09.20.18

Weinheim, Germany

www.freudenberg-pm.com

2018 Nonwovens Sales: $2.1 billion

(including sales from Freudenberg Performance Materials,

Freudenberg Filtration Technologies and Japan Vilene)

Key Personnel

Frank Heislitz, CEO; Thomas Herr, CFO; John McNabb, COO

Plants

Weinheim, Germany; Neuenburg, Germany; Kaiserslautern, Germany; Greetland, U.K.; Swindon, U.K.; Littleborough, Wales, U.K.; Colmar, France; Barcelona, Spain; Nizhiniy, Novgorod, Russia; Sant´ Omero, Italy; Cossato, Italy; Novedrate, Italy; Pisticci, Italy; Suzhou, China; Nantong, China; Chennai, India; Pyungtaek, South Korea; Yang Mei, Taiwan; Tayuan, Taiwan; San Martin/Buenos Aires, Argentina; Durham, NC; Jacarei, Brazil; Cape Town, South Africa; Macon, GA

ISO Status

All locations are ISO 9001 and ISO 14001 certified; locations serving the automotive industry are TS 16469 certified; all sites are OHSAS 18001 certified

Processes

Drylaid staple fiber, wetlaid, spunbond, meltblown, needlepunch, thermal bond, chemical bond, water entanglement

Brands

Comfortemp, Evolon, SoundTex, Vlieseline, Terbond, Texbond

Major Markets

Automotive, apparel, construction, building interiors, energy, medical, hygiene and special applications, shoe and leather goods

As it celebrates the 20th anniversary of its unique Evolon microfilament technology, finishes up work on its latest Tufts line in Taipei, Taiwan, and lets the ink dry on its latest filtration-related acquisition, Freudenberg is a company that wears many hats in the nonwovens industry. The company’s nonwovens-related businesses fall within three of its major divisions, Freudenberg Performance Materials, Freudenberg Filtration Technologies and Japan Vilene. Together, the three divisions reported sales of about $2.1 billion in 2018.

The largest division, Performance Materials, which was created through a marriage of the nonwovens business and Texbond, Freudenberg’s construction-related entity, in 2014, reported a challenging year in 2018. Sales were impacted by negative exchange rates and profits were hit with rising raw material prices.

The division’s largest recent investment is a new headliner line in Suzhou, China. The line which was officially complete in March, enables the company to meet the increasing demand for high-quality car headliners in China and South-East Asia.

With the new production line, Freudenberg will increase its annual production of technical textiles in Suzhou by around eight million square meters per year. Customers will particularly benefit from higher quality of the next generation headliner products. “This investment underscores our long-term commitment to Asia. We want to continue to support our customers in the automotive market with innovative and sustainable solutions that will help them grow,” comments Dr. Frank Heislitz, CEO of Freudenberg Performance Materials.

Freudenberg & Vilene Company headliners are based on nonwovens and can be finished in various ways to provide additional functionality. Apart from excellent surface appearance with good abrasion resistance, outstanding acoustic properties and improved stain resistance, these products contribute to higher comfort in the car interior as well as marked reduction in vehicle weight when combined with other vehicle components. In addition, the company also uses a proportion of recycled products in the manufacture of its products. In this way, Freudenberg helps its customers to reduce their environmental footprint.

In Asia and China, Freudenberg & Vilene Company enjoys long-standing relationships with Asian OEMs, where it holds a leading position in the market. A cornerstone of this success has been the ability to create numerous headliner innovations.

Meanwhile, in Taiwan, in March 2018, Freudenberg said it would add a production line at its Tufts facility in Tayuan Tao-Yuan. Expansion of this capacity will allow the company to meet growing demand in the traditional automotive and carpet markets in Asia. The investment will add about 11,000 metric tons to Freudenberg’s Taiwan capacity. It is expected to be complete by 2020.

“The new line features the most advanced spinning technology available which means a more uniform product,” says chief technology officer John McNabb. “Once this technology proves itself, we will roll it out to our existing spunbond lines.”

Outside of Taiwan, Freudenberg operates a spunbond facility in Durham, NC, where it continuously upgrades its lines to improve uniformity and improve tufting performance of materials targeting carpet, backing, automotives, carpet tiles and shoe components.

