Pranay Bhaskar Sahu, Welspun India Limited01.03.12

Industrialization and urbanization has led to concentration of human settlement at urban centers, which are the hub of the commercial activities. Industrialization has also led to an increase in personal income levels and the consequential expansion of the middle class, allowing a greater number of folks to indulge in value added consumer disposable items like facial cleaning wipes, moist towelettes, personal hygiene wipes and time-saving products like household cleaning wipes etc. The growing use of wipes in industrial and consumer applications, combined with modernization and increased consumer awareness, has led to an increase of demand of wipes globally. This review paper gives brief information on wipes, their applications, their advantages and also about wiping fabric technologies.

What are Wipes?

Wipes can be a paper, tissue or nonwoven; they are subjected to light rubbing or friction, in order to remove dirt or liquid from the surface. Consumers want wipes to absorb, retain or release dust or liquid on demand. One of the main benefits that wipes provide is convenience – using a wipe is quicker and easier than the alternative of dispensing a liquid and using another cloth/paper towel to clean or remove the liquid.

Wipes started at the bottom or more precisely, the baby’s bottom. Yet, during the past decade, the category has grown to include hard surface cleaning, makeup applications and removal, dusting and floor cleaning.In fact, applications other than baby care now account for about 50% of sales in the wipes category.

North America continues to be the leading market, and is projected to grow from $4.5 billion in 2009 to $5.5 billion in 2014. Western Europe is second with sales of $3.6 billion in 2009, which is predicted to grow to $4.2 billion in 2014.The third major market for nonwoven wipes is Asia, which is expected to expand from $1.3 billion in 2009 to almost $2 billion by 2014. South America and Eastern Europe are predicted to grow over smaller bases, reaching $551 million and $558 million, respectively by 2014.

According to reports, China represents more than 33% of the world’s spunlace production, growing more than 33% between 2008 and 2009. More rapid gains will be linked to developing nations such as China and India; China alone will increase its demand for wipes to nearly $500 million in 2011 and will surpass Japan as the leading market in the Asia/Pacific region. [17]

Classification – Wipes categories -

Based on applications (Where):

Wipes mainly cater into 3 categories:

1.Personal Care wipes

2.Household & home cleaning wipes

3.Industrial cleaning wipes

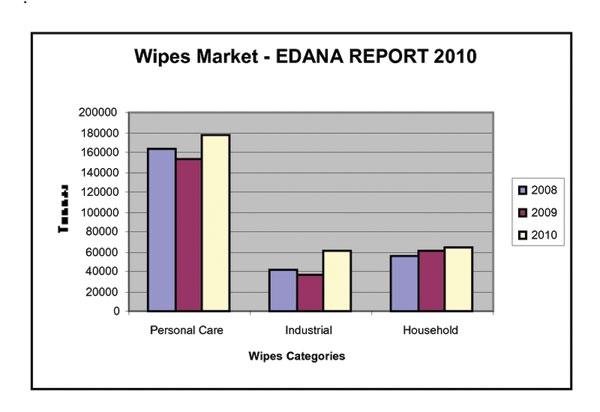

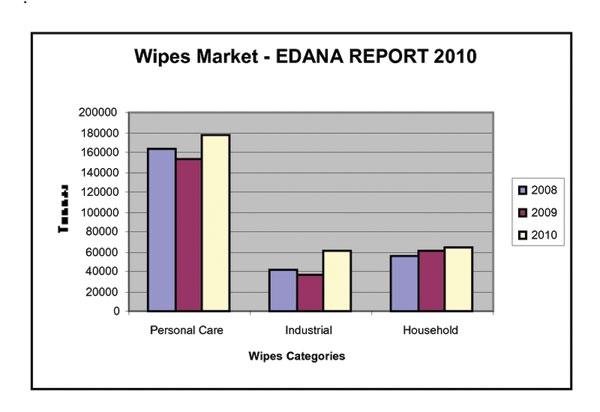

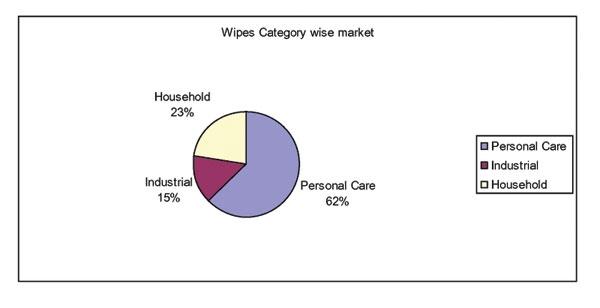

As per the EDANA’s report in 2010, the total wipes deliveries in 2010, amounted to 283,058 tonnes to be compared to 250,356 tonnes in 2009. They subdivide as shown in table 1.

