Karen McIntyre, editor12.02.15

Talk to any supplier to the global hygiene market and they will tell you a similar story. The consumer profile is changing. Baby diapers are no longer the only driver for innovation. Adult incontinence products are no longer for just healthcare institutions, but also active adults. Increasing disposable incomes in developing nations have opened up opportunities for first feminine hygiene items and then other absorbent products.

This has created a marketplace where suppliers have to be on their toes, able to quickly revert to the changing market needs whether it be for a better fitting training pant or a more discrete adult incontinence pad. The result has been a steady stream of innovations, partnerships between companies and a range of solutions that will surely propel the market forward.

“People are becoming less sensitized to health issues and historical taboos, which increases the population of people using disposable hygienic products,” says Nathan Weaver, vice president, Global Hygiene, H.B. Fuller. “And today, as the baby diaper market continues to grow, parents in both developed and emerging regions are more concerned about the diapers they are putting on their children. All these factors lead to a changing consumer profile that drives changes to the absorbent product design.”

Also influencing the hygiene market are changing consumer lifestyles. With families today more active at home and work, the nonwovens industry has committed to looking for new solutions. “The increased comfort and underwear-like feeling are true goals today and clearly people are ready to innovate and look for new solutions especially from spunlace technology,” says Marjo Kuisma, product manager, hygiene at Suominen.

While baby diapers continue to be the bread and butter segment in the hygiene industry—offering high volumes and low margins—the importance of this market is here to stay. Suppliers and manufacturers continue to find new ways to improve product performance without ignoring costs and a look at the diaper market during the past decade reflects this innovation. However, during this time the adult incontinence market has provided companies throughout the value chain with the opportunity to create different offerings for different user types within the segment thanks to the users’ ability to provide feedback.

“We have seen CPG companies re-launching their AI product lines as a response to the growth in this segment and suppliers like Conwed fine-tuning their materials and components to meet the demands for efficient, comfortable and discreet disposable products,” explains Ivan Soltero, strategic marketing manager, of Conwed Plastics, a supplier of elastomeric netting products for hygiene applications.

Berry Goes Global

Berry Plastics significantly expanded its role as a supplier to the hygiene market earlier this year when it purchased Avintiv, one of the world’s largest makers of spunmelt nonwovens for diapers and other absorbent products. As the dust continues to settle on this acquisition, Berry has already announced it will keep the nonwovens business in tact, grouping it with the existing films business into one division.

Grouping these businesses together makes sense for both companies. The two entities share many of the same customers within the hygiene market and together have significant buying power in the polypropylene resin market, and with manufacturing assets in Latin America, North America, Europe and Asia, Avintiv will allow Berry to achieve an important goal—to be more global. While the company has not yet made any plans to expand its film production to any of Avintiv’s offshore facilities, executives have repeatedly pointed to its global manufacturing footprint as a key driver behind the acquisition.

Another advantage is the marriage of two major components in the back sheet of the diaper—a film and nonwoven. “We can now focus on improving the performance of the total outer cover of the diaper, if not by combining the film and nonwovens ourselves then by understanding how best to maximize the properties of each component in the customer combined outer cover,” Mary Jo Lilly, vice president, personal care/medical films, says. “We are moving closer to the integrated optimized nonwoven/film outer covering of the entire personal care articles.”

Looking more specifically at its films business where Berry supplies backsheet materials for all types of hygiene products, Lilly says its role is no different from any other key supplier to the hygiene industry looking to provide innovation and increased efficiency to its customers to help them meet their goals of hitting lower cost targets with better performing products to their customers. To achieve this, Berry has invested heavily in it extrusion equipment which has allowed it to offer value added, lower gauge films with the same or better performance.

This has allowed Berry to respond to consumer need for a more personalized product, smaller quantities and shorter lead times. “We are challenged to supply what the customer wants in the time they want it,” she adds. “This means shorter lead times and smaller quantities at an acceptable price. The old days of running the largest SKU for a month are gone. No one wants to carry inventory anymore. Everyone is focused on working capital. They want individualization and personalization.”

