David J. Price, Partner, Price Hanna Consultants LLC02.02.17

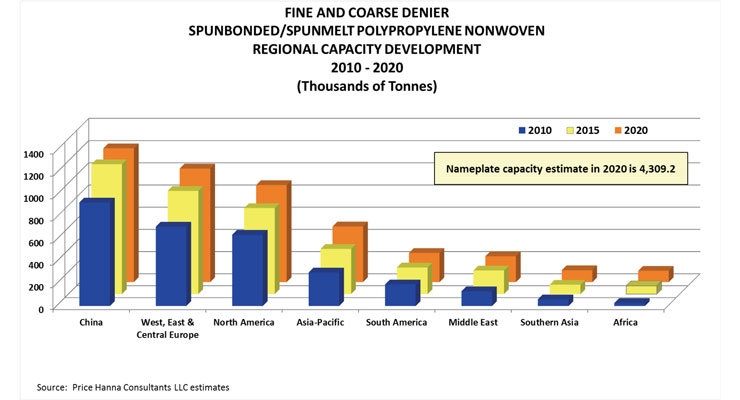

We estimate that the global nameplate capacity of spunbonded/spunmelt polypropylene nonwovens at year end 2016 was just over 4.0 million tons, or about 3.6% higher than year-end 2015. Based upon announced expansions, nameplate capacity will increase in 2017 to nearly 4.2 million tons equal to annual growth rate of 3.2% during the period 2015–2017. Based upon expansions underway or announced, we expect global nameplate capacity to be on the order of 4.3 million tons in 2020 equal to a 2% annual growth rate during 2015 – 2020. This rate of capacity expansion compares to 5.3% per year during 2010–2015. Actual global capacity is likely to be slightly higher in 2020 given that suspected, but not yet announced capacity expansions are not included in our estimates. Year-over-year annual capacity growth may be higher due to uneven installations of capacity.

Although still early in the period, underway or announced global capacity expansion in tons during 2015–2020 is well behind that realized during 2010–2015. During 2010–2015, 1.39 million tons of new capacity was commissioned as compared to 415,000 tons thus far commissioned or announced during 2015–2020. We expect that capacity will be higher than our current estimate in 2020 but still lag that installed during 2010–2020 as capacity installed in the latter period continues to be absorbed.

Selected producers continue to install capacity to modernize their technology base, meet changing and growing demand, position themselves in high growth regional markets and achieve lower cash costs once new higher output capacity is fully utilized.

By region and based upon already announced projects, capacity growth during 2015 - 2017 in Southern Asia is expected to be above 10% per year and ahead all other global regions. Capacity growth in Southern Asia (India/other), Africa and Asia-Pacific will be above the global average. Capacity growth in Europe is expected to be above 4% per year during this period with most of that new capacity being installed in Northern Europe. In North America, capacity growth is expected to be about 4% per year as merchant market demand is growing faster than total demand. New installations in China are expected to be limited in the near term following a multi-year period of rapid expansion.

Global demand growth for nonwovens made on this technology is expected to grow about 4.9% per year in tons and 5.1% in square meters during 2015–2020. Higher square meter demand growth is related to the use of lower weight nonwovens in hygiene end uses, which results in lower demand in tons although we believe that most of the downward trend in down weighting has now been fully realized. We estimate that global machine output capacity utilization increased slightly in 2016 and will continue to increase through 2020 given the current assumption of capacity expansion now foreseen.

Demand is expected to grow at higher rates in emerging markets where penetration of disposable and durable nonwovens is low. Total market growth in tons is expected to be highest in Africa, China and Southern Asia and in the Asia-Pacific region during 2015–2020. More moderate growth is projected in Europe, North America and South and Central America while modest growth is expected in the Middle East.

Demand for spunbonded and spunmelt nonwovens in hygiene end uses as well as in other end use markets will drive growth. Year-over-year demand growth in China has weakened from high levels but remains attractive. On the whole, hygiene demand growth in the Asia-Pacific region remains attractive due to increasing use of spunbonded and spunmelt polypropylene nonwovens as a substitute for other nonwoven materials, as well as from increasing penetration of disposable hygiene products. Improving growth is beginning to result in increased machine utilization, particularly in Asia as a whole and among selected producers worldwide. Attractive growth in Asia Pacific and increasing capacity utilization in South America and China will attract new machine installations late in the period.

The largest market for spunmelt polypropylene is hygiene, which commands about two thirds of the total worldwide capacity of fine and coarse denier spunmelt polypropylene nonwovens. Other important markets for nonwovens made from spunmelt polypropylene technology include a variety of construction applications (geotextiles, residential and commercial wall wrap and ground covers), home furnishings (furniture construction fabrics and carpet backing), medical and industrial protective apparel, automotive and other end uses. We estimate that more nonwovens are made from spunmelt polypropylene technology than any other type of nonwovens technology worldwide.

