Lianna Albrizio, Assistant Editor01.06.22

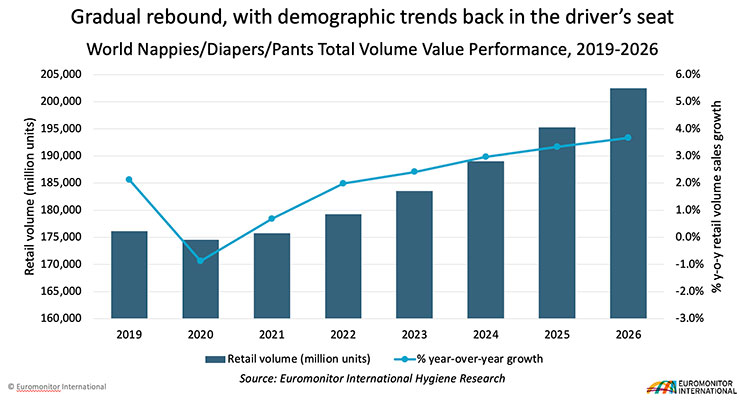

While birth rates fell due to the Covid-19 pandemic, curbing diapers’ and pull-up pants’ consumption growth in the developed world, growing hygiene and product awareness as well as brand variety expansion continue to drive per capita consumption in developing markets. And, according to Liying Qian, senior analyst at Euromonitor International, beginning this year onward, birth rates are expected to increase given greater vaccination rates as the world inches out of the Covid-19 pandemic shrinking fears of hospital visits. Nigeria, for example, is expected to see the largest absolute increase in live births through 2025 further expanding the consumer pool for diapers and pants, which comprise a $47.3 billion market.

As birth rates are expected to pick up, diaper purchasers, which comprise mostly of Millennial and Generation Z aged parents, are seeking sustainable, quality ingredients. Natalia Richer, diaper and absorbent hygiene products global consultant at Diaper Testing International, says hemp fibers will be a growing trend in absorbent hygiene and wipes with Bast Fibre Technologies Inc. leading the transformation into sustainable nonwovens. Bast Fibre—which designs plastic-free nonwoven products made from 100% bast fiber—works with high-biomass annual crops and steers clear of wood-pulp-derived sources to eliminate plastic pollution and deforestation.

Plant-based ingredients such as bio-based plastics—or those made from renewable resources like plant-based ethanol in lieu of non-renewable petroleum – is another growing trend in diapers. Other plant-based ingredients such as viscose derived from bamboo trees and cotton blends are weaving their way into the fabric of personal absorbent hygiene in the years ahead.

In terms of absorbency, diaper manufacturers such as Ontex, Drylock, Abena and Essity are including absorbent channels along the diaper core, as reflected in the latest diaper launches in Europe and the U.S.

“As a global consultant at Diaper Testing International, I’m able to see thousands of diapers from around the world and have the unique position to touch, see and test all the newest diaper launches, including many prototypes as well,” says Richer. “The main trends I see in diaper design is a focus on absorbent channels. The result is typically diapers that are thinner, have better pad integrity and help distribute urine quickly.”

Product Innovations

Pricie Hanna, managing partner with Price Hanna Consultants, concurs. She said manufacturers are making diapers with variations on channels and core designs to produce a more effective distribution and acquisition of fluid and dryer surfaces on the topsheet and longer-term absorption without the addition of more raw materials.

“The most recent, very innovative example that we’ve seen is Ontex’s Climaflex, which combines uniquely positioned channels more with dual-layer core designs,” she says. “We’re seeing a lot of people look at doing more with channels and core layers to achieve highly effective systems for fast desorption of fluid from the topsheet to maintain skin dryness fluid retention in the core layers for up to 12-hour leakage protection.”

Ontex Group launched the Climaflex technology in early December, which the manufacturer is touting as a “next-generation” diaper core made extra thin and breathable as it is comfortable and doesn’t sacrifice absorbency, which is advanced even with a fast-moving baby. Developed by Ontex engineers together with a research and development team in Germany, the Climaflex technology is first launched under Ontex’s Little Big Change brand in Austria, Belgium, France, Germany, Luxemburg and The Netherlands. It will also be rolled out across retailer diaper brands.