At the same time, Berry must also be cognizant of new technologies so it can be able to meet the ever-changing demands of its customers. “We are constantly innovating beyond the value films,” Lilly says. “We have a now, next, future philosophy and we continue to build breathable and non-breathable products designed to provide cost-effective performance for baby diapers and adult incontinence products that offer softness and discretion.”

Growing Up

Many suppliers are reporting an increased focus on the adult incontinence market, driven of course by the greying population as well as a greater acceptance of incontinence as a medical problem. Perhaps the biggest shake up of this market in recent months is the return of Procter & Gamble who launched its Always Discreet light incontinence line in mid-2014 and has reported better-than-expected results for the product line thus far.

Like many hygiene-minded companies, Conwed Plastics executives report that adult incontinence is the main focus when it comes to hygiene. While its elastomeric netting Rebound is commercialized in baby training pants, it is the adult incontinence segment that is truly driving innovation and making companies push the limits of what they’ve done in the past to please users who can actually provide feedback about the products’ overall performance. The difference between the two markets, executives say, is that fluid management and skin health are the key barometers of how a baby diaper performs, while in adult incontinence, discretion, odor control and increased comfort are important.

“This hygiene segment calls for disposable products that make users feel they are wearing normal underwear; so besides the standard fit and fluid management features, it demands making lighter, thinner and more breathable items,” says Soltero. “This is where our elastomeric netting offers a distinctive alternative. Rebound not only provides the weight, thinness, stretch, recovery and fit desired but it also brings another level of comfort — superior air permeability, water vapor transmission and heat transfer performance — to the final nonwoven composite on the pursuit of creating highly comfortable and efficient disposable products.”

Conwed’s elastomeric netting offers heat and moisture management performance that can impact users’ level of comfort while wearing disposable adult incontinence briefs and underwear.

In general, optimal fluid management, fit and skin health are always key elements when evaluating any hygiene disposable product. “What we see in the adult incontinence segment, however, is the users’ expectation that their hygiene disposable product should not only take care of those basic requirements, but it should also make them feel comfortable,” Soltero adds. “Comfort could be defined differently depending on the user but it is clear that breathability, heat and moisture management performance contribute exponentially to increase the level of general comfort when wearing an incontinence brief or underwear.”

Courtney Korselt, global communications manager of adhesives supplier Bostik, has also witnessed an increased awareness of adult incontinence sufferers’ needs, and this company has certainly honed its product line to reflect this. “It’s interesting to compare the adult incontinence product with the diaper,” she says. “If you looked at it many years ago, they were much the same but now we are looking at different sets of requirements. You can even break it down further with the different needs of the consumer and institutional customer.”

Barbara Bulleri, sales and marketing director at closures specialist Texsus, says the adult incontinence market is becoming more sophisticated as more people are trying to remain active despite their issues.

The backsheet of the babydiaper is a combination of nonwoven materials and films.

“In the past, the market for incontinence was more institutional, so people looking for cheap products that can do the job,” she says. “Now it seems the product is becoming more sophisticated especially in mature markets. In this case, softness is not as important as in baby diapers but dryness and discretion are the most important.”

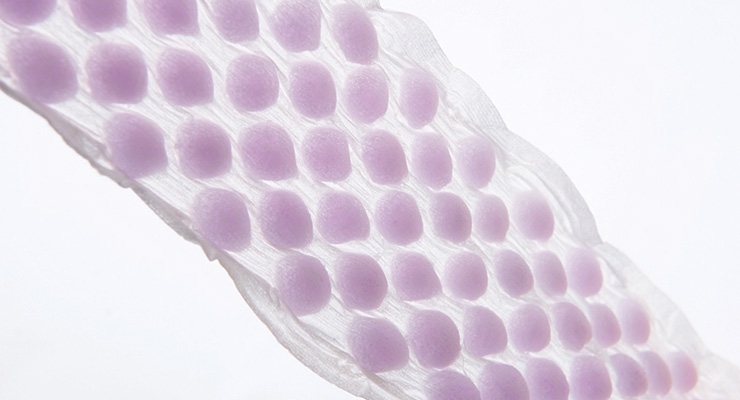

Speaking of softness, Texsus is investing $3.5 million in machinery to help it deliver a new solution in diaper closures with a three-dimensional look and touch as well as top-level performance. This new loop, which will be available as a complete closure system called the Sloopy Lock, is not only soft to the touch, it’s three-dimensional construction makes it look soft.