We expect machine capacity utilization to increase through 2020. In certain global regions, this will lead to installation of new capacity to meet demand. In some of those global regions which are oversupplied, demand is somewhat concentrated among selected producers. These producers will have higher capacity utilization than the regional average, which may drive installation of added capacity in an otherwise oversupplied market.

Historically, spunmelt polypropylene capacity has grown to keep pace with rising demand. Over the last several years, however, other reasons have arisen to install new capacity. Demand for lower weight spunmelt nonwovens, which could not be cost efficiently made on older generation technology, drove installation of new capacity. More recently, demand for softer nonwovens has given rise to increased bicomponent capacity which is but one of a number of methods that may be employed to achieve more soft nonwovens made on this technology.

Secondly, the latest generation spunmelt technology offers more spinning beams, wider width, higher throughput, faster line speeds, finer fiber denier extrusion, greater energy efficiency and higher output than earlier generation technology. This new technology, once fully utilized, can make a lower cost product. The versatility and benefits of this new generation of technology motivated many producers to modernize, even in advance of demand being sufficient to absorb the new capacity.

Thirdly, there has been competitive positioning in strategic and emerging markets in recent years. New producers have entered North America, China, Peru, Egypt/Africa, Russia, Indonesia and India. More recently, strategic positioning within global regions themselves has led to the installation of capacity more closely located to demand to minimize transportation costs. Lastly, while there has been some consolidation among producers, there has been very little equipment rationalization. Early generation equipment continues to operate, mostly at cash cost margins.

We expect that the newest units of capacity will be utilized first as this technology will have the greatest product capability and will achieve lowest cost of manufacture once the lines are fully utilized. The next earliest generation of capacity may then replace even older units of capacity now in operation, possibly resulting in the retirement of very early generation technology. We estimate that in 2015, 30% of all fine denier spunbonded capacity still in operation was early generation.

In addition to how producers deal with the installation of new and the rationalization of old capacity, there are other impacts that new installations of spunbonded polypropylene capacity bring about. One of these impacts is the increasingly high capital cost of new spunmelt polypropylene technology, which could prompt consolidation among some producers to lessen the burden of the high investment cost. This issue has given rise to the introduction of smaller units of capacity which incorporate the most modern features of advanced spinning technology at lower costs. A second related impact is the challenge of technological obsolescence requiring continuing reinvestment to remain competitive. The rapid pace of technology modernization drives concern about falling behind in the race to modernize, forcing a choice between modernizing, repositioning or even withdrawing from the market. Still, another issue will be the change in import and export flows as new producers in regions formerly requiring imports seek to become exporters.

Recent investments allow producers to remain product capable and to achieve higher growth in emerging markets. Consolidation among the both large and small producers has occurred and may likely continue.

Despite these impacts, the modernization of the spunmelt polypropylene technology platform is healthy and positive. New capacity is being installed demonstrating the vibrancy of the market demand for products made on this, the leading technology for nonwovens manufacture in the world.

David Price is the author of the Price Hanna Consultants LLC annual subscription report “Spunbonded and Spunmelt Nonwoven Polypropylene World Capacities, Supply/Demand and Manufacturing Economics. More info: Michele Scannapieco; mscannapieco@pricehanna.com; www.pricehanna.com.

Although still early in the period, underway or announced global capacity expansion in tons during 2015–2020 is well behind that realized during 2010–2015. During 2010–2015, 1.39 million tons of new capacity was commissioned as compared to 415,000 tons thus far commissioned or announced during 2015–2020. We expect that capacity will be higher than our current estimate in 2020 but still lag that installed during 2010–2020 as capacity installed in the latter period continues to be absorbed.

Selected producers continue to install capacity to modernize their technology base, meet changing and growing demand, position themselves in high growth regional markets and achieve lower cash costs once new higher output capacity is fully utilized.

By region and based upon already announced projects, capacity growth during 2015 - 2017 in Southern Asia is expected to be above 10% per year and ahead all other global regions. Capacity growth in Southern Asia (India/other), Africa and Asia-Pacific will be above the global average. Capacity growth in Europe is expected to be above 4% per year during this period with most of that new capacity being installed in Northern Europe. In North America, capacity growth is expected to be about 4% per year as merchant market demand is growing faster than total demand. New installations in China are expected to be limited in the near term following a multi-year period of rapid expansion.

Global demand growth for nonwovens made on this technology is expected to grow about 4.9% per year in tons and 5.1% in square meters during 2015–2020. Higher square meter demand growth is related to the use of lower weight nonwovens in hygiene end uses, which results in lower demand in tons although we believe that most of the downward trend in down weighting has now been fully realized. We estimate that global machine output capacity utilization increased slightly in 2016 and will continue to increase through 2020 given the current assumption of capacity expansion now foreseen.