The personal care wipes market has increased by 15.7% compared to 2009. Nonwovens sales to industrial wipes are directly affected by the evolution of industrial production, which was peak in 2007 in Europe. The market has recorded an increase in 13% compared to 2009. The market of household wipes apparently continued to show positive development, 6.5% in 2010 following the 7.7% already observed in 2009.

Personal Care wipes:

• Baby wipes: Baby wipes are wet wipes used to cleanse the sensitive skin of infants. These are saturated with solutions anywhere from gentle cleansing ingredients to alcohol-based“cleaners.” Baby wipes are typically sold in plastic tubs that keep the cloths moist and allow for easy dispensing.

• Cleansing pads: Cleansing pads are fiber sponges that have been previously soaked with water, alcohol and other active ingredients for a specific intended use. There are different types of cleansing pads offered by the beauty industry: makeup removing pads, anti-spot treatments and anti-acne pads that usually contain salicylic acid, vitamins, menthol and other treatments).Cleansing pads for preventing infection are usually saturated with alcohol and bundled in sterile package. Hands and instrument may be disinfected with these pads while treating wounds. Disinfecting cleansing pads are often included in first aid kits for this purpose.

• Pain relief: These are pain relief pads sopping with alcohol and benzocaine. These pads are good for treating minor scrapes, burns, and insect bites. They disinfect the injury and also ease pain and itching.

• Personal hygiene: These are usually pre-moistened and come either individually packaged or in one larger container that can be resealed. These kinds of wipes can be useful when you’re doing outdoor activities, especially during warmer weather. The wipes can remove dirt and sweat before they settle into your pores. Some no-rinse wipes can even remove waterproof makeup.

• Pet care: Today one can find even wet wipes for pet care, for example eye, ear, or dental cleansing pads (with boric acid, potassium chloride, zinc sulfate, sodium borate) for dogs, cats, horses, and birds

Household & home cleaning wipes:

• Kitchen wipes

• Bathroom wipes

• Food service wipes

• Glass surface cleaning wipes

• Automotive care wipes

Industrial cleaning wipe

• Degreasing / Machinery cleaning wipes

When it comes to industrial applications, choosing the right wipe for the job can make an enormous difference in terms of performance, efficiency and economy. Rags and laundered cloths were once the all-purpose solution for wiping dirt and oils from equipment and hands. Convenient disposable wipes are now widely recognized as the preferred alternative.

Disadvantages of rags over disposable wipes (Why):

1. Rags are generally less absorbent especially if they are made of a non-cotton material, while laundered cloths often smear liquids, grease and oil, instead of absorbing them.

2. There are high hidden costs involved in the collection, counting and storage of laundered cloths.

3. Contamination of laundered cloths is also an issue, particularly for the food and beverage sectors, as reuse of the cloth can aide the spread of bacteria.

4. Rags are losing popularity in industrial applications given the variable quality and inconsistent size, absorbency and strength of the cloth. Furthermore, rags often give poorer performance after being repeatedly laundered.

Benefits disposable wipes (Why):

1. They are clean, fresh and can be precut to convenient sizes and shapes.

2. Pre-cut wipes provide higher levels of convenience and mobility, as the wipes are available individually in a compact packaging and ready-folded.

3. Disposable wipes are consistently clean and absorbent with no danger of wiping on rather than wiping off any contaminants. When you use a clean wipe every time, there is no need to worry about cross contamination.

Different industries and processes demand different products. Therefore, it is necessary to select the best wipe for the job with premium quality, specialist products offering improved economy through reduced wastage. For example, the plastics industry has different needs from the hygiene requirements of the food industry.