According to Annick De Poorter, executive vice president of innovation and sustainability at Ontex, baby skin comfort and ensuring protection against leaks are key purchase drivers.

Qian of Euromonitor adds that they’ve seen a push for cleaner, more sustainable ingredients over the past five years. While these types of diapers are pricier, Qian says kicking in a few extra dollars for top-quality diapers with organic ingredients like shea butter to provide the baby’s delicate skin with additional moisture is worth it for both mother and child. Such high-quality diapers, like from Procter & Gamble and Hello Bello, works to prevent diaper rashes – something caused by the more affordable counterparts – which would add additional burdens for parents in terms of spending more money on creams and giving their baby discomfort.

According to Euromonitor, increasingly hectic lifestyles compounded by rapid urbanization continues to encourage convenience-craving parents to turn to disposable diapers and pants for leak prevention and potty training. Specifically, swimming and nighttime protection resonate with higher-income parents and encourage additional purchasing.

Ontex’s Climaflex technology, for example, enables heat to transfer across the full surface of the diaper, which ensures breathability and heat regulation, maintaining freshness and dryness for the baby’s skin. These diapers have a dual-layer core: the first layer attracts liquid quickly while the second locks it in just as fast despite a highly mobile baby. What’s more, the diaper channel has been designed to handle areas where liquid absorption and distribution is most needed, no matter the baby’s gender. From the central pee points and beyond, liquid can quickly access and distribute through the branches of the dryness-providing channeled core. And, despite, high saturation, Climaflex technology provides a lighter core and smart bending lines making for a comfortable and secure fit for the child.

Open tape diapers comprised almost three quarters of the entire category’s total sales in 2020 and will maintain that dominance, according to Euromonitor’s analysis. At this rate, by the end of 2025, open tape diapers are expected to account for over two-thirds of total category sales. The popularity of open tape diapers – prominent in Middle Eastern and African countries, such as Nigeria, Kenya and Egypt – are attributed to affordability and appeal to low-income consumers who are making the switch from cloth diapers to disposable counterparts with product education.

While open tape diapers dominate the baby diaper category from a sales perspective, major launches of new products such as plant-based Pull-Ups New Leaf training paints from Kimberly-Clark and P&G’s Pampers Ninjamas Nighttime Underwear are rising in popularity.

Similarly, Unicharm launched Lifree absorbent pants in Southeast Asia in 2020. The elastic waist band diapers which are in three sizes, can be pulled up and down like underwear without sagging while providing optimal leak protection.

Meanwhile, Pampers Pure Protection Hybrid diapers are part reusable, part disposable. Pairing soft, reusable cloth covers with disposable inserts featuring Pampers’ trusted leak protection, wetness is locked in for up to 12 hours.

Parents can reuse the cloth diaper cover before washing, a move that may save an average of 270 gallons of water per year versus traditional cloth diapers, according to statistics provided by Pampers. And, a “one size fits most” design meant to grow with baby is paired with an absorbent disposable insert that uses 25% less waste.

“Pampers Pure Protection Hybrid Diapers help keep baby’s skin dry and healthy while producing less waste,” says Katie Stahlheber, P&G NA Baby Care Communications. “They are designed to help parents take ‘baby steps’ to better the world their babies will grow up in.”

For its part, Peejama patented its washable training pants in early 2020 with the goal of providing pajama-like pants for overnight potty training. The pants are made of an absorbent core made of a bamboo-cotton blend. The liners – which can absorb up to 10 ounces of fluid – gives the wearer a wet sensation to prompt a bathroom trip.

“Consumers for baby diapers love the idea of cotton because they’ve always had the perception that cotton is softer than anything else,” notes Hanna. “The idea of cotton and trust in its naturalness is very big and I think we’ll see that continue.”

According to Passport, a global market information database by Euromonitor International, the cloth format, while bubbling under, is gaining traction among Millennial and Gen Z parents. Consumer acceptance of Dorabe, the first domestic Vietnamese brand to provide machine-washable cloth diapers, has grown over the past few years due in part to influencers’ endorsements and promotions and has expanded into the U.S. and European markets. While appealing to lower income and eco-conscious parents (saving buyers 70% of diaper spending), the inconvenience tied to washing them and hygiene shortcomings are projected to limit popularity.

