Karen McIntyre, Editor02.02.17

Already among the largest technologies for nonwovens worldwide, spunbond and spunmelt nonwovens continue to grow not only in terms of volumes but also in scope as new technologies emerge targeting areas both within and outside of its core market—hygiene. Although many equate polypropylene spunbond nonwovens with the hygiene market, some experts say that industrial applications consume slightly more (52%) of these types of nonwovens than hygiene.

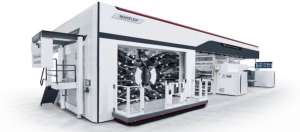

Still, many of the new lines popping up around the world, especially those supplied by German machine supplier Reicofil, offer the low weights, high strength and uniform product required of today’s hygiene market. Considered by some as the standard in hygiene applications, this technology also offers the high volumes, albeit at a hefty price tag, needed for success in hygiene.

“Spunbond polypropylene continues to be the dominant technology platform in the nonwovens business and largely in hygiene, which continues to grow,” says industry consultant David Price. “We are seeing the technology grow faster in some regions of the world than others due to penetration levels.”

According Price, between 2010 and 2015, 37 production lines came onstream around the globe, many of which were placed in new plants in developing areas including India, Africa and throughout the Asia-Pacific. Capacity of these new lines is expected to be absorbed by 2020 or before in a number of regions, driven largely by demand for improved product qualities in hygiene items.

While new line announcements have slowed down in recent months, in the past year lines—all targeting hygiene—have been announced by Berry Plastics in North America, Pegas in the Czech Republic, Fitesa in South Carolina and Germany, Fibertex Personal Care in Malaysia, Avgol in Israel and India, Toray Advanced Materials in Korea, Mitsui Chemical in Japan and Asahi Kasei in Thailand. These lines respond not only to growth in hygiene but also to the changing requirements of the market like lighter weights, softer feel and less raw material consumption and are to some degree replacing older lines, which feature earlier generations of technology that are now being targeted toward areas outside of hygiene.

So So Soft

In recent years, the Chinese diaper market has surprised many industry watchers by raising the bar when it comes to softness. As the Chinese diaper market has demanded softer diapers, other parts of the world have followed suit, edging out more value-oriented options. This trend has trickled down into the nonwovens side of the business, forcing manufacturers to adapt their output.

While some companies have opted to up their air through bonded or carded outputs to expand their “soft” range, others have adapted their existing offerings, either by raw material changes or processing enhancement, to develop a softer spunmelt.

Berry Plastics, perhaps the world’s largest manufacturer of spunbond and spunmelt nonwovens, has taken a multipronged approach to offering softer nonwovens, enhancing its spunmelt output while investing in new carded technology. The company recently completed a $20 million carding investment at its Terno d’Isola, Italy facility, which will help it launch products like 3D Airten, a high end material for the next level of softness and bulk and a fully customizable three-dimensional texture pattern. This material, which is going to be introduced next year, is likely an extension of Airten-22S, a premium air through bonded nonwoven for topsheet and backsheet applications.

“Consumers are expecting more and more from their hygiene products today. The requirements put on our customers to meet these high expectations in unique and value added ways are a constant challenge,” says Sean Imlay, vice president, global hygiene. “The global portfolio assembled by Berry Plastics is unmatched in the industry in its variety and truly offers something for every need.”

Of course, Berry’s spunmelt business continues to be strong. In May 2016, the company announced it would add a new line at an undisclosed site in North America. The new line will add 16,000 metric tons to the company’s existing North American base, which includes lines in Virginia, North Carolina and Mexico serving the North American markets and will be focused on premium applications in desired hygiene and healthcare markets.

This new line, and other recent Berry investments, are likely responsible for several other new “soft” launches including Kamisoft Advance, a soft nonwoven and NG S-Tex, which offers enhanced proprietary technology providing differentiated superior visual softness. Berry will also upgrade its soft calendered landing zone portfolio, which is made in Nueville, France, at a site acquired from Dounor Nonwovens.

On the machinery side, technology leader Reicofil has developed technology in response to demands for bulky and soft nonwovens, particularly for topsheet and backsheet applications, where mid-segment product ranges are being gradually squeezed out of the market by premium products.

In June 2016, the company introduced new developments in high loft spunbond technology that offer unique possibilities for the manufacture of thick, soft nonwovens and have the potential to unlock new areas of application for its customers, according to Michael Maas, operations director research & development.