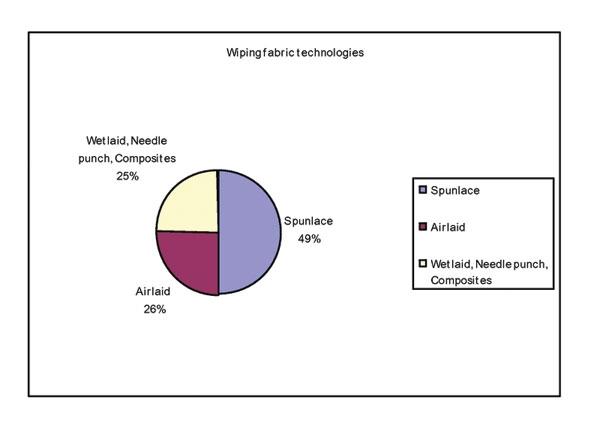

Globally preferred wiping fabric technologies

In 2009 spunlace leads with 358,600 tones and $5.5 billion in sales, roughly half of the total market. This is followed by airlaid, which has volumes of 188,287 tones and sales amounting to $2.3 billion in 2009. Other major technologies include carded, wet laid, spun laid, needle punch and composites. In terms of CAGR projections over the 2009-14 period, composites are expected to have the highest CAGR at 8.5%, with the segment growing over a small base. Following this are spunlace at 6.7%, spun laid at 5.1% and needle punch at 4.9%.

Major product through spunlace and airlaid technologies are wipes and in wipes also the major market is for wet wipes.

Global demand for dry/wet wipes

Pre-moistened or wet wipes are normally supplied to the consumer already wet or pre-moistened with a liquid, while the dry wipes are supplied dry, with the understanding that the consumer will add a liquid if needed. In 2009, wet wipes contributed around 71% of the total wipes market. Over time, dry wipes are predicted to gradually gain market share, growing from 29% in 2009 to 30% in 2014. [9]

Raw materials for wiping fabrics [1]:

• Wood Pulp: It is the main raw material for the wetlaid sector. Wood pulp is also used in spun lace – composite / hybrid processes such as “Spun-Pulp-Spun” SPS or “Spun-Carded-Spun” SPC. It is also favorites for “airlaid paper” (short-fiber based) technologies.

• Polyester: It is by far the most common fiber for carded technologies. As

per the application and wipes categories the blend percentage varies. Normally the Industrial wipes are made from 100% Polyester. It is estimated at nearly 43% of the fiber consumed in spun lace.

• Viscose: It is another common fiber for wipes, especially for personal care. Personal care wipes are used on very sensitive parts – baby care, facial wipes etc.It has to be very soft, smooth and silky. Viscose fiber has all these properties and because of these properties viscose fiber is referred as “art silk” in the textile industry. Nonwovens industry producers have been working on developing wipes that will flush. To create a

flushable nonwoven product, the right combination of strength, easy break up and dispersion is required. To be considered truly flushable the wipe must also be biodegradable. Wipes made from viscose fibers have all these properties and thus can be categorized has flushable products.

Household wipes are generally made up of polyester and viscose blended fibers, polyester being the major component.

• Cotton:Environmental consciousness combined with price increases

and shortages in competing materials have created a strong market opportunity for cotton in the nonwoven industry during the past two years, particularly in the wipes market where the addition of cotton can boost absorbency and strength. Cotton has been enjoying a place in the private label baby wipes market, viscose continues to be a dominant fiber in most spunlace applications, despite a global supply shortage that has driven up prices.

Wipes business – Supply chain & strategy:

The wiping fabric manufacturers starts the business by delivering the wipe roll goods to either the branded wipes converters or private label wipes converters. Branded wipes converters after conversion sell their products in their own name. While the private label converters do the conversion for some other branded wipes manufacturers or for some retail giants like Wal-Mart. Over the period of time the wiping fabric manufacturers also start wipes conversion in-house, again for own brand or for some leading wipes brand..

Conclusion:

Developed regions like the U.S., Western Europe and Japan will continue to lead the global wipes market because of the large affluent population and lifestyle trends focused on time saving products. Developing regions like China and India will show a rapid growth for wipes – due to the industrial expansions leading to express economic growth.

Opportunities for growth exist however they can only be realized by continuously introducing innovative products. Wiping fabric manufacturers are working hard to make sure their wipes customers have lots of choices when it comes to environmentally friendly products.Some of the categories where we can expect to see future growth are household cleaning wipes, toddler wipes and facial wipes.

Baby care may have marked the beginning of nonwovens market; the marketers are now moving into even more lucrative categories in an effort to expand the use of wipes beyond babies and are reaching to older kids and their parents. Their portability and convenience, coupled with the hygiene aspect of their single usage, has made them very popular with all types of consumers. Clearly wipes are a rags-to-riches success story in the household and personal products industry and we can bet that demand for these products will continue to grow.

