Silke Brand-Kirsh, Executive Partner, Sclegel und Partner02.18.16

Multinational brand owners from the U.S., Japan and Europe are fiercely competing for marketshare in the hygiene market of China and Southeast Asia while both regions are in a process of great change. China is going through its seemingly first major economic turmoil, while the ASEAN markets are becoming serious economic powers with still vast untapped market potential. With a GDP per capita growth between 3-7% a year, the freely disposable income of a large share of the population is constantly increasing in these regions. This trend makes hygiene products more affordable for a larger number of people.

While in China, the U.S.-based hygiene product brand owners Procter & Gamble and Kimberly-Clark are still clear market leaders, the Japanese companies Unicharm and Kao are leading the market in Southeast Asia. But the picture is changing as all these players are investing heavily in capacity expansion, new product and marketing concepts and approaches to compete for the new generation of wealthy middle class consumers in the region.

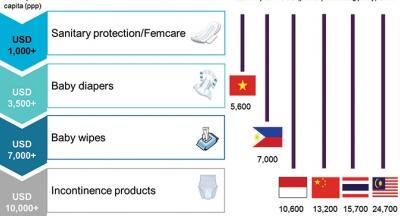

There is a clear correlation between the GDP per capita power purchasing parity (ppp) of a country and the likelihood that the population will buy absorbent hygiene products. The readiness to buy hygiene products starts at about $1000 GDP per capita (ppp), with sanitary protection products. If the country’s economy progresses to $3500 per capita, consumers will usually start buying baby diapers. At $7000 baby wipes are purchased and at a level of $10,000 plus the incontinence market starts to develop.

The economies of Southeast Asia are very diverse, comparable to the various regions of China. In SEA we are dealing with three types of economies—Indonesia, Thailand and Malaysia with more than $10,000 of GDP per capita. The Philippines, has a GDP per capita of $7000, whereas Vietnam only reaches $5600. China has an overall GDP per capita of $15,700. Larger tier 1 cities reach a GDP per capita of about $29,000, while in some poorer rural regions the GDP per capita reaches only $7000.

This creates a huge growth potential particularly in China, which will remain one of the world’s fastest-growing economies in the future, despite its recent economic slowdown. By 2030 it is estimated that 66% of the world’s middle class will be living in Asia. This includes China and Southeast Asia, which will be the focus of this article. As local companies are increasingly competing for market share, existing multinational companies from Japan, the U.S. and Europe will intensify their fight for the new well-off consumer segment. Winners will be the companies that best understand and meet consumer requirements.

Emerging Asian Countries Show Increasing Need for Hygiene Products;

China is Asia’s largest market for nonwoven hygiene products

China, Asia’s largest market for hygiene products, is going through tremendous changes at the moment. Economic slowdown and a stock market crash are only one piece of the puzzle. China will remain a very attractive market for global hygiene product brand owners and their nonwoven suppliers. According to the Euromonitor report 2015, China’s personal hygiene product industry is expected to continue growing at a CAGR of close to 13% in terms of retail sales value in 2019. After all, consumers are still spending, as is apparent from the following facts:

- Double digit year-on-year total retail growth at the end of 2015.

- Total sales of the online sales portal Alibaba were up 60% from 2014.

- Complete relaxation of the one-child policy will lead to higher birth rates.

- A growing middle class willing to pay a premium for convenience and high quality.

- A positive economic development even outside of the metropolitan areas.

New diaper brands are popping up throughout Southeast Asia

The rapidly expanding diaper market in China offers a continuous business opportunity for foreign hygiene producers from Japan, the U.S. and Europe. Most of the projected growth will probably come from lower-tier cities and rural areas, where the baby and personal care products’ penetration remains low at around 10%, compared to more than 90% in major metropolitan areas where it is slowly reaching maturity. Also the birth rate in China’s tier 1 metropolitan cities is much lower than in other areas of China. Shanghai only has four births per thousand people per year. In Germany there is an average of eight births per thousand people, in the U.S. the average is 13 births per 1000.

There is a new young generation of parents born after the 1980s who have become the first mainstream consumer group for diapers in China. They are better educated, wealthier and willing to spend heavily to provide their babies with the best they can afford. Consequently, the marketshare for high-priced diapers in China has grown from less than 10% in 2010 to 15% in 2013. The success of the high-end brands has also called counterfeits onto the scene. Brands like Coon and Merries have in the recent past been successfully copied by Chinese companies. Counterfeits are priced at 155–185 yuan ($23-$28) for a pack of 50 diapers; the same price as the genuine article.

But genuine Chinese brand owners have also been able to successfully increase local sales by improving product quality, optimizing their product portfolio and increasing their proportion of mid-to-high-end products.

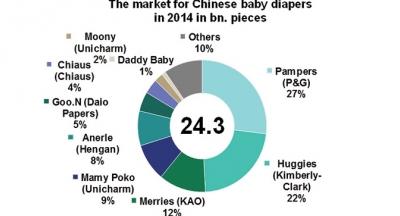

In 2014, China’s largest local brand owner Hengan increased its overall sales by 12.5%. In 2014, it had a marketshare of 8% in China. In comparison, U.S.-based P&G and Kimberly-Clark supply almost 50% of China’s market volume, followed by Japan’s Kao, Unicharm and Daio Paper with a joint marketshare of 28%.