Elsewhere in the U.S., Freudenberg’s construction facility in Macon, GA, was expanded with a new line in mid-2017. The new line featured new technology for Freudenberg allowing it to offer glass reinforced polyester spunbond nonwovens to satisfy demand in the roofing markets. Following the completion of one of these lines, Freudenberg shut down an existing staple fiber in Macon.

Meanwhile, in South America, August 2018 saw the end of production at Freudenberg’s Villa Zagala, Argentina, facility amidst economic challenges in the region. Production of materials at the site, which is located near Buenos Aires, have been transferred to Freudenberg’s plant in Jacarei, Brazil. The move impacts Freudenberg’s hygiene business, where it is a niche player supplying acquisition and distribution materials for diapers and feminine hygiene products.

“This decision was necessitated by the joint effects of market characteristics over recent years in combination with structural conditions in Argentina that have been unfavorable for this type of business,” executives say. “We continue to serve our clients in the usual way from a modern facility with a highly efficient production system as part of our strategy of asset consolidation. Other Freudenberg Group companies and the shoe and interlinings divisions belonging to Freudenberg Performance Materials have and will continue their operations as usual.”

The closure was not the first measure Freudenberg made to secure itself against difficult conditions in Argentina. In 2016, the company launched a major restructuring of its hygiene operations, making its facility there fully dedicated to the hygiene market. This effort was initially successful and executives said the initial turnaround in South America was a major contributor to profit growth in the division in 2016.

Admittedly a niche player in the hygiene market, Freudenberg also shut down a hygiene-related site in Greetland, U.K., in late 2018 after a major customer decided to go in a different direction. “The line was very customized and it couldn’t be retrofitted,” McNabb says. “For us, hygiene is a niche area, we don’t compete globally.”

Within the company’s filtration business, Freudenberg Filtration Technologies announced it would purchase Apollo Air Cleaner Co. in China in December 2018. With approximately 1000 employees and €96 million in sales, Apollo is a leading supplier of air and water filtration products in China. The acquisition strengthens Freudenberg’s position in China’s rapidly growing filtration market, which is growing strong thanks to stricter regulations and increased environmental awareness.

“Apollo is a great fit for Freudenberg,” says Andreas Kreuter, CEO of Freudenberg Filtration Technologies. “It is an innovative technology company that complements our own portfolio of filtration solutions for indoor air and water purification.”

The company also has first class production expertise and excellent networks in the industry. The product solutions of Apollo keep air or drinking water free of (ultra) fine particles, dangerous gases, odors and microorganisms and protect health. At its production site in Shunde, China, the company has established high standards for product quality, process efficiency and workplace safety, and is certified to ISO 9001, ISO 14001 and TS 16949.

Apollo will continue as a joint venture between Freudenberg (major shareholder) and the current sole proprietor Apollo Trading Group, Japan, under the name Freudenberg Apollo Filtration Technologies. Freudenberg Filtration Technologies intends to bring its current consumer filtration business into the joint venture.

Looking at the overall division, Freudenberg Filtration Technologies continued on its sustainable, profitable growth path in 2018 despite a challenging market environment. Within the industrial filtration business, a focus on selected market segments as well as strong demand for filters for air purifiers in China had a positive impact. Meanwhile, the automotive filtration business—both for new vehicles and replacement parts was strong with sales growing in Europe and North America.

Freudenberg has responded to this demand with investments in new cabin air filter lines in Kaiserlautern, Germany as well as a production plant for high resistance air filters in China. Additionally, the group completed an extensive expansion at its factory in Potvorice, Slovakia, making the automotives and industrial filters site one of the group’s largest and most modern factories.

Back to Freudenberg’s nonwoven roll goods business, the company continues to find new application areas for Evolon, its continuous filament technology which his celebrating its 20th anniversary this year. Last year, Evolon released a new generation of the technology using super microfilaments that are half the thickness and twice the density of those used in original Evolon substrates. This opened up new application areas like bedding, technical packaging and many others.

“We have found that the new generation technology has allowed us to enter many new applications,” McNabb says. “It seems the more we work on the technology, the more applications we uncover.”