References:

1. http://www.edana.org

2.http://www.inda.org

3. http://www.nonwovens-industry.com

4. http://www.barnhardt.net/NewsImages/SpunlaceVSairlaid.pdf

5. http://www.ahlstrom.com/en/products/fiberComposites/Documents/Wipes%20documents/Wiping%20fabrics%20technologies.pdf

6. http://www.cleaning-matters.co.uk/stories/articles

7. http://health.howstuffworks.com/skin-care/cleansing/products/face-cleansing

8. http://en.wikipedia.org/wiki/Wet_wipe

9. www.intertechpira.com/Steady-Growth-for-the-Global-Nonwoven-Wipes-Market-Despite-Economic-Slowdown.

10. Magdalena Kondej, “Developing markets hold both potential and challenges for wipes manufacturers”, NONWOVENS INDUSTRY, April 2010, 136-139

11. The Freedonia Group, “World Wipes Industry study with forecasts for 2011 & 2016, August 2007

12. Ian Butler, “Outlook & Prospects for Nonwovens in India”, The Indian Textile Journal, October 2007

13. Ravishankar Gopal, “Nonwovens’ Potential And the Unique Indian Situation”, NONWOVENS INDUATRY, February 2005

14. Karen McIntyre, “Spunlace Showdown”, NONWOVEN INDUSTRY, March2011

15. www.happi.com/articles/2006/10/from-rags-to-riches

16. www.happi.com/wipes/2010/09/wipes-market-watch

17. www.happi.com/articles/2007/10/wipes-clean-up

18. Karen Bitz McIntyre, “What Is Your Nonwoven Made Of?”, Nonwoven Industry, June 2007

19. J. B. Rodie,“Fibers for Nonwovens”,Textile World/September/October 2010

What are Wipes?

Wipes can be a paper, tissue or nonwoven; they are subjected to light rubbing or friction, in order to remove dirt or liquid from the surface. Consumers want wipes to absorb, retain or release dust or liquid on demand. One of the main benefits that wipes provide is convenience – using a wipe is quicker and easier than the alternative of dispensing a liquid and using another cloth/paper towel to clean or remove the liquid.

Wipes started at the bottom or more precisely, the baby’s bottom. Yet, during the past decade, the category has grown to include hard surface cleaning, makeup applications and removal, dusting and floor cleaning.In fact, applications other than baby care now account for about 50% of sales in the wipes category.

North America continues to be the leading market, and is projected to grow from $4.5 billion in 2009 to $5.5 billion in 2014. Western Europe is second with sales of $3.6 billion in 2009, which is predicted to grow to $4.2 billion in 2014.The third major market for nonwoven wipes is Asia, which is expected to expand from $1.3 billion in 2009 to almost $2 billion by 2014. South America and Eastern Europe are predicted to grow over smaller bases, reaching $551 million and $558 million, respectively by 2014.

According to reports, China represents more than 33% of the world’s spunlace production, growing more than 33% between 2008 and 2009. More rapid gains will be linked to developing nations such as China and India; China alone will increase its demand for wipes to nearly $500 million in 2011 and will surpass Japan as the leading market in the Asia/Pacific region. [17]

Classification – Wipes categories -

Based on applications (Where):

Wipes mainly cater into 3 categories:

1.Personal Care wipes

2.Household & home cleaning wipes

3.Industrial cleaning wipes

As per the EDANA’s report in 2010, the total wipes deliveries in 2010, amounted to 283,058 tonnes to be compared to 250,356 tonnes in 2009. They subdivide as shown in table 1.

The personal care wipes market has increased by 15.7% compared to 2009. Nonwovens sales to industrial wipes are directly affected by the evolution of industrial production, which was peak in 2007 in Europe. The market has recorded an increase in 13% compared to 2009. The market of household wipes apparently continued to show positive development, 6.5% in 2010 following the 7.7% already observed in 2009.

Personal Care wipes:

• Baby wipes: Baby wipes are wet wipes used to cleanse the sensitive skin of infants. These are saturated with solutions anywhere from gentle cleansing ingredients to alcohol-based“cleaners.” Baby wipes are typically sold in plastic tubs that keep the cloths moist and allow for easy dispensing.