“In the future, our customers will have to offer soft nonwoven products all over the world,” he says. “It is critical to their businesses to adopt developments early and to be innovative. We already started years ago to develop the technology basis for softer products. Today we are able to offer various solutions for different customer needs.”

Remarking that the process for three-dimensional nonwovens is being constantly developed at the Reicofil Technology Center, which is among the world’s largest research and development centers dedicated to the production of spunbond nonwovens. Located in Troisdorf, Germany, the center houses three high-tech lines to carry out research in close cooperation with customers, institutions and other partners.

Voluminous nonwovens generally consist of self-crimping fibers but the Reicofil technology uses filaments from two different raw materials produced in a side-by-side structure and bonded with hot air or a special embossing calendar. The result is a premium nonwoven used as a top and backsheet in diapers.

“Our technology is reliable and efficient,” Maas says. “It offers a perfect balance of production costs and product properties.”

Another area where Reicofil sees potential for its high loft nonwovens is in packaging of bulk goods. The company’s “Rethinking Packaging” project includes solutions for packaging bulk materials with nonwovens. The team has developed nonwoven cement bag prototypes. “Imagine transferring this solution to packaging all kinds of bulk goods—there is a gigantic potential for nonwovens in the packaging industry,” Maas adds. “Our current developments will wipe away paper bags and woven polypropylene bags due to its superior performance per weight and its unbeatable price.”

Back to hygiene, Fibertex Nonwovens is one of the players choosing to upgrade existing assets to improve softness. The Aalborg, Denmark-based company has announced an upgrade to an existing line in Aalborg—reportedly the addition of new spinning capabilities—that will not only add capacity but allow it to make the same super-soft spunmelt nonwovens currently made at the company’s facility in Malaysia, where a second plant will soon house the company’s fifth line in the country.

Israel-based Avgol has also fine-tuned its spunbond and spunmelt technology to meet the need for softer products. Its Avgol Lux family of fabrics is said to offer manufacturers a visually distinct soft touch fabric solution. The three products in the range Soft touch, Silky smooth softness and Cotton softness are all suitable for topsheet, backsheet and leg cuff applications—as well as ear and landing zone substrates—where they meet the needs of the latest hygiene product design trends around the world.

Executives say the new line has been in development for a number of years and represents significant research and development investment across a number of product performance parameters. The line was initially launched in Asia. “The need for softer nonwovens, which we saw originate in China and is now spreading throughout the world is actually an inspiration and a great motivator to challenge the status quo and bring forth new products in the pipeline,” Price says. “It is a great opportunity for everyone in the nonwovens business, regardless of what type of technology they are using.”

As developments in improving Reicofil technology continue to pave the way for premium hygiene technologies, older Reicofil grades, like the Reicofil 3 lines installed in the 1990s and 2000s are not being shuttered. They are instead being targeted toward non-hygiene areas like automotives or filtration where they offer a competitive cost structure. “It is amazingly flexible technology that is able to have a second life,” Price says.

Not Just Hygiene

Beyond the Reicofil technology, other spunmelt technologies are being chosen by companies looking to enter markets with not only a smaller investment but also a line that offers flexibility in processing and raw material usages. “Every customer is asking for something different—weight, size, color,” says Enrico Buriani, CEO of industrial spunbond manufacturer Radici Group. “When there are all of these parameters, you need to be able to play with the machine and change directions quickly.”

Radici Group has been making spunbond nonwovens since 1995 and has consistently chosen Italian technology over larger Reicofil lines. While this technology traditionally has not offered the low weights and uniform product needed in hygiene, it allowed the company to enter the market at a lower capacity and target a range of markets thanks to its flexible configuration.

“The technology that we have, especially in the last five to 10 years, has allowed us to narrow our focus on industrial applications,” Buriani says. “Our material is not homogenous or lightweight like what goes into hygiene but it does offer a number of advantages like better distribution of mechanical properties. You can say we changed our weakness to opportunity.”

Unlike some of the larger lines, which are too big to handle frequent transition throughput, these lines offer the flexibility needed for industrial applications. Radici offers more than 150 colors, in different shades. “If someone wants just three metric tons of a product, we can do it,” Buriani says, adding that every customer is asking for something different. “We can play with the machine to meet their parameters, allowing them to be more successful.”

