—as well as the opening of a new plant in Luleburgaz, Turkey.

The maker of spunbond, meltblown and spunlaced nonwovens unveiled Mogul South Carolina Nonwovens—an $18 million investment—in Grey Court, SC, in late March. The site operates a 3.2 meter, high-speed parallel laid spunlace line with 15,000 tons of annual capacity. The investment is intended to meet demand in the wipes, hygiene, filtration and automotive markets. From this base, Mogul says it will be able to better serve existing customers and capitalize on the growing need for high quality nonwovens in North and South America as well as in Asia-Pacific. Featuring 90,000 square feet of manufacturing space on 20 acres of land, the new site brings more than 70 jobs to the U.S., adding to the 500 employees that are currently part of the Mogul Nonwovens group.

“Mogul has always been a global player with the majority of sales exported to more than 50 countries globally, but to be an international player you also need to manufacture globally,” says Serkan Gogus, CEO of Mogul. “The U.S. is our largest single export market and one of the largest and sustaining economies in the world which played a role in the decision.”

Meanwhile, the new Luleburgaz plant, outside of Istanbul, is now fully operational and is Mogul’s third plant in Turkey. Mogul already operates two plants in Gaziantep. An Andritz neXline spunlace line was installed, and designed with a crosslapped configuration in order to cater to a wide variety of end uses such as applications for the automotive sector, artificial leather, dry wipes or roofing substrates. Mogul also invested in an Andritz Spunjet line for the site to produce technical nonwovens from splittable bicomponent filaments.

Also part of Mogul’s growth strategy is new product development. “Diversification first gives us the chance to differentiate product mix and not to put all of our eggs in one basket, allowing us to reduce risks and then allowing us to be a one stop shop for our customers’ different needs. And diversification allows us to serve different applications and customers,” Gogus says.

Launched in February, Mogul describes Madaline as a nonwoven that can be treated like a traditional textile—with similar touch and drape and the capability to be stitched without fraying.

Madaline features state-of-the-art and patented bico technology to extrude unique filament designs and thereafter subject them to high-pressure water jets to simultaneously shear, fibrillate, entangle and consolidate microfilaments into a fabric. Its microfilaments are up to 100 times thinner than a human hair. The fabric’s dense structure provides good barrier and filtration properties and, thanks to its microfilaments, has good moisture management capability. It is absorbent, quick to dry and breathes well. Madaline can be used in a range of applications from clothing to home textiles and medical wipes to wallcoverings.

Durell spunlace from Mogul debuted in March and is manufactured at the Luleburgaz plant. The crosslapped product supplements Mogul’s existing production of Aqualace parallel-laid spunlace. According to Gogus, crosslapped spunlace technology differs from parallel laid spunlace in that the crosslapper forms a web by laying down the carded fiber at a 90-degree angle to the line’s direction. In a parallel-laid process the carded fiber is laid down parallel to the line’s direction. Through this crosslapping of the web, the resultant spunlace achieves similar tensile strength in both machine direction (MD) and cross direction (CD). Application areas include automotives, building materials, filtration, home textiles, wipes, medical, laminates, personal care, artificial leather, print media and disposable linens.

In Kahramanmaras, Turkey, Teknomelt, a producer of meltblown and spunbond nonwovens, operates out of one site in the city. M. Sami Oner, export manager of Teknomelt, says many industries and manufacturing plants call this city home, mostly in the textile industry, but Teknomelt is the sole nonwovens manufacture there. “A main advantage is that our city is close to the main ports in the region,” he says.

Volume wise, Teknomelt’s key markets are hygiene and medical, followed by absorbent products and wipes. According to Oner, the hygiene market is growing with new investments every year, but he says it’s important to understand where this growth is coming from. Some roll goods manufacturers are establishing diaper-manufacturing plants, he explains, though growth records show new investments and growth for diaper producers and nonwovens producers are shown separately. “But if you look deeply, some of them are related—with the same company outputs that have raw material (nonwovens) and hygiene products manufacturing capabilities.”

Growth is also being seen in the medical market, with new product introductions and increasing demand, along with the expectation of high quality products because of hygiene regulations. “Not only is producing and selling enough, but providing after sale support is becoming very important,” Oner explains. “New products are usually introduced to market with cooperation between buyer groups and suppliers to understand the [situation] and provide the right material for it.”

Each year, Teknomelt, which was established in 2009, tries to either make upgrades and new investments or add new products to its offerings. In 2014, the company started to make meltblown wipes with a “crow’s foot” pattern. This year, the company launched three new products—abrasive wipes, meltblown wipes with enhanced durability with multi layer construction, and an extra thick material made of meltblown for sound insulation in automotives.