In other news, Disposable Soft Goods Japan celebrated its one-year launch of Mirafeel diapers. The revolutionary re-fastenable pants diaper with front re-closeable seams enable the best fit for babies of all sizes. Designed and manufactured in Japan and winners of the Good Design and Good Parenting Awards in 2021, Mirafeel is equipped with soft-pleated waist gathers and a cushiony-soft, three-dimensional topsheet providing optimal comfort against baby’s delicate skin. Its proprietary thin dry absorbent core is one of the thinnest and most efficient absorbent cores available. What’s more, the diapers are designed by Japanese artists who also craft the packaging design.

“Throughout our 48-year history we pride ourselves on being the first mover in terms of product innovation and supporting the needs of families,” says DSG Japan founder Brandon Wang. “Our most recent venture in Japan strikes at the heart of our beliefs – Japanese technological innovation is amongst the best in the world, and we are honored to have been able to establish our facility here and serve Japanese consumers over the past year.”

Kelheim Fibres has partnered with Sumo diaper to develop a high-performance absorbent pad that uses no fossil materials. The pad is part of a reusable diaper system developed and marketed by Sumo. The entire system developed by Sumo founders Luisa Kahlfeldt and Caspar Böhme is made of sustainable mateirals while offering high performance and innovative design.

The pad is made with the needlepunch/thermal bonded process using a blend of specialty viscose and bicomponent fibers, chosen to ensure the product’s washability. By combining nonwovens, usually found mainly in the single-use sector, with reusable products, Sumo and Kelheim Fibres have chosen a completely new approach to developing reusable diapers.

Inside the pad, the speciality fibers from Kelheim offer special properties: In the distribution layer (ADL), the trilobal cross-section of the Galaxy fiber forms capillary channels that enable efficient and optimized liquid distribution and thus optimum use of the capacity of the absorbent core, offering the lowest rewet values. In the absorbent core, the segmented hollow fiber Bramante fibers store liquid not only between but also inside the fibre. The liquid remains there even when pressure is applied to the construction, providing excellent rewet values. Bramante can absorb up to 260% of its own weight in liquid.

The innovative nonwoven construction with the speciality fibers from Kelheim performs significantly better in tests in terms of air permeability, liquid absorption and rewetting than commercially available solutions made of synthetic fibres or cotton in knitted structures and has earned Sumo diapers a place among the finalists for the IDEA Long-Life Product Achievement Award.

Dr. Marina Crnoja-Cosic, Director New Business Development at Kelheim Fibres, says, "Working with Sumo is inspiring and professional in equal measure. We share a passion for driving the transformation to a bio-based society with innovative solutions.

The launch is scheduled for the first of May.

Fun Designs, Subscription Services and a New Diaper Plant

Another trend in diaper design is the embellishment of characters on the diapers, which are meant to mimic traditional pajamas. Hello Bello, a premium and affordable personal care company founded by husband-and-wife team Dax Shepard and Kristen Bell, also provides fun, whimsical and seasonal designs on their diapers. The diapers, which company president Erica Buxton likens to a cloth-like softness, are free of chloride and artificial fragrances. This month, Hello Bello’s diapers will be designed with a limited-time Dr. Seuss theme included with wipes in a bundle box during its monthly promotion.

Subscription services, such as those offered by Hello Bello, are a growing trend amongst other direct-to-consumer brands such as Nest Diapers and Parasol Diapers, Qian says.

According to key findings from Euromonitor’s Passport, financial uncertainty and price inflation precipitated by the ongoing Covid-19 pandemic are driving consumers to seek value-centric products without compromising on quality. This has pushed companies to reassess the supply chain for cost reductions and further articulate functionality-centric value propositions that resonate with childbearing Millennials and Generation Z-aged parents.

With the pandemic accelerating e-commerce growth, digital strategy is a key component in a brand’s retail success. As shoppers are attracted to a hassle-free shopping experience provided on the web, companies are striving for a happy medium between customizability and inclusivity.

“Hello Bello developed an ecosystem with baby care that branched into baby wipes, cream, shampoos, beyond diapers. Subscription services is a good bundling,” explains Qian. “Integration services encourage consumers to shop other baby products. It makes sense for companies. For consumers, it’s convenient to buy in bulk.”

