Kin Ohmura07.10.17

The rate of domestic nonwovens production is growing more slowly in Japan than overseas production, as many Japanese manufacturers focus their investments to other areas of Asia.

Leading the way on this trend are Asahi Kasei, which recently announced it would add a third line, doubling capacity, in Thailand, and Mitsui, which makes 15,000 tons of nonwovens in China and 30,000 tons in Thailand. Other recent investments by Japanese nonwovens producers outside of Japan include Daiwabo’s four-line thermal bonding operation in Indonesia and Unitika’s 10,000-ton polyester spunbond operation in Thailand.

However, Japanese producers continue to invest locally, just as not as high of a rate. Mitsui just announced an expansion to its spunmelt capacity in Japan and Unitika continues to expand its production facilities.

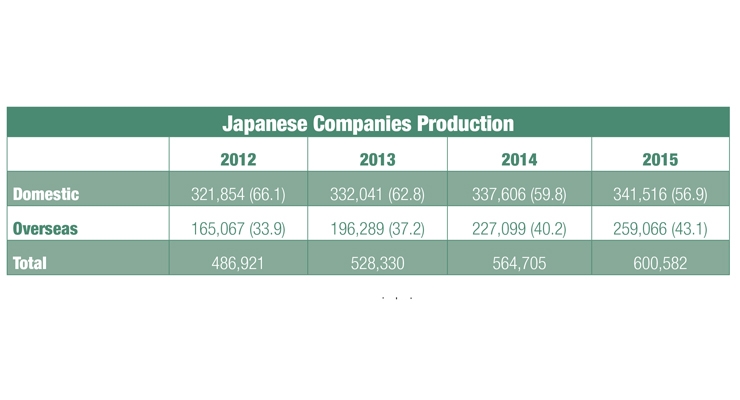

The table below shows the amount of domestic production of the nonwovens and overseas amount of production by Japanese nonwovens manufacturers.

The overseas amount of production of nonwovens by Japan-based companies increased by 30,000 tons per year between 2012 and 2015, from 165,000 tons to 259,000 tons. The amount of production, merged with domestic products and that of overseas is 486,900 tons in 2012, 528,330 tons in 2013, 564,705 tons in 2014 and 600,500 tons in 2015, representing an annual growth rate of 6-8%.

The increasing amount of overseas production has upped the ratio by 10 points from 33.9% in 2012 to 43.1% in 2015. It is expected that offshore production exceeds domestic production in 2018-2019, thanks to continued foreign investment by Japanese companies.

The majority of offshore production is spunbond/meltblown (SMMS), representing 70% of all foreign investment including the recent lines announced by Mitsui and Asahi Kasei. According to the end use applications, medical care/hygiene use account for the majority with 203,790 tons in 2015, occupying 78.7% of the overseas amount of production.

Almost all of the nonwovens used in the medical care and hygiene markets is used in baby diapers. More than 70% of the offshore production of nonwovens is spunbond/meltblown for diapers. The overseas amount of production of nonwovens for diapers exceeded 200,000 tons and also include thermal bonded nonwovens. This is nearly three times as many nonwovens made for diapers produced in Japan.

Behind hygiene and medical, nonwovens used for automotive use outside of Japan represented 8.4% or 21,671 tons, but investment in needlepunch nonwovens for automotives is growing more slowly than consumption, signaling that some Japanese automakers are fueling their overseas operations with nonwovens made by non-Japanese companies.

Leading the way on this trend are Asahi Kasei, which recently announced it would add a third line, doubling capacity, in Thailand, and Mitsui, which makes 15,000 tons of nonwovens in China and 30,000 tons in Thailand. Other recent investments by Japanese nonwovens producers outside of Japan include Daiwabo’s four-line thermal bonding operation in Indonesia and Unitika’s 10,000-ton polyester spunbond operation in Thailand.

However, Japanese producers continue to invest locally, just as not as high of a rate. Mitsui just announced an expansion to its spunmelt capacity in Japan and Unitika continues to expand its production facilities.

The table below shows the amount of domestic production of the nonwovens and overseas amount of production by Japanese nonwovens manufacturers.

The overseas amount of production of nonwovens by Japan-based companies increased by 30,000 tons per year between 2012 and 2015, from 165,000 tons to 259,000 tons. The amount of production, merged with domestic products and that of overseas is 486,900 tons in 2012, 528,330 tons in 2013, 564,705 tons in 2014 and 600,500 tons in 2015, representing an annual growth rate of 6-8%.

The increasing amount of overseas production has upped the ratio by 10 points from 33.9% in 2012 to 43.1% in 2015. It is expected that offshore production exceeds domestic production in 2018-2019, thanks to continued foreign investment by Japanese companies.

The majority of offshore production is spunbond/meltblown (SMMS), representing 70% of all foreign investment including the recent lines announced by Mitsui and Asahi Kasei. According to the end use applications, medical care/hygiene use account for the majority with 203,790 tons in 2015, occupying 78.7% of the overseas amount of production.

Almost all of the nonwovens used in the medical care and hygiene markets is used in baby diapers. More than 70% of the offshore production of nonwovens is spunbond/meltblown for diapers. The overseas amount of production of nonwovens for diapers exceeded 200,000 tons and also include thermal bonded nonwovens. This is nearly three times as many nonwovens made for diapers produced in Japan.

Behind hygiene and medical, nonwovens used for automotive use outside of Japan represented 8.4% or 21,671 tons, but investment in needlepunch nonwovens for automotives is growing more slowly than consumption, signaling that some Japanese automakers are fueling their overseas operations with nonwovens made by non-Japanese companies.