Demand is expected to grow at higher rates in emerging markets where penetration of disposable and durable nonwovens is low. Total market growth in tons is expected to be highest in Africa, China and Southern Asia and in the Asia-Pacific region during 2015–2020. More moderate growth is projected in Europe, North America and South and Central America while modest growth is expected in the Middle East.

Demand for spunbonded and spunmelt nonwovens in hygiene end uses as well as in other end use markets will drive growth. Year-over-year demand growth in China has weakened from high levels but remains attractive. On the whole, hygiene demand growth in the Asia-Pacific region remains attractive due to increasing use of spunbonded and spunmelt polypropylene nonwovens as a substitute for other nonwoven materials, as well as from increasing penetration of disposable hygiene products. Improving growth is beginning to result in increased machine utilization, particularly in Asia as a whole and among selected producers worldwide. Attractive growth in Asia Pacific and increasing capacity utilization in South America and China will attract new machine installations late in the period.

The largest market for spunmelt polypropylene is hygiene, which commands about two thirds of the total worldwide capacity of fine and coarse denier spunmelt polypropylene nonwovens. Other important markets for nonwovens made from spunmelt polypropylene technology include a variety of construction applications (geotextiles, residential and commercial wall wrap and ground covers), home furnishings (furniture construction fabrics and carpet backing), medical and industrial protective apparel, automotive and other end uses. We estimate that more nonwovens are made from spunmelt polypropylene technology than any other type of nonwovens technology worldwide.

We expect machine capacity utilization to increase through 2020. In certain global regions, this will lead to installation of new capacity to meet demand. In some of those global regions which are oversupplied, demand is somewhat concentrated among selected producers. These producers will have higher capacity utilization than the regional average, which may drive installation of added capacity in an otherwise oversupplied market.

Historically, spunmelt polypropylene capacity has grown to keep pace with rising demand. Over the last several years, however, other reasons have arisen to install new capacity. Demand for lower weight spunmelt nonwovens, which could not be cost efficiently made on older generation technology, drove installation of new capacity. More recently, demand for softer nonwovens has given rise to increased bicomponent capacity which is but one of a number of methods that may be employed to achieve more soft nonwovens made on this technology.

Secondly, the latest generation spunmelt technology offers more spinning beams, wider width, higher throughput, faster line speeds, finer fiber denier extrusion, greater energy efficiency and higher output than earlier generation technology. This new technology, once fully utilized, can make a lower cost product. The versatility and benefits of this new generation of technology motivated many producers to modernize, even in advance of demand being sufficient to absorb the new capacity.

Thirdly, there has been competitive positioning in strategic and emerging markets in recent years. New producers have entered North America, China, Peru, Egypt/Africa, Russia, Indonesia and India. More recently, strategic positioning within global regions themselves has led to the installation of capacity more closely located to demand to minimize transportation costs. Lastly, while there has been some consolidation among producers, there has been very little equipment rationalization. Early generation equipment continues to operate, mostly at cash cost margins.

We expect that the newest units of capacity will be utilized first as this technology will have the greatest product capability and will achieve lowest cost of manufacture once the lines are fully utilized. The next earliest generation of capacity may then replace even older units of capacity now in operation, possibly resulting in the retirement of very early generation technology. We estimate that in 2015, 30% of all fine denier spunbonded capacity still in operation was early generation.

In addition to how producers deal with the installation of new and the rationalization of old capacity, there are other impacts that new installations of spunbonded polypropylene capacity bring about. One of these impacts is the increasingly high capital cost of new spunmelt polypropylene technology, which could prompt consolidation among some producers to lessen the burden of the high investment cost. This issue has given rise to the introduction of smaller units of capacity which incorporate the most modern features of advanced spinning technology at lower costs. A second related impact is the challenge of technological obsolescence requiring continuing reinvestment to remain competitive. The rapid pace of technology modernization drives concern about falling behind in the race to modernize, forcing a choice between modernizing, repositioning or even withdrawing from the market. Still, another issue will be the change in import and export flows as new producers in regions formerly requiring imports seek to become exporters.

Recent investments allow producers to remain product capable and to achieve higher growth in emerging markets. Consolidation among the both large and small producers has occurred and may likely continue.

Despite these impacts, the modernization of the spunmelt polypropylene technology platform is healthy and positive. New capacity is being installed demonstrating the vibrancy of the market demand for products made on this, the leading technology for nonwovens manufacture in the world.

David Price is the author of the Price Hanna Consultants LLC annual subscription report “Spunbonded and Spunmelt Nonwoven Polypropylene World Capacities, Supply/Demand and Manufacturing Economics. More info: Michele Scannapieco; mscannapieco@pricehanna.com; www.pricehanna.com.