02.02.16

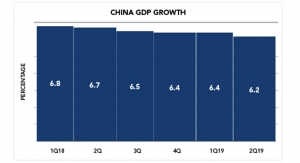

Even though 2016 is brand new, there have already been a few major announcements made for the Asian market. This proves—as if we needed more proof—how reliant nonwovens and disposable companies are on growth in the developing markets. This region offers a one-two punch of a low penetration rate and a strengthening GDP that makes for nice opportunities in the hygiene market.

Last month, Fibertex Personal Care, an early trailblazer in the Asian market, said it would add line no. 5 in Malaysia. Saying the "time is right for Asian investment," CEO Mikael Staal Axelsen said that he is projecting Asian growth to be signfiicantly higher (about 10%) than more developed regions where increases are about 1-2%. These numbers motivated the Danish producer to investment about $60 million to increase its Asian production by 20%.

When the new line is complete, Fibertex Personal Care will be one of the biggest Asian producers of spunmelt nonwovens and the largest non-Japenese supplier to Japan. This has helped the company, which has not added a new line in its Danish headquarters in several years, to grow its sales year on year.

Fibertex is not alone. Companies like Berry Plastics, Avgol, Toray Advanced Materials, Mitsui Chemicals, Kuraray and First Quality have all looked east toward Asia to expand its manufacturing footprint and increase sales.

This month Japan's JNC Corporation (formerly Chisso) said it would add air-through capabilties to its existing fibers operation in Japan. The company already makes nonwovens in China and Thailand but decided to start making them in Japan to meet local demand in the country but to also free up capacity on its foreign operations to meet demand in their local markets.

Meanwhile, within the diaper market Kimberly-Clark announced in early January it had broken ground an a new plant in Tianjin, China to meet demand for baby diapers and other local goods. The new site is the company's fourth in China where it has been in oparation since 2004.

Amidst all of this investment, there are still noticeable absences within the market. Fitesa, one of the most ambitious investors in the spunmelt market, has yet to announce a new line in Asia (although it operates some airlaid and thermal bond assets in China). Glatfelter has established sales companies within Asia but has yet to announce plans to establish an airlaid operation there. And, Suominen's, the world's largest manufacturer of spunlaced nonwovens, has chosen to invest instead in new assets in the U.S. and upgrades to existing lines in South America and Europe, even as the spunlace investment by local Chinese companies has been fairly constant.

Some companies are placing bets on Asia while others are focusing on developed markets, offering valued added products in their existing markets to improve margins and enter new markets areas. Time will tell which one was the safe bet....or maybe they both are.

Last month, Fibertex Personal Care, an early trailblazer in the Asian market, said it would add line no. 5 in Malaysia. Saying the "time is right for Asian investment," CEO Mikael Staal Axelsen said that he is projecting Asian growth to be signfiicantly higher (about 10%) than more developed regions where increases are about 1-2%. These numbers motivated the Danish producer to investment about $60 million to increase its Asian production by 20%.

When the new line is complete, Fibertex Personal Care will be one of the biggest Asian producers of spunmelt nonwovens and the largest non-Japenese supplier to Japan. This has helped the company, which has not added a new line in its Danish headquarters in several years, to grow its sales year on year.

Fibertex is not alone. Companies like Berry Plastics, Avgol, Toray Advanced Materials, Mitsui Chemicals, Kuraray and First Quality have all looked east toward Asia to expand its manufacturing footprint and increase sales.

This month Japan's JNC Corporation (formerly Chisso) said it would add air-through capabilties to its existing fibers operation in Japan. The company already makes nonwovens in China and Thailand but decided to start making them in Japan to meet local demand in the country but to also free up capacity on its foreign operations to meet demand in their local markets.

Meanwhile, within the diaper market Kimberly-Clark announced in early January it had broken ground an a new plant in Tianjin, China to meet demand for baby diapers and other local goods. The new site is the company's fourth in China where it has been in oparation since 2004.

Amidst all of this investment, there are still noticeable absences within the market. Fitesa, one of the most ambitious investors in the spunmelt market, has yet to announce a new line in Asia (although it operates some airlaid and thermal bond assets in China). Glatfelter has established sales companies within Asia but has yet to announce plans to establish an airlaid operation there. And, Suominen's, the world's largest manufacturer of spunlaced nonwovens, has chosen to invest instead in new assets in the U.S. and upgrades to existing lines in South America and Europe, even as the spunlace investment by local Chinese companies has been fairly constant.

Some companies are placing bets on Asia while others are focusing on developed markets, offering valued added products in their existing markets to improve margins and enter new markets areas. Time will tell which one was the safe bet....or maybe they both are.