Other up-and-coming local brand owners are Chiao and the Vinda Group. Vinda was established in 1985 and currently runs nine advanced production bases in China. In 2013, SCA became the majority shareholder of Vinda. In 2014, SCA transferred its hygiene business in China to Vinda. Vinda now owns the brands Drypers, Dr.P, Sealer, Prokids, EQ Dry and Control Plus in China, while SCA remains its majority shareholder. SCA also bought the successful Taiwanese hygiene company Everbeauty to strengthen its foothold in Greater China. Another Taiwanese brand is Fuberg, which has successfully expanded into Southeast Asia.

Over 200 new diaper brands—both foreign and domestic—have emerged in the market since 2013, bringing the total number of diaper brands in China to 1200 from 506 companies before 2013. However, the market remains highly cocentrated, with the top 10 brands capturing 80% of sales.

Local companies are trying to catch up with foreign hygiene product manufacturers.

The Chinese government has adopted various macroeconomic regulations and control measures in order to sustain steady economic growth within China. This has resulted in many local manufacturers, including those for hygienic disposables, focusing much more on serving the domestic market than going abroad. While none of the Chinese brand owners owns a foreign production site, they do export their products under their own brands to developing countries and produce OEM and ODM products for foreign manufactures (e.g. the Chinese company Chiaus).

In an attempt to make inroads into the foreign market share in China and in order to cater to consumers’ rising demand for higher-quality products, many domestic manufacturers have invested heavily in foreign manufacturing equipment, trying to upgrade their products in terms of quality, packaging and image. Local hygiene product makers have also invested in R&D to make their products as absorbent and as thin as foreign brands. In terms of distribution, marketing and promotion, foreign brand owners are still superior to local brands despite recent improvements.

As more and more Chinese brands are entering the market, greater competition is expected. The winners of the game will ultimately be those brands, which truly understand the Chinese market needs. In many cases, American and European brands in particular are not responding fast enough. Early movers like P&G have in the recent past failed to keep pace with China’s everchanging market environment. They have not offered high-end products to the Chinese market fast enough and have consequently lost market shares to their Japanese competitors.

Sales of Japan’s Kao Group doubled year-on-year in 2013 and 2014. Sales of the local brands even grew threefold in 2014.

Is Southeast Asia the new China for players in the hygiene market?

Southeast Asia (SEA) is the second-fastest growing region in Asia after China. It also offers excellent business opportunities for hygiene product companies. Product brand owners from Japan, Europe and the U.S. are also competing for marketshare here. Thus large global hygiene players have greatly expanded their presence in SEA, especially since 2010. In most of these countries Japan is already the leading supplier of hygiene products, followed by American brand owners and then local companies.

Southeast Asia is the region located south of China and east of India. Its population amounts to 640 million, with 10 million new babies born each year, 300 million women and 40 million elderly people. Compared to the U.S., this region has twice the population with about the same share of newborn babies but with a much lower share of elderly persons.

About 13% of Asia’s total GDP is generated in Southeast Asia, which is growing at an average rate of 4.5% per year and has a GDP per capita of $10,300. China’s GDP per capita is $12,900. In 2014, the foreign direct investment in this region exceeded China’s and amounted to $128 billion. Five countries represent 90% of the region’s GDP and population: Indonesia, Thailand, the Philippines, Malaysia and Vietnam.

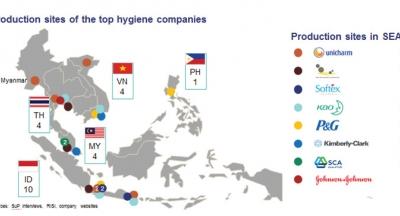

Hygiene companies have been investing in sites throughout Asia.

Compared to Asia’s largest economy China, SEA is shaped by a more complex and diverse market structure. Also regarding the degree of urbanization of the population the countries differ immensely. While 75% of Malaysia’s population lives in cities, rendering the country almost as developed as Western countries (the U.S., for example has 81% urban population), Vietnam has a very rural society with only 34% of its population living in cities. The shares of urban population in Thailand and Indonesia are around 50% and that in the Philippines is only 44%.

The fertility rates in the region also vary considerably. With more than three children born per woman, the Philippines has the highest birth rate, followed by Malaysia (2.55), Indonesia (2.15), Vietnam (1.83) and Thailand with only 1.5 children born per woman. This is lower than in China (1.6 children per woman) and is basically due to birth control initiatives that were introduced in the 1980s and have obviously proved very successful. As a consequence, a large proportion of the Thai population is over 65 years old.