“We are still one of the youngest but fast growing nonwoven manufacturers in Turkey,” Oner says. “Every two years we apply for a fastest growing companies competition organized by government agencies, and in 2014 we took 31st place and in 2016 we were 52nd among the top 100 in Turkey. This encourages us, and we know that it is only possible with the help of our team that is focusing on quality and productivity with customer oriented approaches. We try to maintain our place and make it better every year.”

Meanwhile, General Nonwovens, which operates out of two factories in Gaziantep, Turkey, manufactures polypropylene (PP) spunbond nonwovens, polyester (PET) spunbond nonwovens, polylactic acid (PLA) spunbond nonwovens, spunbond-meltblown-spunbond (SMS) nonwovens, and air through bonded nonwovens (ADL and ATB).

Several brands are manufactured by General Nonwovens including HyGen, which is used in the hygiene industry for topsheets, backsheets, ADL, leg cuffs, front ears and core-wraps. The producer also offers a very soft air through bond fabric for companies looking for soft-touch fabric used in premium disposable product end uses. Other brands include FilterGen for the filtration industry, TexGen for coated and laminated fabrics, as well as home textiles, AutoGen for the automotive industry and IndiGen for industrial and technical textiles applications.

New from General Nonwovens are PLA spunbond fabrics that are biodegradable and are made of renewable materials such as cornstarch or sugarcane. These 100% PLA spunbond fabrics are decomposable and environmental friendly. Because these fabrics are thermally bonded, they do not have any binder chemicals, according to Alican Yilankirkan, business development director, General Nonwovens.

New supersoft highloft ATB products from the HyGen brand were also introduced recently, and are used both as a topsheet layer, which is in contact with a baby’s skin, as well as the outer layer as a component of a super-soft breathable textile backsheet.

Yilankirkan says the company exports about 50% of its products to European countries and the U.S., while a limited portion serves Middle East markets. The other half of its output is consumed locally.

“Nonwoven production in Turkey is growing at a very high rate and therefore the competition becomes more and more visible every year,” Yilankirkan says. “However, General Nonwovens as a company with roots not only in the nonwovens industry, but also in different fields of trade and industry, is well prepared to manage the business with its high-qualified team supported with a strong product pipeline.”

Turkey, especially in the last decade, has become a center for nonwovens, he adds. “Almost all type of nonwovens are widely available in Turkey. These not only include commodity products but also specialties. Turkey has a very good strategic location supported with highly educated and skilled workforce and a good infrastructure. These parameters combined with the entrepreneurship vision of the families in this business lead Turkey to be center for nonwovens.”

The most recent news from another Gaziantep-based nonwovens producer, Gulsan Group, is the purchase of a new Reifenhäuser Reicofil 5 line. Reicofil 5 supercedes Reicofil 4+ technology and sets new standards for spunbond and composite nonwovens, according to Reifenhäuser. The new line, which will be located in Gaziantep, Turkey, will feature six beams, will be 5.2 meters wide and will add 35,000 tons of capacity to Gulsan’s operation. It will serve the hygiene and markets.

This news follows a previous announcement from Gulsan, in February 2017, that it would add a new Reicofil 4+ line at its Cairo, Egypt, site, which is on track to start in 2018.

These two latest investments will bring Gulsan Turkey’s total capacity to 120,000 tons and Egypt’s total capacity to 40,000 tons per year.

According to the company, these new investment decisions for Turkey and Egypt have been made to support Gulsan’s future growth in the industry and in the region with highly sophisticated and up-to-date production technologies to its business partners and reinforces the company’s position as one of the leading manufacturers of spunmelt materials with total of 160,000 tons per year capacity in the EMEA (Europe, Middle East and Africa) region.

Saudi Arabia

In Saudi Arabia, Saudi Arabian Advanced Fabrics (SAAF) operates at two sites, one on the East coast of the country near Dammam and one on the West coast near Jeddah. A producer of spunmelt and treated nonwovens, SAAF’s core markets are medical and hygiene.

“The location of KSA (Kingdom of Saudi Arabia) is very strategic for SAAF as it is a gateway to the Middle East region as well as Asia, Africa, Europe and the USA and sits alongside the largest source of raw material—oil—in the world,” explains Darren Stein, sales director Hygiene, SAAF. “The all-round benefit of local raw material supply, converting and supply chain makes KSA a really great location for nonwoven production.”

In the medical market, SAAF makes SMS fabrics for gowns and drapes, and CSR sterilization wrap, offering high tensile strength, elongation, and good air permeability that enables superior performance for this application. SAAF’s Medalon product used for surgeons and other operating room staff offers a degree of protection, for both the patient and healthcare worker that is not found in traditional products, according to the company. Treated in-house, Medalon offers a high level of barrier to fluid penetration with a hydro head exceeding most products on the market, good antistatic properties and full alcohol repellency.