Radici’s main market is roofing where it offers spunbond materials that surround a breathable film to form a composite structure. Other markets include automotive wraps, envelopes, airbags and agrotextiles.

Radici’s new investment, a Farè line which should be complete by the end of 2017, is a bicomponent line featuring core/sheath technology, which will allow the company to design new products with different properties. “This is now a new concept but it is a brand new patented technology. Its big advantage is energy savings because it is a main component in the recipe of spunbond production,” Buriani says.

Calling this investment a crucial point for the company, Buriani says it will allow it to produce products with different qualities. One key market is in tabletop applications for restaurants.

“The touch of feel must be as close as possible to cloth. People don’t want it to feel like a plastic sheet. Bico is good for this because it can contain the stronger materials—or a recycled material that is not soft—within the core and use the softer fibers in the sheath of the product. This allows a company to add a lower cost or recycled material in the core, while keeping the sheath or the part that comes in contact with the customers—higher quality.”

Stefano Colombo, sales manager of Faré Spa, says his company has seen increased demand for bicomponent lines in recent years. These lines allow nonwovens producers to use multiple polymers—polypropylene, polyamides, polyesters and polyamides—while other new developments from Faré make new spunbond materials with special characteristics that can’t be achieved with the traditional monocomponent lines.

“The bonding of the bicomponent filaments to obtain the nonwovens can be via thermo, hydro or needlepunched or through-air bonding processes,” he explains. “This occurs in one single step (from raw material polymers to the final rolls) to have products with characteristics similar (and in certain cases better) compared to the products that today are made with two-step processes such as spunlace and through air (high loft) products.”

New developments from Farè are allowing its technology to achieve the same high bulkiness and softness of the through air products, creating products that could ultimately find themselves in the hygiene market.

“At last, the prospective applications for these new spunbond have become realistic now,” Colombo says. “Indeed, we have just received a new order for a new bicomponent line from a European player who is already active in both the industrial and the hygienic fields.”

Mogul’s Moves

Another company that has chosen to focus its spunbond output outside of the hygiene market is Turkey’s Mogul. The company’s Madaline nonwoven features a hybrid-mix microfilament fabrics that uses state-of-the-art and patented bicomponent technology to extrude unique filament designs which are subsequently subjected to high pressure water jets which fibrillate, entangle and consolidate the microfilaments into a nonwoven fabric. The properties of Madaline allow it to easily handle finishing processes such as dyeing, printing, cutting and stitching, similar to a traditional textiles, according to commercial director Serkan Gogus.

“This hybrid technology brings the best of two worlds,” he says. “On one side there’s a unique bicomponent spunbond technology but the bonding is made by hydroentangling which forms microfilaments and gives the fabric unique properties like softness and drape, which brings textile properties. We believe that hybrid technologies are the future of this industry and can open new frontiers for nonwovens in new applications such as apparel and upholstery. That’s why we invested in this technology.”

Madaline’s microfilaments are up to 100 times thinner than a human hair, which allow Madaline to feature good barrier and filtration properties as well as energy savings, breathability, moisture management, thermal insulation and wind resistance.

Madaline’s applications areas include apparel, sportswear, artificial leather, mattress coverings(anti-allergy bedding), filtration, dry wipes, packaging, etc. as either an improved nonwoven or displacing other materials and traditional textiles.

efforts look to revamp spunbond process.

After working at several nonwovens-related companies in the 1980s and 1990s, Perry Hartge has been a gun for hire in engineering and development products for the past two decades. Many of his past projects are integrating cutting edge technologies with a bit of research and development but he has more recently, founded his own project. In partnership with a Florida machinery company, Hartge has simplified the spunbond process, by making the fiber finishing and web formation one process and balancing air flow and energy consumption.

The H2 process, which has been developed by Hartge and his partners over the last 10 years, could cost as much as 90% less than current lines and requires 50% less labor while offering a smaller footprint, fewer precision machine parts and a simplified operation. The key is H2’s patent and PCT protected impingement spinning system, a robust high output process that makes a wide range of spunbond fabrics. The system produces high spin speeds, however, the forming dynamics slow down the fibers before the belt, making lay down easy, similar to the meltblown process.

The process can be adapted to spunmelt with the addition of a meltblown beam of the customer’s choice.

Recognizing that current offerings for hygiene bring a lot to the table when it comes to uniformity and low weights, Hartge says the high cost of investment and complexity of these lines have created a lack of diversity in the market.