Hello Bello’s subscription box includes seven packs of diapers and three packs of wipes with 20 designs from which to choose.

“It really goes back to our overall mission of not having to choose between baby and budget,” explains Buxton. “High premium products is, to me, why people trust our brand.”

In October, Hello Bello celebrated the grand opening of its first diaper factory in Waco, TX. The state-of-the-art, 312,000 square-feet integrated facility will provide greater sustainability in both production and distribution, best-in-class quality control of the supply chain, and will keep costs low for the consumer.

The new diaper distribution and manufacturing factory is an emblem of the company’s multi-million-dollar investment in U.S. manufacturing, which has resulted in the creation of nearly 200 new jobs for the region.

Dyper Diverts More Than 10 Million Tons of Diaper Waste

Dyper announced that it has diverted more than ten million pounds of diaper waste from the nation’s landfills through its eco-conscious commercial landfill avoidance program Redyper.

Redyper fulfills Dyper's mission to provide parents with the most guilt-free, closest-to-zero impact diapering journey available. By collecting used diapers from Dyper customers, the optional Redyper service centrally processes and composts the waste. Available, for an additional fee, as a mail away service nationally, local curbside pickup is now live in New York City, Los Angeles, and Chicago.

“The average child uses 3700 diapers by the time they are potty-trained, and more than 30,000 pounds of dirty diapers enter our landfills each and every week - where they can sit for up to 500 years,” says Sergio Radovcic, founder and CEO of Dyper. “It is critical for the planet that we address this problem – and that’s why we’re excited to announce Redyper's expansion into three of the nation’s largest markets. The Redyper service is a cost-effective, responsible step that parents can take to ensure the health of the planet that they will give to their child.”

Before Redyper's growth into the nation’s three largest cities, the curbside pickup service was already available in 11 cities across the country, including Boston, Phoenix and Washington, D.C. The program will expand to an additional 20 U.S. cities in 2022.

Dyper brand diapers are free of chlorine, latex, alcohol, lotions, TBT, and phthalates. The premium diapers are unprinted, unscented, soft to the touch, yet extremely durable and absorbent. Crafted with viscose fibers from responsibly sourced bamboo, Dyper is available at dyper.com, as well as retailers Amazon, Babylist, Grove Collaborative, Hive Brands and Thrive Market.

As birth rates are expected to pick up, diaper purchasers, which comprise mostly of Millennial and Generation Z aged parents, are seeking sustainable, quality ingredients. Natalia Richer, diaper and absorbent hygiene products global consultant at Diaper Testing International, says hemp fibers will be a growing trend in absorbent hygiene and wipes with Bast Fibre Technologies Inc. leading the transformation into sustainable nonwovens. Bast Fibre—which designs plastic-free nonwoven products made from 100% bast fiber—works with high-biomass annual crops and steers clear of wood-pulp-derived sources to eliminate plastic pollution and deforestation.

Plant-based ingredients such as bio-based plastics—or those made from renewable resources like plant-based ethanol in lieu of non-renewable petroleum – is another growing trend in diapers. Other plant-based ingredients such as viscose derived from bamboo trees and cotton blends are weaving their way into the fabric of personal absorbent hygiene in the years ahead.

In terms of absorbency, diaper manufacturers such as Ontex, Drylock, Abena and Essity are including absorbent channels along the diaper core, as reflected in the latest diaper launches in Europe and the U.S.

“As a global consultant at Diaper Testing International, I’m able to see thousands of diapers from around the world and have the unique position to touch, see and test all the newest diaper launches, including many prototypes as well,” says Richer. “The main trends I see in diaper design is a focus on absorbent channels. The result is typically diapers that are thinner, have better pad integrity and help distribute urine quickly.”

Product Innovations

Pricie Hanna, managing partner with Price Hanna Consultants, concurs. She said manufacturers are making diapers with variations on channels and core designs to produce a more effective distribution and acquisition of fluid and dryer surfaces on the topsheet and longer-term absorption without the addition of more raw materials.