In contrast to the situation in China, the Japanese brand owners Unicharm and Kao play a leading role in many SEA countries. Unicharm is the market leader with its Mamipoco Baby diaper brand in Indonesia and Thailand. U.S.-based P&G and Kimberly-Clark do not play the same leading role in SEA as they do in China. P&G leads the baby diaper market only in the Philippines and comes in third in Vietnam. Local companies already play a much more important role in SEA. As in China, the incontinence market is in the hands of Chinese and local companies, such as DSG, Diana JSC and Fuberg. European SCA is clear market leader in the baby and incontinence segment in Malaysia. In China SCA does not appear at all in the list of top 5 players.

Indonesia

Indonesia has the largest hygiene market of the selected countries. The major hygiene converting investment began in the early 1980s with the company Softex, a textile company that started with the production of femcare products, then moved into the diaper market (Happy Nappy, Sweety Baby), and is also producing its “Confidence” adult care products. In the late 1990s, Unicharm and the Thai DSG Group invested in Indonesia and in 2010 there followed an investment wave by Unicharm, Softex, Kao, and P&G.

The penetration rates for disposable hygiene products in Indonesia are over 70% in femcare, around 20% in baby diapers and still at a very low level in incontinence products. Unicharm, with a market share of over 60% in baby diapers and over 40% in femcare and incontinence products, clearly leads the market, followed by Kao in sanitary protection. Softex and DSG gained importance in recent years. Femcare covers a wide variety of products with more players entering the market, and we estimate a CAGR of around 5%. In baby diapers, there is huge potential because of high birth rates and low penetration rates; consequently we estimate a CAGR of 15%. We see a growing importance of incontinence products, but this will remain a niche market.

Thailand

In Thailand, very early investments came from Unicharm, Johnson & Johnson and the Thai DSG group in the 1990s. Kao started producing in the mid-2000s, and DSG added more capacity in 2012. We have identified a very substantial market for femcare products with penetration rates of 85%, with Unicharm having a market share of more than 50% and Kao following up as No. 2. In baby diapers, we have a penetration rate of 30%, also with Unicharm clearly being No. 1 with over 60% market share. Incontinence products, at 10%, has one of the highest penetration rates in the region, basically because of the aging population and also because Thailand is a popular retirement destination for elderly people. In femcare, we see a major trend to ultra-thin products, while in baby diapers, pull ups remain the most important product, already accounting for over 75% of the market.

Malaysia

Kao started producing in Malaysia even before the 1990s. Major capacity was added by Kimberly-Clark, DSG and SCA in the years leading up to 2000. Latest investments again stem from SCA and DSG around the year 2010. The Malaysian market is a very mature femcare market with lots of variety and many different products with odor control features. Schlegel und Partner estimates the femcare market penetration to be above 90% with market leaders including Kimberly-Clark and Kao. Also, for the baby diaper market, the market penetration is higher than 80%, with SCA being No. 1 with a market share of 25%. With an estimated penetration rate above 10%, the incontinence market is the most developed in the region. SCA also leads the incontinence segment with a share of more than 60%.

Philippines

Johnson & Johnson and P&G invested quite early in the Philippines, but after their initial activities no further investments were undertaken by global brand owners. The femcare penetration rate is around 70%, baby diapers more than 15% and incontinence is still very small. Johnson & Johnson clearly leads the femcare market with a market share of over 50%, whereas P&G is No. 1 in baby diapers, followed by the local JS Unitrade brand. Due to the low disposable income and the lack of investments, we do not predict a major change in the Philippines.

Vietnam

Vietnam saw some converting investment in the 1990s by Kimberly-Clark, P&G and Kao and more by Unicharm in 2005. The hygiene market is at a very low level with a penetration rate in femcare of about 50%, baby diapers only 15% and incontinence below 1%. K-C leads the sanitary protection market and is No. 2 in baby diapers, whereas Unicharm is No. 2 in sanitary protection and No. 1 in baby diapers. P&G is in third place, and there is also competition from local companies such as KyVy. Due to the low disposable income we cannot expect any major shift or push in the hygiene market. However, low penetration rates of all products provide scope for some possible market expansions.

Countries Competing for Leading Position in China and SEA;

Japan well placed in the battle for China’s and SEA’s new hygiene product consumer.

Japan is one of the largest suppliers of advanced hygiene products, such as baby diapers, feminine hygiene and incontinence products and nonwoven materials in Asia. Japanese brand owners like Unicharm or Kao are very important players in most of emerging Asia. Unicharm, which holds a market share of 35% in Japan, has expanded its business into all emerging markets in Asia and is today the market leader in most of them. It was able to achieve a 60% market share with its Mamipoco Baby diaper brand in Indonesia and Thailand. In sanitary napkins, the market share is 50% in Thailand and 40% in Indonesia. The second largest Japanese player Kao has a 30% share in the domestic market and is among the Top 5 players in baby diapers in China.

As Japan has been persistently losing local customers in a stagnant local economic environment, with a falling birth rate and a rising number of deaths, the country has become heavily dependent on foreign direct investment (FDI). Some estimates say that by 2050 the population in Japan could be as low as 97 million; 30 million lower than now. Japan today already ranks third in the world regarding FDI.