• Cleansing pads: Cleansing pads are fiber sponges that have been previously soaked with water, alcohol and other active ingredients for a specific intended use. There are different types of cleansing pads offered by the beauty industry: makeup removing pads, anti-spot treatments and anti-acne pads that usually contain salicylic acid, vitamins, menthol and other treatments).Cleansing pads for preventing infection are usually saturated with alcohol and bundled in sterile package. Hands and instrument may be disinfected with these pads while treating wounds. Disinfecting cleansing pads are often included in first aid kits for this purpose.

• Pain relief: These are pain relief pads sopping with alcohol and benzocaine. These pads are good for treating minor scrapes, burns, and insect bites. They disinfect the injury and also ease pain and itching.

• Personal hygiene: These are usually pre-moistened and come either individually packaged or in one larger container that can be resealed. These kinds of wipes can be useful when you’re doing outdoor activities, especially during warmer weather. The wipes can remove dirt and sweat before they settle into your pores. Some no-rinse wipes can even remove waterproof makeup.

• Pet care: Today one can find even wet wipes for pet care, for example eye, ear, or dental cleansing pads (with boric acid, potassium chloride, zinc sulfate, sodium borate) for dogs, cats, horses, and birds

Household & home cleaning wipes:

• Kitchen wipes

• Bathroom wipes

• Food service wipes

• Glass surface cleaning wipes

• Automotive care wipes

Industrial cleaning wipe

• Degreasing / Machinery cleaning wipes

When it comes to industrial applications, choosing the right wipe for the job can make an enormous difference in terms of performance, efficiency and economy. Rags and laundered cloths were once the all-purpose solution for wiping dirt and oils from equipment and hands. Convenient disposable wipes are now widely recognized as the preferred alternative.

Disadvantages of rags over disposable wipes (Why):

1. Rags are generally less absorbent especially if they are made of a non-cotton material, while laundered cloths often smear liquids, grease and oil, instead of absorbing them.

2. There are high hidden costs involved in the collection, counting and storage of laundered cloths.

3. Contamination of laundered cloths is also an issue, particularly for the food and beverage sectors, as reuse of the cloth can aide the spread of bacteria.

4. Rags are losing popularity in industrial applications given the variable quality and inconsistent size, absorbency and strength of the cloth. Furthermore, rags often give poorer performance after being repeatedly laundered.

Benefits disposable wipes (Why):

1. They are clean, fresh and can be precut to convenient sizes and shapes.

2. Pre-cut wipes provide higher levels of convenience and mobility, as the wipes are available individually in a compact packaging and ready-folded.

3. Disposable wipes are consistently clean and absorbent with no danger of wiping on rather than wiping off any contaminants. When you use a clean wipe every time, there is no need to worry about cross contamination.

Different industries and processes demand different products. Therefore, it is necessary to select the best wipe for the job with premium quality, specialist products offering improved economy through reduced wastage. For example, the plastics industry has different needs from the hygiene requirements of the food industry.

Globally preferred wiping fabric technologies

In 2009 spunlace leads with 358,600 tones and $5.5 billion in sales, roughly half of the total market. This is followed by airlaid, which has volumes of 188,287 tones and sales amounting to $2.3 billion in 2009. Other major technologies include carded, wet laid, spun laid, needle punch and composites. In terms of CAGR projections over the 2009-14 period, composites are expected to have the highest CAGR at 8.5%, with the segment growing over a small base. Following this are spunlace at 6.7%, spun laid at 5.1% and needle punch at 4.9%.

Major product through spunlace and airlaid technologies are wipes and in wipes also the major market is for wet wipes.

Global demand for dry/wet wipes

Pre-moistened or wet wipes are normally supplied to the consumer already wet or pre-moistened with a liquid, while the dry wipes are supplied dry, with the understanding that the consumer will add a liquid if needed. In 2009, wet wipes contributed around 71% of the total wipes market. Over time, dry wipes are predicted to gradually gain market share, growing from 29% in 2009 to 30% in 2014. [9]

Raw materials for wiping fabrics [1]:

• Wood Pulp: It is the main raw material for the wetlaid sector. Wood pulp is also used in spun lace – composite / hybrid processes such as “Spun-Pulp-Spun” SPS or “Spun-Carded-Spun” SPC. It is also favorites for “airlaid paper” (short-fiber based) technologies.