“The most recent, very innovative example that we’ve seen is Ontex’s Climaflex, which combines uniquely positioned channels more with dual-layer core designs,” she says. “We’re seeing a lot of people look at doing more with channels and core layers to achieve highly effective systems for fast desorption of fluid from the topsheet to maintain skin dryness fluid retention in the core layers for up to 12-hour leakage protection.”

Ontex Group launched the Climaflex technology in early December, which the manufacturer is touting as a “next-generation” diaper core made extra thin and breathable as it is comfortable and doesn’t sacrifice absorbency, which is advanced even with a fast-moving baby. Developed by Ontex engineers together with a research and development team in Germany, the Climaflex technology is first launched under Ontex’s Little Big Change brand in Austria, Belgium, France, Germany, Luxemburg and The Netherlands. It will also be rolled out across retailer diaper brands.

According to Annick De Poorter, executive vice president of innovation and sustainability at Ontex, baby skin comfort and ensuring protection against leaks are key purchase drivers.

Qian of Euromonitor adds that they’ve seen a push for cleaner, more sustainable ingredients over the past five years. While these types of diapers are pricier, Qian says kicking in a few extra dollars for top-quality diapers with organic ingredients like shea butter to provide the baby’s delicate skin with additional moisture is worth it for both mother and child. Such high-quality diapers, like from Procter & Gamble and Hello Bello, works to prevent diaper rashes – something caused by the more affordable counterparts – which would add additional burdens for parents in terms of spending more money on creams and giving their baby discomfort.

According to Euromonitor, increasingly hectic lifestyles compounded by rapid urbanization continues to encourage convenience-craving parents to turn to disposable diapers and pants for leak prevention and potty training. Specifically, swimming and nighttime protection resonate with higher-income parents and encourage additional purchasing.

Ontex’s Climaflex technology, for example, enables heat to transfer across the full surface of the diaper, which ensures breathability and heat regulation, maintaining freshness and dryness for the baby’s skin. These diapers have a dual-layer core: the first layer attracts liquid quickly while the second locks it in just as fast despite a highly mobile baby. What’s more, the diaper channel has been designed to handle areas where liquid absorption and distribution is most needed, no matter the baby’s gender. From the central pee points and beyond, liquid can quickly access and distribute through the branches of the dryness-providing channeled core. And, despite, high saturation, Climaflex technology provides a lighter core and smart bending lines making for a comfortable and secure fit for the child.

Open tape diapers comprised almost three quarters of the entire category’s total sales in 2020 and will maintain that dominance, according to Euromonitor’s analysis. At this rate, by the end of 2025, open tape diapers are expected to account for over two-thirds of total category sales. The popularity of open tape diapers – prominent in Middle Eastern and African countries, such as Nigeria, Kenya and Egypt – are attributed to affordability and appeal to low-income consumers who are making the switch from cloth diapers to disposable counterparts with product education.

While open tape diapers dominate the baby diaper category from a sales perspective, major launches of new products such as plant-based Pull-Ups New Leaf training paints from Kimberly-Clark and P&G’s Pampers Ninjamas Nighttime Underwear are rising in popularity.

Similarly, Unicharm launched Lifree absorbent pants in Southeast Asia in 2020. The elastic waist band diapers which are in three sizes, can be pulled up and down like underwear without sagging while providing optimal leak protection.

Meanwhile, Pampers Pure Protection Hybrid diapers are part reusable, part disposable. Pairing soft, reusable cloth covers with disposable inserts featuring Pampers’ trusted leak protection, wetness is locked in for up to 12 hours.

Parents can reuse the cloth diaper cover before washing, a move that may save an average of 270 gallons of water per year versus traditional cloth diapers, according to statistics provided by Pampers. And, a “one size fits most” design meant to grow with baby is paired with an absorbent disposable insert that uses 25% less waste.

“Pampers Pure Protection Hybrid Diapers help keep baby’s skin dry and healthy while producing less waste,” says Katie Stahlheber, P&G NA Baby Care Communications. “They are designed to help parents take ‘baby steps’ to better the world their babies will grow up in.”

For its part, Peejama patented its washable training pants in early 2020 with the goal of providing pajama-like pants for overnight potty training. The pants are made of an absorbent core made of a bamboo-cotton blend. The liners – which can absorb up to 10 ounces of fluid – gives the wearer a wet sensation to prompt a bathroom trip.