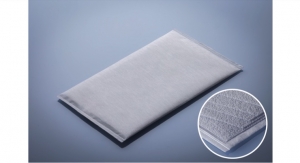

Another interesting technology targeting new applications is Comfortemp fiber ball, the world’s first padding made from fiber balls. It is ideal for use in sports garments as well as in the fashion segment where it offers optimal breathability, is supersoft and fluff and there’s no fiber migration. Freudenberg’s latest offering in this technology is made from 80% recycled fibers, providing a eco version in down fill replacement.

www.freudenberg-pm.com

2018 Nonwovens Sales: $2.1 billion

(including sales from Freudenberg Performance Materials,

Freudenberg Filtration Technologies and Japan Vilene)

Key Personnel

Frank Heislitz, CEO; Thomas Herr, CFO; John McNabb, COO

Plants

Weinheim, Germany; Neuenburg, Germany; Kaiserslautern, Germany; Greetland, U.K.; Swindon, U.K.; Littleborough, Wales, U.K.; Colmar, France; Barcelona, Spain; Nizhiniy, Novgorod, Russia; Sant´ Omero, Italy; Cossato, Italy; Novedrate, Italy; Pisticci, Italy; Suzhou, China; Nantong, China; Chennai, India; Pyungtaek, South Korea; Yang Mei, Taiwan; Tayuan, Taiwan; San Martin/Buenos Aires, Argentina; Durham, NC; Jacarei, Brazil; Cape Town, South Africa; Macon, GA

ISO Status

All locations are ISO 9001 and ISO 14001 certified; locations serving the automotive industry are TS 16469 certified; all sites are OHSAS 18001 certified

Processes

Drylaid staple fiber, wetlaid, spunbond, meltblown, needlepunch, thermal bond, chemical bond, water entanglement

Brands

Comfortemp, Evolon, SoundTex, Vlieseline, Terbond, Texbond

Major Markets

Automotive, apparel, construction, building interiors, energy, medical, hygiene and special applications, shoe and leather goods

As it celebrates the 20th anniversary of its unique Evolon microfilament technology, finishes up work on its latest Tufts line in Taipei, Taiwan, and lets the ink dry on its latest filtration-related acquisition, Freudenberg is a company that wears many hats in the nonwovens industry. The company’s nonwovens-related businesses fall within three of its major divisions, Freudenberg Performance Materials, Freudenberg Filtration Technologies and Japan Vilene. Together, the three divisions reported sales of about $2.1 billion in 2018.

The largest division, Performance Materials, which was created through a marriage of the nonwovens business and Texbond, Freudenberg’s construction-related entity, in 2014, reported a challenging year in 2018. Sales were impacted by negative exchange rates and profits were hit with rising raw material prices.

The division’s largest recent investment is a new headliner line in Suzhou, China. The line which was officially complete in March, enables the company to meet the increasing demand for high-quality car headliners in China and South-East Asia.

With the new production line, Freudenberg will increase its annual production of technical textiles in Suzhou by around eight million square meters per year. Customers will particularly benefit from higher quality of the next generation headliner products. “This investment underscores our long-term commitment to Asia. We want to continue to support our customers in the automotive market with innovative and sustainable solutions that will help them grow,” comments Dr. Frank Heislitz, CEO of Freudenberg Performance Materials.

Freudenberg & Vilene Company headliners are based on nonwovens and can be finished in various ways to provide additional functionality. Apart from excellent surface appearance with good abrasion resistance, outstanding acoustic properties and improved stain resistance, these products contribute to higher comfort in the car interior as well as marked reduction in vehicle weight when combined with other vehicle components. In addition, the company also uses a proportion of recycled products in the manufacture of its products. In this way, Freudenberg helps its customers to reduce their environmental footprint.

In Asia and China, Freudenberg & Vilene Company enjoys long-standing relationships with Asian OEMs, where it holds a leading position in the market. A cornerstone of this success has been the ability to create numerous headliner innovations.

Meanwhile, in Taiwan, in March 2018, Freudenberg said it would add a production line at its Tufts facility in Tayuan Tao-Yuan. Expansion of this capacity will allow the company to meet growing demand in the traditional automotive and carpet markets in Asia. The investment will add about 11,000 metric tons to Freudenberg’s Taiwan capacity. It is expected to be complete by 2020.

“The new line features the most advanced spinning technology available which means a more uniform product,” says chief technology officer John McNabb. “Once this technology proves itself, we will roll it out to our existing spunbond lines.”

Outside of Taiwan, Freudenberg operates a spunbond facility in Durham, NC, where it continuously upgrades its lines to improve uniformity and improve tufting performance of materials targeting carpet, backing, automotives, carpet tiles and shoe components.

