There’s

no doubt about it. The consumer wipes market continues to thrive.

Despite mass entry, extreme product proliferation and not a few skeptics

over the market’s long-term viability, new products continue

to emerge and consumers seem eager to buy them.

When the first non-baby wipes began emerging about five years ago,

the nonwovens industry watched with bated breath. Similar introductions

a decade ago were not met with success and subsequently taken quietly

off the market. This time, however, the string of disinfectant all-purpose

household cleaning wipes introduced by Clorox and Procter & Gamble

caused an explosion in the consumer market. They were followed not

only by a string of use-specific wipes—glass cleaners, floor

mops and auto care products—but also heralded a string of wipes

for personal care applications, pet care products and a large range

of other wipe products. According to market tracker Euromonitor, the

global market for disposable consumer-oriented wipes is valued at

about $4.5 billion and has seen double-digit growth every year since

1997.

|

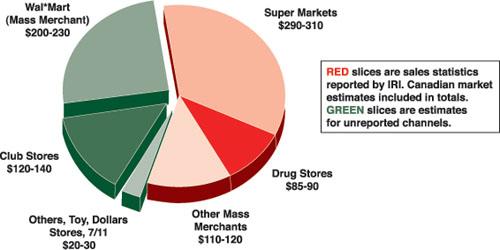

TABLE 1

Consumer Wipes Sales By Retail Outlet

(U.S.$ millions)

|

|

|

source: INDA

|

While baby wipes, the segment that started it all, continues to represent

the largest portion of sales with $1.9 billion, new applications like

facial cleansing, deodorant wipes and electrostatic wipes are growing

the most rapidly as consumers who once used baby wipes for a range

of non-baby cleansing needs now use these new styles of wipes to wash

their faces, freshen up or whatever the task may be.

“Consumer wipes are still growing at a significantly more rapid

pace than industrial wiping products; however, in each case, it’s

the niche areas that comprise most of the growth,” explained

Susan Stansbury of the Arketype Group, Green Bay, WI, “In consumer

wipes products, cosmetics and household cleaning, wet wipes are still

growing at a pace beyond 4%.”

Many credit consumers’ active lifestyles with the recent success

of the wipes category. The combinations of job pressures, increased

children activities and overall, have left many pressed for time and

these products allow them to perform daily tasks in substantially

less time. This saved time makes up for the extra cost per application

of an impregnated wipe in the eyes of many consumers and industry

sources are claiming that more consumers will make the switch to wipes.

That said, growth in consumer wipes is expected to continue as manufacturers

look to fill new niches in both the consumer goods market.

Let’s Talk Numbers

Globally, the wipes market has enjoyed unprecedented growth in the

past six years with sales increasing from $1.8 billion in 1997 to

$4.5 billion in 2002. According to figures supplied by Euromonitor,

Western Europe consumes a large amount of wipes with sales to this

region, reaching $1.8 billion in 2002, compared to $578 million in

1997. Euromonitor put North American wipes sales slightly below Western

Europe at $1.7 billion in 2002, while INDA, the Association of the

Nonwoven Fabrics Industry, Cary, NC, estimates the size of the North

American market at $2.2 billion (see figure 2), making it uncertain

which region is actually consuming the most wipes. Either way, these

two developed regions are still posting strong growth in wipes, which

is a different story than other nonwovens market areas like diapers

and feminine hygiene items where maturity has meant slow growth.

|

FIGURE 2

The North American Household Wipes Market

|

|

|

source: INDA

|

Meanwhile, developing regions have been slower to embrace wipes—largely

due to limited disposable incomes for such products—but in recent

years, these world regions have begun buying them too. After hovering

in the $13-15 million range in the late 1990s, the wipes market of

Eastern Europe took off in 2000 and is now valued around $24 million.