“Consumers for baby diapers love the idea of cotton because they’ve always had the perception that cotton is softer than anything else,” notes Hanna. “The idea of cotton and trust in its naturalness is very big and I think we’ll see that continue.”

According to Passport, a global market information database by Euromonitor International, the cloth format, while bubbling under, is gaining traction among Millennial and Gen Z parents. Consumer acceptance of Dorabe, the first domestic Vietnamese brand to provide machine-washable cloth diapers, has grown over the past few years due in part to influencers’ endorsements and promotions and has expanded into the U.S. and European markets. While appealing to lower income and eco-conscious parents (saving buyers 70% of diaper spending), the inconvenience tied to washing them and hygiene shortcomings are projected to limit popularity.

In other news, Disposable Soft Goods Japan celebrated its one-year launch of Mirafeel diapers. The revolutionary re-fastenable pants diaper with front re-closeable seams enable the best fit for babies of all sizes. Designed and manufactured in Japan and winners of the Good Design and Good Parenting Awards in 2021, Mirafeel is equipped with soft-pleated waist gathers and a cushiony-soft, three-dimensional topsheet providing optimal comfort against baby’s delicate skin. Its proprietary thin dry absorbent core is one of the thinnest and most efficient absorbent cores available. What’s more, the diapers are designed by Japanese artists who also craft the packaging design.

“Throughout our 48-year history we pride ourselves on being the first mover in terms of product innovation and supporting the needs of families,” says DSG Japan founder Brandon Wang. “Our most recent venture in Japan strikes at the heart of our beliefs – Japanese technological innovation is amongst the best in the world, and we are honored to have been able to establish our facility here and serve Japanese consumers over the past year.”

Kelheim Fibres has partnered with Sumo diaper to develop a high-performance absorbent pad that uses no fossil materials. The pad is part of a reusable diaper system developed and marketed by Sumo. The entire system developed by Sumo founders Luisa Kahlfeldt and Caspar Böhme is made of sustainable mateirals while offering high performance and innovative design.

The pad is made with the needlepunch/thermal bonded process using a blend of specialty viscose and bicomponent fibers, chosen to ensure the product’s washability. By combining nonwovens, usually found mainly in the single-use sector, with reusable products, Sumo and Kelheim Fibres have chosen a completely new approach to developing reusable diapers.

Inside the pad, the speciality fibers from Kelheim offer special properties: In the distribution layer (ADL), the trilobal cross-section of the Galaxy fiber forms capillary channels that enable efficient and optimized liquid distribution and thus optimum use of the capacity of the absorbent core, offering the lowest rewet values. In the absorbent core, the segmented hollow fiber Bramante fibers store liquid not only between but also inside the fibre. The liquid remains there even when pressure is applied to the construction, providing excellent rewet values. Bramante can absorb up to 260% of its own weight in liquid.

The innovative nonwoven construction with the speciality fibers from Kelheim performs significantly better in tests in terms of air permeability, liquid absorption and rewetting than commercially available solutions made of synthetic fibres or cotton in knitted structures and has earned Sumo diapers a place among the finalists for the IDEA Long-Life Product Achievement Award.

Dr. Marina Crnoja-Cosic, Director New Business Development at Kelheim Fibres, says, "Working with Sumo is inspiring and professional in equal measure. We share a passion for driving the transformation to a bio-based society with innovative solutions.

The launch is scheduled for the first of May.