About 30% ($40 billion) of the Japanese outward FDI in 2013 was directed toward the Asian market. In 2013, Southeast Asia was the most important destination in Asia with a share of 58%, compared to only 40% in 2010, with a focus on Thailand, Indonesia, Philippines, Malaysia, and Vietnam. During the same period, the share of Japanese FDI towards China decreased from 33% in 2010 to 22% in 2013. However, China remains the most important market with new diaper investments of Kao and Unicharm and a strong focus on coastal areas and on developing emerging inland demand. Its cultural and geographical kinship with these regions that often gives them a competitive advantage over the U.S. and Europe.

Like Japanese consumers, Chinese and SEA consumers often prioritize quality above any other aspect and attach greater importance to gentleness and softness of diapers than either Americans or Europeans do. This preference appears to carry over into other Asian markets, where it is an advantage as Japanese companies compete with companies like Kimberly-Clark, Procter & Gamble and European SCA. Success factors for Japanese companies in China and the SEA region thus include a premium high-quality approach to targeting end-users with above-average disposable incomes and an interest in innovative products, as is the case especially in China. Japanese companies try to limit direct competition with local brands, look for markets that have a substantial demand for quality brands in high-end segments, and also undertake intensive market research to find out possible ways of adapting to local conditions. Japanese companies like Daio with their premium line of GOO.N disposable diapers have been extremely successful in China, despite prices five times higher than domestic and higher than many other competing foreign brands, because Chinese parents have been so impressed with the product’s quality and innovative features.

Japanese companies, especially Unicharm, credit much of their success to in-depth market research studying local consumers and fine-tuning of products based on consumers’ specific needs. They translate their results into a marketing approach which matches the needs of local lifestyles long before their local and international competitors.

One result of Japan’s approach in the region is a significant growth in demand for ‘made-in-Japan’ diapers, although Japan’s leading producers all operate production sites in China and SEA and offer locally manufactured products. But especially in China consumers opt for products imported from Japan due to rising concerns about the safety of baby products made in China, even if they have to buy them for twice the price they would have to pay for a Japanese brand produced in China. Kao is selling its high-tech China-made Merries for 24 cents per diaper, half of what Japan-made Merries go for in China. Also in Thailand, Unicharm was the first in 2010 to offer thinner disposable diapers with enhanced breathability and flexibility intended for regular daily use. Within three years, the disposable diapers usage rate rose from 20-50%. Unicharm now controls 60% of the disposable diaper market in Thailand.

Overall, Japanese diaper manufacturers are expecting substantial growth in Asian markets other than Japan between now and 2020.

U.S. hygiene product brand owners in Asia re-assess their Asia strategy to remain successful

U.S. nonwoven hygiene product manufacturers in Asia are going through a period of massive change as the market is growing more demanding and premium brands have grown significantly faster than economy or low price diapers in Asia, a segment for which American companies had mainly catered to in the past.

Procter & Gamble (P&G), Kimberly-Clark and Johnson & Johnson are the three major brand owners successfully operating in China and Southeast Asia. In many of the markets they were the pioneers for nonwoven disposable products.

P&G was the first U.S. company to enter China and Southeast Asia. This was in the late 1990s when parents in those Asian countries had no awareness of disposable diapers. P&G had the hard task of not only persuading parents that their diapers were the best but also of creating the need for disposable diapers in the first place. It took years of research and trial and error for P&G to become the No. 1 seller of disposable diapers in China. P&G has, so far, created three major concepts to gain, maintain and raise market share:

‘Quality before price’: P&G had successfully entered Asia with a lower-quality and cheaper version of U.S. and European diapers. When Japanese companies started to gain market share, P&G discovered in extensive market research programs that it is not enough to make and market a lower-quality version of U.S. and European diapers. Their research had shown that parents in Asia wanted softness and comfort for their children with price being of secondary importance.

‘Golden sleep campaign: With the support of the Beijing Children’s Hospital’s Sleep Research Center, P&G researchers found in two studies between 2005 and 2006 that good sleep makes children more intelligent. The ad campaign successfully boasted “scientific” results, such as “Baby Sleeps with 50% Less Disruption” and “Baby Falls Asleep 30% Faster.”

‘Made in Japan’: This stands for super-premium products such as Japanese Merries diapers and Huggies platinum diapers. P&G has now rolled out a line of premium diapers in China with this prominent new claim. The new Pampers has elastic waistbands and gold designs. P&G had lost market share to Japanese companies in this segment because it did not have a product for the high-end market segment.

No other American diaper brand has spent as much money on market research, marketing and advertising to support its quest to penetrate the Asian market than P&G. To intensify its understanding of Southeast Asia and China and to better serve consumers in the region, P&G has even relocated its global headquarters for its personal care and baby care business units to Singapore.

Competition between U.S., Japanese and local suppliers for growing markets in Asia will continue

The rate of market uptake for nonwoven disposable hygiene products continues to rise rapidly in emerging Asia on the back of economic growth, especially in China and Southeast Asia. As per capita income is rising rapidly, urbanization is accelerating and consumers’ increasing awareness of health and hygiene will continue to provide support for the development of the market for personal hygiene products.