Elsewhere in the U.S., Freudenberg’s construction facility in Macon, GA, was expanded with a new line in mid-2017. The new line featured new technology for Freudenberg allowing it to offer glass reinforced polyester spunbond nonwovens to satisfy demand in the roofing markets. Following the completion of one of these lines, Freudenberg shut down an existing staple fiber in Macon.

Meanwhile, in South America, August 2018 saw the end of production at Freudenberg’s Villa Zagala, Argentina, facility amidst economic challenges in the region. Production of materials at the site, which is located near Buenos Aires, have been transferred to Freudenberg’s plant in Jacarei, Brazil. The move impacts Freudenberg’s hygiene business, where it is a niche player supplying acquisition and distribution materials for diapers and feminine hygiene products.

“This decision was necessitated by the joint effects of market characteristics over recent years in combination with structural conditions in Argentina that have been unfavorable for this type of business,” executives say. “We continue to serve our clients in the usual way from a modern facility with a highly efficient production system as part of our strategy of asset consolidation. Other Freudenberg Group companies and the shoe and interlinings divisions belonging to Freudenberg Performance Materials have and will continue their operations as usual.”

The closure was not the first measure Freudenberg made to secure itself against difficult conditions in Argentina. In 2016, the company launched a major restructuring of its hygiene operations, making its facility there fully dedicated to the hygiene market. This effort was initially successful and executives said the initial turnaround in South America was a major contributor to profit growth in the division in 2016.

Admittedly a niche player in the hygiene market, Freudenberg also shut down a hygiene-related site in Greetland, U.K., in late 2018 after a major customer decided to go in a different direction. “The line was very customized and it couldn’t be retrofitted,” McNabb says. “For us, hygiene is a niche area, we don’t compete globally.”

Within the company’s filtration business, Freudenberg Filtration Technologies announced it would purchase Apollo Air Cleaner Co. in China in December 2018. With approximately 1000 employees and €96 million in sales, Apollo is a leading supplier of air and water filtration products in China. The acquisition strengthens Freudenberg’s position in China’s rapidly growing filtration market, which is growing strong thanks to stricter regulations and increased environmental awareness.

“Apollo is a great fit for Freudenberg,” says Andreas Kreuter, CEO of Freudenberg Filtration Technologies. “It is an innovative technology company that complements our own portfolio of filtration solutions for indoor air and water purification.”

The company also has first class production expertise and excellent networks in the industry. The product solutions of Apollo keep air or drinking water free of (ultra) fine particles, dangerous gases, odors and microorganisms and protect health. At its production site in Shunde, China, the company has established high standards for product quality, process efficiency and workplace safety, and is certified to ISO 9001, ISO 14001 and TS 16949.

Apollo will continue as a joint venture between Freudenberg (major shareholder) and the current sole proprietor Apollo Trading Group, Japan, under the name Freudenberg Apollo Filtration Technologies. Freudenberg Filtration Technologies intends to bring its current consumer filtration business into the joint venture.

Looking at the overall division, Freudenberg Filtration Technologies continued on its sustainable, profitable growth path in 2018 despite a challenging market environment. Within the industrial filtration business, a focus on selected market segments as well as strong demand for filters for air purifiers in China had a positive impact. Meanwhile, the automotive filtration business—both for new vehicles and replacement parts was strong with sales growing in Europe and North America.

Freudenberg has responded to this demand with investments in new cabin air filter lines in Kaiserlautern, Germany as well as a production plant for high resistance air filters in China. Additionally, the group completed an extensive expansion at its factory in Potvorice, Slovakia, making the automotives and industrial filters site one of the group’s largest and most modern factories.

Back to Freudenberg’s nonwoven roll goods business, the company continues to find new application areas for Evolon, its continuous filament technology which his celebrating its 20th anniversary this year. Last year, Evolon released a new generation of the technology using super microfilaments that are half the thickness and twice the density of those used in original Evolon substrates. This opened up new application areas like bedding, technical packaging and many others.

“We have found that the new generation technology has allowed us to enter many new applications,” McNabb says. “It seems the more we work on the technology, the more applications we uncover.”

Another interesting technology targeting new applications is Comfortemp fiber ball, the world’s first padding made from fiber balls. It is ideal for use in sports garments as well as in the fashion segment where it offers optimal breathability, is supersoft and fluff and there’s no fiber migration. Freudenberg’s latest offering in this technology is made from 80% recycled fibers, providing a eco version in down fill replacement.