“We are seeing a trend toward having a material that is soft,” says Bulleri. “We achieve this by using a nonwoven made from bicomponent materials and then we use a special embossing to make the material three-dimensional.”

Know Your Customer

At Bostik, success has been gained by staying in touch with what is going on in the market. Even though its product—adhesives—is a small part of the hygiene product, Bostik keeps abreast of trends throughout the diaper design. “It’s important for us to be able to predict the next consumer trend,” says Diane Toonen, director of strategic marketing at Bostik . “It’s critical to us to be able to help the customer. We have to see changes coming.”

In fact, the movement toward thinner, lighter diapers has changed the way adhesives are used in the diaper. As the core integrity becomes more challenged, the role of the adhesives has increased and Bostik has worked hard to develop products that can work with new diaper designs. “It depends on the SAP to pulp ratio,” Toonen says. “Once you get to a 30% pulp level, the role a different adhesive is required. It doesn’t really matter when the rations are 50:50. Adhesives don’t play as critical of a role in the core.”

Bostik has worked with SAP producer BASF developing low-pulp and pulp-free core designs.

H.B. Fuller has also tailored its adhesives line up to address changing market dynamics. Its product line addressing thinner cores is the Full-Care 7000 series of core adhesives, which provide superior core integrity as manufacturers continue to reduce the amount of fluff. Other innovative products like the HydroLock absorbent hotmelt and PD8081H water-based superabsorbent polymer system deliver absorbency to a targeted area. For products requiring more sophisticated stretch engines, the Full-Care 9700 series of stretch lamination adhesives are designed for low odor, high bonding strength, and excellent aged performance and stability.

“With each of these trends we see as an opportunity to deliver value to our customers and help them stay ahead of market trends,” Weaver says. “We strive to understand the impact adhesives can have on these challenges and find ways to incorporate that into the disposable product design.”

Superabsorbent polymer makers have also been responding to the need for thinner diapers. Last month Evonik said it had developed a technology—in partnership with a small engineering company—to make a laminate structure combining layers of superabsorbents and nonwovens to serve as an absorbent core in hygiene products.

This unique structure allows the diaper core to absorb and distribute fluid more quickly than competing structures.

According to Markus Henn, global director, application technology for Evonik, the laminate is flexible and expandable in two dimensions.

“This results in a unique structure so basically the laminate has two nonwoven layers and a SAP is placed in a compartment between

the two,” he adds. “The specific technology that we are using is elastic fibers in between the nonwoven layers that resembled small pockets containing the SAP.”

The structure gives the diaper core a high level of stability. The elastic fibers or strands stick to the nonwovens and form an open cell structure. This ensures that the superabsorbent particles remain at the place where they are needed but also keeps the adhesive from infringing on the SAP properties. Therefore, the diaper is considerably more efficient—rewetting is significantly reduced while wearer comfort is enhanced considerably.

In developing the product, which Evonik hopes to license to diaper makers, the company ran tests on a number types of nonwovens and even some tissue materials. Henn says the type of nonwoven used depends upon the use of the final product. “We have seen some indication of what types of nonwovens work or work better but we don’t really see too many limitations on what should be used,” he says. “The technology really allows the user to fine tune the absorbent core and use the materials best suited for the application.”

Enter Spunlace

While spunlace is normally associated with wipe products, the technology’s soft hand, flexibility of raw materials and clean production process are slowly earning it a place in the hygiene market. Spunlace provider Suominen has been focusing on growth in this market for a few years and established a Care division to drive growth in the hygiene and medical segments. At the time, sales outside of wipes, traveling and catering, represented just 10% of Suominen’s.