Japan seems to be taking over the high-end market with its highly innovative and advanced materials. ‘Made in Japan’ has become synonymous with high-end premium quality in the disposable nonwoven hygiene product market. Instead, U.S. companies stand for long-term engagement in China and Southeast Asia, where they have mainly captured the standard product segment, in which they hold the highest market share. In the diaper market, super-premium products such as the Merries diaper and the Huggies Platinum diaper grew significantly faster than economy or low price diapers. Local and American companies will continue to work hard to increase and maintain their market share, respectively, and both will try hard to dig into Japan’s existing and future market share in the premium segments. For the time being there is room for everyone in this expanding market for nonwoven disposable hygiene products. But the air is getting thinner. Success will require in-depth market insights into the ever changing consumer demands and tastes and cravings for new products in the emerging Asian markets.

For inquiries, please contact:

Silke Brand-Kirsch, +49 6201 9915 55

silke.brandkirsch@schlegelundpartner.de

Dorothea Slevogt +49 6201 9915 76

dorothea.slevogt@schlegelundpartner.de n

While in China, the U.S.-based hygiene product brand owners Procter & Gamble and Kimberly-Clark are still clear market leaders, the Japanese companies Unicharm and Kao are leading the market in Southeast Asia. But the picture is changing as all these players are investing heavily in capacity expansion, new product and marketing concepts and approaches to compete for the new generation of wealthy middle class consumers in the region.

The economies of Southeast Asia are very diverse, comparable to the various regions of China. In SEA we are dealing with three types of economies—Indonesia, Thailand and Malaysia with more than $10,000 of GDP per capita. The Philippines, has a GDP per capita of $7000, whereas Vietnam only reaches $5600. China has an overall GDP per capita of $15,700. Larger tier 1 cities reach a GDP per capita of about $29,000, while in some poorer rural regions the GDP per capita reaches only $7000.

This creates a huge growth potential particularly in China, which will remain one of the world’s fastest-growing economies in the future, despite its recent economic slowdown. By 2030 it is estimated that 66% of the world’s middle class will be living in Asia. This includes China and Southeast Asia, which will be the focus of this article. As local companies are increasingly competing for market share, existing multinational companies from Japan, the U.S. and Europe will intensify their fight for the new well-off consumer segment. Winners will be the companies that best understand and meet consumer requirements.

Emerging Asian Countries Show Increasing Need for Hygiene Products;

China is Asia’s largest market for nonwoven hygiene products

China, Asia’s largest market for hygiene products, is going through tremendous changes at the moment. Economic slowdown and a stock market crash are only one piece of the puzzle. China will remain a very attractive market for global hygiene product brand owners and their nonwoven suppliers. According to the Euromonitor report 2015, China’s personal hygiene product industry is expected to continue growing at a CAGR of close to 13% in terms of retail sales value in 2019. After all, consumers are still spending, as is apparent from the following facts:

- Double digit year-on-year total retail growth at the end of 2015.

- Total sales of the online sales portal Alibaba were up 60% from 2014.

- Complete relaxation of the one-child policy will lead to higher birth rates.

- A growing middle class willing to pay a premium for convenience and high quality.

- A positive economic development even outside of the metropolitan areas.

New diaper brands are popping up throughout Southeast Asia

The rapidly expanding diaper market in China offers a continuous business opportunity for foreign hygiene producers from Japan, the U.S. and Europe. Most of the projected growth will probably come from lower-tier cities and rural areas, where the baby and personal care products’ penetration remains low at around 10%, compared to more than 90% in major metropolitan areas where it is slowly reaching maturity. Also the birth rate in China’s tier 1 metropolitan cities is much lower than in other areas of China. Shanghai only has four births per thousand people per year. In Germany there is an average of eight births per thousand people, in the U.S. the average is 13 births per 1000.

There is a new young generation of parents born after the 1980s who have become the first mainstream consumer group for diapers in China. They are better educated, wealthier and willing to spend heavily to provide their babies with the best they can afford. Consequently, the marketshare for high-priced diapers in China has grown from less than 10% in 2010 to 15% in 2013. The success of the high-end brands has also called counterfeits onto the scene. Brands like Coon and Merries have in the recent past been successfully copied by Chinese companies. Counterfeits are priced at 155–185 yuan ($23-$28) for a pack of 50 diapers; the same price as the genuine article.

But genuine Chinese brand owners have also been able to successfully increase local sales by improving product quality, optimizing their product portfolio and increasing their proportion of mid-to-high-end products.

In 2014, China’s largest local brand owner Hengan increased its overall sales by 12.5%. In 2014, it had a marketshare of 8% in China. In comparison, U.S.-based P&G and Kimberly-Clark supply almost 50% of China’s market volume, followed by Japan’s Kao, Unicharm and Daio Paper with a joint marketshare of 28%.