Fun Designs, Subscription Services and a New Diaper Plant

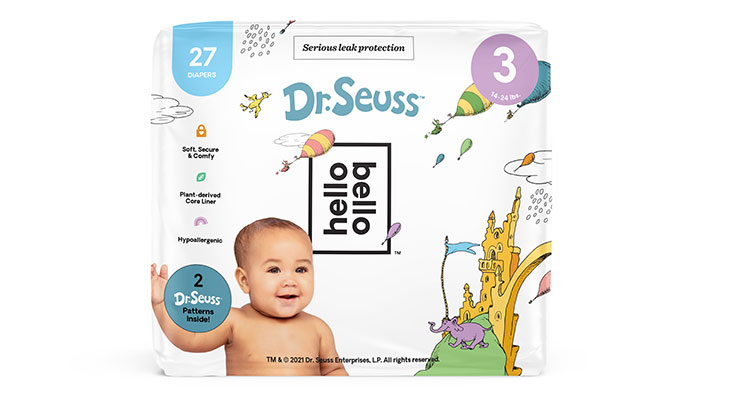

Another trend in diaper design is the embellishment of characters on the diapers, which are meant to mimic traditional pajamas. Hello Bello, a premium and affordable personal care company founded by husband-and-wife team Dax Shepard and Kristen Bell, also provides fun, whimsical and seasonal designs on their diapers. The diapers, which company president Erica Buxton likens to a cloth-like softness, are free of chloride and artificial fragrances. This month, Hello Bello’s diapers will be designed with a limited-time Dr. Seuss theme included with wipes in a bundle box during its monthly promotion.

Subscription services, such as those offered by Hello Bello, are a growing trend amongst other direct-to-consumer brands such as Nest Diapers and Parasol Diapers, Qian says.

According to key findings from Euromonitor’s Passport, financial uncertainty and price inflation precipitated by the ongoing Covid-19 pandemic are driving consumers to seek value-centric products without compromising on quality. This has pushed companies to reassess the supply chain for cost reductions and further articulate functionality-centric value propositions that resonate with childbearing Millennials and Generation Z-aged parents.

With the pandemic accelerating e-commerce growth, digital strategy is a key component in a brand’s retail success. As shoppers are attracted to a hassle-free shopping experience provided on the web, companies are striving for a happy medium between customizability and inclusivity.

“Hello Bello developed an ecosystem with baby care that branched into baby wipes, cream, shampoos, beyond diapers. Subscription services is a good bundling,” explains Qian. “Integration services encourage consumers to shop other baby products. It makes sense for companies. For consumers, it’s convenient to buy in bulk.”

Hello Bello’s subscription box includes seven packs of diapers and three packs of wipes with 20 designs from which to choose.

“It really goes back to our overall mission of not having to choose between baby and budget,” explains Buxton. “High premium products is, to me, why people trust our brand.”

In October, Hello Bello celebrated the grand opening of its first diaper factory in Waco, TX. The state-of-the-art, 312,000 square-feet integrated facility will provide greater sustainability in both production and distribution, best-in-class quality control of the supply chain, and will keep costs low for the consumer.

The new diaper distribution and manufacturing factory is an emblem of the company’s multi-million-dollar investment in U.S. manufacturing, which has resulted in the creation of nearly 200 new jobs for the region.

Dyper Diverts More Than 10 Million Tons of Diaper Waste

Dyper announced that it has diverted more than ten million pounds of diaper waste from the nation’s landfills through its eco-conscious commercial landfill avoidance program Redyper.

Redyper fulfills Dyper's mission to provide parents with the most guilt-free, closest-to-zero impact diapering journey available. By collecting used diapers from Dyper customers, the optional Redyper service centrally processes and composts the waste. Available, for an additional fee, as a mail away service nationally, local curbside pickup is now live in New York City, Los Angeles, and Chicago.

“The average child uses 3700 diapers by the time they are potty-trained, and more than 30,000 pounds of dirty diapers enter our landfills each and every week - where they can sit for up to 500 years,” says Sergio Radovcic, founder and CEO of Dyper. “It is critical for the planet that we address this problem – and that’s why we’re excited to announce Redyper's expansion into three of the nation’s largest markets. The Redyper service is a cost-effective, responsible step that parents can take to ensure the health of the planet that they will give to their child.”

Before Redyper's growth into the nation’s three largest cities, the curbside pickup service was already available in 11 cities across the country, including Boston, Phoenix and Washington, D.C. The program will expand to an additional 20 U.S. cities in 2022.

Dyper brand diapers are free of chlorine, latex, alcohol, lotions, TBT, and phthalates. The premium diapers are unprinted, unscented, soft to the touch, yet extremely durable and absorbent. Crafted with viscose fibers from responsibly sourced bamboo, Dyper is available at dyper.com, as well as retailers Amazon, Babylist, Grove Collaborative, Hive Brands and Thrive Market.