“It’s only a matter of time before a viable competitor emerges,” he says.“If you are going to identify how to change the market, you need to come up with something that requires 10 times less capital and the ability to make 10 times more products. That is how technology goes. Eventually someone is going to crack that market and we will see a shift in supply.”

Still, many of the new lines popping up around the world, especially those supplied by German machine supplier Reicofil, offer the low weights, high strength and uniform product required of today’s hygiene market. Considered by some as the standard in hygiene applications, this technology also offers the high volumes, albeit at a hefty price tag, needed for success in hygiene.

“Spunbond polypropylene continues to be the dominant technology platform in the nonwovens business and largely in hygiene, which continues to grow,” says industry consultant David Price. “We are seeing the technology grow faster in some regions of the world than others due to penetration levels.”

According Price, between 2010 and 2015, 37 production lines came onstream around the globe, many of which were placed in new plants in developing areas including India, Africa and throughout the Asia-Pacific. Capacity of these new lines is expected to be absorbed by 2020 or before in a number of regions, driven largely by demand for improved product qualities in hygiene items.

While new line announcements have slowed down in recent months, in the past year lines—all targeting hygiene—have been announced by Berry Plastics in North America, Pegas in the Czech Republic, Fitesa in South Carolina and Germany, Fibertex Personal Care in Malaysia, Avgol in Israel and India, Toray Advanced Materials in Korea, Mitsui Chemical in Japan and Asahi Kasei in Thailand. These lines respond not only to growth in hygiene but also to the changing requirements of the market like lighter weights, softer feel and less raw material consumption and are to some degree replacing older lines, which feature earlier generations of technology that are now being targeted toward areas outside of hygiene.

So So Soft

In recent years, the Chinese diaper market has surprised many industry watchers by raising the bar when it comes to softness. As the Chinese diaper market has demanded softer diapers, other parts of the world have followed suit, edging out more value-oriented options. This trend has trickled down into the nonwovens side of the business, forcing manufacturers to adapt their output.

While some companies have opted to up their air through bonded or carded outputs to expand their “soft” range, others have adapted their existing offerings, either by raw material changes or processing enhancement, to develop a softer spunmelt.

Berry Plastics, perhaps the world’s largest manufacturer of spunbond and spunmelt nonwovens, has taken a multipronged approach to offering softer nonwovens, enhancing its spunmelt output while investing in new carded technology. The company recently completed a $20 million carding investment at its Terno d’Isola, Italy facility, which will help it launch products like 3D Airten, a high end material for the next level of softness and bulk and a fully customizable three-dimensional texture pattern. This material, which is going to be introduced next year, is likely an extension of Airten-22S, a premium air through bonded nonwoven for topsheet and backsheet applications.

“Consumers are expecting more and more from their hygiene products today. The requirements put on our customers to meet these high expectations in unique and value added ways are a constant challenge,” says Sean Imlay, vice president, global hygiene. “The global portfolio assembled by Berry Plastics is unmatched in the industry in its variety and truly offers something for every need.”

Of course, Berry’s spunmelt business continues to be strong. In May 2016, the company announced it would add a new line at an undisclosed site in North America. The new line will add 16,000 metric tons to the company’s existing North American base, which includes lines in Virginia, North Carolina and Mexico serving the North American markets and will be focused on premium applications in desired hygiene and healthcare markets.

This new line, and other recent Berry investments, are likely responsible for several other new “soft” launches including Kamisoft Advance, a soft nonwoven and NG S-Tex, which offers enhanced proprietary technology providing differentiated superior visual softness. Berry will also upgrade its soft calendered landing zone portfolio, which is made in Nueville, France, at a site acquired from Dounor Nonwovens.

On the machinery side, technology leader Reicofil has developed technology in response to demands for bulky and soft nonwovens, particularly for topsheet and backsheet applications, where mid-segment product ranges are being gradually squeezed out of the market by premium products.

In June 2016, the company introduced new developments in high loft spunbond technology that offer unique possibilities for the manufacture of thick, soft nonwovens and have the potential to unlock new areas of application for its customers, according to Michael Maas, operations director research & development.

“In the future, our customers will have to offer soft nonwoven products all over the world,” he says. “It is critical to their businesses to adopt developments early and to be innovative. We already started years ago to develop the technology basis for softer products. Today we are able to offer various solutions for different customer needs.”