Other up-and-coming local brand owners are Chiao and the Vinda Group. Vinda was established in 1985 and currently runs nine advanced production bases in China. In 2013, SCA became the majority shareholder of Vinda. In 2014, SCA transferred its hygiene business in China to Vinda. Vinda now owns the brands Drypers, Dr.P, Sealer, Prokids, EQ Dry and Control Plus in China, while SCA remains its majority shareholder. SCA also bought the successful Taiwanese hygiene company Everbeauty to strengthen its foothold in Greater China. Another Taiwanese brand is Fuberg, which has successfully expanded into Southeast Asia.

Local companies are trying to catch up with foreign hygiene product manufacturers.

The Chinese government has adopted various macroeconomic regulations and control measures in order to sustain steady economic growth within China. This has resulted in many local manufacturers, including those for hygienic disposables, focusing much more on serving the domestic market than going abroad. While none of the Chinese brand owners owns a foreign production site, they do export their products under their own brands to developing countries and produce OEM and ODM products for foreign manufactures (e.g. the Chinese company Chiaus).

In an attempt to make inroads into the foreign market share in China and in order to cater to consumers’ rising demand for higher-quality products, many domestic manufacturers have invested heavily in foreign manufacturing equipment, trying to upgrade their products in terms of quality, packaging and image. Local hygiene product makers have also invested in R&D to make their products as absorbent and as thin as foreign brands. In terms of distribution, marketing and promotion, foreign brand owners are still superior to local brands despite recent improvements.

As more and more Chinese brands are entering the market, greater competition is expected. The winners of the game will ultimately be those brands, which truly understand the Chinese market needs. In many cases, American and European brands in particular are not responding fast enough. Early movers like P&G have in the recent past failed to keep pace with China’s everchanging market environment. They have not offered high-end products to the Chinese market fast enough and have consequently lost market shares to their Japanese competitors.

Sales of Japan’s Kao Group doubled year-on-year in 2013 and 2014. Sales of the local brands even grew threefold in 2014.

Is Southeast Asia the new China for players in the hygiene market?

Southeast Asia (SEA) is the second-fastest growing region in Asia after China. It also offers excellent business opportunities for hygiene product companies. Product brand owners from Japan, Europe and the U.S. are also competing for marketshare here. Thus large global hygiene players have greatly expanded their presence in SEA, especially since 2010. In most of these countries Japan is already the leading supplier of hygiene products, followed by American brand owners and then local companies.

Southeast Asia is the region located south of China and east of India. Its population amounts to 640 million, with 10 million new babies born each year, 300 million women and 40 million elderly people. Compared to the U.S., this region has twice the population with about the same share of newborn babies but with a much lower share of elderly persons.

About 13% of Asia’s total GDP is generated in Southeast Asia, which is growing at an average rate of 4.5% per year and has a GDP per capita of $10,300. China’s GDP per capita is $12,900. In 2014, the foreign direct investment in this region exceeded China’s and amounted to $128 billion. Five countries represent 90% of the region’s GDP and population: Indonesia, Thailand, the Philippines, Malaysia and Vietnam.

Hygiene companies have been investing in sites throughout Asia.

Compared to Asia’s largest economy China, SEA is shaped by a more complex and diverse market structure. Also regarding the degree of urbanization of the population the countries differ immensely. While 75% of Malaysia’s population lives in cities, rendering the country almost as developed as Western countries (the U.S., for example has 81% urban population), Vietnam has a very rural society with only 34% of its population living in cities. The shares of urban population in Thailand and Indonesia are around 50% and that in the Philippines is only 44%.

The fertility rates in the region also vary considerably. With more than three children born per woman, the Philippines has the highest birth rate, followed by Malaysia (2.55), Indonesia (2.15), Vietnam (1.83) and Thailand with only 1.5 children born per woman. This is lower than in China (1.6 children per woman) and is basically due to birth control initiatives that were introduced in the 1980s and have obviously proved very successful. As a consequence, a large proportion of the Thai population is over 65 years old.

In contrast to the situation in China, the Japanese brand owners Unicharm and Kao play a leading role in many SEA countries. Unicharm is the market leader with its Mamipoco Baby diaper brand in Indonesia and Thailand. U.S.-based P&G and Kimberly-Clark do not play the same leading role in SEA as they do in China. P&G leads the baby diaper market only in the Philippines and comes in third in Vietnam. Local companies already play a much more important role in SEA. As in China, the incontinence market is in the hands of Chinese and local companies, such as DSG, Diana JSC and Fuberg. European SCA is clear market leader in the baby and incontinence segment in Malaysia. In China SCA does not appear at all in the list of top 5 players.

Indonesia

Indonesia has the largest hygiene market of the selected countries. The major hygiene converting investment began in the early 1980s with the company Softex, a textile company that started with the production of femcare products, then moved into the diaper market (Happy Nappy, Sweety Baby), and is also producing its “Confidence” adult care products. In the late 1990s, Unicharm and the Thai DSG Group invested in Indonesia and in 2010 there followed an investment wave by Unicharm, Softex, Kao, and P&G.