• Polyester: It is by far the most common fiber for carded technologies. As

per the application and wipes categories the blend percentage varies. Normally the Industrial wipes are made from 100% Polyester. It is estimated at nearly 43% of the fiber consumed in spun lace.

• Viscose: It is another common fiber for wipes, especially for personal care. Personal care wipes are used on very sensitive parts – baby care, facial wipes etc.It has to be very soft, smooth and silky. Viscose fiber has all these properties and because of these properties viscose fiber is referred as “art silk” in the textile industry. Nonwovens industry producers have been working on developing wipes that will flush. To create a

flushable nonwoven product, the right combination of strength, easy break up and dispersion is required. To be considered truly flushable the wipe must also be biodegradable. Wipes made from viscose fibers have all these properties and thus can be categorized has flushable products.

Household wipes are generally made up of polyester and viscose blended fibers, polyester being the major component.

• Cotton:Environmental consciousness combined with price increases

and shortages in competing materials have created a strong market opportunity for cotton in the nonwoven industry during the past two years, particularly in the wipes market where the addition of cotton can boost absorbency and strength. Cotton has been enjoying a place in the private label baby wipes market, viscose continues to be a dominant fiber in most spunlace applications, despite a global supply shortage that has driven up prices.

Wipes business – Supply chain & strategy:

The wiping fabric manufacturers starts the business by delivering the wipe roll goods to either the branded wipes converters or private label wipes converters. Branded wipes converters after conversion sell their products in their own name. While the private label converters do the conversion for some other branded wipes manufacturers or for some retail giants like Wal-Mart. Over the period of time the wiping fabric manufacturers also start wipes conversion in-house, again for own brand or for some leading wipes brand..

Conclusion:

Developed regions like the U.S., Western Europe and Japan will continue to lead the global wipes market because of the large affluent population and lifestyle trends focused on time saving products. Developing regions like China and India will show a rapid growth for wipes – due to the industrial expansions leading to express economic growth.

Opportunities for growth exist however they can only be realized by continuously introducing innovative products. Wiping fabric manufacturers are working hard to make sure their wipes customers have lots of choices when it comes to environmentally friendly products.Some of the categories where we can expect to see future growth are household cleaning wipes, toddler wipes and facial wipes.

Baby care may have marked the beginning of nonwovens market; the marketers are now moving into even more lucrative categories in an effort to expand the use of wipes beyond babies and are reaching to older kids and their parents. Their portability and convenience, coupled with the hygiene aspect of their single usage, has made them very popular with all types of consumers. Clearly wipes are a rags-to-riches success story in the household and personal products industry and we can bet that demand for these products will continue to grow.

References:

1. http://www.edana.org

2.http://www.inda.org

3. http://www.nonwovens-industry.com

4. http://www.barnhardt.net/NewsImages/SpunlaceVSairlaid.pdf

5. http://www.ahlstrom.com/en/products/fiberComposites/Documents/Wipes%20documents/Wiping%20fabrics%20technologies.pdf

6. http://www.cleaning-matters.co.uk/stories/articles

7. http://health.howstuffworks.com/skin-care/cleansing/products/face-cleansing

8. http://en.wikipedia.org/wiki/Wet_wipe

9. www.intertechpira.com/Steady-Growth-for-the-Global-Nonwoven-Wipes-Market-Despite-Economic-Slowdown.

10. Magdalena Kondej, “Developing markets hold both potential and challenges for wipes manufacturers”, NONWOVENS INDUSTRY, April 2010, 136-139

11. The Freedonia Group, “World Wipes Industry study with forecasts for 2011 & 2016, August 2007

12. Ian Butler, “Outlook & Prospects for Nonwovens in India”, The Indian Textile Journal, October 2007

13. Ravishankar Gopal, “Nonwovens’ Potential And the Unique Indian Situation”, NONWOVENS INDUATRY, February 2005

14. Karen McIntyre, “Spunlace Showdown”, NONWOVEN INDUSTRY, March2011

15. www.happi.com/articles/2006/10/from-rags-to-riches

16. www.happi.com/wipes/2010/09/wipes-market-watch

17. www.happi.com/articles/2007/10/wipes-clean-up

18. Karen Bitz McIntyre, “What Is Your Nonwoven Made Of?”, Nonwoven Industry, June 2007

19. J. B. Rodie,“Fibers for Nonwovens”,Textile World/September/October 2010