A similar story can be told in the Asia-Pacific where sales started

their upward climb in 1999 and are now at about $694 million. Even

Africa and the Middle East and Australasia, while smaller regions,

are estimating their wipes sales at $75 million a piece. Only Latin

America seems to be having trouble in the wipes segment. Sales, typically

in the $130 million range peaked at $155 million in 2001 and then

experienced a drop to $136 million in 2002, thanks to economic problems

in this region.

By category, the past six years have seen a tremendous shift in wipe

products. In 1997, the largest segment by far was baby wipes, which

comprised more than 80% of global wipes sales at $1.3 billion. Over

the years, while the size of this market has tripled, baby wipe sales,

while still robust by most industries’ standards, have been more

modest, making it a somewhat smaller portion of the market. While

still the wipes market’s largest segment, baby wipes now represent

only about one-third of the market. This shift can be attributed to

the aforementioned explosion in new product introductions in the past

six years. The market for household cleaning wipes has growing from

a paltry $220 million in 1997 to nearly $1.5 billion in 2002. If this

growth continues, certainly household wipes have a good chance of

unseating baby wipes as the largest segment of the wipes category.

Notable increases within household wipes include electrostatic wipes,

which have grown from $111 million to $709 million during the six-year

period, and antibacterial wipes, which have increased from $26 million

to $334 million.

The nonwovens industry has welcomed the growth of this segment. Not

only has it increased sales, it has brought nonwovens closer to the

end user. Trade associations in both North America and Europe have

dedicated annual conferences to the role of nonwovens in consumer

products, and this awareness has led to new product introductions

outside of the wipes category.

A Word About Baby

Still the largest market for wipes worldwide, baby wipes are also

the most well-known application for the substrates. While growth

in this segment has slowed, thanks largely to maturity as well as

market proliferation, sales in this market continue to climb in

the slow single digits each year. Much of this growth is underway

in developed regions where consumer spending is rising in general.

In developed regions, sales are declining as consumers who once

used baby wipes for non-baby tasks, are switching to new products

like deodorant and personal cleansing cloths and moist towelettes.

In the U.S., baby wipes sales dropped 5% to $412 million last year

in supermarkets, drug stores and mass merchandisers, excluding Wal-Mart,

according to market tracker Information Resources Inc., Chicago,

IL.

|

| Recent wipe introduction have focused

on niche areas, according to industry observers. |

To offset some of these declines, baby care marketers are specializing

their wipes lines by offering added benefits to wow mothers. Procter

& Gamble, for example, introduced Pampers Sensitive Touch Baby

Wipes two years ago. This product, designed for sensitive baby skin,

is hypoallergenic and alcohol free, and these features were well

received by caregivers. The product has already achieved estimated

sales of $16 million, according to industry sources.

Not to be outdone, P&G rival Kimberly-Clark now offers Newborn

Ultra-Gentle baby wipes as well as a natural-based and an original

wipe product under its Huggies brand. Additionally, K-C has recently

entered the burgeoning baby bath business with the launch of disposable

wash cloths and baby wash. The dry, disposable cloths are available

in a lavender and chamomile-scented version as well as in a no-soap

version that can be used with Huggies baby wash. These products

use the same proprietary Co-form Technology used in K-C’s wipes

business.

Despite these efforts by the branded manufacturers, the largest

segment of the baby wipes market is private label with a 28% marketshare,

according to IRI. This shows that mothers are not as brand loyal

when it comes to wipes as they with diapers. In fact, some executives

have pointed to a trend where mothers are filling branded tubs with

private label products. Therefore brands have had to rely on promotional

spending, couponing and other discounting efforts to grab marketshare.

The threat of private label products extends beyond baby care in

the wipes market. Looking to cash in on the explosive growth of

this segment, private label manufactures have been one step behind

brands when it comes to offering new wipe products in virtually

any consumer category. “Private label gives consumers an incentive

to try a type of product that could otherwise be cost prohibitive

when offered by a national brand,” explained Carmen Baker,

project manager for private label wipe manufacturer Rockline Industries,

Sheboygan, WI. “This has allowed us to experience incredible

growth in the past several years.”