The penetration rates for disposable hygiene products in Indonesia are over 70% in femcare, around 20% in baby diapers and still at a very low level in incontinence products. Unicharm, with a market share of over 60% in baby diapers and over 40% in femcare and incontinence products, clearly leads the market, followed by Kao in sanitary protection. Softex and DSG gained importance in recent years. Femcare covers a wide variety of products with more players entering the market, and we estimate a CAGR of around 5%. In baby diapers, there is huge potential because of high birth rates and low penetration rates; consequently we estimate a CAGR of 15%. We see a growing importance of incontinence products, but this will remain a niche market.

Thailand

In Thailand, very early investments came from Unicharm, Johnson & Johnson and the Thai DSG group in the 1990s. Kao started producing in the mid-2000s, and DSG added more capacity in 2012. We have identified a very substantial market for femcare products with penetration rates of 85%, with Unicharm having a market share of more than 50% and Kao following up as No. 2. In baby diapers, we have a penetration rate of 30%, also with Unicharm clearly being No. 1 with over 60% market share. Incontinence products, at 10%, has one of the highest penetration rates in the region, basically because of the aging population and also because Thailand is a popular retirement destination for elderly people. In femcare, we see a major trend to ultra-thin products, while in baby diapers, pull ups remain the most important product, already accounting for over 75% of the market.

Malaysia

Kao started producing in Malaysia even before the 1990s. Major capacity was added by Kimberly-Clark, DSG and SCA in the years leading up to 2000. Latest investments again stem from SCA and DSG around the year 2010. The Malaysian market is a very mature femcare market with lots of variety and many different products with odor control features. Schlegel und Partner estimates the femcare market penetration to be above 90% with market leaders including Kimberly-Clark and Kao. Also, for the baby diaper market, the market penetration is higher than 80%, with SCA being No. 1 with a market share of 25%. With an estimated penetration rate above 10%, the incontinence market is the most developed in the region. SCA also leads the incontinence segment with a share of more than 60%.

Philippines

Johnson & Johnson and P&G invested quite early in the Philippines, but after their initial activities no further investments were undertaken by global brand owners. The femcare penetration rate is around 70%, baby diapers more than 15% and incontinence is still very small. Johnson & Johnson clearly leads the femcare market with a market share of over 50%, whereas P&G is No. 1 in baby diapers, followed by the local JS Unitrade brand. Due to the low disposable income and the lack of investments, we do not predict a major change in the Philippines.

Vietnam

Vietnam saw some converting investment in the 1990s by Kimberly-Clark, P&G and Kao and more by Unicharm in 2005. The hygiene market is at a very low level with a penetration rate in femcare of about 50%, baby diapers only 15% and incontinence below 1%. K-C leads the sanitary protection market and is No. 2 in baby diapers, whereas Unicharm is No. 2 in sanitary protection and No. 1 in baby diapers. P&G is in third place, and there is also competition from local companies such as KyVy. Due to the low disposable income we cannot expect any major shift or push in the hygiene market. However, low penetration rates of all products provide scope for some possible market expansions.

Countries Competing for Leading Position in China and SEA;

Japan well placed in the battle for China’s and SEA’s new hygiene product consumer.

Japan is one of the largest suppliers of advanced hygiene products, such as baby diapers, feminine hygiene and incontinence products and nonwoven materials in Asia. Japanese brand owners like Unicharm or Kao are very important players in most of emerging Asia. Unicharm, which holds a market share of 35% in Japan, has expanded its business into all emerging markets in Asia and is today the market leader in most of them. It was able to achieve a 60% market share with its Mamipoco Baby diaper brand in Indonesia and Thailand. In sanitary napkins, the market share is 50% in Thailand and 40% in Indonesia. The second largest Japanese player Kao has a 30% share in the domestic market and is among the Top 5 players in baby diapers in China.

As Japan has been persistently losing local customers in a stagnant local economic environment, with a falling birth rate and a rising number of deaths, the country has become heavily dependent on foreign direct investment (FDI). Some estimates say that by 2050 the population in Japan could be as low as 97 million; 30 million lower than now. Japan today already ranks third in the world regarding FDI.

About 30% ($40 billion) of the Japanese outward FDI in 2013 was directed toward the Asian market. In 2013, Southeast Asia was the most important destination in Asia with a share of 58%, compared to only 40% in 2010, with a focus on Thailand, Indonesia, Philippines, Malaysia, and Vietnam. During the same period, the share of Japanese FDI towards China decreased from 33% in 2010 to 22% in 2013. However, China remains the most important market with new diaper investments of Kao and Unicharm and a strong focus on coastal areas and on developing emerging inland demand. Its cultural and geographical kinship with these regions that often gives them a competitive advantage over the U.S. and Europe.

Like Japanese consumers, Chinese and SEA consumers often prioritize quality above any other aspect and attach greater importance to gentleness and softness of diapers than either Americans or Europeans do. This preference appears to carry over into other Asian markets, where it is an advantage as Japanese companies compete with companies like Kimberly-Clark, Procter & Gamble and European SCA. Success factors for Japanese companies in China and the SEA region thus include a premium high-quality approach to targeting end-users with above-average disposable incomes and an interest in innovative products, as is the case especially in China. Japanese companies try to limit direct competition with local brands, look for markets that have a substantial demand for quality brands in high-end segments, and also undertake intensive market research to find out possible ways of adapting to local conditions. Japanese companies like Daio with their premium line of GOO.N disposable diapers have been extremely successful in China, despite prices five times higher than domestic and higher than many other competing foreign brands, because Chinese parents have been so impressed with the product’s quality and innovative features.