Since then, Suominen has introduced a number of products across both categories. Most recently, in October, Suominen officially launched Fibrella Move, a product developed specifically for the global hygiene market. The material, which uses state-of-the-art forming, bonding and finishing technologies, is a major step forward in fluid acquisition and management for feminine care and other absorbent hygiene applications. Not only does it enhance wearer comfort and body fit, it also offers converters a new choice—a nonwoven that easily runs on high speed converting lines and is highly compatible with other components.

Suominen’s Kuisma gives several reasons why Fibrella Move is ideal for hygiene applications. “It is all about the end user benefits; superior masking, efficient fluid management, comfort and exceptional body fit. In fact due to the capability of unique design our product structure is suitable for all hygiene areas - feminine, baby and incontinence,” she says. “Fibrella Move is designed for high line speed converting and is supremely compatible with other materials in hygiene product.”

Fibrella Move follows the January introduction of Fibrella Lite, an advanced lightweight and soft substrate for stretch applications. Both products are perfect examples of innovative application using spunlace technology that are able to match the market needs. “Hygiene end products are requiring more and more nonwovens that can bring the soft and conformable, body fit feeling,” Kuisma says. “With spunlace technology we can offer the differentiation and step towards more ‘underwear like’ products.”

Like Suominen, spunlace maker Jacob Holm has been diversifying beyond wipes and into hygiene and other markets in recent years. Most recently, the company introduced a lightweight product portfolio, under the SoftLite brand, to cater to the need for lighter and softer hygiene products with basis weights as low as 15 gsm. In addition to being light and soft, key features oinclude excellent stretch and recovery, skin sensitivity and the ability to be engineered for optimal fluid management. While much of Jacob Holm’s business experience is in the wipes market, the company feels expansion into hygiene is the next logical step.

“We are experienced in the consumer market with wipes, it was a natural evolvement to also offer our fabrics in this growing consumer category,” says CEO Martin Mikkelsen. “As a

Stretchability is becoming increasingly in diapers and other hygiene items.

pioneer in lightweight fabrics, our offering meets the market need for ultimate softness and excellent stretch and recovery. It allows comfort and freedom to move in hygiene products.”

The most textile-like nonwoven technology, spunlace uses no chemicals or heat to create pure and soft fabrics. This technology offers 50% more elongation than other technologies. All staple fibers can be processed, natural and man-made.

“Consumers desire ultra-lightweight absorbent hygiene products without compromising performance,” Mikkelsen adds. “As hygiene products are getting thinner to increase comfort, the challenge emerges to make sure the product still feels soft. This increases the need for light but lofty ultrasoft fabrics.”

The need for new products will continue to drive innovation forward in the hygiene market. At the heart of this innovation is the balance between performance and cost, whether the product is for the baby diaper, adult incontinence or feminine hygiene market. “People use the products and dispose of them,” Conwed’s Soltero says. “Suppliers are under pressure to offer cost competitive materials to satisfy an industry used to compensate low margins with high production volumes. So everybody’s Holy Grail is to create disposable products with the highest performance at the most affordable cost.”

This has created a marketplace where suppliers have to be on their toes, able to quickly revert to the changing market needs whether it be for a better fitting training pant or a more discrete adult incontinence pad. The result has been a steady stream of innovations, partnerships between companies and a range of solutions that will surely propel the market forward.

“People are becoming less sensitized to health issues and historical taboos, which increases the population of people using disposable hygienic products,” says Nathan Weaver, vice president, Global Hygiene, H.B. Fuller. “And today, as the baby diaper market continues to grow, parents in both developed and emerging regions are more concerned about the diapers they are putting on their children. All these factors lead to a changing consumer profile that drives changes to the absorbent product design.”

Also influencing the hygiene market are changing consumer lifestyles. With families today more active at home and work, the nonwovens industry has committed to looking for new solutions. “The increased comfort and underwear-like feeling are true goals today and clearly people are ready to innovate and look for new solutions especially from spunlace technology,” says Marjo Kuisma, product manager, hygiene at Suominen.