On the hygiene side, SAAF is a major supplier to diaper and feminine hygiene manufacturers that are looking for cost effective fabrics that are either hydrophilic (topsheet) or hydrophobic (BLC/backsheet), as well as core containment fabrics.

“SAAF is constantly evaluating expansion opportunities,” Stein says. “[Our] focus is on both new products and machinery upgrades—changes that will give SAAF a further competitive advantage by taking products and capabilities to the next level.”

In Dammam and Rabigh, Saudi Arabia, Saudi German Co. For Nonwoven Products (SGN) manufactures spunbond and spunmelt SMS materials from Reifenhäuser technologies. The manufacturer also has a distribution center in Antwerp, Belgium, that services its European business as a local supply. Targeting the hygiene, industrial and agricultural markets, Nigel Gautry, marketing and sales manager, SGN, says that 21-year-old company is entering the medical market with nonwovens for gowns, drapes and sterile barrier systems.

“We decided to enter the medical market as this is a market that is perfectly aligned to our core strategy of improving health and happiness,” Gautry explains. “Medical interventions are increasing and the demand for single-use medical fabrics are in greater demand, especially in the developing markets close to our shores.”

New product introductions from SGN include a range of absorbent materials for absorbent drapes and for disinfection wiping materials with high bulk, low lint and high absorbency with textile like feel. In hygiene, SGN UltraSoft is a high bulk, soft material for topsheet applications in baby and feminine care, while SGN UltraSilk is a high bulk, silky soft feel nonwoven which can be used for backsheet and topsheet applications in baby and feminine care.

Gautry says the Kingdom of Saudi Arabia is an ideal location for nonwovens manufacturing because it’s the center of polymer production with low manufacturing costs, which can compete with other geographies. “Geographically [it’s] centrally located for delivery to all continents,” he adds.

Israel

Focusing on the global hygiene market, Avgol, headquartered in Tel Aviv, Israel, delivers a range of products to the baby diaper, adult incontinence and feminine hygiene sectors. The spunmelt nonwovens producer supplies 32 countries from existing production sites in Tel Aviv, Israel; Mocksville, NC in the U.S.; Hubei, China; and Tula, Russia. The company recently reported to the Tel Aviv Stock Exchange that it had signed an agreement for the sale of its rights in its factory in Barkan, Israel, for NIS 52.5 million ($15 million). The deal excludes the six production lines at the plant, which will remain under Avgol’s ownership.

The sale includes a lease-back agreement under which Avgol will lease the property and buildings for two years for NIS 4.68 million ($1.3 million) per year, with options to extend the lease for three periods of two years each. Avgol says that assuming the deal is completed it will post a one-time pre-tax capital gain of $10 million. Completion is expected by the end of this year.

The sale of the Barkan factory is in line with the decision by Avgol’s board to eventually concentrate its Israeli production in its new factory in Dimona, Israel. The $60 million manufacturing site in Dimona is part of Avgol’s ambition to grow its customer base in Europe, the Middle East, Africa and South America. A new state-of-the-art Reicofil 4 line with SSMMS and twin calendar configuration was commissioned at the site in March and is currently commercializing, according to Shane Vincent, vice president global sales & marketing, Avgol.

The opening of the new Israeli site, located in the Negev desert, forms part of a huge multi-million dollar investment and expansion program by Avgol. A second production line was installed at its Russian site last year and a fifth line is being commissioned at its site in Mocksville, NC.

“In order to further grow our multi-national presence, we need to have world-class operations that allow us to deliver the very best new product developments, that are demanded by our customers, on a consistent basis around the world,” Vincent says.

In new product news, Avgol introduced Skinguard topsheet material for the global adult incontinence market at this year’s INDEX show. The fabric is treated with copper oxide to stimulate the production of collagen and other key proteins, stabilize skin layers and improve the look of skin. The result is advanced skin protection and enhancement, improved odor control and long lasting effect throughout the life of the product.

Meanwhile, Kibbutz Shamir, Israel-based Shalag Nonwovens’ main business is in air-through bonded and calender bonded technologies, but also produces small volumes of stitchbonded and needlepunched nonwovens through the subsidiary Noam Urim. The company also manufactures with thermal bonded and air through bonded technologies in Oxford, NC, in the U.S. Shalag largely focuses on the hygiene market, including baby diapers, feminine hygiene and adult incontinence products.

Gabi Gal, Shalag’s director of sales and marketing, says the company is currently upgrading one of its old calender bonded lines in Israel to a new air through bonded line, which will increase its air through bonded capacity in Israel by 50%. The reasoning behind the move is that Shalag sees more opportunities with ATB nonwovens than with calender bonded, according to Gal. The line is expected to be complete in April 2018.