Japanese companies, especially Unicharm, credit much of their success to in-depth market research studying local consumers and fine-tuning of products based on consumers’ specific needs. They translate their results into a marketing approach which matches the needs of local lifestyles long before their local and international competitors.

One result of Japan’s approach in the region is a significant growth in demand for ‘made-in-Japan’ diapers, although Japan’s leading producers all operate production sites in China and SEA and offer locally manufactured products. But especially in China consumers opt for products imported from Japan due to rising concerns about the safety of baby products made in China, even if they have to buy them for twice the price they would have to pay for a Japanese brand produced in China. Kao is selling its high-tech China-made Merries for 24 cents per diaper, half of what Japan-made Merries go for in China. Also in Thailand, Unicharm was the first in 2010 to offer thinner disposable diapers with enhanced breathability and flexibility intended for regular daily use. Within three years, the disposable diapers usage rate rose from 20-50%. Unicharm now controls 60% of the disposable diaper market in Thailand.

Overall, Japanese diaper manufacturers are expecting substantial growth in Asian markets other than Japan between now and 2020.

U.S. hygiene product brand owners in Asia re-assess their Asia strategy to remain successful

U.S. nonwoven hygiene product manufacturers in Asia are going through a period of massive change as the market is growing more demanding and premium brands have grown significantly faster than economy or low price diapers in Asia, a segment for which American companies had mainly catered to in the past.

Procter & Gamble (P&G), Kimberly-Clark and Johnson & Johnson are the three major brand owners successfully operating in China and Southeast Asia. In many of the markets they were the pioneers for nonwoven disposable products.

P&G was the first U.S. company to enter China and Southeast Asia. This was in the late 1990s when parents in those Asian countries had no awareness of disposable diapers. P&G had the hard task of not only persuading parents that their diapers were the best but also of creating the need for disposable diapers in the first place. It took years of research and trial and error for P&G to become the No. 1 seller of disposable diapers in China. P&G has, so far, created three major concepts to gain, maintain and raise market share:

‘Quality before price’: P&G had successfully entered Asia with a lower-quality and cheaper version of U.S. and European diapers. When Japanese companies started to gain market share, P&G discovered in extensive market research programs that it is not enough to make and market a lower-quality version of U.S. and European diapers. Their research had shown that parents in Asia wanted softness and comfort for their children with price being of secondary importance.

‘Golden sleep campaign: With the support of the Beijing Children’s Hospital’s Sleep Research Center, P&G researchers found in two studies between 2005 and 2006 that good sleep makes children more intelligent. The ad campaign successfully boasted “scientific” results, such as “Baby Sleeps with 50% Less Disruption” and “Baby Falls Asleep 30% Faster.”

‘Made in Japan’: This stands for super-premium products such as Japanese Merries diapers and Huggies platinum diapers. P&G has now rolled out a line of premium diapers in China with this prominent new claim. The new Pampers has elastic waistbands and gold designs. P&G had lost market share to Japanese companies in this segment because it did not have a product for the high-end market segment.

No other American diaper brand has spent as much money on market research, marketing and advertising to support its quest to penetrate the Asian market than P&G. To intensify its understanding of Southeast Asia and China and to better serve consumers in the region, P&G has even relocated its global headquarters for its personal care and baby care business units to Singapore.

Competition between U.S., Japanese and local suppliers for growing markets in Asia will continue

The rate of market uptake for nonwoven disposable hygiene products continues to rise rapidly in emerging Asia on the back of economic growth, especially in China and Southeast Asia. As per capita income is rising rapidly, urbanization is accelerating and consumers’ increasing awareness of health and hygiene will continue to provide support for the development of the market for personal hygiene products.

Japan seems to be taking over the high-end market with its highly innovative and advanced materials. ‘Made in Japan’ has become synonymous with high-end premium quality in the disposable nonwoven hygiene product market. Instead, U.S. companies stand for long-term engagement in China and Southeast Asia, where they have mainly captured the standard product segment, in which they hold the highest market share. In the diaper market, super-premium products such as the Merries diaper and the Huggies Platinum diaper grew significantly faster than economy or low price diapers. Local and American companies will continue to work hard to increase and maintain their market share, respectively, and both will try hard to dig into Japan’s existing and future market share in the premium segments. For the time being there is room for everyone in this expanding market for nonwoven disposable hygiene products. But the air is getting thinner. Success will require in-depth market insights into the ever changing consumer demands and tastes and cravings for new products in the emerging Asian markets.

For inquiries, please contact:

Silke Brand-Kirsch, +49 6201 9915 55

silke.brandkirsch@schlegelundpartner.de

Dorothea Slevogt +49 6201 9915 76

dorothea.slevogt@schlegelundpartner.de n