While baby diapers continue to be the bread and butter segment in the hygiene industry—offering high volumes and low margins—the importance of this market is here to stay. Suppliers and manufacturers continue to find new ways to improve product performance without ignoring costs and a look at the diaper market during the past decade reflects this innovation. However, during this time the adult incontinence market has provided companies throughout the value chain with the opportunity to create different offerings for different user types within the segment thanks to the users’ ability to provide feedback.

“We have seen CPG companies re-launching their AI product lines as a response to the growth in this segment and suppliers like Conwed fine-tuning their materials and components to meet the demands for efficient, comfortable and discreet disposable products,” explains Ivan Soltero, strategic marketing manager, of Conwed Plastics, a supplier of elastomeric netting products for hygiene applications.

Berry Goes Global

Berry Plastics significantly expanded its role as a supplier to the hygiene market earlier this year when it purchased Avintiv, one of the world’s largest makers of spunmelt nonwovens for diapers and other absorbent products. As the dust continues to settle on this acquisition, Berry has already announced it will keep the nonwovens business in tact, grouping it with the existing films business into one division.

Grouping these businesses together makes sense for both companies. The two entities share many of the same customers within the hygiene market and together have significant buying power in the polypropylene resin market, and with manufacturing assets in Latin America, North America, Europe and Asia, Avintiv will allow Berry to achieve an important goal—to be more global. While the company has not yet made any plans to expand its film production to any of Avintiv’s offshore facilities, executives have repeatedly pointed to its global manufacturing footprint as a key driver behind the acquisition.

Another advantage is the marriage of two major components in the back sheet of the diaper—a film and nonwoven. “We can now focus on improving the performance of the total outer cover of the diaper, if not by combining the film and nonwovens ourselves then by understanding how best to maximize the properties of each component in the customer combined outer cover,” Mary Jo Lilly, vice president, personal care/medical films, says. “We are moving closer to the integrated optimized nonwoven/film outer covering of the entire personal care articles.”

Looking more specifically at its films business where Berry supplies backsheet materials for all types of hygiene products, Lilly says its role is no different from any other key supplier to the hygiene industry looking to provide innovation and increased efficiency to its customers to help them meet their goals of hitting lower cost targets with better performing products to their customers. To achieve this, Berry has invested heavily in it extrusion equipment which has allowed it to offer value added, lower gauge films with the same or better performance.

This has allowed Berry to respond to consumer need for a more personalized product, smaller quantities and shorter lead times. “We are challenged to supply what the customer wants in the time they want it,” she adds. “This means shorter lead times and smaller quantities at an acceptable price. The old days of running the largest SKU for a month are gone. No one wants to carry inventory anymore. Everyone is focused on working capital. They want individualization and personalization.”

At the same time, Berry must also be cognizant of new technologies so it can be able to meet the ever-changing demands of its customers. “We are constantly innovating beyond the value films,” Lilly says. “We have a now, next, future philosophy and we continue to build breathable and non-breathable products designed to provide cost-effective performance for baby diapers and adult incontinence products that offer softness and discretion.”

Growing Up

Many suppliers are reporting an increased focus on the adult incontinence market, driven of course by the greying population as well as a greater acceptance of incontinence as a medical problem. Perhaps the biggest shake up of this market in recent months is the return of Procter & Gamble who launched its Always Discreet light incontinence line in mid-2014 and has reported better-than-expected results for the product line thus far.

Like many hygiene-minded companies, Conwed Plastics executives report that adult incontinence is the main focus when it comes to hygiene. While its elastomeric netting Rebound is commercialized in baby training pants, it is the adult incontinence segment that is truly driving innovation and making companies push the limits of what they’ve done in the past to please users who can actually provide feedback about the products’ overall performance. The difference between the two markets, executives say, is that fluid management and skin health are the key barometers of how a baby diaper performs, while in adult incontinence, discretion, odor control and increased comfort are important.

“This hygiene segment calls for disposable products that make users feel they are wearing normal underwear; so besides the standard fit and fluid management features, it demands making lighter, thinner and more breathable items,” says Soltero. “This is where our elastomeric netting offers a distinctive alternative. Rebound not only provides the weight, thinness, stretch, recovery and fit desired but it also brings another level of comfort — superior air permeability, water vapor transmission and heat transfer performance — to the final nonwoven composite on the pursuit of creating highly comfortable and efficient disposable products.”