Flush With Ideas

Now that wipe products are fully immersed into consumers’ lives,

the next step for manufacturers is to continuously improve them.

Research and development teams are trying to improve the overall

quality of their wipes without raising costs. One area that has

emerged as a hot topic is flushability and achieving this goal has

been difficult as there is some debate over the definition of flushability

on the consumer market.

Some believe that a wipe is flushable if it fits down the commode,

not taking into consideration what happens to the wipe after it

enters the septic system; others equate flushability with a product’s

ability to disperse like toilet tissue and still others will only

deem a product flushable if it completely biodegrades in water.

Either way, many consumers are interested in the flushability or

biodegradability of a wipe only if it doesn’t drive up the

overall price of the product, according to wipes industry consultant

Phil Mango. “Basically they are not willing to pay more for

the product or sacrifice overall quality,” he said.

While there are several types of flushable wipes on the market—for

toilet cleaning, kids care and personal hygiene—most wipe products

are not fully dispersible. This has challenged wipes manufacturers

to convey the risks associated with flushing unflushable wipes.

While consumer ignorance regarding the failure of most wipes to

biodegrade has not yet posed too much of a problem, as the use of

wipes broaden so will the threat to municipal septic and sewer systems

nationally. In fact, the city of Raleigh is already making it illegal

to flush a wipe down the toilet, an action that can be punishable

with up to a $25,000 fine. Additionally, wipe products (together

with tree roots) have been blamed for clogging a section of a sewer

system in Grand Rapids, MI.

Government officials are concerned that wipe manufacturers are not

doing enough to warn consumers against flushing wipes. While some

non-flushable disinfectant wipes, bear large warning insignias against

flushing, others have this information in small type that the consumer

is unlikely to read. This has led INDA, Association of the Nonwoven

Fabrics Industry, Cary, NC, and the European Disposable and Nonwovens

Association, Brussels, Belgium, to kick off efforts to increase

education on this matter. The efforts are intended to fend off the

threat of additional legislation that could diminish wipe popularity.

In addition to flushability, flexibility is also an interest among

consumer products manufacturers. “All of the major companies

are trying to develop a flexible, stronger wipe,” Mr. Mango

said. “This is more of a defensive move than an offensive measure.

They are all afraid that the competition will come up with some

sort of superwipe before them.”

Spunlace Explosion

Nonwoven wipes, either dry or wet, have typically been made from

two types of nonwovens technologies—airlaid or spunlace. Traditionally,

the North American market has favored the thickness of airlaid,

due largely to the fact that most baby wipes made in the region

uses airlaid substrates. Meanwhile, Europeans have favored the slickness

and tactile feel of spunlaced wipes, which dominate abroad.

This market dynamic has begun to shift in recent years and spunlace

is becoming preferred over airlaid in many wipe applications. This

has partly been caused by P&G’s rumored switch from airlaid

to spunlaced materials in its U.S. baby wipes business. According

to reports, P&G had been using spunlaced nonwovens in European

applications for some time but has only recently incorporated the

material into its North American business.

The rise of spunlace can also be attributed to advancements in manufacturing

processes. Decorative options such as embossing as well as more

consistent quality and varieties of weights have been developed

by the many nonwovens producers looking to make a buck off of wipe

manufacturers in search of variety. Also, unlike airlaid, spunlaced

wipes can be offered in both canister or tub form whereas airlaid’s

thickness makes packagingin pull-through canisters difficult.

“Manufacturers of airlaid just aren’t keeping up,”

said Mr. Mango. “Overcapacity and other market conditions have

really squeezed research and development efforts in airlaid and

the market has felt the result.”

Despite these problems, airlaid has continued to be strong in special

performance wipes where toughness is important. These include scrubbers

for a variety of uses and automotive cleaners.

With so many potential areas for wipes to penetrate, certainly consumer

goods manufacturers will continue to consider them important aspects

of their business. Eager to save time through revolutionary new

products, consumers will continue to enthusiastically choose wipe

products for their daily activities.

|