|

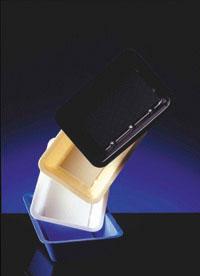

| McAirlaid’s SuperCore technology

is the first commercial airlaid made for food pads without latex

or synthetic binders. |

Nearly five years ago, as optimism

for the future of airlaid reached its high water mark, several companies

were predicting that its increased capacity would lead to new applications.

Currently, a much different reality exists, and the landscape for

airlaid application is more a vast, mysterious tract than the land

of milk and honey.

Companies such as Concert, Buckeye and BBA Fiberweb were the major

contributors to this airlaid expansion which was driven for use

in medical, diaper and wipes applications. Yet, when these markets

failed to explode as anticipated, all was not lost and food packaging

emerged as a ripe new application for airlaid. Some industry experts

estimate that the use of airlaid in food packaging has increased

ten times since 2000, most notably in the application of meat trays

and absorbent meat pads, a market previously dominated by multiply

laminated tissue.

In the past five years, the Food and Drug Administration’s

approval of certain superabsorbents in both granular and fibrous

form for indirect food contact has provided an excellent opportunity

for airlaid manufacturers. Airlaid technology now represents an

ideal vehicle for efficient use of superabsorbents in food packaging

and a variety of new product formats have been designed for this

growing market. A recent study conducted by The Freedonia Group,

Inc., a Cleveland-based industrial market research firm, forecasts

that “...U.S. foodservice packaging demand should climb 4%

per year to $7.6 billion in 2008.” This growth is not limited

to airlaid, but the material consistently takes a larger share of

the the food packaging market every year.

The Door Is Open

Traditional food packaging products have been made for years utilizing

multiple plies of absorbent tissue products that are typically stitch

laminated to a barrier film material. While these products have

served as effective, low cost absorbent pads for poultry and red

meat packaging, there are some significant drawbacks.

The film tends to delaminate from the pad when it is wet, and the

lack of wet strength in the tissue results in an unattractive pulp

mass at the bottom of the tray when the meat is removed. Most significantly,

the tissue product will absorb fluid but has poor retention properties

so fluid can re-emerge into the pack. Recent advances in commercial

technology have prompted a new phase of growth and product diversification.

In the early days of airlaid there were primarily three properties

that airlaid products brought—absorbency, wet strength and

softness. Today, the picture has changed.

The ability of modern airlaid systems to incorporate a broad range

of synthetic fibers and diverse bonding technologies has yielded

a new range of properties, particularly controlled absorption, wet

strength and hydrophobic zones and surfaces as well as the ability

to present the technology in multiple ply structures. These properties

are all attractive to food package manufacturers. Additionally,

airlaid products can provide cost-effective absorbency, which is

the Holy Grail of all interested parties.

The final product is an attractive-looking packaging tray or a meat

pad that retains its integrity when wet and has better fluid retention

properties that together, provide an attractive case-ready package

that satisfies customer demand.

|

| McAirlaid’s SuperCore is also

found in absorbent meat pads. |

Complex Cycles

Supply and demand issues have most recently hampered extensive growth

of airlaid in the application of food packaging with a number of

complex cycles. Most recently, the availability of superabsorbent

fibers—a component common to airlaid food packages and absorbent

meat pads—is in short supply for this market. While plenty

of airlaid exists worldwide, the type ideal for food pads is limited

due to limited raw material supply. Another factor that dictates

the food packaging market is the price of meat itself. Currently,

with poultry prices at an all-time high, poultry producers have

been able to upgrade the quality of the packaging used to deliver

their products. Yet, when chicken prices are low, producers look

to cut costs by lowering the quality of packaging. Packaging materials

will literally change with the state of the market, forcing cost

sensitivity into the equation. An example of this would be last

year’s chicken flu outbreak in the Netherlands which forced

the EU to immediately adopt a ban on movement of poultry within

the Netherlands and also any export of poultry and eggs from that

country. In the beef industry, the recent infection of mad cow disease

prevented the export of beef from the U.K. and forced the destruction

of hundreds of thousands of cows in that country. Events like these

can cause severe economic damage to the respective industries and

cause heavy fluctuations in pricing. However, Europe is traditionally

a more advanced market for food presentation with the U.K. leading

this trend. Within nonwovens airlaid is the dominant material used

for food packaging and as becoming more predominant in U.S. food

packaging.

|

| Ahlstrom is making inroads in food

packaging with the use of wetlaid technology. |

Technology Beckons

Advances in technology is matching changes in food packaging trends.

No longer a niche, airlaid food pads are becoming a viable market

that is vulnerable to technological changes in packaging. Literally,

the way meat is sold drives food packaging development. Food packaging

producers say their customers are looking for a high degree of absorbency,

controlling the liquid that is secreted from the meat. As always

cost and wet strength-- problems associated with earlier tissue

pads, are important considerations.

Steinfurt, Germany-based McAirlaids has focused on technology in

meat packaging with its current offering, SuperCore. The first commercial

airlaid food packaging material without latex or synthetic bonding

fibers, SuperCore uses a proprietary patented thermo-mechanical

bonding process. The flexibility of its production process enables

McAirlaid clients to tailor make SuperCore to the individual needs

and requirement of its customers. “Currently, the economic

situation in Europe is on a downturn, due to governmental and economic

restructuring. But, the introduction of our new product should keep

us ahead of the competition,” said Alex Maximov, managing

director of McAirlaids.

|

| Ahlstrom’s wetlaid technology is already used in products

such as tea bags and coffee filters. |

Airlaid Alternatives

Recognizing the potential for growth in food packaging markets Ahlstrom,

Windsor Locks, CT, is making a play with its offerings of absorbent

food packaging applications in wetlaid technology. Ahlstrom’s

initiative is banking on what it claims is wetlaid’s ability

to process more efficiently than airlaid in the production of food

pads.

“Wetlaid is the company’s core technology, and we have

been successful with wetlaid in other market segments in food packaging,”

said Brian Koscher, director of marketing for meat packaging products

at Ahlstrom. “We are the market leader in the reinforcement

substrate used in fibrous meat casings, so what we have commercially

available, what we are using today, is what we at Ahlstrom are using

to increase our sales by expanding into new categories of food packaging

by starting with what we know best.” Mr. Koscher said his

company recognizes there are an ample number of airlaid suppliers

active in the food packaging industry, but feels that Ahlstrom’s

flexibility with wetlaid technology can take advantage of his customer’s

desire for differentiation in the form of more colorful finished

product’s functionality, and potential additional features

such as anti-microbial treatments found in its products.

“If you establish yourself as a value-added supplier, you

certainly can earn pricing to meet your objective,” he said.

Staying The Course

Since experts in the food industry say package leaking is a huge

complaint among customers, superabsorbency will increase airlaid’s

potential for incremental growth in meat packaging. However, this

growth hinges on its ability for constant improvement of product

offerings. Increased competition among end users and alternative

technologies, such as wetlaid, can only cause further development.

Food packaging experts claim those in the game are converting to

airlaid due to customer demand for a premium product, thus, development

and upgrading is bound to happen.

|