Conwed’s elastomeric netting offers heat and moisture management performance that can impact users’ level of comfort while wearing disposable adult incontinence briefs and underwear.

In general, optimal fluid management, fit and skin health are always key elements when evaluating any hygiene disposable product. “What we see in the adult incontinence segment, however, is the users’ expectation that their hygiene disposable product should not only take care of those basic requirements, but it should also make them feel comfortable,” Soltero adds. “Comfort could be defined differently depending on the user but it is clear that breathability, heat and moisture management performance contribute exponentially to increase the level of general comfort when wearing an incontinence brief or underwear.”

Courtney Korselt, global communications manager of adhesives supplier Bostik, has also witnessed an increased awareness of adult incontinence sufferers’ needs, and this company has certainly honed its product line to reflect this. “It’s interesting to compare the adult incontinence product with the diaper,” she says. “If you looked at it many years ago, they were much the same but now we are looking at different sets of requirements. You can even break it down further with the different needs of the consumer and institutional customer.”

Barbara Bulleri, sales and marketing director at closures specialist Texsus, says the adult incontinence market is becoming more sophisticated as more people are trying to remain active despite their issues.

The backsheet of the babydiaper is a combination of nonwoven materials and films.

Speaking of softness, Texsus is investing $3.5 million in machinery to help it deliver a new solution in diaper closures with a three-dimensional look and touch as well as top-level performance. This new loop, which will be available as a complete closure system called the Sloopy Lock, is not only soft to the touch, it’s three-dimensional construction makes it look soft.

“We are seeing a trend toward having a material that is soft,” says Bulleri. “We achieve this by using a nonwoven made from bicomponent materials and then we use a special embossing to make the material three-dimensional.”

Know Your Customer

At Bostik, success has been gained by staying in touch with what is going on in the market. Even though its product—adhesives—is a small part of the hygiene product, Bostik keeps abreast of trends throughout the diaper design. “It’s important for us to be able to predict the next consumer trend,” says Diane Toonen, director of strategic marketing at Bostik . “It’s critical to us to be able to help the customer. We have to see changes coming.”

In fact, the movement toward thinner, lighter diapers has changed the way adhesives are used in the diaper. As the core integrity becomes more challenged, the role of the adhesives has increased and Bostik has worked hard to develop products that can work with new diaper designs. “It depends on the SAP to pulp ratio,” Toonen says. “Once you get to a 30% pulp level, the role a different adhesive is required. It doesn’t really matter when the rations are 50:50. Adhesives don’t play as critical of a role in the core.”

Bostik has worked with SAP producer BASF developing low-pulp and pulp-free core designs.

H.B. Fuller has also tailored its adhesives line up to address changing market dynamics. Its product line addressing thinner cores is the Full-Care 7000 series of core adhesives, which provide superior core integrity as manufacturers continue to reduce the amount of fluff. Other innovative products like the HydroLock absorbent hotmelt and PD8081H water-based superabsorbent polymer system deliver absorbency to a targeted area. For products requiring more sophisticated stretch engines, the Full-Care 9700 series of stretch lamination adhesives are designed for low odor, high bonding strength, and excellent aged performance and stability.

“With each of these trends we see as an opportunity to deliver value to our customers and help them stay ahead of market trends,” Weaver says. “We strive to understand the impact adhesives can have on these challenges and find ways to incorporate that into the disposable product design.”

Superabsorbent polymer makers have also been responding to the need for thinner diapers. Last month Evonik said it had developed a technology—in partnership with a small engineering company—to make a laminate structure combining layers of superabsorbents and nonwovens to serve as an absorbent core in hygiene products.

This unique structure allows the diaper core to absorb and distribute fluid more quickly than competing structures.

According to Markus Henn, global director, application technology for Evonik, the laminate is flexible and expandable in two dimensions.

“This results in a unique structure so basically the laminate has two nonwoven layers and a SAP is placed in a compartment between

the two,” he adds. “The specific technology that we are using is elastic fibers in between the nonwoven layers that resembled small pockets containing the SAP.”