Remarking that the process for three-dimensional nonwovens is being constantly developed at the Reicofil Technology Center, which is among the world’s largest research and development centers dedicated to the production of spunbond nonwovens. Located in Troisdorf, Germany, the center houses three high-tech lines to carry out research in close cooperation with customers, institutions and other partners.

Voluminous nonwovens generally consist of self-crimping fibers but the Reicofil technology uses filaments from two different raw materials produced in a side-by-side structure and bonded with hot air or a special embossing calendar. The result is a premium nonwoven used as a top and backsheet in diapers.

“Our technology is reliable and efficient,” Maas says. “It offers a perfect balance of production costs and product properties.”

Another area where Reicofil sees potential for its high loft nonwovens is in packaging of bulk goods. The company’s “Rethinking Packaging” project includes solutions for packaging bulk materials with nonwovens. The team has developed nonwoven cement bag prototypes. “Imagine transferring this solution to packaging all kinds of bulk goods—there is a gigantic potential for nonwovens in the packaging industry,” Maas adds. “Our current developments will wipe away paper bags and woven polypropylene bags due to its superior performance per weight and its unbeatable price.”

Back to hygiene, Fibertex Nonwovens is one of the players choosing to upgrade existing assets to improve softness. The Aalborg, Denmark-based company has announced an upgrade to an existing line in Aalborg—reportedly the addition of new spinning capabilities—that will not only add capacity but allow it to make the same super-soft spunmelt nonwovens currently made at the company’s facility in Malaysia, where a second plant will soon house the company’s fifth line in the country.

Israel-based Avgol has also fine-tuned its spunbond and spunmelt technology to meet the need for softer products. Its Avgol Lux family of fabrics is said to offer manufacturers a visually distinct soft touch fabric solution. The three products in the range Soft touch, Silky smooth softness and Cotton softness are all suitable for topsheet, backsheet and leg cuff applications—as well as ear and landing zone substrates—where they meet the needs of the latest hygiene product design trends around the world.

Executives say the new line has been in development for a number of years and represents significant research and development investment across a number of product performance parameters. The line was initially launched in Asia. “The need for softer nonwovens, which we saw originate in China and is now spreading throughout the world is actually an inspiration and a great motivator to challenge the status quo and bring forth new products in the pipeline,” Price says. “It is a great opportunity for everyone in the nonwovens business, regardless of what type of technology they are using.”

As developments in improving Reicofil technology continue to pave the way for premium hygiene technologies, older Reicofil grades, like the Reicofil 3 lines installed in the 1990s and 2000s are not being shuttered. They are instead being targeted toward non-hygiene areas like automotives or filtration where they offer a competitive cost structure. “It is amazingly flexible technology that is able to have a second life,” Price says.

Not Just Hygiene

Beyond the Reicofil technology, other spunmelt technologies are being chosen by companies looking to enter markets with not only a smaller investment but also a line that offers flexibility in processing and raw material usages. “Every customer is asking for something different—weight, size, color,” says Enrico Buriani, CEO of industrial spunbond manufacturer Radici Group. “When there are all of these parameters, you need to be able to play with the machine and change directions quickly.”

Radici Group has been making spunbond nonwovens since 1995 and has consistently chosen Italian technology over larger Reicofil lines. While this technology traditionally has not offered the low weights and uniform product needed in hygiene, it allowed the company to enter the market at a lower capacity and target a range of markets thanks to its flexible configuration.

“The technology that we have, especially in the last five to 10 years, has allowed us to narrow our focus on industrial applications,” Buriani says. “Our material is not homogenous or lightweight like what goes into hygiene but it does offer a number of advantages like better distribution of mechanical properties. You can say we changed our weakness to opportunity.”

Unlike some of the larger lines, which are too big to handle frequent transition throughput, these lines offer the flexibility needed for industrial applications. Radici offers more than 150 colors, in different shades. “If someone wants just three metric tons of a product, we can do it,” Buriani says, adding that every customer is asking for something different. “We can play with the machine to meet their parameters, allowing them to be more successful.”

Radici’s main market is roofing where it offers spunbond materials that surround a breathable film to form a composite structure. Other markets include automotive wraps, envelopes, airbags and agrotextiles.

Radici’s new investment, a Farè line which should be complete by the end of 2017, is a bicomponent line featuring core/sheath technology, which will allow the company to design new products with different properties. “This is now a new concept but it is a brand new patented technology. Its big advantage is energy savings because it is a main component in the recipe of spunbond production,” Buriani says.