The structure gives the diaper core a high level of stability. The elastic fibers or strands stick to the nonwovens and form an open cell structure. This ensures that the superabsorbent particles remain at the place where they are needed but also keeps the adhesive from infringing on the SAP properties. Therefore, the diaper is considerably more efficient—rewetting is significantly reduced while wearer comfort is enhanced considerably.

In developing the product, which Evonik hopes to license to diaper makers, the company ran tests on a number types of nonwovens and even some tissue materials. Henn says the type of nonwoven used depends upon the use of the final product. “We have seen some indication of what types of nonwovens work or work better but we don’t really see too many limitations on what should be used,” he says. “The technology really allows the user to fine tune the absorbent core and use the materials best suited for the application.”

Enter Spunlace

While spunlace is normally associated with wipe products, the technology’s soft hand, flexibility of raw materials and clean production process are slowly earning it a place in the hygiene market. Spunlace provider Suominen has been focusing on growth in this market for a few years and established a Care division to drive growth in the hygiene and medical segments. At the time, sales outside of wipes, traveling and catering, represented just 10% of Suominen’s.

Since then, Suominen has introduced a number of products across both categories. Most recently, in October, Suominen officially launched Fibrella Move, a product developed specifically for the global hygiene market. The material, which uses state-of-the-art forming, bonding and finishing technologies, is a major step forward in fluid acquisition and management for feminine care and other absorbent hygiene applications. Not only does it enhance wearer comfort and body fit, it also offers converters a new choice—a nonwoven that easily runs on high speed converting lines and is highly compatible with other components.

Suominen’s Kuisma gives several reasons why Fibrella Move is ideal for hygiene applications. “It is all about the end user benefits; superior masking, efficient fluid management, comfort and exceptional body fit. In fact due to the capability of unique design our product structure is suitable for all hygiene areas - feminine, baby and incontinence,” she says. “Fibrella Move is designed for high line speed converting and is supremely compatible with other materials in hygiene product.”

Fibrella Move follows the January introduction of Fibrella Lite, an advanced lightweight and soft substrate for stretch applications. Both products are perfect examples of innovative application using spunlace technology that are able to match the market needs. “Hygiene end products are requiring more and more nonwovens that can bring the soft and conformable, body fit feeling,” Kuisma says. “With spunlace technology we can offer the differentiation and step towards more ‘underwear like’ products.”

Like Suominen, spunlace maker Jacob Holm has been diversifying beyond wipes and into hygiene and other markets in recent years. Most recently, the company introduced a lightweight product portfolio, under the SoftLite brand, to cater to the need for lighter and softer hygiene products with basis weights as low as 15 gsm. In addition to being light and soft, key features oinclude excellent stretch and recovery, skin sensitivity and the ability to be engineered for optimal fluid management. While much of Jacob Holm’s business experience is in the wipes market, the company feels expansion into hygiene is the next logical step.

“We are experienced in the consumer market with wipes, it was a natural evolvement to also offer our fabrics in this growing consumer category,” says CEO Martin Mikkelsen. “As a

Stretchability is becoming increasingly in diapers and other hygiene items.

The most textile-like nonwoven technology, spunlace uses no chemicals or heat to create pure and soft fabrics. This technology offers 50% more elongation than other technologies. All staple fibers can be processed, natural and man-made.

“Consumers desire ultra-lightweight absorbent hygiene products without compromising performance,” Mikkelsen adds. “As hygiene products are getting thinner to increase comfort, the challenge emerges to make sure the product still feels soft. This increases the need for light but lofty ultrasoft fabrics.”

The need for new products will continue to drive innovation forward in the hygiene market. At the heart of this innovation is the balance between performance and cost, whether the product is for the baby diaper, adult incontinence or feminine hygiene market. “People use the products and dispose of them,” Conwed’s Soltero says. “Suppliers are under pressure to offer cost competitive materials to satisfy an industry used to compensate low margins with high production volumes. So everybody’s Holy Grail is to create disposable products with the highest performance at the most affordable cost.”