Calling this investment a crucial point for the company, Buriani says it will allow it to produce products with different qualities. One key market is in tabletop applications for restaurants.

“The touch of feel must be as close as possible to cloth. People don’t want it to feel like a plastic sheet. Bico is good for this because it can contain the stronger materials—or a recycled material that is not soft—within the core and use the softer fibers in the sheath of the product. This allows a company to add a lower cost or recycled material in the core, while keeping the sheath or the part that comes in contact with the customers—higher quality.”

Stefano Colombo, sales manager of Faré Spa, says his company has seen increased demand for bicomponent lines in recent years. These lines allow nonwovens producers to use multiple polymers—polypropylene, polyamides, polyesters and polyamides—while other new developments from Faré make new spunbond materials with special characteristics that can’t be achieved with the traditional monocomponent lines.

“The bonding of the bicomponent filaments to obtain the nonwovens can be via thermo, hydro or needlepunched or through-air bonding processes,” he explains. “This occurs in one single step (from raw material polymers to the final rolls) to have products with characteristics similar (and in certain cases better) compared to the products that today are made with two-step processes such as spunlace and through air (high loft) products.”

New developments from Farè are allowing its technology to achieve the same high bulkiness and softness of the through air products, creating products that could ultimately find themselves in the hygiene market.

“At last, the prospective applications for these new spunbond have become realistic now,” Colombo says. “Indeed, we have just received a new order for a new bicomponent line from a European player who is already active in both the industrial and the hygienic fields.”

Mogul’s Moves

Another company that has chosen to focus its spunbond output outside of the hygiene market is Turkey’s Mogul. The company’s Madaline nonwoven features a hybrid-mix microfilament fabrics that uses state-of-the-art and patented bicomponent technology to extrude unique filament designs which are subsequently subjected to high pressure water jets which fibrillate, entangle and consolidate the microfilaments into a nonwoven fabric. The properties of Madaline allow it to easily handle finishing processes such as dyeing, printing, cutting and stitching, similar to a traditional textiles, according to commercial director Serkan Gogus.

“This hybrid technology brings the best of two worlds,” he says. “On one side there’s a unique bicomponent spunbond technology but the bonding is made by hydroentangling which forms microfilaments and gives the fabric unique properties like softness and drape, which brings textile properties. We believe that hybrid technologies are the future of this industry and can open new frontiers for nonwovens in new applications such as apparel and upholstery. That’s why we invested in this technology.”

Madaline’s microfilaments are up to 100 times thinner than a human hair, which allow Madaline to feature good barrier and filtration properties as well as energy savings, breathability, moisture management, thermal insulation and wind resistance.

Madaline’s applications areas include apparel, sportswear, artificial leather, mattress coverings(anti-allergy bedding), filtration, dry wipes, packaging, etc. as either an improved nonwoven or displacing other materials and traditional textiles.

efforts look to revamp spunbond process.

After working at several nonwovens-related companies in the 1980s and 1990s, Perry Hartge has been a gun for hire in engineering and development products for the past two decades. Many of his past projects are integrating cutting edge technologies with a bit of research and development but he has more recently, founded his own project. In partnership with a Florida machinery company, Hartge has simplified the spunbond process, by making the fiber finishing and web formation one process and balancing air flow and energy consumption.

The H2 process, which has been developed by Hartge and his partners over the last 10 years, could cost as much as 90% less than current lines and requires 50% less labor while offering a smaller footprint, fewer precision machine parts and a simplified operation. The key is H2’s patent and PCT protected impingement spinning system, a robust high output process that makes a wide range of spunbond fabrics. The system produces high spin speeds, however, the forming dynamics slow down the fibers before the belt, making lay down easy, similar to the meltblown process.

The process can be adapted to spunmelt with the addition of a meltblown beam of the customer’s choice.

Recognizing that current offerings for hygiene bring a lot to the table when it comes to uniformity and low weights, Hartge says the high cost of investment and complexity of these lines have created a lack of diversity in the market.

“It’s only a matter of time before a viable competitor emerges,” he says.“If you are going to identify how to change the market, you need to come up with something that requires 10 times less capital and the ability to make 10 times more products. That is how technology goes. Eventually someone is going to crack that market and we will see a shift in supply.”